Vizsla Silver: Significant Exploration Progress Awaits Metal Turns Bullish (NYSE:VZLA)

wakila

A Hold Rating for the Stock of Vizsla Silver Corp.

This analysis now gives a “Hold” recommendation rating on Vizsla Silver Corp. (NYSE:VZLA) (TSXV:VZLA:CA) shares — a silver/gold explorer with operations on the Panuco property and the La Garra-Metates District in southern Sinaloa, Mexico — a change from the previous rating of “Buy”.

Previous analysis suggested buying Vizsla Silver on the back of a well-progressing portfolio of exploration activities ahead of an expected bull market in gold and silver in 2024. Highly correlated with changes in precious metal prices, in a positive manner, shares were trading at the bottom of the stock price cycle, offering an attractive price to strengthen or establish a position.

The Reason to Remain Optimistic with Vizsla Silver

This analysis recommends continuing to hold the shares in your portfolio as expectations for the Vizsla mineral project remain positive. In this context, it must be added that progress has been made since the last analysis, so these expectations are even stronger than before. Furthermore, there are indications that 2024 will be a significant year, with Vizsla providing some confirmation of the concreteness of its mineral intentions. Investors may want to remain positioned in this stock to take advantage of the favorable outlook, including that for the price of the precious metal. Vizsla Silver is not yet producing bullion, but the idea it may do so at some point in the future is gaining momentum and this means that its share price is already influenced by the development of silver/gold bullion prices in the commodity markets.

Interest Rate Bets Influence Silver and Gold Prices

Like silver and gold prices, Vizsla Silver shares are very sensitive to interest rate news. Since March 2022, the US Federal Reserve (Fed) has been raising interest rates to curb runaway inflation. On July 26, 2023, the Fed raised interest rates for the eleventh time: a 25-basis point increase, so the interest rate on federal funds is currently 5.25% to 5.50%. Since then, interest rates are widely believed to have peaked, and the central bank is holding on to them to push inflation further towards the 2 percent target. In June 2022, inflation was as high as 9.1%, but then fell under the influence of the Fed’s interest rate hike policy and is now around 3.2%. With inflation having fallen significantly and interest rates peaking, analysts now believe that the end of restrictive monetary policy is near and that it must be prevented from slowing the economy more than necessary if interest rates are instead kept high for too long. This situation raises hopes for the start of the interest rate reduction policy and, since the latest tightening, contributes to a very favorable climate around the ounce, especially for gold, which, despite an uncertain start, ended 2023 in a remarkably positive manner. Silver ended the year flat despite the impact of rising borrowing costs on investments in energy transition projects, where the gray metal plays a critical role.

How Vizsla Silver Shares Performed on the Stock Markets

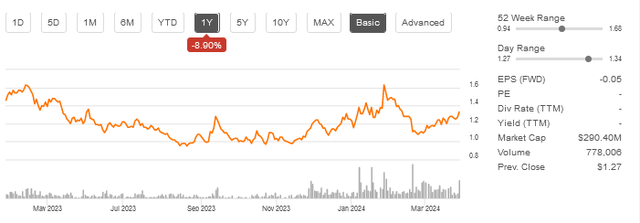

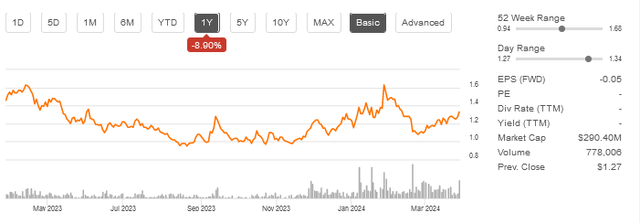

Driven by newfound positive momentum for the precious metal amid expectations of rate cuts from the Fed, shares of Vizsla Silver recovered in the second half of 2023 and continued to rise until peaking in late January 2024, on both North American markets of the NYSE American stock market and TSX Venture Exchange in Canada.

