Weekly Market Sentiment: Review #2 – Analysis and Forecasts – February 19, 2024

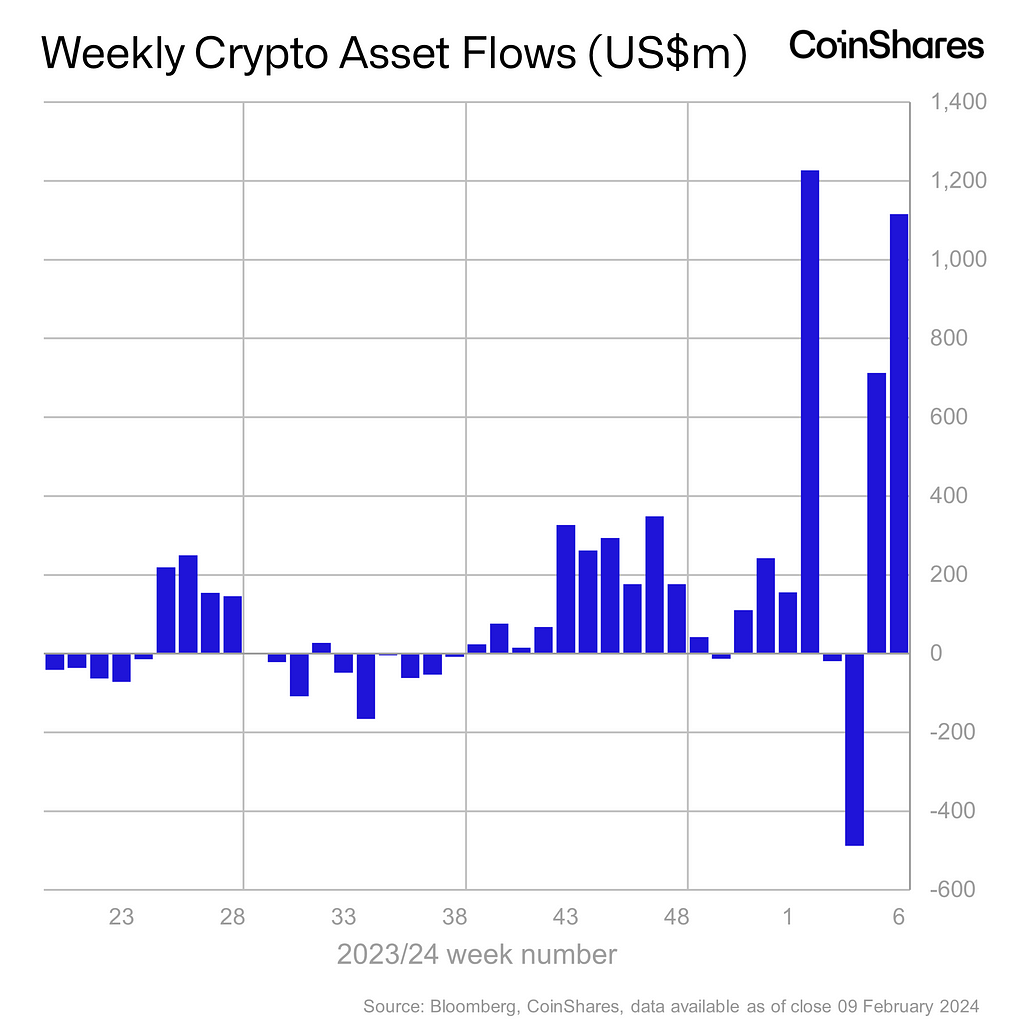

Investment inflows into cryptocurrencies reached more than $1.1 billion, bringing total inflows since the beginning of the year to more than $2.7 billion.

