Weekly Market Sentiment: Review #3 – Analysis and Forecasts – March 4, 2024

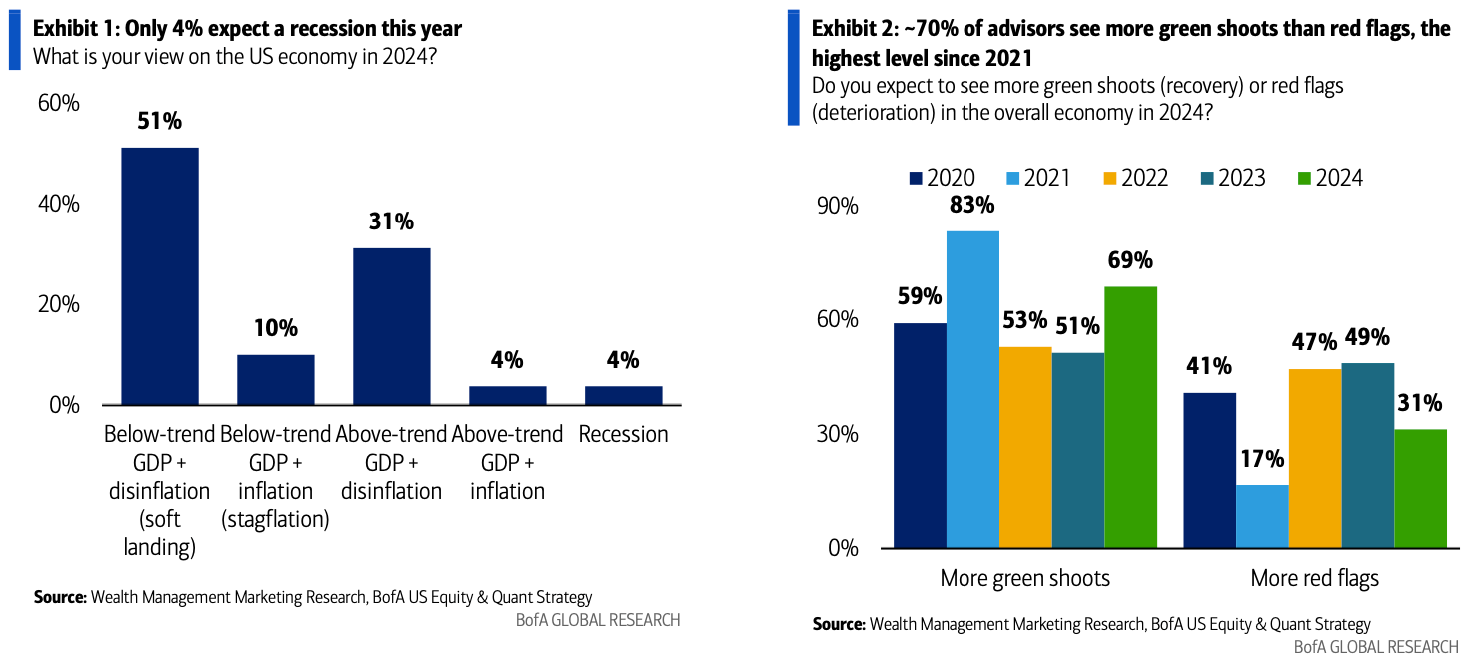

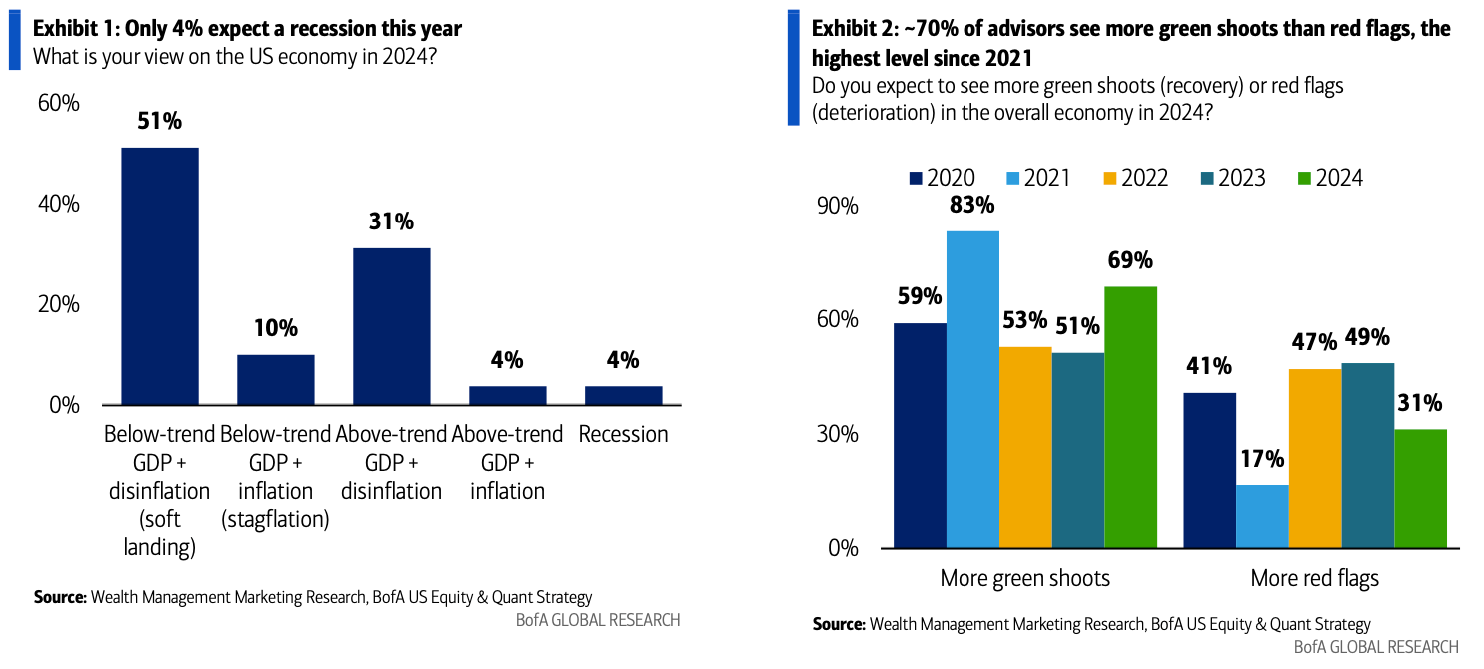

Only 4% of financial advisors expect a recession this year, down from 85% last year. They also expect more recovery than the data shows contraction.

