VIX Spikes Above 16 – Is This the End? | a cautious investor

VIX ended the week just above 16, rising to its highest level in 2024. What does this tell us about investor sentiment, and how does it compare to previous market cycles?

Let’s take a quick look at market history through the lens of the VIX. Let’s focus on which levels tend to be good signs of a market reversal, then move further into secondary levels and relate them back to the current setup where the VIX is around 16. Quarter 2024.

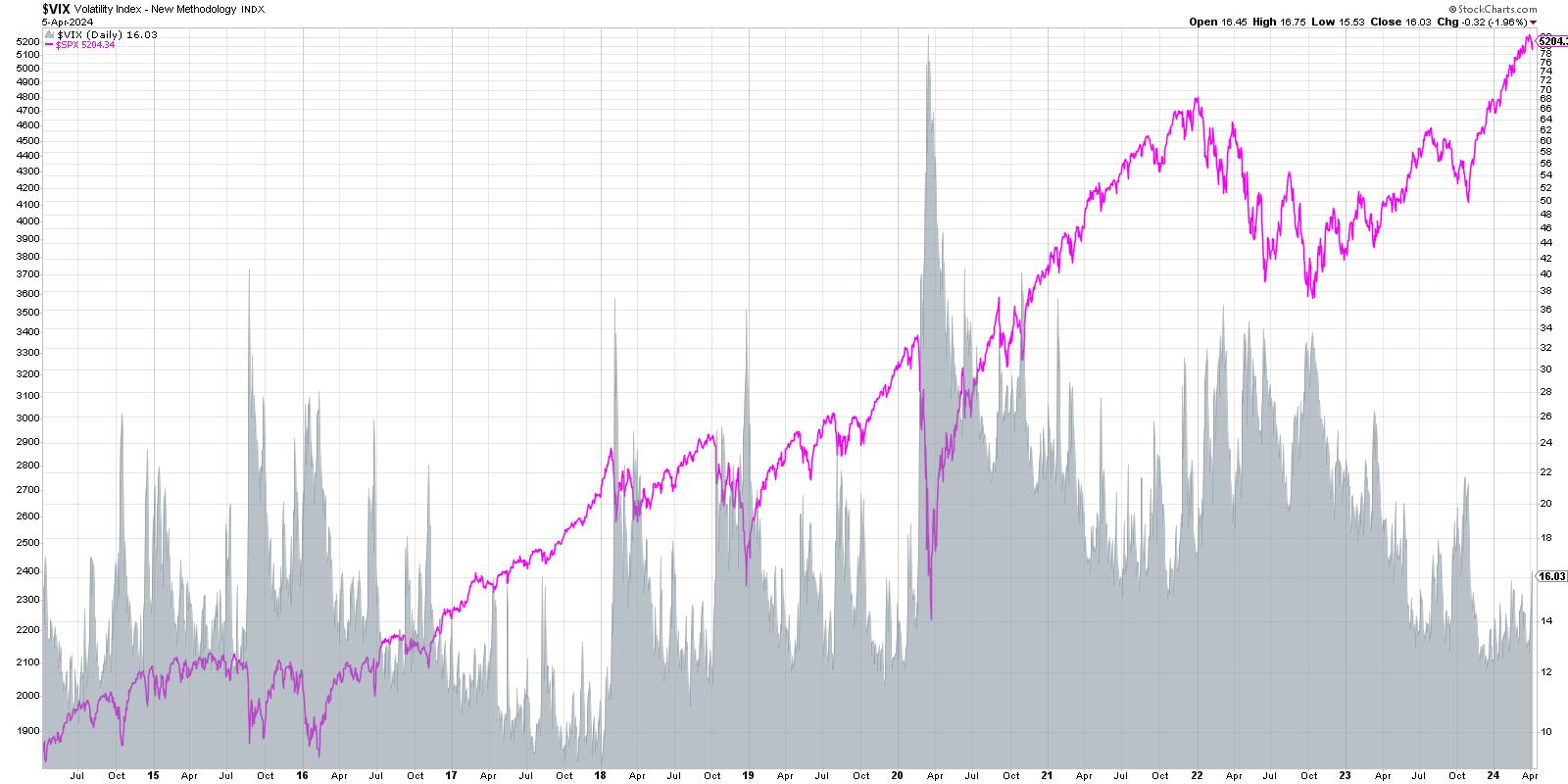

We start with a 10-year chart of the S&P 500 Index (shown in pink) and compare it to the VIX (shown in grey). You will probably be attracted to the surge in VIX in 2020, 2019, and 2015. Each spike means a significant decline in the S&P 500.

Why does VIX tend to rise when SPX falls? This ties in with one of my favorite market sayings: “The market goes up the escalator and down the elevator.” Basically, bull markets are characterized by slow and steady accumulation on the way up as investors add to their positions over time. However, when investors become nervous and fear that the stock price will fall, they tend to panic and sell very quickly. In reality, there is often a feedback loop where selling lowers the price, which leads to additional selling, which causes the price to fall further.

The VIX is often called a “fear gauge” because of its inverse relationship with stock prices, but I prefer the term “uncertainty gauge” because it better reflects what this series is actually designed to measure.

Let’s look at the inverse relationship in more detail.