Fund flow into cryptocurrency

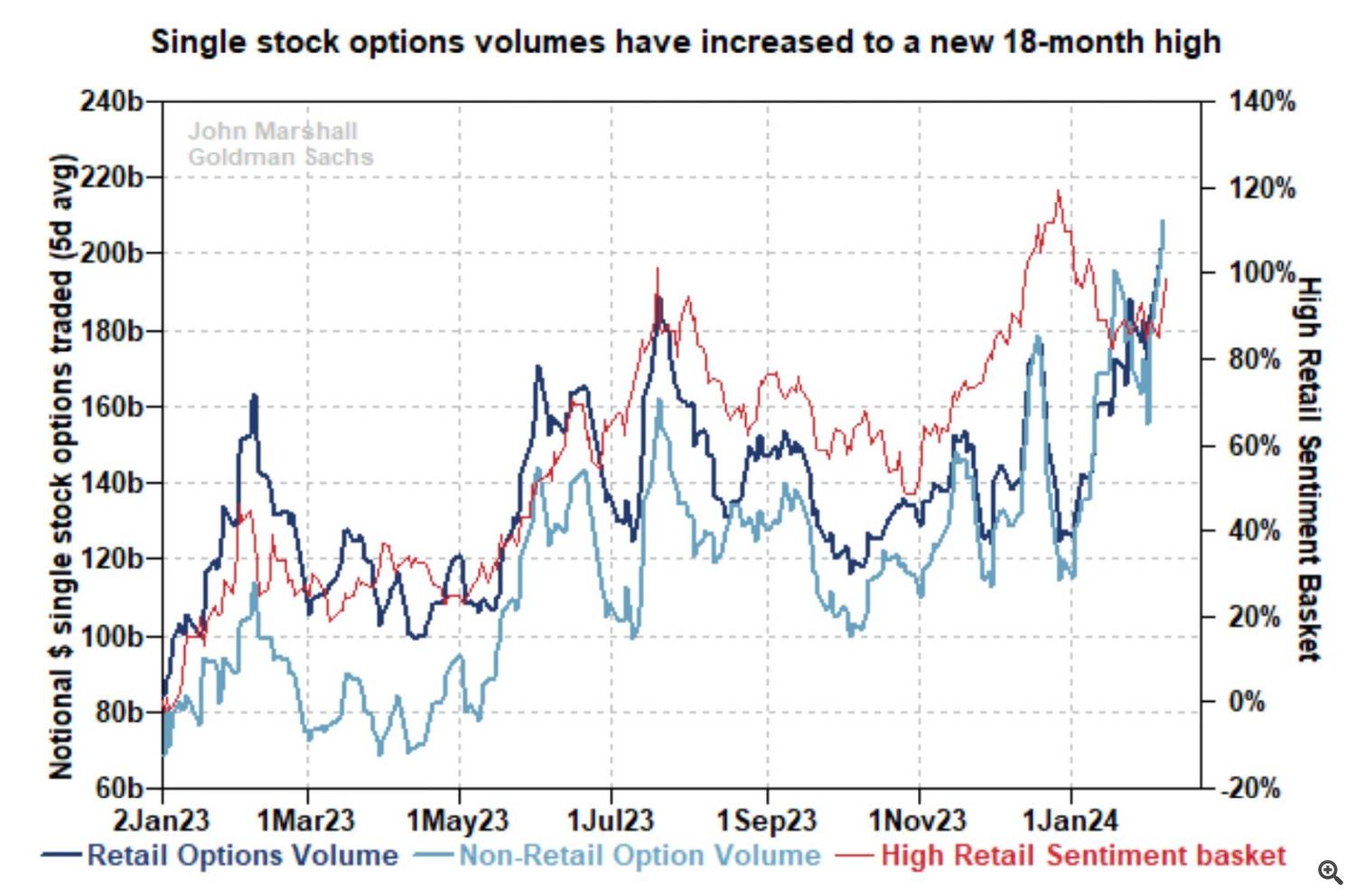

Options trading volume for individual stocks has increased significantly over the past week and is now at an 18-month high. This suggests that investors are poised for sustained gains.

