Vote with your money and feet

Individual voting, often considered a civic duty, statistically has a negligible effect on election results. Studies have shown that differences between Republican and Democratic state governments are minimal on a variety of policy outcomes.

Politicians often declare each election ‘the most important election of our lifetime’ to rally their supporters. But despite increased voter turnout, change remains difficult.

Government continues to grow, but trust and satisfaction with government institutions continue to decline. Seventy percent of Americans have “some or little” confidence in the presidency, and the economic confidence rating among American adults is -41 on a scale of -100 to 100. 74% of Americans believe economic conditions are worsening.

Vote with your money

Besides voting in elections, there are other ways for individuals to affect change. For example, consumers always “vote” with their money when choosing which goods and services to buy. It serves as a signal to producers, such as entrepreneurs and companies, about what products the market wants.

A notorious example is “New Coke,” launched by Coca-Cola in 1985. Angry consumers rejected the new flavor. Some have even started campaigns urging the company to return original Coca-Cola products. Less than a year later, Coca-Cola changed tack and admitted its mistake.

Today, marketers remember New Coke as perhaps the most famous failed product in history. But this episode also demonstrates the immediacy of consumer feedback loops and the impact they have when people vote with their money.

Vote with your feet

Another approach is to “vote in person,” or relocate to areas where cultural climate, economic opportunity, and other factors better align with priorities. As populations shift, governments have an incentive to adjust policies to maintain their tax base.

During the pandemic and its aftermath, many Americans have moved from states with strict business and school closure policies. Migration occurred on a historic scale as people moved from states like California and New York to places like Florida and Tennessee. In 2020, California’s population declined for the first time in 100 years.

Money 2.0 is even more powerful.

Bitcoin users are taking this action a step further by rejecting fiat currency altogether. However, this can present unique challenges depending on where you live. The question then becomes, which location best meets the needs of Bitcoin users?