Vizsla Silver Corp. shares under the symbol VZLA on the NYSE American market as of this writing:

Source: Seeking Alpha

Vizsla Silver Corp. shares under the symbol VZLA:CA on the TSX Venture Exchange in Canada as of this writing:

Source: Seeking Alpha

Expectations of lower interest rates bode well for precious metals and the following better explains the rationale behind this dynamic: As the likelihood of a rate cut increases, the opportunity cost of holding investments in non-yielding bullion rather than fixed-income assets is perceived by investors to be lower. This dynamic increases demand for precious metals and creates upward pressure on the price per ounce.

Gold is the precious metal par excellence, but the same relationship is observed between interest rate expectations and the price of silver or poor man’s gold as well.

The first cut was expected at the Fed’s meeting in March 2024 but failed to materialize as the economy did not provide sufficient evidence of inflation returning to 2%.

As expectations for a rate cut at the Fed’s March 2024 meeting faded with the Fed and ECB saying there was no reason to rush in cutting borrowing costs until it was clear lower inflation was sustainable, Vizsla Silver shares fell sharply from their peaks in late January 2024 on weaker momentum in precious metals.

So, shares of Vizsla Silver reached the bottom of the cycle at the end of February 2024, but being as volatile as gold and silver, a new rally took place as soon as the precious metal regained momentum on renewed optimism about the rate cut. Driven by signs of a softening of the economy across manufacturing activity and consumption, as well as January 2024’s 3-year-lowest annual increase in the US inflation rate, bets that the Federal Reserve will cut interest rates later this year reinforced earlier this month, with the market eyeing possible start during the June meeting.

Vizsla Silver Corp. shares are now trading at approximately another peak of the stock price cycle on both North American markets.

The Value of Vizsla Silver Shares on the Stock Markets

On the NYSE American stock market under the symbol VZLA, the shares of Vizsla Silver Corp. were at $1.33 apiece giving it a market cap of $290.40 million, as of this writing. Shares are slightly closer to the upper bound of the 52-week range of $0.94 to $1.68. The stock is not characterized by high trading volume, as 778,006 shares changed hands in the last regular trading hours and an average volume of 439,025 shares changed hands in the last 3 months. The outstanding shares total 231.77 million. Since trading volume is not high, retail investors should be aware of the risk of having too fat of a position, which can make it more cumbersome to quickly reduce the shares if necessary.

Source: Seeking Alpha

Shares were completely above the MA Ribbon, which, along with the shape of the share price curve and the trend of the 14-RSI at 60.91, is another strong indication that the shares are trading in the upper part of the cycle.

Source: TradingView

On the TSX Venture Exchange in Canada under the symbol VZLA:CA, the shares of Vizsla Silver Corp. were at CA$1.77 apiece giving it a market cap of CA$394.10 million, as of this writing. Shares are slightly closer to the upper bound of the 52-week range of CA$1.26 to CA$2.25. The stock is characterized by low trading volume: a volume of 452,193 shares changed hands in the last regular trading hours and an average volume of 258,730 shares changed hands in the last 3 months. The outstanding shares total 231.77 million. Regarding the risk associated with a low volume of shares traded, the same considerations for the US market also apply to shares of Vizsla Silver Corp. listed in the Canadian market.

Source: Seeking Alpha

Shares were completely above the MA Ribbon, which, along with the shape of the share price curve and the trend of the 14-RSI at 59.58, indicate that the shares are trading in the upper part of the cycle.

Source: TradingView

Possible Share Price Development

From these price levels, Vizsla Silver shares in both markets could now decline and move towards the lower part of the stock price cycle under the influence of mainly 2 factors: a) The presence of a good downside margin for the stocks to form a lower price as suggested by the RSI indicators; and b) factors that would create the necessary negative winds to create the counter pressure.

The Precious Metal: a Pause before a new Rally

As of March 7, 2024, when it peaked at $2,159/oz, gold was considered overbought due to correlations with past trends, and the daily RSI ratios are now likely to have strengthened even more as the price has reached $2,227.50/oz. Therefore, a weakening of the price momentum or a price decline can still be expected, also because there appears no reason to arouse further optimism and give the gold price the necessary boost.