Size of individual stock options

institutional investor

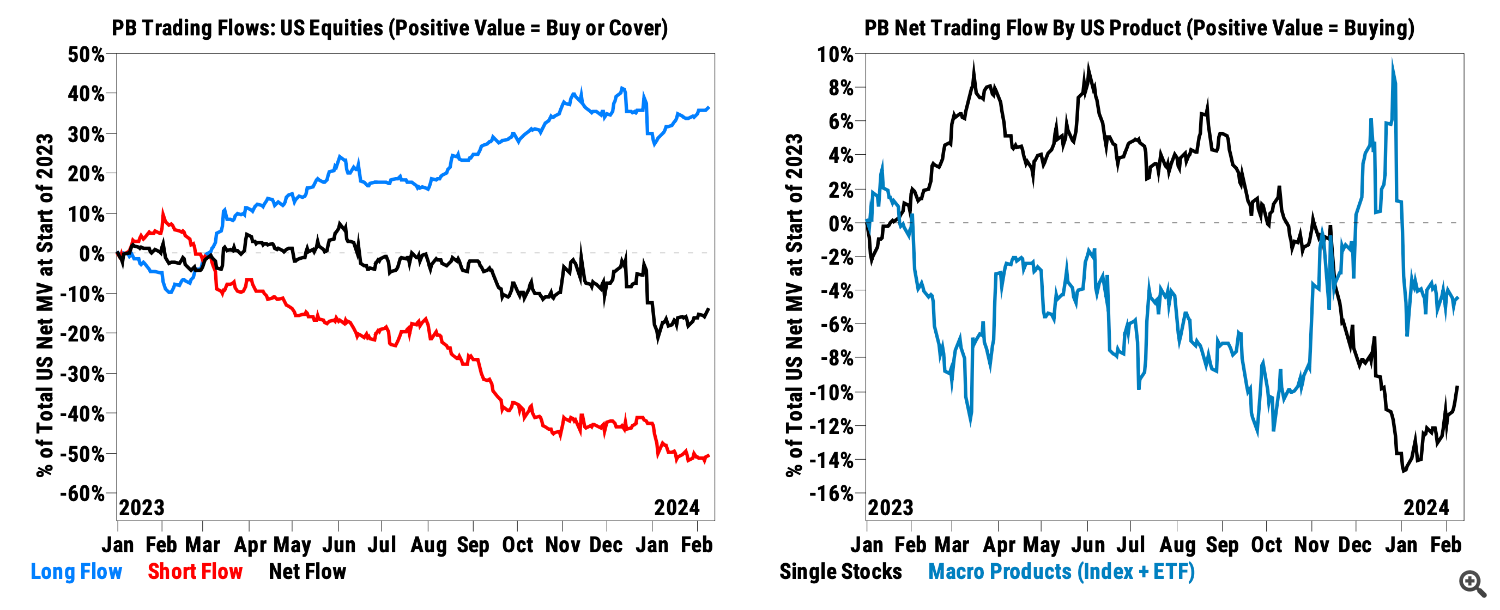

Hedge funds have been buying U.S. stocks (primarily individual stocks rather than funds) for three straight weeks at the fastest pace since March 2023.

Hedge funds flow into U.S. stocks

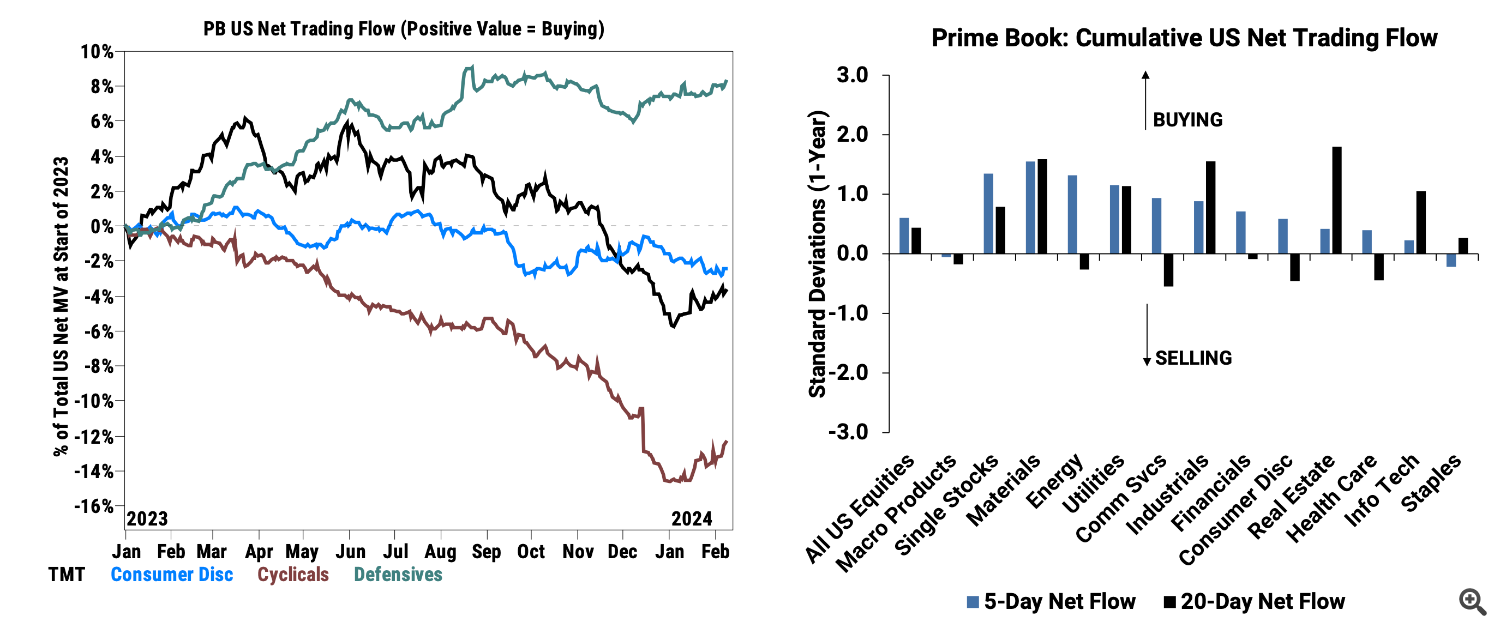

Hedge funds have been the biggest purchases of cyclical stocks since September 2021. Industrial stocks were bought for the sixth week in a row, the biggest net buy of the year.

