VYMI: International Dividend ETF, Yield 4.7% Growth, Momentum

DKosig

Vanguard International High Dividend Yield ETF (NASDAQ:VYMI) is a diversified index ETF that focuses on international stocks with above-average returns. VYMI offers investors a healthy yield of 4.7%, a cheap valuation, and some momentum. The fund is a strong investment Opportunity and purchase.

VYMI – Basic

- Investment Manager: Vanguard

- Base Indices: High Dividend Yield Indexes Worldwide | LSEG

- Dividend Yield: 4.73%

- Expense ratio: 0.22%

- Total return CAGR over 5 years: 8.06%

VYMI – Overview and Analysis

Indexes and Portfolios

VYMI is an index ETF that tracks the FTSE All-World, excluding the US High Dividend Yield Index. The index includes the highest-performing international stocks until their cumulative market capitalization reaches 50% of the total market capitalization of those stocks. So divide the market into two based on returns and invest in the half with higher returns.

This is a broad index and the results are as follows: It’s a very well-diversified fund that invests in over 1,000 securities, a broad range of industries, and country exposure. Diversification is greater than most broad stock indices, including the S&P 500 and Nasdaq-100.

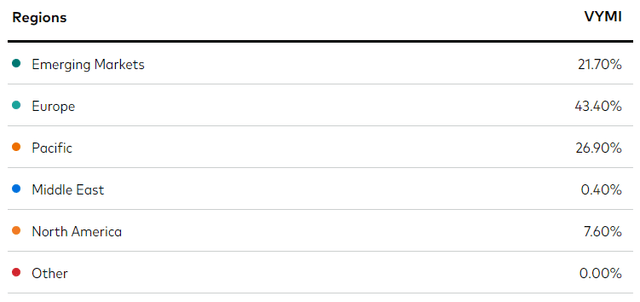

VYMI is overweighted in Europe due to its relatively large number of public stocks.

secret

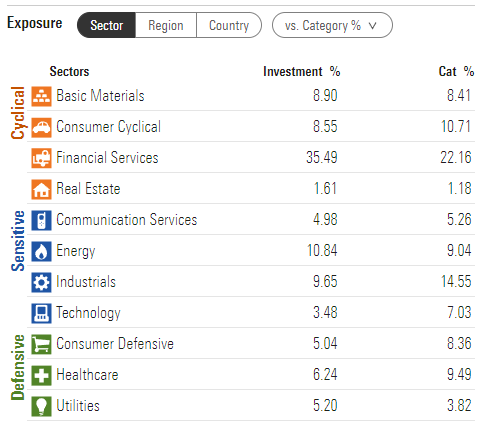

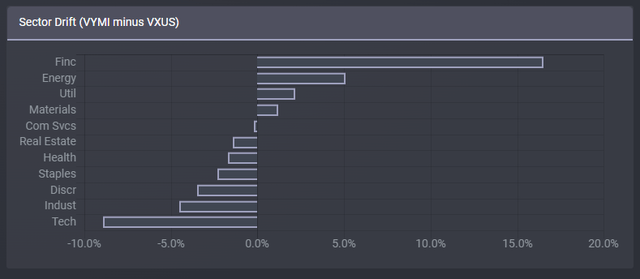

The fund is overweighted several established economic industries, particularly financial industries, due to their above-average returns. On the other hand, the fund is underweight in technology because few technology companies offer competitive returns. This industry bias is very common in international and dividend ETFs.

dawn of fame

Etfrc.com

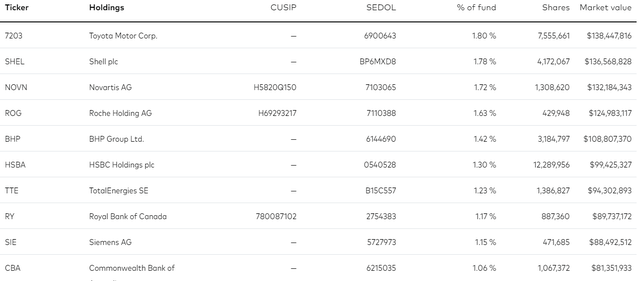

VYMI’s large stake is owned by Novartis (NVS) and Roche (OTCQX:RHHBY), large international energy/commodities players including Shell (SHEL) and TotalEnergies (TTE). Energy is somewhat overrepresented in the fund’s top holdings, with its overall allocation only slightly above average at 10%.

**Editor’s Note: The NOVN ticker and ROG ticker are both Swiss tickers of Novartis and Roche.

secret

Overall, this fund provides investors with diversified exposure to international stocks and all the benefits that come with it. In my opinion, this fund is diversified enough to serve as a core portfolio holding.