The recent rally has pushed gold prices up more than 7% this month, and gold is mysteriously on track to post its best monthly gain since October 2023. Despite the Federal Reserve’s dovish interest rate outlook, this price level does not yet appear to have been reached on a solid basis. Expectations of U.S. rate cuts from June have relaxed somewhat, and as described a little later in this analysis, the Fed appears poised to cut them from the third quarter, as U.S. inflation numbers came in stronger than expected in January and February. Perhaps the increase in gold purchases by the central bank of top consumer China could explain the price rise in March. However, even this explanation does not seem very convincing. At a time of great uncertainty and risk, banks will look to increase their cash reserves rather than pump liquidity through large gold purchases while gold prices are at high levels. And in fact, China’s central bank buying doesn’t seem to be a particularly noticeable trend, but rather a part of everyday transactions.

In the absence of reasonable explanations, propaganda may be behind this rise in gold prices since the beginning of the month. Therefore, there is a risk of this gold price falling to lower levels because:

a) it is not supported.

b) because the conditions have become even tighter.

c) and with inflation perhaps not yet out of the impasse in an economy that is once again proving robust, the possibility of a rate cut later this year than June 2024 is increasingly looming.

Perhaps silver is not yet considered completely overpriced like gold: compared to the peak of around $25.90/ounce on March 8, 2022, and the subsequent decline from $26 to $18, the price per ounce is now $24.9, an increase of 7% year on year, and a more than 5% increase year-to-date. The peak of two years ago has not yet been exceeded. But even if the situation is not yet as tense as the gold price and there is theoretically the possibility of further increases, the price per ounce of silver is unlikely to have a rally from these levels as is weighed down by the following factor: The perceived risk that the start of interest rate cuts will be delayed until after the June meeting. On this point, around mid-March 2024, in the first of two biannual US Congress hearings, US Federal Reserve Chairman Jerome Powell reiterated that the central bank was in no hurry to cut interest rates. That same week, but a few days earlier, Atlanta Fed President Raphael Bostic said he expected the first rate cut in the third quarter of the year and that it would be followed by a pause. Additionally, JPMorgan Chase (JPM) CEO Jamie Dimon insisted that the Fed should not cut interest rates in June because he is not yet convinced that the risk of inflation has been overcome. In addition, the Silver Institute also sees near-term challenges for silver from interest rate cuts in the US, as these are likely to occur in the second half of 2024 to boost silver investments rather than the first half of the current year.

Vizsla Silver shares: Possibly Low Share Price, but not Soon

Due to the short-term challenges highlighted above, the stock price may form another inviting point to start a position or increase the volume of shares in the portfolio but for the time being the appropriate recommendation rating is “Hold” for retail investors.

2024 is forecast by analysts to be a very positive year for gold and silver for two main reasons:

- Because investors will demand the precious metal, particularly gold, as a portfolio hedge against geopolitical risks due to tensions in the Middle East and the Red Sea.

- But mainly because, as already mentioned, the Fed is expected to start cutting the borrowing cost in the second half of the year, and lower interest rates bode well for demand for no-income yielding silver and gold.