Hedge funds flow into U.S. stocks by sector

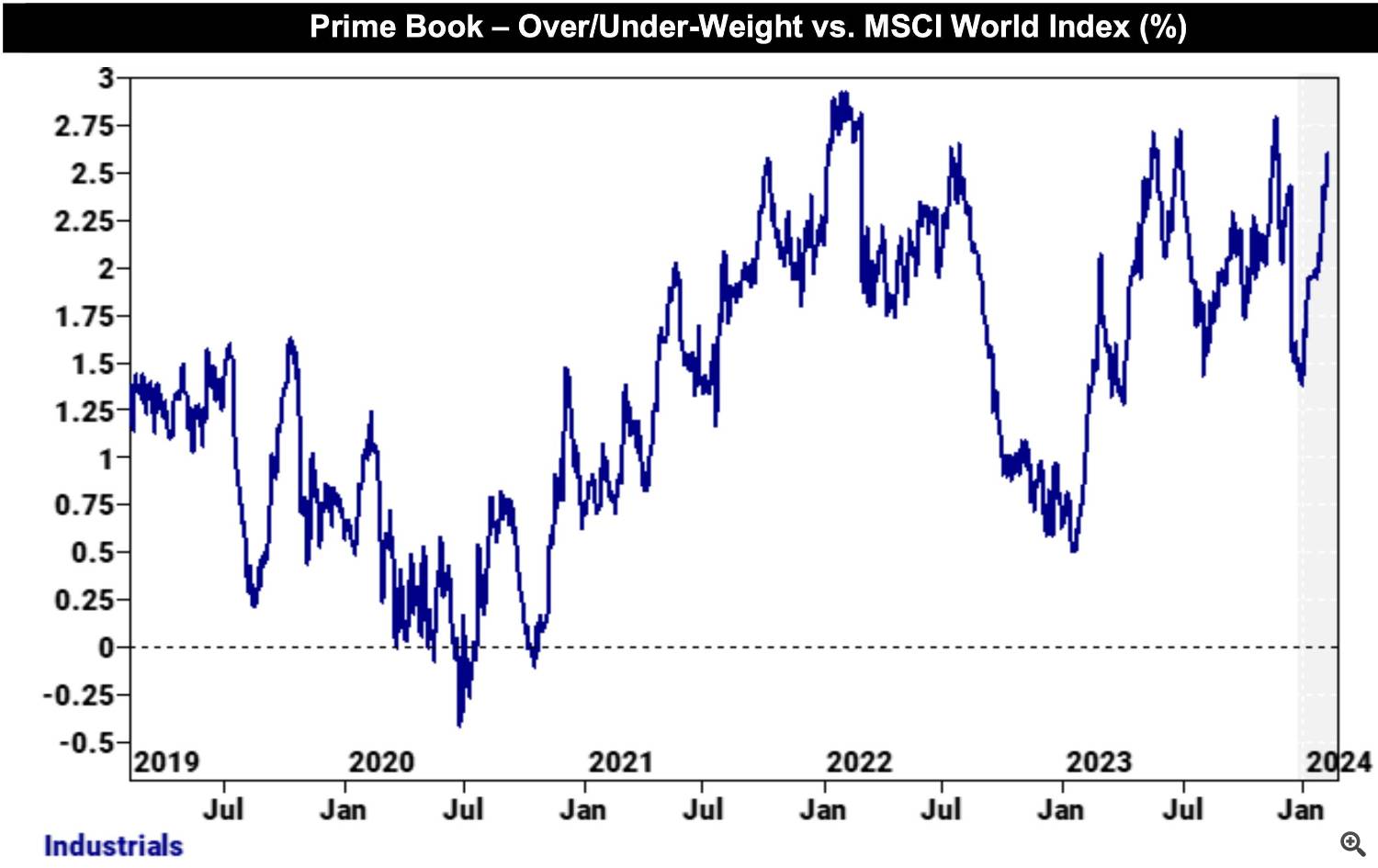

Proportion of industrial goods in hedge fund portfolio vs. Share of industrial goods in MSCI World Index

