Watch out for the Hindenburg sign! | a cautious investor

key

gist

- Jim Miekka created the Hindenburg Omen after studying conditions at previous market peaks.

- The Hindenburg Omen triggered an early signal this week as the S&P 500 finally closed above 5000 for the first time.

- If a second signal appears in the next four weeks, this could confirm a major bearish signal for the stock.

The S&P 500 may have been known as the index that broke the incredible 5,000 mark. That alone is a pretty incredible milestone for a benchmark that was down about 3500 just a year ago! However, another important signal may also develop. It’s the terrifying Hindenburg Omen.

So what is the Hindenburg Omen and what does it actually represent?

Today we’re looking at a broad market indicator that Jim Miekka created a few years ago, and it basically looks for very common conditions at the top of the major markets. Do valid signals guarantee a major market top? Of course not. But if you look back at market history, a major peak has rarely occurred without the Hindenburg Omen issuing a bearish signal right before it.

The Hindenburg Omen can be divided into three components: a bullish market trend, extensions to new highs and new lows, and a bearish rotation in breadth. Let’s review each component in turn.

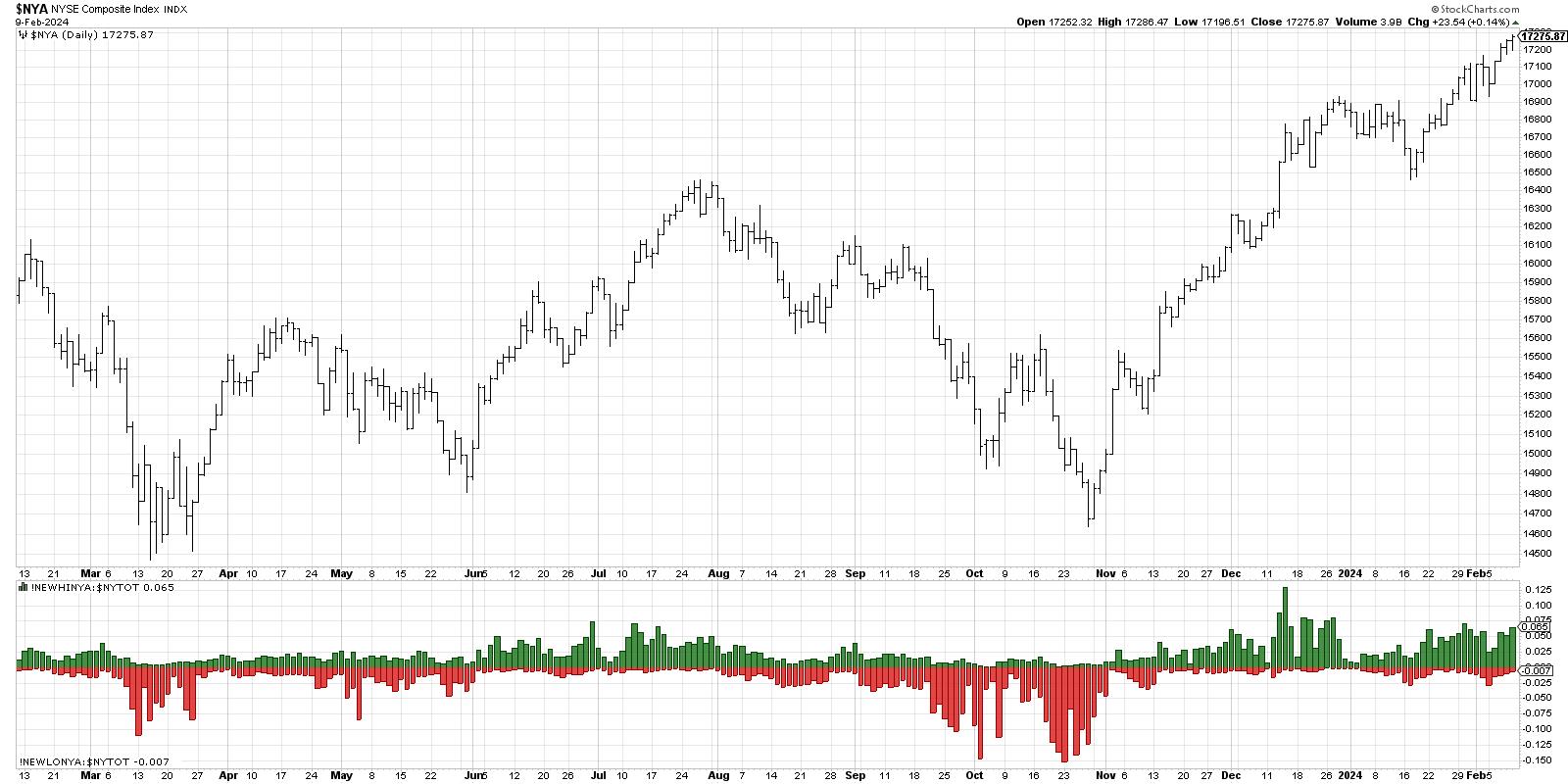

First, you need to determine if the market is already in an established upward trend. This is because it is an indicator designed to identify market peaks. So we look at the NYSE Composite Index ($NYA) chart and see if the 50-day percent change (ROC) is positive. That means the market is higher than it was 10 weeks ago. If so, the first condition is met.

