vodafone idea fpo: As Vi Speak: Telecom company rings maximum FPO of Rs18,000 crore.

The telco, formed in 2018 through the merger of Aditya Birla Group’s Idea Cellular and Vodafone Plc’s Indian unit, priced the issue at ₹10-11 per share. At the top of the band, the issue is being issued at a discount of around 26% to Rs 14.87 per share, which was recently set as a priority issue to one of the promoters.

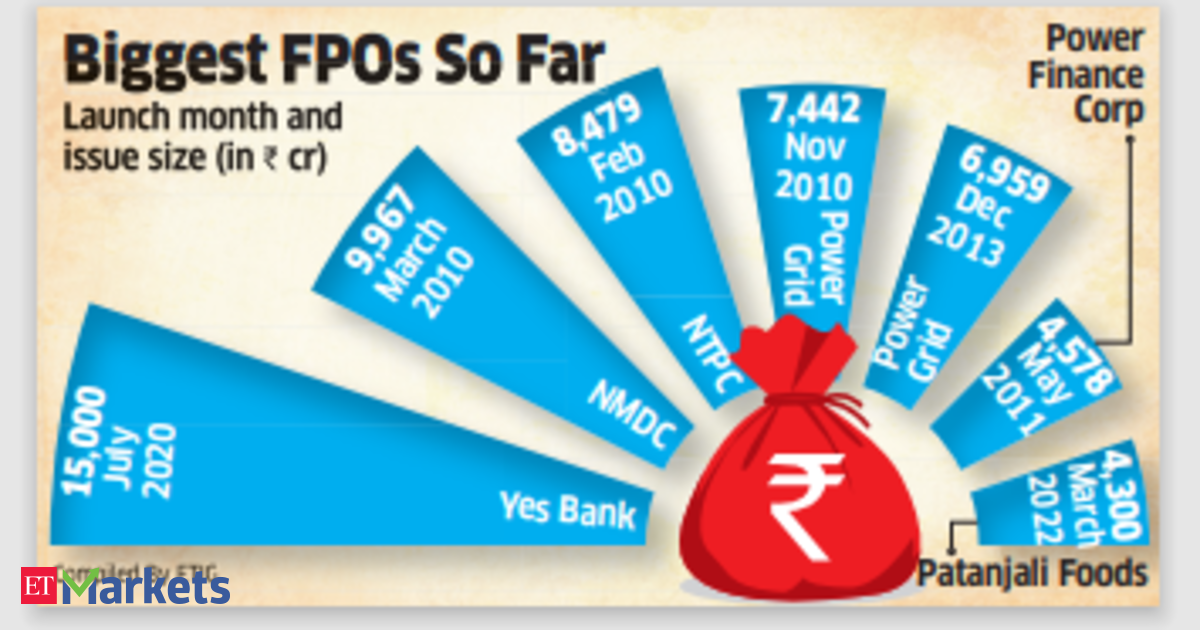

The previous largest FPO was undertaken by Yes Bank in July 2020, raising Rs 15,000 crore. In February last year, Adani Enterprises suddenly canceled its Rs 20,000 crore FPO, a day after successfully closing the offer. This follows a 28.5% decline in the stock price following the Hindenburg Research report.

The board has approved an FPO of “up to Rs 18,000 crore”, Vodafone Idea said in a statement on Friday. The price, it said, “is approximately a 15% discount compared to the last closing price of Rs 12.95.”

“Despite a discount of 15-17 per cent, the near-term recovery path for Vi looks uncertain,” said Shivani Nyati, head of assets at Swastika Investmart. “While the financing will strengthen Vi’s infrastructure, the company faces challenges on the financial front. “2026 will see a potential financial crisis looming, with significant spectrum and up to $4 billion in adjusted gross revenue (AGR) dues to be paid.”

Shares of Vi closed 0.2 per cent higher at Rs 12.96 on the BSE on Friday, from an intra-day low of Rs 12.23, despite overall weakness in the market. The Indian government is Vi’s largest shareholder, holding more than 33% of the shares. This was obtained in lieu of membership fees as part of the previous rescue plan. According to analysts, equity financing worth Rs 20,000 crore, including issue of shares to promoter entities, would imply dilution of around 26 per cent.

The telco said on Friday that its capital raising committee will meet on April 16 to allocate shares to successful anchor investors.

A person familiar with the matter told ET earlier that the stake for anchor investors reserved for qualified institutional buyers (QIBs) has already been fully subscribed. Half of the FPO’s book is typically allocated for QIBs, 35% for individual investors and the remainder for high net worth individuals (HNIs).

Last week, the loss-making telco’s board approved the issuance of preference shares to raise Rs 2,075 crore from Oriana Investments Pte Ltd, an Aditya Birla Group (ABG) company. This sets the stage for a broader Rs 45,000-crore funding programme, including: The debt of Rs 25,000 crore is key to helping the telco compete effectively with rivals Reliance Jio and Bharti Airtel and stem steep subscriber losses.

The money is needed to repay suppliers such as tower company Indus Towers, strengthen 4G networks and fund the rollout of 5G services. Jio and Bharti Airtel have already completed the rollout of their pan-India 5G services.

The person quoted above had earlier told ET that debt financing of around Rs 25,000 crore would be raised soon after the FPO closes.

“Completion of the planned Rs 4,500-crore financing will enable VIL to increase network capital expenditure and narrow the gap with peers in 4G coverage and 5G rollout,” Citi Research said in a note. “The combination of the possibility of post-election tariff hikes and the possibility of AGR relief (a matter pending before the Supreme Court) will significantly improve VIL’s cash flow position.”

Citi may still face cash shortfall in the second half of FY26 once the government’s ongoing moratorium on AGR and spectrum repayment ends unless the Center exercises its option to convert these dues into equity, Citi added. The AGR dues are Rs 70,000 crore.

Goldman Sachs estimates that in the absence of recent headline rate hikes, Vi will need $8 billion to $10 billion (Rs 65,000-83,000 crore) in new capital over the next two years to build a mobile broadband network that can compete with Airtel and Jio. I estimated it.

Vi’s net debt widened to Rs 2.14 lakh crore in the third quarter of the fiscal, while cash and cash equivalents stood at Rs 318.9 crore. Currently, the bank’s debt stands at around Rs 4,500 billion.

The company’s total mobile user base fell by another 1.02 million at the end of February, to 222.5 million. Market leader Jio added 3.59 million users while Airtel added 1.53 million users, taking their subscriber base to 467.48 million and 384.01 million respectively.

Axis Capital, Jefferies and SBI Capital were appointed as the offering banks.