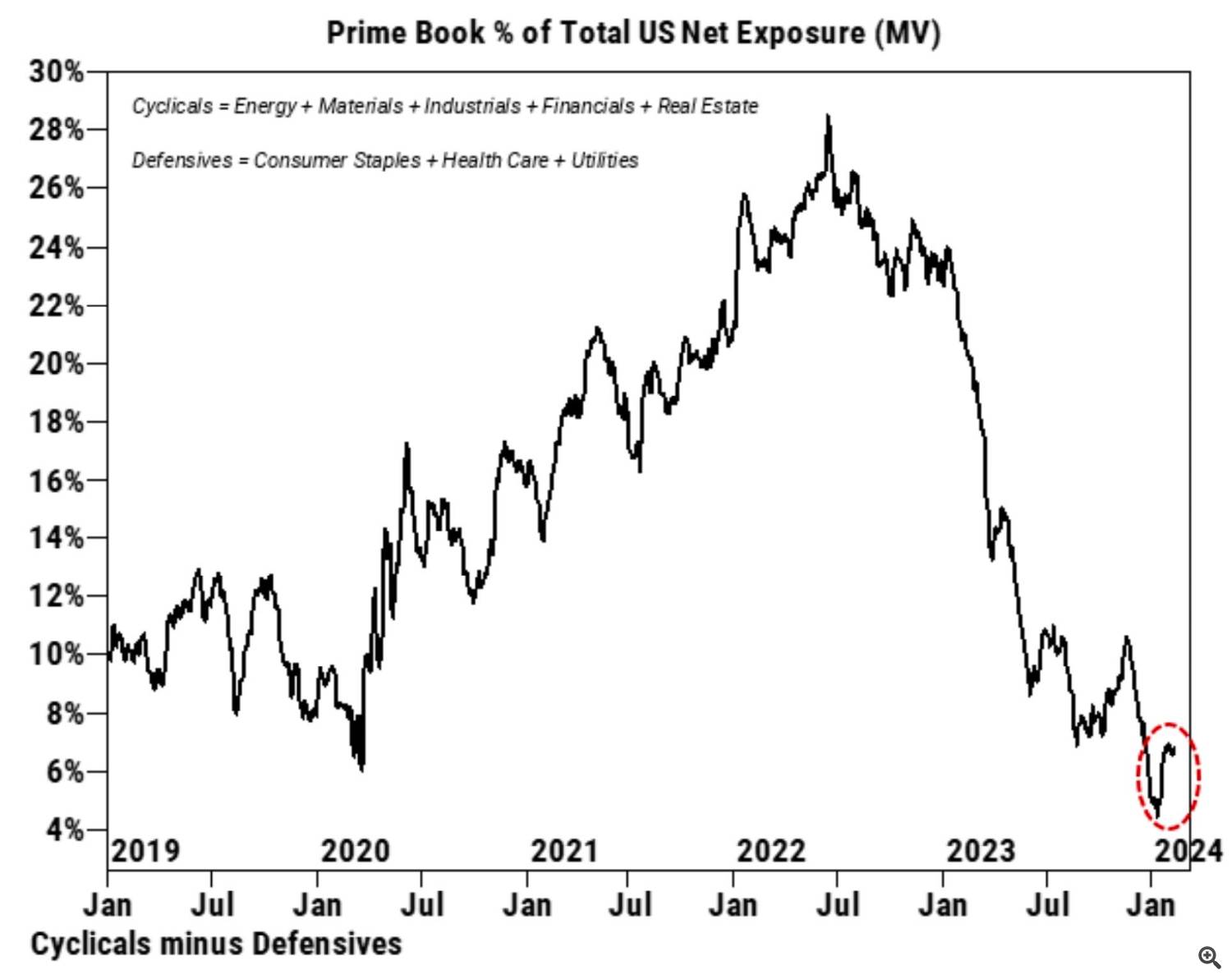

Despite recent buying of cyclical stocks, their share of hedge fund portfolios relative to the defensive sector remains at a four-year low.

Proportion of cyclical stocks in hedge fund portfolios compared to defensive sectors

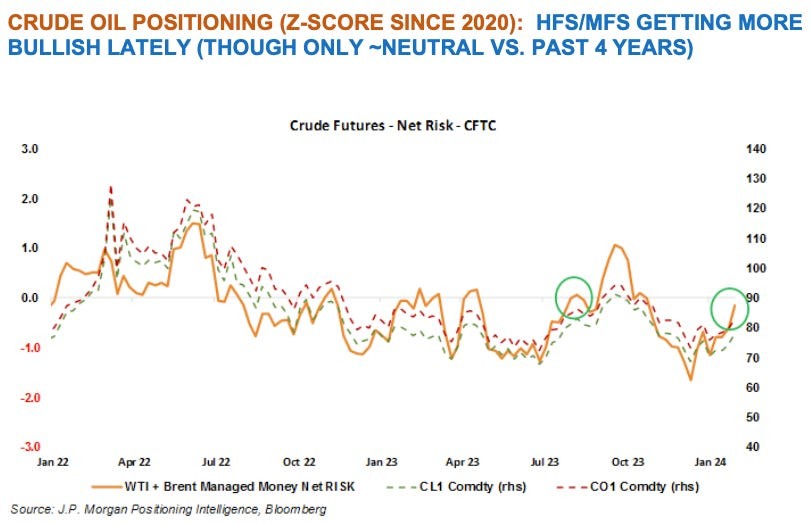

The fund’s net position in oil futures has been increasing since the end of last year and reached its highest level since the third quarter of 2023.