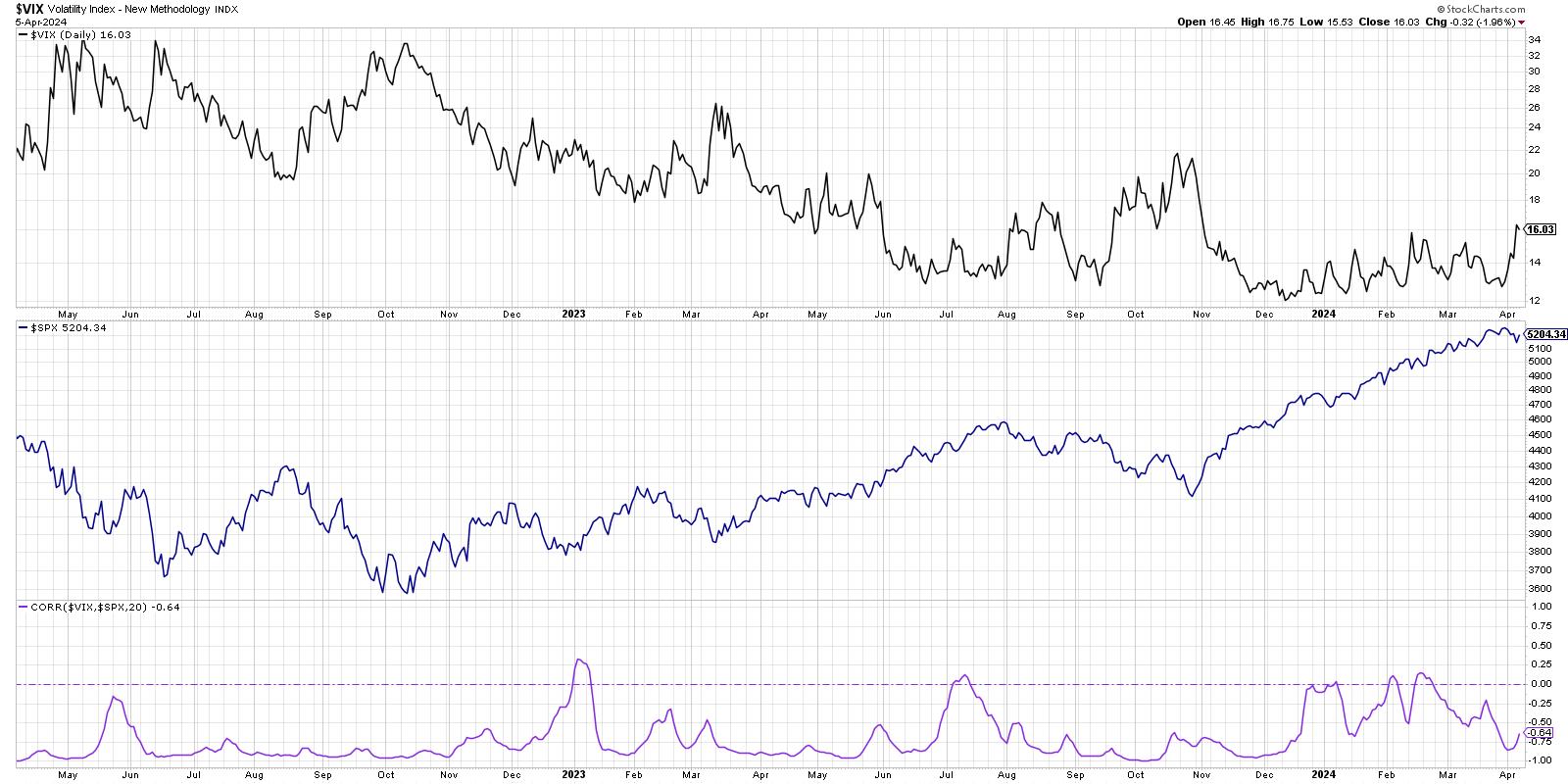

Here we show the VIX in the top panel, the S&P 500 in the center, and the 20-day moving correlation between the two data series. Notice how often there is a strong inverse relationship between the two. Although there were occasional spikes in the correlation near the zero level (essentially no relationship between the two data series), the correlation generally stayed in the -0.7 to -1.0 range.

