Volume Analysis (VSA) – Trading Strategy – May 8, 2024

Market Sentiment Revealed:

Explore Volume Spread Analysis (VSA) for Forex Traders

For Forex traders, understanding market sentiment is important to make informed decisions. traditional technical analysis We focus on price movements, but what if we could look deeper and measure the buying and selling pressures behind these movements? Enter Volume Spread Analysis (VSA).

What is VSA?

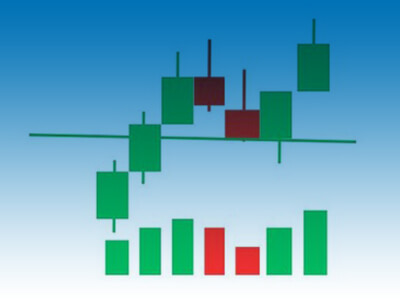

VSA is a technical analysis method that examines relationships such as: price action Volume to measure basic supply and demand in a market. by candlestick chart analysis Together with volume bars, VSA attempts to identify the intentions of large players such as institutions and market makers.

Key elements of VSA:

- Volume: High volume followed by strong price action (large candles) suggests institutional intervention and is potentially a sign of a continuation of the trend. Conversely, low volume following strong price movements can indicate a lack of confidence and a possible trend reversal.

- Price range (spread): The difference between the high and low points of a candle indicates the price range. VSA focuses on closing prices along this range. When trading volume is high and the closing price is formed near the high point, it indicates buying pressure, and when trading volume is high and the closing price is formed near the low point, it indicates selling advantage.

- Closing price position: The position of the closing price within the candle body provides a clue. Closes near the middle indicate indecision, while closes near the extremes (top or bottom) indicate buying or selling pressure, respectively.

Interpretation of the story:

VSA focuses on specific candlestick patterns combined with volume levels to infer supply and demand. Here are some basic interpretations:

- High volume across a wide range of bars: This may indicate strong buying (close near the high) or selling pressure (close near the low).

- Low volume in a wide range of bars: This may indicate indecision or fatigue after a strong movement.

- High volume in a narrow range of bars: This could suggest an accumulation (close near the high) or distribution (close near the low) of large players.

remember: VSA is not a magic formula. It is a tool used in conjunction with other tools. Technical indicators and strong risk management can help you improve your trading decisions.

VSA for Forex Trading:

Keep in mind that VSA can be applied to any market, but Forex has its own unique characteristics. Unlike stocks, Forex volume refers to the number of ticks (price movements) rather than actual units traded. However, experienced VSA users can interpret relative changes in tick volume.

Benefits of VSA:

- Improved trading timing: VSA can help you identify potential entry and exit points by measuring the strength of price movements.

- Check the trends: VSA can act as a filter to validate trends identified by other users. Technical indicators.

- Understand market psychology: VSA provides insight into the sentiment of large market participants by deciphering the volume behind price movements.

Limitations of VSA:

- Subjectivity: VSA interpretation can be subjective and requires practice and experience to improve analysis.

- Not a standalone strategy: VSA should be used in conjunction with other technical indicators. Risk management strategy.

Study materials:

- books: “Volume Diffusion Analysis” by Richard Wyckoff

- Online Courses: Tons of online courses and resources to dive deeper into VSA

implication:

VSA is valuable Tools for Forex Traders We seek to understand market psychology beyond simple price action. Incorporating VSA into your analysis can provide valuable insight into the buying and selling pressures driving price movements, potentially allowing you to make more informed trading decisions. However, remember that VSA should be used in conjunction with other trading strategies and risk management practices.

Ready to dive deeper? Explore online VSA training resources, including forums and video tutorials, to gain a practical understanding of different price and volume patterns. Practice and experience are the keys to learning VSA and using it effectively in your Forex trading journey.

disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a qualified financial advisor before making any investment decisions.

happy trading

May Pip be in your favor!