We wish you a happy Kryptmas

A year ago, world-renowned currency expert Niall Ferguson sold his Bitcoin.

He recently confessed, “I was a fool.”

He had good reasons to sell. By December 2022, Terra/Luna had collapsed, FTX had just gone bankrupt, SBF had been arrested, and the epidemic was spreading to traditional banks like Silvergate, SVB, and even the big name Credit Suisse.

“I forgot the first rule of cryptocurrency investing,” Ferguson wrote. “Once you buy something, you should always keep it.”

Ferguson is the author of one of my favorite finance books. Rise of money. (It was later made into an Emmy Award-winning PBS documentary.) He is a senior fellow at Stanford and Harvard. He gave a series of economics lectures for the BBC. The money is his.

But even Ferguson embarrassingly sold his cryptocurrency last year.

Merry Cryptmas, dear reader, if you have been patiently following our investment approach this year, holding cryptocurrencies and continuing to save a little each month.

It is indeed Merry Cryptmas.

we are making progress

If there is one takeaway from 2023, it is this: we are making progress.

(Keep in mind that the development of cryptocurrency is generally “2,000 steps forward, 1,000 steps back.”)

From the outside looking in, it’s been a terrible, terrible, no good, very bad year for cryptocurrencies. The trial and imprisonment of Sam Bankman-Fried made headlines. The SEC continued its assault on cryptocurrency companies large and small. And Binance reached a $2.7 billion settlement with the CFTC.

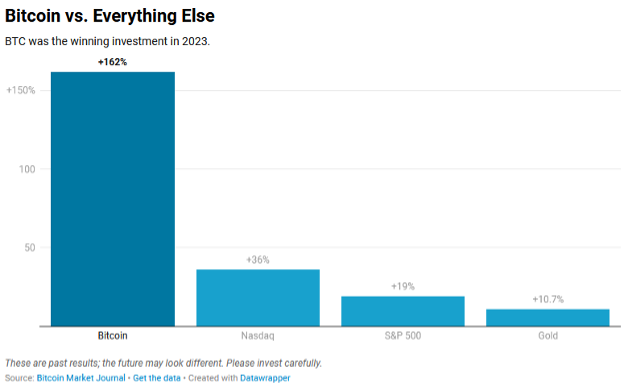

Despite all this bad news, Bitcoin price is up 162% year to date. BTC price more than doubled..

That’s 15 times better than gold (which had a good year). That’s 9x better than the S&P 500 (which had a great year). It’s five times better than the tech-heavy Nasdaq (which had a great year).

It’s difficult to make sense of the headlines compared to what’s actually going on in cryptocurrency.

That’s why we’re trying to ignore Crypto Twitter while remaining patient and investing in our portfolio of blockchain believers, regardless of what drama the industry faces this week.

Drip, drip, drip. The water flows over the rocks. One day, water will win.

Why are prices going up?

I explained my excitement about the possibility of a Bitcoin ETF a few weeks ago in the Bitcoin analogy, which tells the story of why the price is currently rising.

A Bitcoin ETF, which has not yet been approved by the SEC but is increasingly likely, will make it much easier for average investors to hold Bitcoin in their investment portfolios. This will bring cryptocurrency to the masses.

But there is another hopeful development. This is the flood of institutional funds flowing into Bitcoin.

I serve on the Board of Directors of the Boston Blockchain Association and have hosted four conferences this year focused on institutions (large banks and corporations, etc.). The conference is sold out.

The crowd at this event is not “crypto bros.” It’s not a hoodie, it’s a suit. They are talking about “digital assets”, not cryptocurrencies. They are thinking seriously about using blockchain technology to move real money between traditional and new financial systems.

To some people this may sound boring. I find that incredibly interesting.

Slowly but surely, the existing banknote system is being integrated with the new system. digital money. Governments can tame and control this advance of progress, but it is too big a task to stop. It is inevitable.

While most are still trying to figure out how to integrate cryptocurrencies into the financial system, I think the opposite is true. The financial system will become cryptocurrency.

This means that the financial system will become truly global and digital, with one international currency that will be shared by everyone.

As I said in a TED talk a few years ago, the ultimate end game is one world, one money. A better financial system that truly benefits the world. It is about sharing the world’s wealth more fairly and equitably. One Ka Ching will rule them all.

That’s what we’re creating. And those who invest in it now are being rewarded.

This Cryptmas, I wish for peace on Earth. property every.

Thank you for your trust. Merry Cryptmas.

More than 50,000 investors read this column every Friday. Click to subscribe and join the tribe..