Valuation Analysis

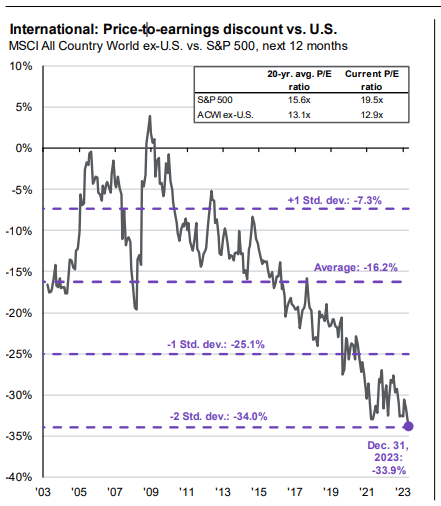

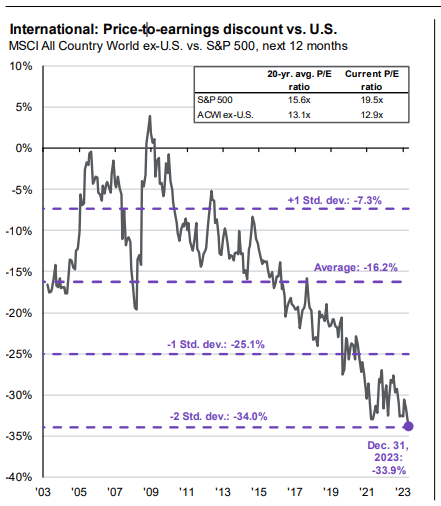

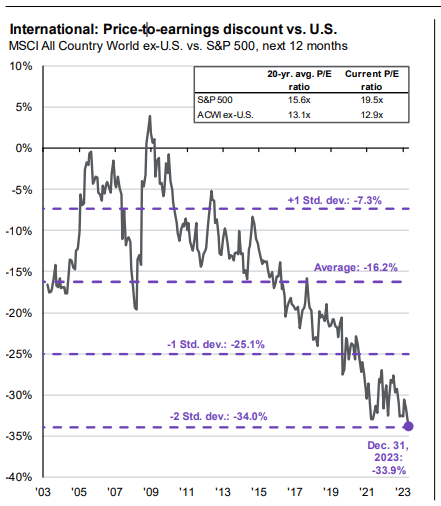

International stocks typically trade at a discount to U.S. stocks because investors are willing to pay a premium for the strength and resilience of the U.S. economy. However, discounts vary and currently double Spacious as usual.

JPMorgan Market Guide

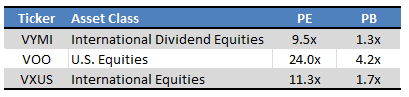

VYMI itself also trades at a significant discount to U.S. stocks and a slight discount to broad international stock indices.

Fund Reports – Table by Author

VYMI’s cheap valuation could lead to significant capital gains and outperformance as valuation normalizes. Valuations may normalize for a variety of reasons, including improving investor sentiment, economic fundamentals, and asset flows.

International stock valuations have remained unusually low for a long time, so there is little confidence that this situation will improve any time soon. There were periods of some improvement, including in late 2020 and early 2022, but most of these movements proved to be temporary and soon reverted. I don’t think there are any catalysts that will improve valuations in the short term.

VYMI’s cheap valuation equates to a low stock price, which directly increases the fund’s dividend yield. Which brings me to the next point.

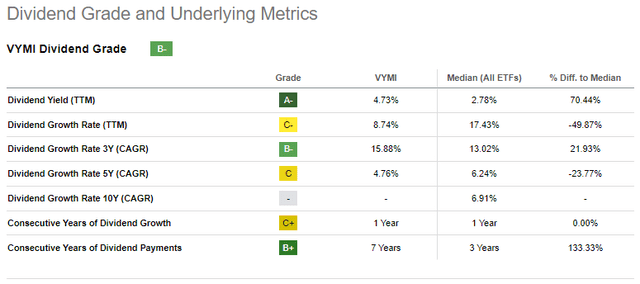

Dividend Analysis

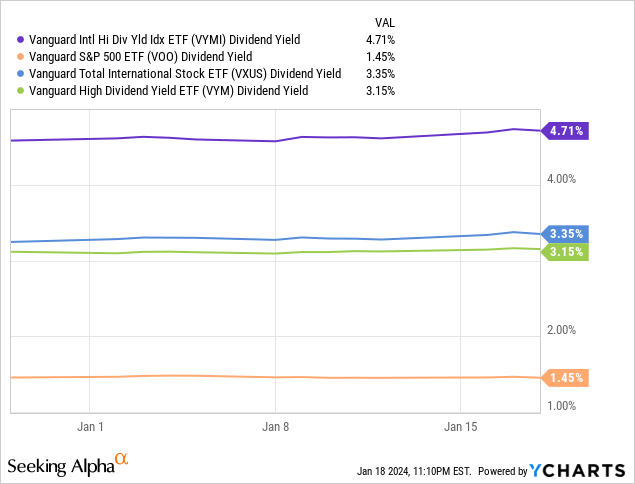

VYMI offers investors a dividend yield of 4.7%. This is a pretty good dividend yield in absolute terms, well above the S&P 500 and slightly higher than international stocks and US dividend stocks.