Next, Miekka found that not only are many stocks hitting new 52-week lows around major market highs, but many stocks are also hitting new 52-week lows. This meant a period of indecision as stocks experienced breakouts and crashes around the same time. Strictly speaking, we are looking for at least 2.8% of NYSE listings to hit a new high and 2.8% to hit a new low on the same day. This gives us the second of the three conditions.

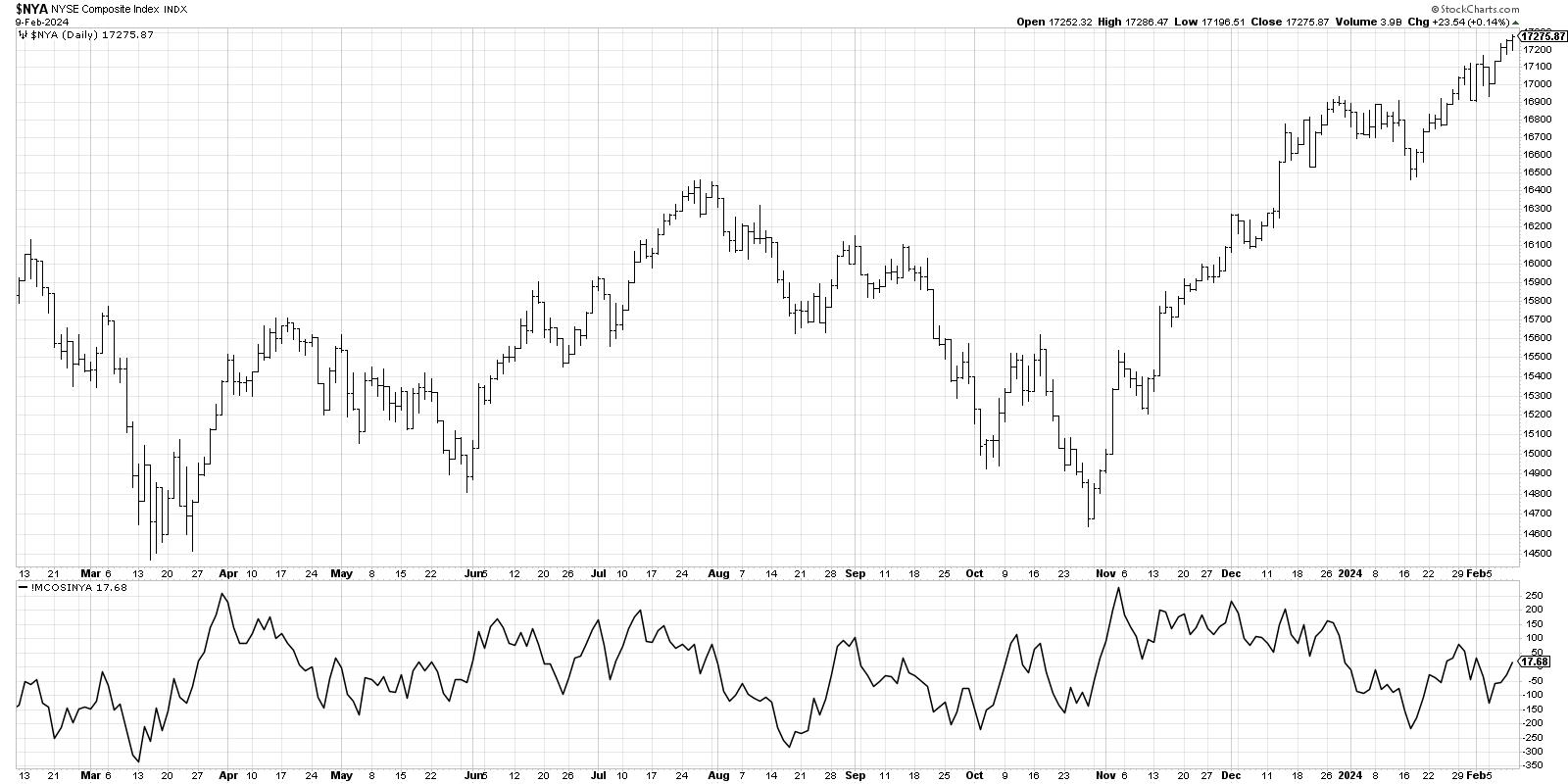

Finally, we are looking for a bearish rotation in market breadth, suggesting that the forces that pushed the benchmark higher during the bullish phase are now starting to dissipate. Here we use the McClellan Oscillator on NYSE data and construct a negative breadth reading when the indicator falls below the zero level.