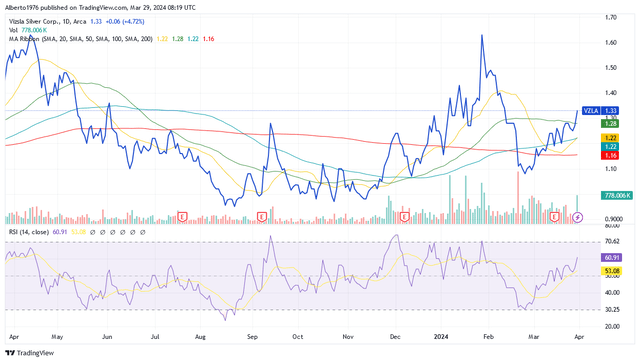

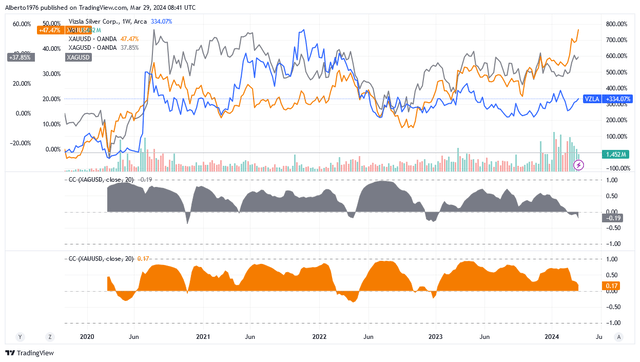

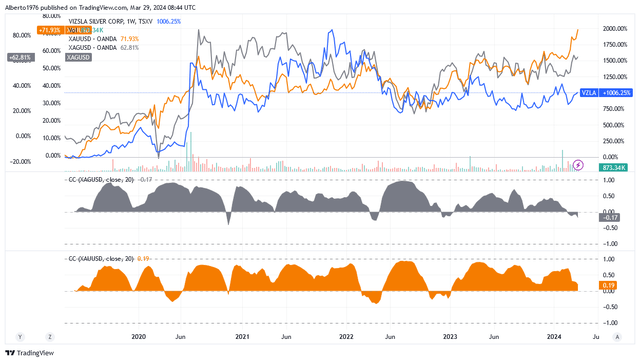

Based on a strong positive correlation with changes in silver and gold prices, as shown in the two charts below, Vizsla Silver’s share price is likely to follow the price of the precious metal, and since the latter is expected to be generally bullish this year, Vizsla Silver shares are therefore on course to have an upward trend as well.

The Positive Correlation Between Vizsla Silver Share Price and the Precious Metal

There is a positive correlation between changes in the precious metal price and the Vizsla Silver stock price, as shown in the two charts below. The positive correlation means that regardless of the return, which can even vary widely between assets, if the precious metal has upward momentum, the Vizsla Silver stock price is most likely also in upward momentum. Instead, when the precious metal is bearish, the Vizsla Silver share price is most likely also in a bearish mood.

Vizsla Silver Corp. shares under the symbol VZLA on the NYSE American market are positively correlated: with Gold Spot Price (XAUUSD:CUR) as indicated by the yellow area curve and with Silver Spot Price (XAGUSD:CUR) as indicated by the gray area curve, both curves in the lower part of the chart.

Source: TradingView

The chart suggests a strong positive correlation between the stock and gold or silver, as both colored area curves have been above zero (or in positive territory) for most of the past five years.

Vizsla Silver Corp.’s shares under the symbol VZLA:CA on the TSX Venture Exchange market correlate positively: with Gold Spot Price (XAUUSD:CUR) as indicated by the yellow area curve and with Silver Spot Price (XAGUSD:CUR) as indicated by the gray area curve, both curves in the lower part of the chart.

Source: TradingView

The chart suggests a strong positive correlation between the stock and gold or silver, as both colored area curves have been above zero (or in positive territory) for most of the past five years.

Vizsla Silver is focused on advancing its flagship project, the 100% owned Panuco silver-gold project in Sinaloa, Mexico, and the roadmap the company has drawn up for 2024 could provide a very important boost to the mining project. Assuming activities are executed as planned and the company hits all its targets, the shares appear well positioned to take robust advantage of the bullish sentiment expected to take place in the precious metals this year.

About Vizsla Silver in Sinaloa, Mexico: the Panuco silver-gold project and the La Garra-Metates District

The Panuco project is 100 percent owned by Vizsla and is located in Sinaloa, a province in western Mexico. This area hosts a prolific silver trend. Here, Canadian exploration and mining company First Majestic Silver Corp. (AG) (FR:CA) has its flagship San Dimas mine which is only 80 km from the Panuco project.

Source: Company Presentation – Vizsla Silver Corp. website

First Majestic Silver Corp. is among the world’s leading silver miners with full-year 2023 production of 26.9 million ounces of silver equivalent, derived from 10.3 million ounces of silver and 198,921 ounces of gold.

San Dimas underground production accounted for nearly 48% of First Majestic Silver’s full year 2023 consolidated production in silver equivalent ounces. San Dimas produced 12.8 million ounces of silver equivalent in 2023 based on 6.4 million ounces of silver and 76,964 ounces of gold produced at a total sustaining cost per ounce of silver equivalent of $16.48 versus the company’s consolidated $20.16/oz.

Based on the benchmark offered by San Dimas, the Panuco mineral area could have the potential to establish silver production significantly cheaper than most mines in the world, as the Silver Institute’s analysis suggests that primary mines averaged an AISC of $17/ounce in H1 2023.