The Fund’s Net Position in Oil Futures

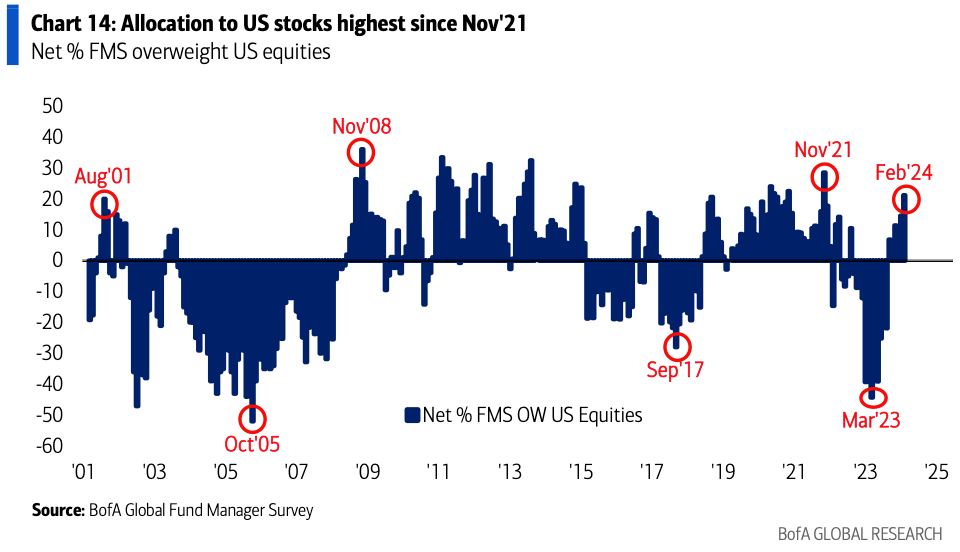

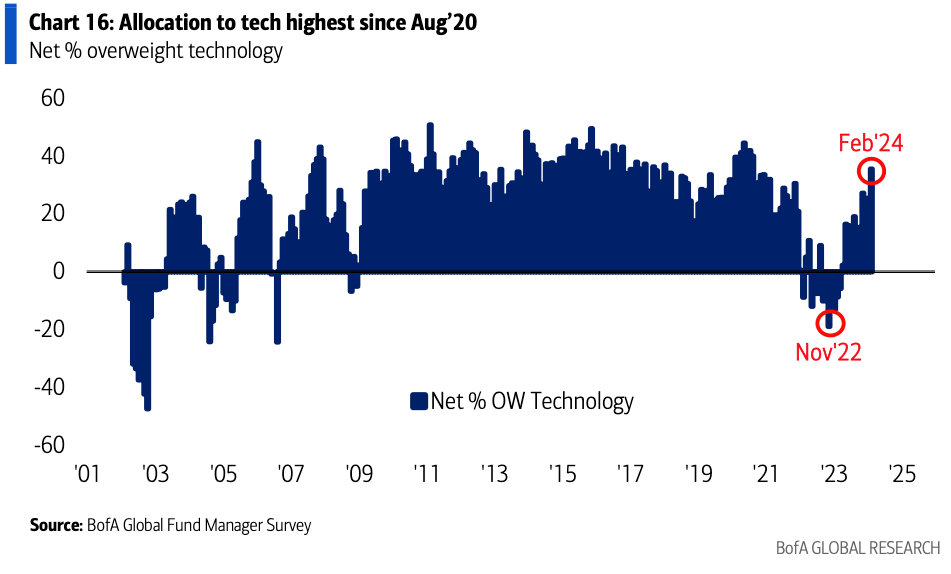

The share of U.S. stocks in fund managers’ portfolios increased by 7 percentage points. m/m net gain of 21% was the highest since November 2021, with technology being the sector that gained the most.

