Walmart: Market Leader Deserves Premium Valuation – Hold Buy (NYSE:WMT)

Shutter_m

We previously worked with Walmart (New York Stock Exchange: WMT) In September 2023, we discussed a solid investment thesis driven by market-leading dollar share and comparative sales growth despite a rising inflation and rising interest rate environment.

Combined with various products We gave the stock a Buy rating across the Retail/E-Commerce and Advertising sectors, and the stock has also delivered a total return of over 15% since then.

In this article, we will discuss why we maintain a Buy rating on WMT stock thanks to the strong growth observed in membership revenue and advertising. This growth typically contributes directly to the bottom line.

The stock remains shareholder friendly, as seen by steady share buybacks, dividend increases, and recent stock splits.

Combined with its unique market leadership in the U.S. retail market, we remain confident in WMT. The ability to deliver profitable growth up front while naturally accounting for the inherent premium valuation.

Despite the premium valuation, the WMT investment thesis remains solid.

WMT recently reported revenue of $173.38 billion (+7.8% QoQ/ +5.7% YoY), operating profit of $7.25 billion (+16.9% QoQ/ +14% YoY), and adjusted earnings of two quarters in the fourth quarter of 2024. The ship’s performance was recorded and reported. EPS was $0.60 (+17.6% QoQ/ +5.2% YoY).

Additionally, in 2024 (CY2023), they also recorded exemplary figures of $648.1 billion (+6% YoY), $270.1 billion (+10.1% YoY), and $2.22 billion (+5.7% YoY), respectively.

It’s clear that WMT’s advertising and membership growth contributed significantly to its excellent revenue/profit growth in FY2024.

For example, its global advertising business saw its membership and other revenue grow +1.4% to $5.48 billion in fiscal 2024, up +28% year-over-year to $3.4 billion, which typically results in higher profit margins compared to commerce. I’m proud of it.

Anyone concerned about the expected deceleration in comparable sales by 3.9% (-0.8 points QoQ/ -4.9 YoY) in Q4 2024 should also pay attention to the impact of deflation on the top line, as CPI has already peaked due to expected rate cuts. You should. It will be priced in the second quarter of 2024, if not in the second quarter of 2024.

The current robust profitability has directly contributed to WMT’s adjusted leverage, which resulted in a debt-to-EBITDA ratio of 0.97x in Q4 2024, compared to 1.03x reported in Q4 2023 and 1.36x in Q4 2020.

As a result, WMT delivered a promising FY2025 (CY2024) with pro forma revenue of $670.86 billion (+3.5% YoY), operating profit of $28.36 billion (+5% YoY), and adjusted EPS of $2.30 (+3.6% YoY). Provided guidelines. (after splitting) is at the midpoint.

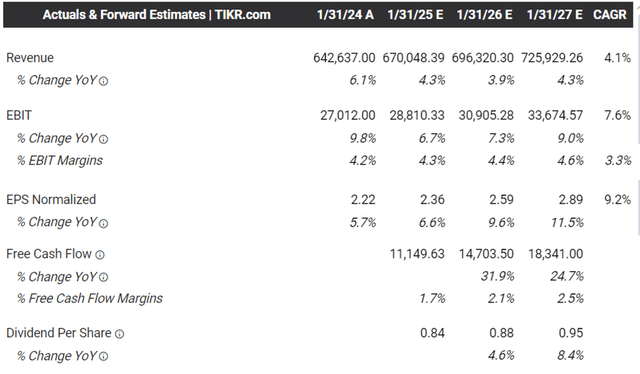

Agreed Forward Estimates

Tikr Terminal

With an excellent operating margin of 4.16% (+0.16 points YoY) in FY 2024 and expected to expand to 4.22% (+0.06 points YoY) in FY 2025, it is surprising that the consensus has raised its estimates moderately compared to 3.90% in FY 2020. This is not it. , further helped by a reduction in float due to share buybacks.

WMT is currently expected to report accelerated top-line/bottom-line growth at a CAGR of +4.1% and +9.2% through FY2027. This compares to previous estimates of +2.9%/+6% and historical growth of +4.2%/. +6.4% each between FY2017 and FY2024.

The projected profitable growth trend is indeed very promising. In particular, this is because cash flow generation will expand in the future, allowing increased capital investment and shareholder returns to be further maintained.