Close to First Majestic Silver’s San Dimas mine and at a shorter distance than Panuco, Vizsla Silver could soon see an increase in its footprint. Located 32 km from the San Dimas mine, Vizsla Silver wants to acquire the La Garra-Metates district. The company would therefore increase the chance of having a broader portfolio of exploration activities in the future and with the property located close to well-known major silver producer First Majestic, there should be no doubt that it is in a prospective area.

Source: Company Presentation – Vizsla Silver Corp. website

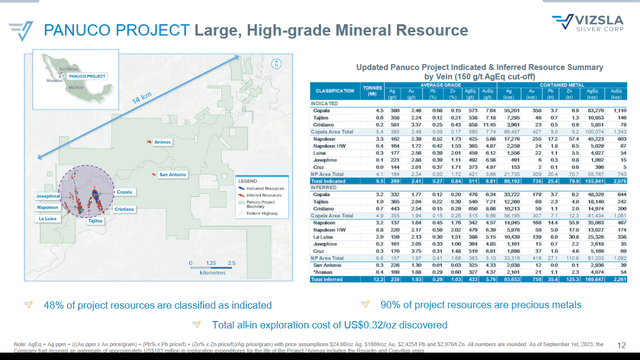

Panuco’s silver-gold project indicates the potential of a high-grade precious metals deposit, as over 350,000 meters of drilling on the mineral property to date has enabled the identification of several high-grade discoveries, shown in the map above from the company’s presentation for March 2024.

- Copala discovery: In the previous analysis, we noted that Copala’s mineralized footprint continues to extend southeast and north of the discovery. From there, drilling confirmed indications that the discovery has high-grade mineralization that remains open in both directions, particularly to the south, while highlighting a robust precious metal structure. The results extended mineralization further south of Copala towards the Tajitos deposit, but not only. They did more. Additional precious metal veins were previously identified between the high-grade Copala deposit and the Cristiano deposit. Drilling activity remains focused on further expansion of the Copala, but a mineralization rich in precious metals was recently encountered approximately 250 meters west of the Copala structure. This appears to be another area of high-grade mineralization emerging on the Panuco property, between the Napoleon and Copala resource areas. The company expects another 2,500 meters of drilling should further expand El Molino’s mineralized footprint as it appears to be open in all directions. This means there is huge upside potential for this stock going forward as the entire mineralization area continues to consolidate as results come in.

- Between the Tajitos deposit and the Copala main deposit: This is an area that requires further research as it hosts two promising high-grade discoveries. These are a structure of interesting mineralization near the surface called the “El Habal structure”, and a high-grade vein called the “Copala Vein 2” with the latter now representing 600 meters of the mineralized strike as drilling confirmed the continuity of the lode.

- The La Luisa Vein within the Napoleon discovery area: For Vizsla Silver, the high-grade Napoleon silver and gold vein is likely to be a key target. Several lateral veins branch off from it and can be explored in all directions. The La Luisa vein is located approximately 700 meters to the west. In the La Luisa vein, where shallow drilling is producing high-grade precious metal deposits over increasing widths, the local high-grade footprint potential has recently expanded further north in the mineralized structure, which remains open in all directions, but also to the south is progressing.

From previous analysis, the results of exploration activities have led to the following improvement: Vizsla’s Indicated Mineral Resource has increased from 7.5 million tons grading 243 grams per ton (g/t) of silver and 2.12 g/t gold or 437 g/t silver equivalent, up to 9.5 million tons grading 289 grams per ton (g/t) of silver and 2.41 g/t gold or 511 g/t silver equivalent. These resources included 58.3 million ounces of silver and 508,000 ounces of gold, or 104.8 million silver equivalent ounces, and now they include 88.192 million ounces of silver and 736,000 ounces of gold, or 155.841 million ounces of silver equivalent.

Vizsla Silver must now make a decision on the development of these resources, but first, it will focus on de-risking the resource base in the western part of the mining district: To this end, the company conducts metallurgical testing to determine how much metal could be recovered using traditional processing techniques. The team can then look forward to the further development phase of the Panuco resources with confidence. Preliminary metallurgical testing has already been completed in the areas associated with Copala, Napoleon, and Tajitos, which represent the majority of the project’s current resource base. The results have been encouraging in this regard. In addition to met testing, Vizsla Silver will continue drilling as the resource requires upgrading and expansion and the company has planned additional exploration activities for more than 65,000 meters.