oProportion of U.S. stocks in fund managers’ portfolios

oProportion of U.S. technology stocks in fund managers’ portfolios

housing market

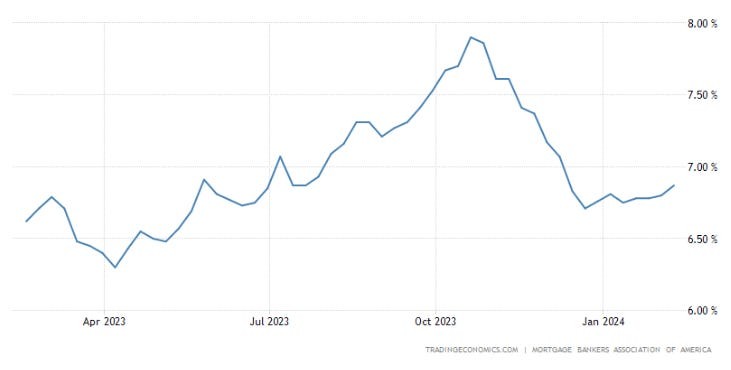

The 30-year mortgage fixed interest rate increased by 7bps. Last week it hit 6.87%, the highest in the past two months.

Average fixed interest rate for a 30-year mortgage

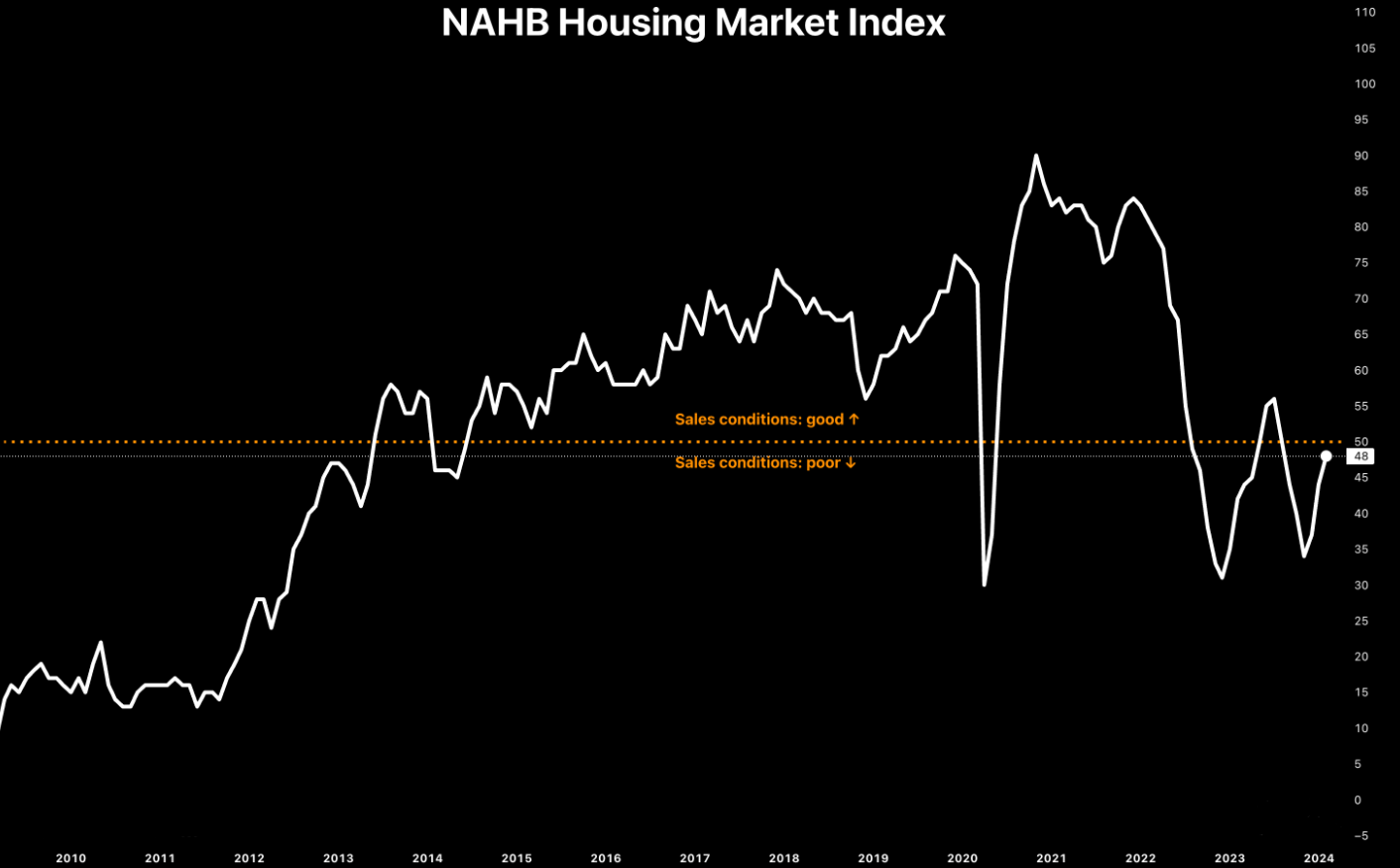

The NAHB housing market index, which measures homebuilder sentiment, rose to 48 (previous consensus of 46 and 44), hitting a six-month high in February.