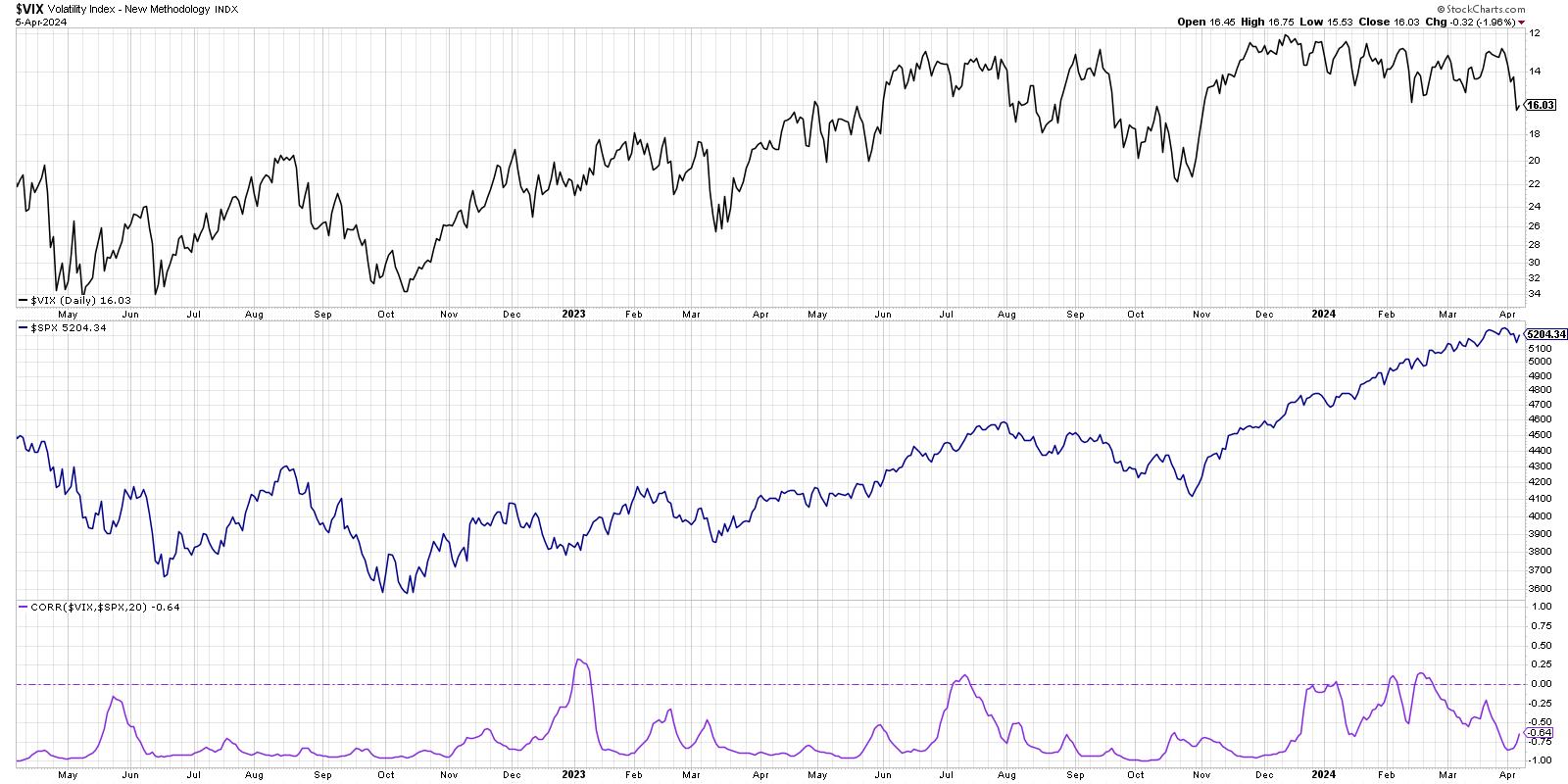

When considering two series that have an inverse relationship, it may be helpful to invert one of the data series.

The top panel now displays the VIX upside down, making it easier to recognize how declines in the S&P 500 typically coincide with surges in the VIX. So have we seen enough of the VIX rising to raise a red flag for this bull market? In my opinion, no. But there are a few key levels to watch heading into the second quarter.