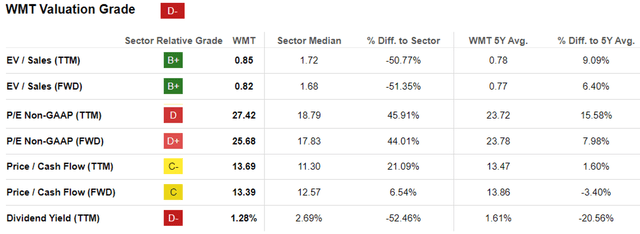

WMT assessment

pursue alpha

As a result of its profitable growth trend, it’s understandable why WMT has a premium FWD P/E valuation of 25.68x and a FWD price/cash flow valuation of 13.39x.

This compares to a one-year average of 24.08x/12.66x, a three-year pre-pandemic average of 19.73x/9.40x, and a sector median of 17.83x/12.57x, respectively.

The same premium is observed in commerce peers such as Costco (COST) at 45.65x/31.06x and Amazon (AMZN) at 41.47x/15.81x, driven by a growing member base, profitable growth trends, and strong shareholder returns. until now.

As a result, we don’t see WMT being expensive here, as it remains the largest U.S. retailer as of January 2024, with offline sales of $376.41 billion (+2.5% YoY) and e-commerce sales of $65.4 billion. (+22.4% YoY) over the past 12 months.

This compares to a total COST of $180.12 billion in the U.S. over the past 12 months and $107.41 billion for Target (TGT) in 2023 (nearly all of its revenue comes from the U.S.), putting it close to being the king of e-commerce. , AMZN’s 2023 North American revenue is $352.82 billion.

In addition, WMT already offers Walmart+, an annual membership plan, to boost e-commerce, and especially offers value-added free shipping and returns, fuel savings, video streaming, and more through Paramount+ to boost e-commerce. sales.

At the same time, the retailer will also offer a new same-day delivery service from March 2024. Walmart+ consumers generally “shop more often and spend more” by “approximately 31% more in-store and +206% more at Walmart.” .com.”

With the tremendous opportunity in the e-commerce market and TAM in the U.S. growing from $4.93 trillion in 2022 to $5.45 trillion in 2027, we believe WMT is well-positioned for continued growth and shareholder returns.

So, is WMT stock a buy?Sell or Hold?

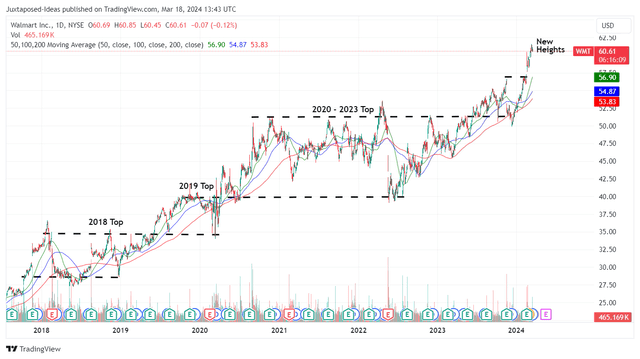

WMT 5 year stock price

trading view

Combined with the tailwind of a stock split announced in early 2024, it’s no wonder why WMT rallied as it did now, breaking its 50/100/200 day moving averages.

With the stock charts hitting new highs at the time of this writing, it can be said that market momentum is very optimistic and is looking even stronger on the back of promising FY2025 (CY2024) guidance.

Based on FY2024 adjusted EPS of $2.22 and FWD P/E of 25.68x, WMT appears to be trading near our fair value estimate of $57, with a minimum premium of +6.7% from current levels.

Based on our FY2027 adjusted EPS estimate of $2.89, there appears to be outstanding upside potential of +21.9% compared to our long-term price target of $74.20.

Readers should also note that WMT recently announced a +9% increase in its dividend per share to $0.83 (post-split), which represents an acceleration of dividend growth compared to the historical three-year dividend per share growth rate of +2.44%.

Seeking Alpha Quant also rates Dividend Safety at B- as its interest coverage ratio of 10.07x and dividend coverage ratio of 2.82x remain stable compared to the five-year averages of 10.91x and 2.60x.

Most of the retailer’s cash flow tailwinds have already been put to good use, with 94M or equivalent 1.1% of the float (post-split) being disposed of over the last 12 months, and 496M/5.7% since FY2020 (CY2019).

As a result of the (prospective) dual-pronged returns through capital appreciation and dividend payments, we are maintaining a Buy rating on WMT stock, especially during any downturn.