Financial Support Is Getting Stronger

Vizsla will support its mineral operations in 2024 with a balance sheet that has cash and short-term investments of approximately $13.6 million, but no significant debt outstanding as of January 30, 2024. This financial strength is opposed to the $24 million allocated by the company to capital expenditures for the trailing twelve months ended January 30, 2024. Vizsla also recently raised proceeds of approx. CA$34.5 million (or US$25.44 million as of this writing) through bought deal financing offering 23 million common shares at CA$1.50 per share.

But beyond the stock issuance, a new financing avenue has opened up for Vizsla Silver Corp and the Canadian explorer would thus bypass resorting to loan capital as borrowings remain expensive. Vizsla Silver Corp. would like to spin out 51% of the shares in Vizsla Royalties Corp. – its 100% owned subsidiary – to the company’s shareholders and distribute the stake on a pro-rata basis so that Vizsla Silver will continue to hold 49% of Vizsla Royalties. Vizsla Royalties Corp. indirectly holds a royalty on any potential future mineral production at Vizsla’s Panuco silver-gold project and may be entitled to additional royalties on any production activities that may be established in the Sinaloa Mining District in the future. Following the spin-out, Vizsla Royalties may be listed on the stock market. In this way, new financial resources will flow to further advance the mining project in Panuco.

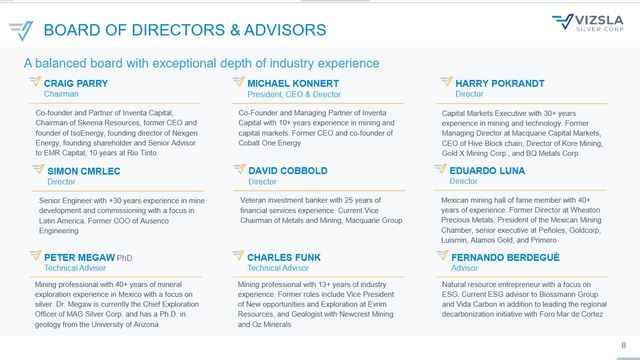

Relevant Additions to the Board of Directors and Advisors

Vizsla Silver welcomed more high-profile specialists to its board with the appointment of Mexican senior mining expert Eduardo Luna in late 2023 and senior mining engineer Simon Cmrlec as Chief Operating Officer in early 2024, adding concreteness to Vizsla’s mineral intentions.

Source: Company Presentation – Vizsla Silver Corp.

Conclusion

This analysis assumes Vizsla Silver will benefit from positive sentiment in precious metals in 2024 as the Fed rate-cutting policy will bolster the demand for silver and gold.

The stock price is positively correlated with silver and gold prices, so if precious metal prices rise, Vizsla Silver will most likely be on an upward trend as well. This strong positive correlation with gold and silver is gaining momentum as Vizsla Silver Corp. continues to advance its portfolio of mineral activities.

Vizsla Silver Corp. is exploring the Panuco district of Sinaloa, a province in western Mexico, and activities are progressing well. The company has increased the resource estimate before the end of 2023, as predicted in the previous analysis, and a preliminary economic assessment should now follow in 2024. Metallurgical testing helps the company de-risk the majority of the resource basin, providing confidence in the development phase of the mineral project.

The company may soon expand its mineral presence in Sinaloa in a very promising area, as well-known global silver operator First Majestic Silver owns the San Dimas mine near the La Garra-Metates district takeover target.

Vizsla Silver Corp.’s financial position is improving to sustain exploration, PEA, and future resource development as well as the completion of the acquisition thanks to a recently completed bought deal financing and the potential listing of the company’s royalty subsidiary following the spin-out transaction.

Therefore, retail investors may want to Hold shares of Vizsla Silver Corp. in their portfolio. The stocks could offer an attractive share price to increase or expand a position in the future. Today, however, retail investors should stick to a Hold rating on Vizsla Silver which is well positioned with its mineral target to replicate bullish sentiment for precious metals in 2024.