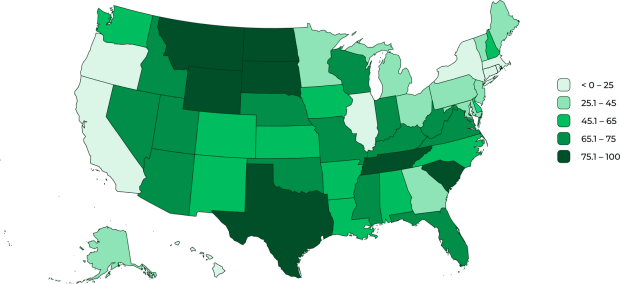

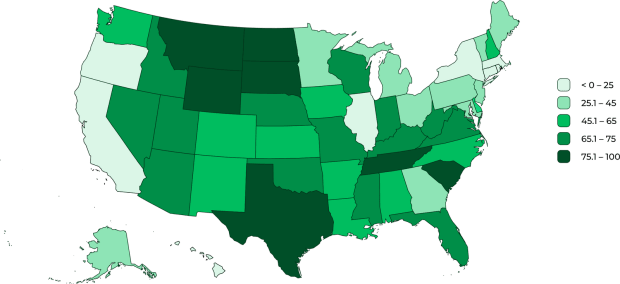

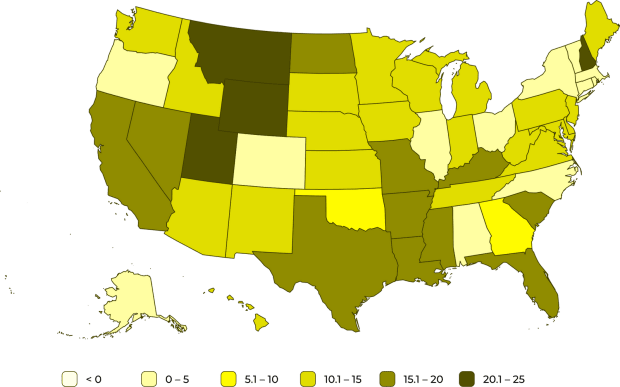

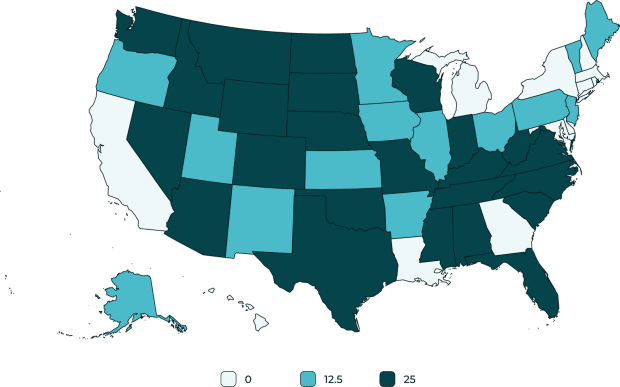

In our search for answers, we were inspired to compile our research into a report we call the Bitcoin Index. Each state in the United States is ranked by priority for Bitcoin miners (<0 - 100).

bitcoin index

Inspiration for this index includes the Sound Money Defense League’s Sound Money Index and the Cato Institute’s Freedom in the 50 States Index. New Hampshire’s Free State Project, which aimed to attract enough liberals to the state to influence policy in favor of liberty, was another source of inspiration. But what sets the Bitcoin Index apart is that it was created by Bitcoin miners, for Bitcoin miners.

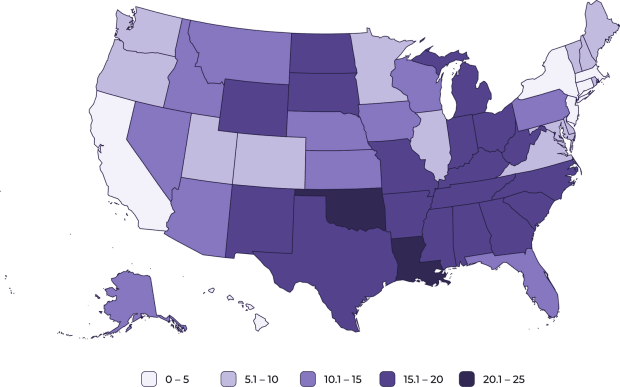

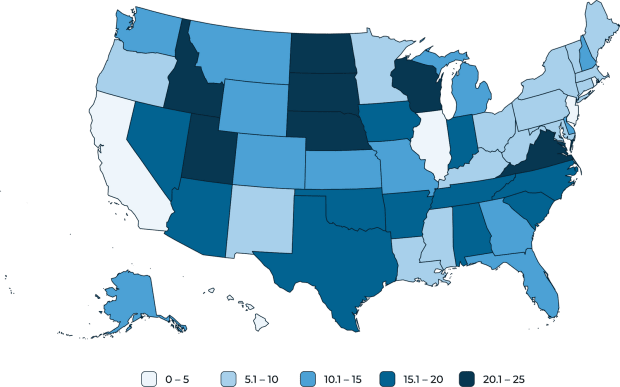

Bitcoin Index Composition

The Bitcoin Index provides analysis for all 50 states using nine indicators across four top categories: Cost of Living, Business-Friendliness, Financial Freedom, and Proactive Positioning. Up to 25 points are allocated per category, and up to 100 points per week. States can receive negative marks for policies that are significantly out of sync with Bitcoin priorities.

category

living expenses

business friendly

financial freedom

pre-positioning

Use index

Technology has given us the freedom to choose where we live and work, and the number of people who own Bitcoin is growing every day. As mobility increases and remote working increases, governments will need to pay more attention to the needs of Bitcoin holders when formulating policies.

It is not inconceivable that national and local governments around the world would explicitly set rules and regulations to attract Bitcoin miners. This has already happened in El Salvador, and while researching the Bitcoin index, we discovered that this is also happening in several states in the US.

We hope the Bitcoin community will find the Bitcoin Index useful as a guide to help them find the ideal place to live, work, and raise their family in a community that aligns with their values.

This is a guest post written by Dave Birnbaum in collaboration with David Waugh. The opinions expressed are solely personal and do not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.

Dave Birnbaum, Director of Product at Coinbits, leads the team that makes Bitcoin user-friendly for the next generation of Bitcoin users. He is a prolific inventor who holds dozens of patents in fields such as fintech, VR, and communications. He lives outside of Nashville.

David Waugh is a business development and communications specialist at Coinbits. He previously served as editor-in-chief of the American Institute for Economic Research.