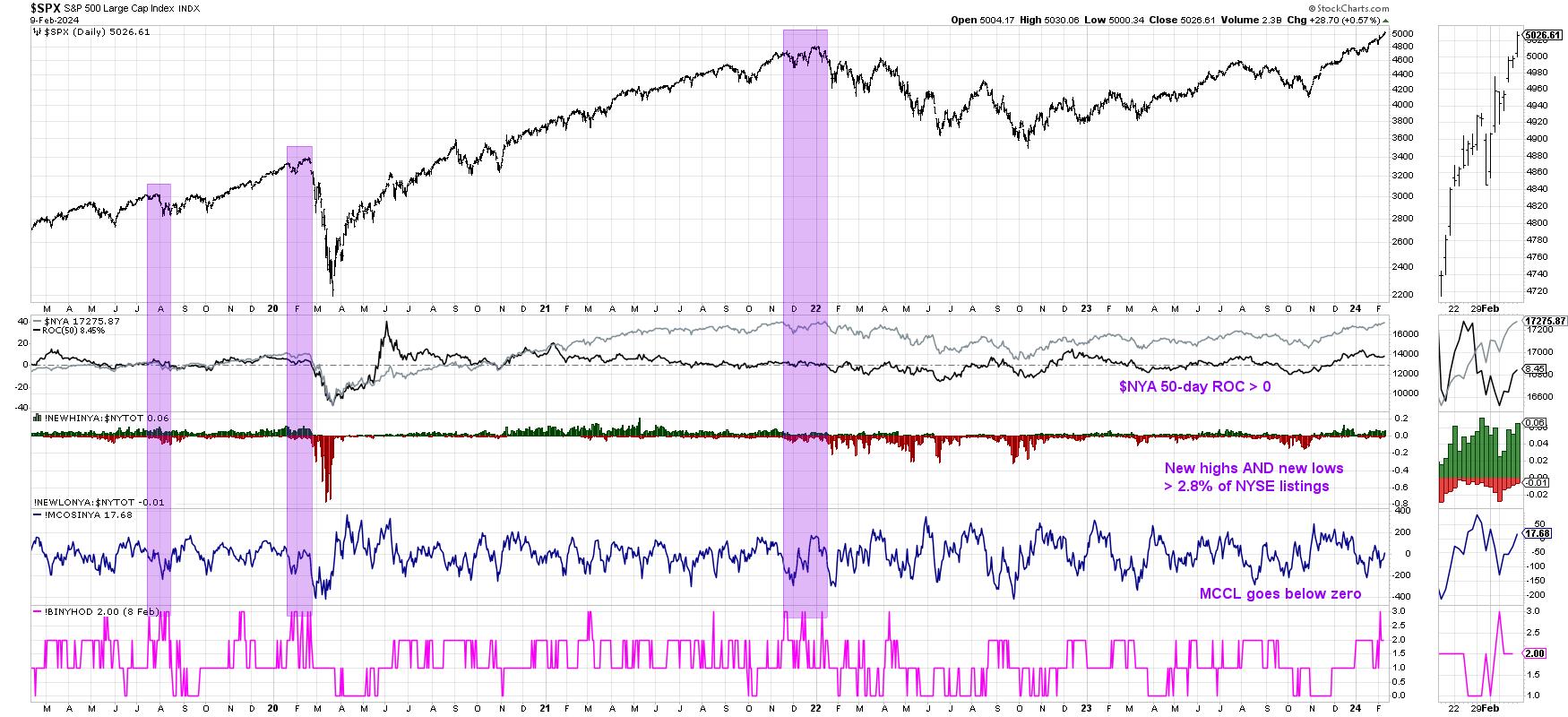

Combining all three indicators together results in a very busy chart like this!

The series at the bottom is a composite indicator that confirms the three conditions above. If all three conditions are met, the indicator displays a value of +3. It is important to note that one signal alone is not enough. Multiple triggers are required within one month to complete a valid Hindenburg Omen signal.

In recent market history, we have seen three valid signals: August 2019, February 2020, and December 2021. Two of these signals occurred before significant downturns. This is why the early signals mentioned this week are a bit skeptical about further markets. Today is backwards. If we see a confirmed Hindenburg Omen signal as another factor converges in the coming weeks, we may be looking at the precipice of a major market decline.

Indicators like the Hindenburg Omen do not send signals very often and certainly cannot predict major market tops with 100% accuracy. But careful investors know to pay attention when things look similar to previous market highs. Remember, every big loss starts with a small loss!

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral bias through technical analysis. He is a frequent host of StockCharts TV and links mindfulness techniques to investor decision-making on his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on risk management through market awareness. He combines strengths in technical analysis, behavioral finance, and data visualization to identify investment opportunities and strengthen relationships between advisors and clients. Learn more