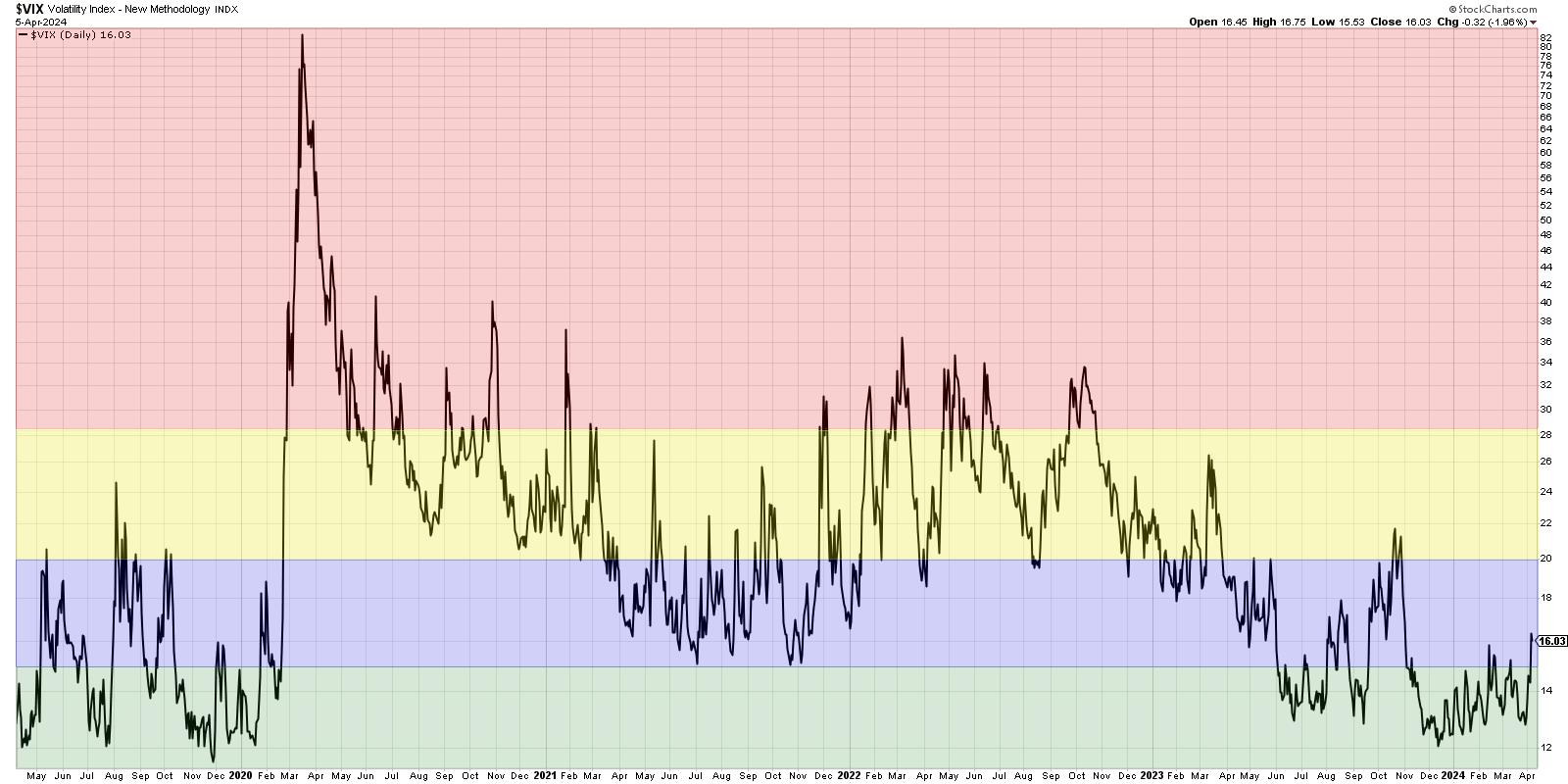

Similar to 2019 and 2017, in a low-volatility environment like the one we have seen over the past eight months, the VIX spends a lot of time below the 15 level (green shaded area). Therefore, a VIX below 15 indicates a bull market phase with low volatility. If the VIX rises above 15 but remains below 20 (blue shaded area), this means that the long-term trend is still positive, but is likely to enter a bearish phase within a bullish trend. If the VIX is above 20 but not above 28.5 (yellow shaded area), this means we are currently in a highly volatile environment. The S&P 500 is probably firmly down by now, and investors may be questioning whether this is the start of a much deeper downturn.

The last time it topped 20 was in October 2023, heading toward market lows. A VIX above 20 usually means a market decline has just begun, so I was quite bearish at the time. The strength of the price action around the October lows, along with the bullish rotation in the breadth and momentum indicators, told us that a VIX above 20 was a false alarm.

Now, if VIX moves above the 28.5 level (red shaded area), the S&P 500 has essentially entered a confirmed bearish phase. This is a level I learned from Tim Hayes of Ned Davis Research.It is based on research conducted on the deep history of VIX. The last two times we have seen rotations above that key 28.5 level? November 2021, just before the market peak in 2022, and February 2020, when the Corona era begins. A VIX above 28.5 is actually quite rare, and I have learned to regard extremes in the VIX as a major red flag and a good reason to shift into a risk-off position.

A quick review of market history shows that a VIX around 16 likely indicates a bearish scenario within a bullish phase. But that also means brace yourself for a higher VIX. This means a higher level of uncertainty. As you can see from this chart, higher uncertainty generally increases the risk that the market will pull the elevator down to a much lower level.

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral bias through technical analysis. He is a frequent host of StockCharts TV and links mindfulness techniques to investor decision-making on his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on risk management through market awareness. He combines strengths in technical analysis, behavioral finance, and data visualization to identify investment opportunities and strengthen relationships between advisors and clients. Learn more