NAHB Housing Market Index

Sleeve

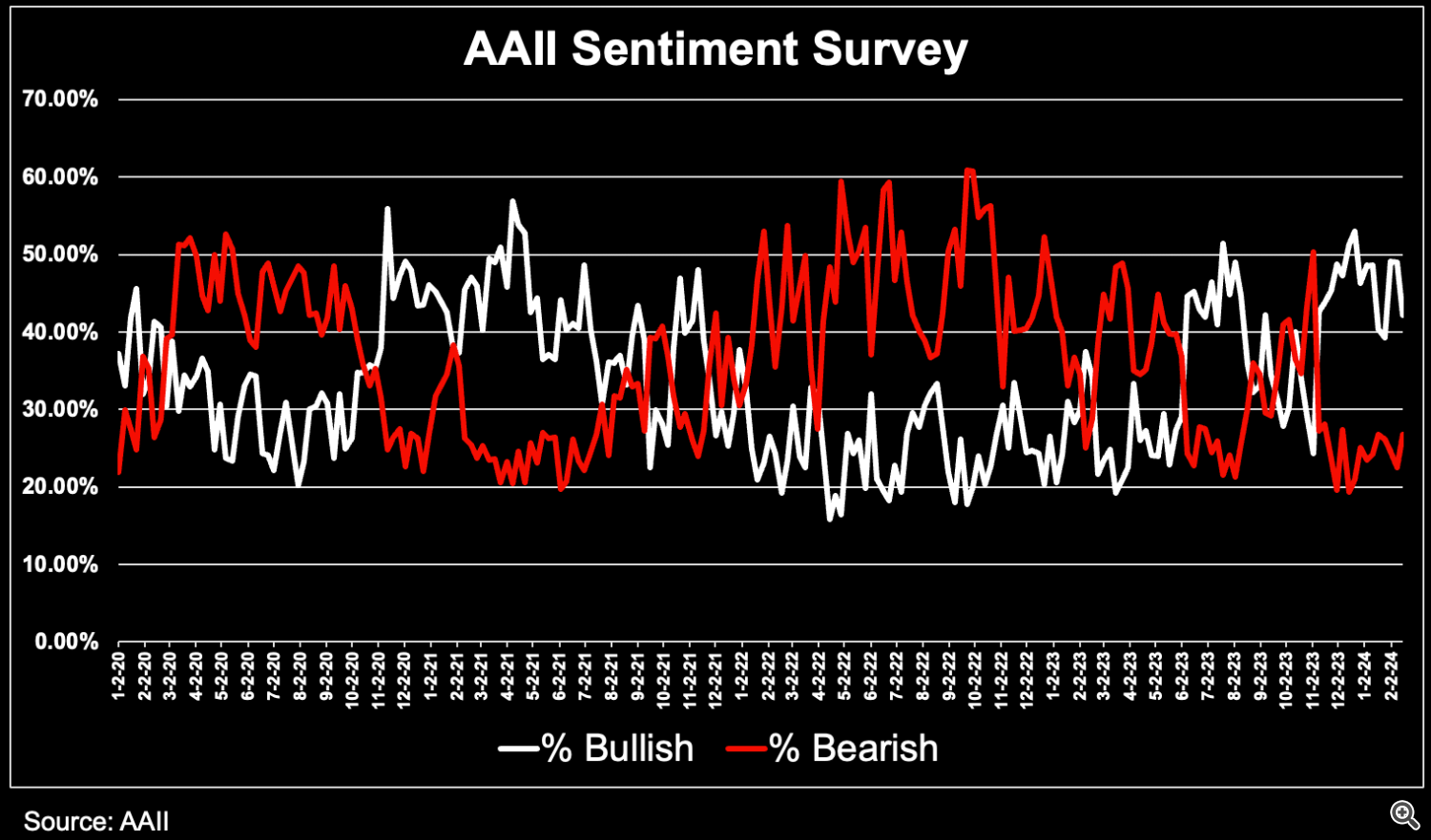

The AAII survey found that the share of “bullish” sentiments among retail investors fell to 42.2% from 49% last week. Bearish sentiment increased from 22.6% to 26.8%.

AAII Retail Investor Sentiment Survey