VYMI’s relatively strong dividend is due to two factors.

First, the fund invests in foreign stocks, which tend to have higher returns than U.S. stocks. This is partly due to differences in industry shares. This is because internationally, there is more emphasis on finance rather than technology. This is also partly due to valuation issues. International stocks typically trade at lower prices, resulting in higher returns.

JPMorgan Market Guide

The second reason the fund’s returns are higher than average is because it focuses on international stocks that produce above-average returns. This may seem obvious, but it’s still important to mention.

VYMI’s dividend has grown quite well in the past, with some volatility.

pursue alpha

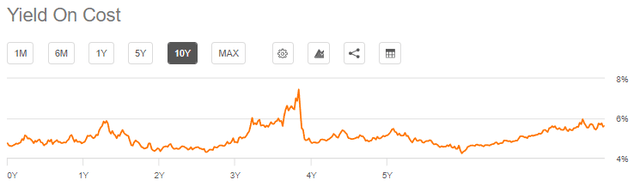

Due to dividend and stock price volatility, the cost-to-earnings ratio is showing little upward trend.

pursue alpha

The best dividend ETFs have returns that are much smoother on the cost curve. For reference, this is the cost-to-return ratio of the SCHD Schwab US Dividend Equity ETF (SCHD).

pursue alpha

Despite the above, VYMI’s dividend appears to be reasonably good, if not outstanding. Investors looking for the highest yield or strong dividend growth might consider other funds, but VYMI offers reasonably good dividends, above average for stock funds.

Performance analysis

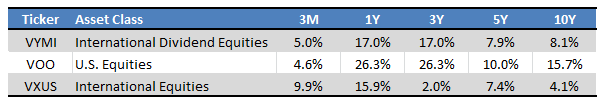

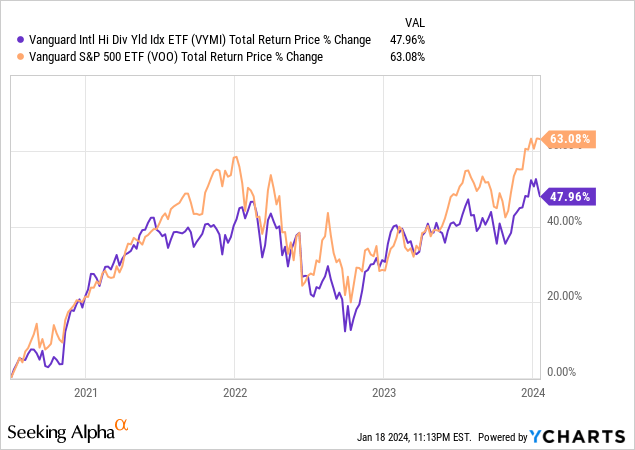

VYMI’s earnings performance is below average at best. The fund has underperformed the S&P 500 over the long term and over most relevant periods. VYMI is surpassed Broader international stocks over the long term and over the most relevant time periods. However, starting in early 2022, performance has improved significantly.

Vanguard – Table by author

VYMI’s performance is easy to explain.

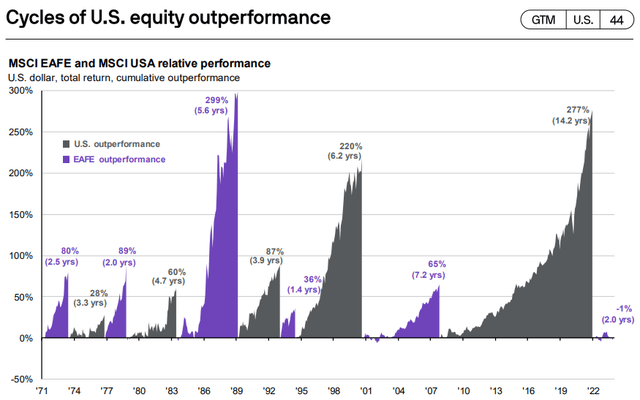

The fund has significantly underperformed the S&P 500 since (relative) international valuations peaked in the aftermath of the financial crisis.

JPMorgan Market Guide

But it has done much better since the pandemic. Returns were broadly similar to those of the S&P 500, with a lot of volatility depending on the specific time period in question. The fund has performed somewhat poorly since mid-2021.

However, it has performed well since we last discussed the fund in mid-2023 and before that in late 2022.

Looking at international stocks more broadly, JPMorgan (JPM) data shows: very It slightly outperformed U.S. stocks between 2022 and 2023, but the trend has largely reversed since then. This was the shortest and shallowest cycle of international performance in decades.

JPMorgan Market Guide

In my opinion, VYMI’s overall performance record is quite good. long term returns was They used to be much weaker, but valuations were also much higher, and both have improved.

conclusion

VYMI offers investors a healthy 4.7% yield, cheap valuation, and momentum. This fund is a strong investment and buying opportunity.