Volatility measurement using average True range indicators -analysis and prediction -March 24, 20125

Volatility Measurement: Conversation Point

- Volatility is to measure price fluctuations for a certain period of time.

- Average True range (ATR) and Volatility Indicator is used.

Technical analysis can give a significant value to the trader.

There is no indicator, but Indicator set We will fully predict the future. The trader can use the historical price fluctuations to get an idea about something. May It happens in the future.

In this article, we will focus on volatility, one of the main factors in determining market conditions, and develop discussions on technical analysis one step further.

Risk of volatility

The charm of high volatility conditions can be clear. The higher the level of volatility, the greater the price fluctuations, and the greater the price movement, the more potential opportunities are.

Traders need to see the entire spectrum of this scenario. The higher the volatility, the less price fluctuations are possible. The reversal can be more aggressive, and if the trader finds himself in the wrong aspect of the movement, the potential loss can be much higher in the high -prestigious environment because the increased activity can accompany a greater price change for the merchant.

Average real range

Regarding volatility measurement, the average actual range indicator is higher than that of most. ATR was created by J. WELLES WILDER (the same gentleman who created the RSI, Parabolic SAR, and ADX indicators) and was designed to measure the actual scope for the specified period.

The actual range is specified as the larger one of the following:

- The highest level of the current period is the lowest level of the current period

- The highest point in the current period is less than the end of the previous period.

- The minimum of the current period is less than the finish of the previous period.

Since we try to measure volatility, the absolute value is used in the above calculation to determine the ‘real range’. Therefore, the biggest of the three numbers above is the ‘true range’ regardless of whether the value is negative or not.

When these values are calculated, they can average short -term fluctuations for a certain period of time (14 periods are common). The result is an average real range.

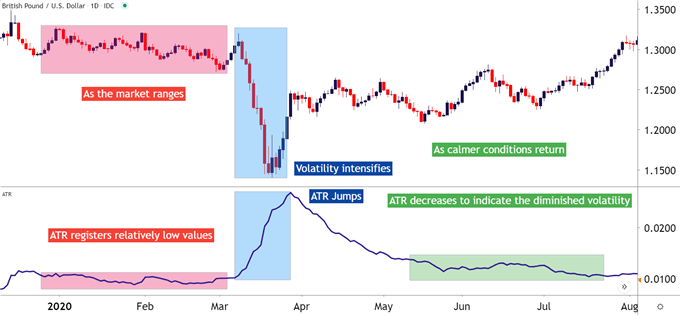

In the chart below, the price fluctuations have increased, and ATR has been added to explain how the indicators register a larger value.

GBP/USD with ATR (January 2020)

How to use ATR

After traders learn how to measure volatility, they can integrate ATR indicators into one of two ways.

- As a volatility filter for determining the strategy or approach to use.

- To measure the stop distance possible when you start a dangerous expenditure or a trading location.

Use ATR as a volatility filter

The trader can access the base environment using one of the two different approaches.

In short, traders can find the bottom environment or continue to change. That is, the trader can access the low explosive resistance by trading the range (a continuous continuation of low volatility), or or evacuation (increasing volatility).

The difference between the two conditions is huge. While the Range Trader tries to sell resistance and buy support, the brake out trader wants to be the opposite.

In addition, the range trader usually has a luxury of well -defined support and resistance for definition arrangement. Breakout trader is not. And brake out can lead to potentially large movements, but the chance of success is quite low. This means that it can be rich in false escape, and brake out transactions often require more aggressive risk compensation ratios (offsetting success with low chance of success).

Use ATR for risk management

One of the main struggles of a new merchant is to learn the location of the suspension of protection when you start a new position. ATR can help this goal.

Since ATRs are based on market price fluctuations, the indicators will grow with volatility. This allows the trader to use a wider stop in the volatile market or use a larger stop in a low power environment.

ATR indicators are displayed in the same price format as the call pair. Therefore, the value of ‘.00458’ is turned on EUR/USD It represents 45.8 pip. Or reading of’ .455 ‘ USDJPY It represents 45.5 pip. As volatility increases or decreases, these statistics increase or decrease.

Traders can use this advantageously by arranging stops according to the value of ATR. It is a direct indicator of the factor of the indicator (e.g. 50%of ATR). The key here is that reading indicators can react to the recent market conditions, allowing traders to adapt to indicators in the approach.