Financial Advisors’ Economic Expectations, Bank of America Survey

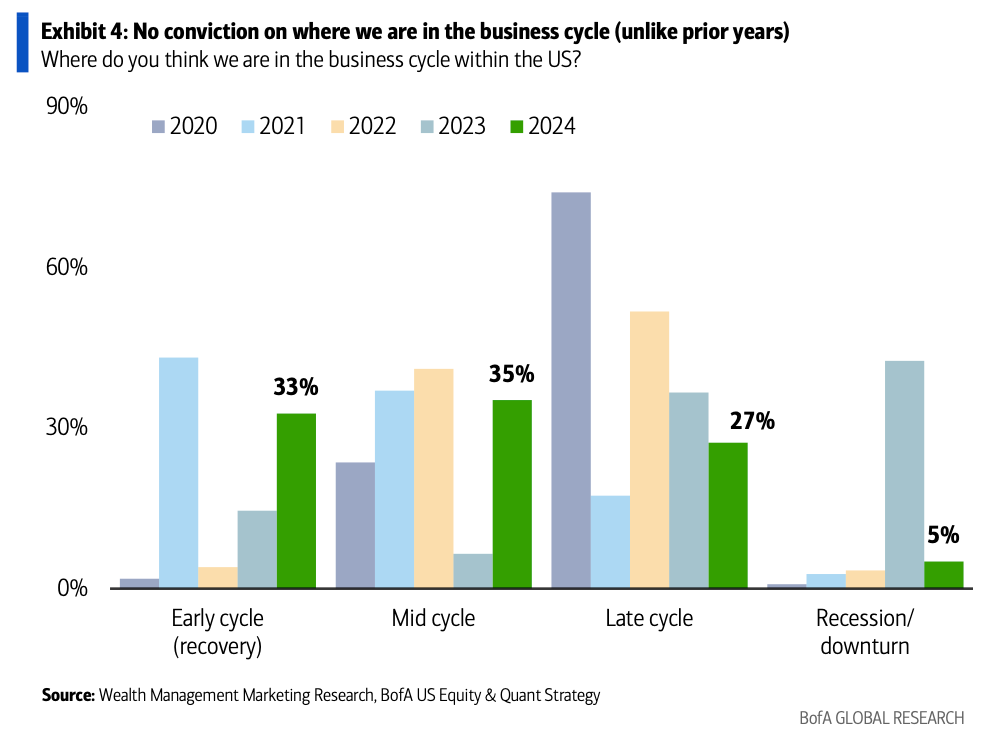

A Bank of America survey found that financial advisors have no clear opinion about where the economy is in the business cycle.

Financial Advisors’ Views on Current Stage of the Business Cycle, Bank of America Survey

Chicago’s CFSEC index of economic activity fell from +7 in January to -14 in February. This indicates that economic growth is below trend.

Chicago CFSEC Economic Activity Index

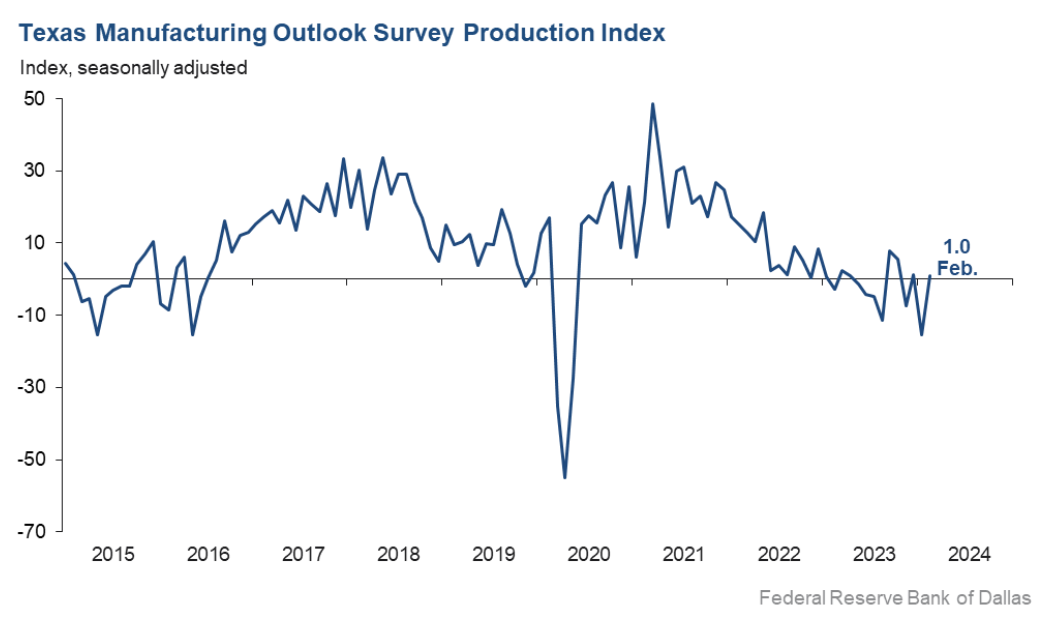

The Dallas Fed’s headline Texas Manufacturing PMI was -11.3 in February 2024, up from an eight-month low of -27.4 the previous month (consensus -8). The new orders component, a key indicator of demand, rose 18 points to 5.2 in February, the first positive reading since May 2022. The expected future business activity component rose 17 points to 6.2, returning to positive territory after six months of negative readings.

Texas Fed overall manufacturing PMI

Only 4% of financial advisors expect a recession this year, down from 85% last year. They also expect more recovery than the data shows contraction.

Financial Advisors’ Economic Expectations, Bank of America Survey

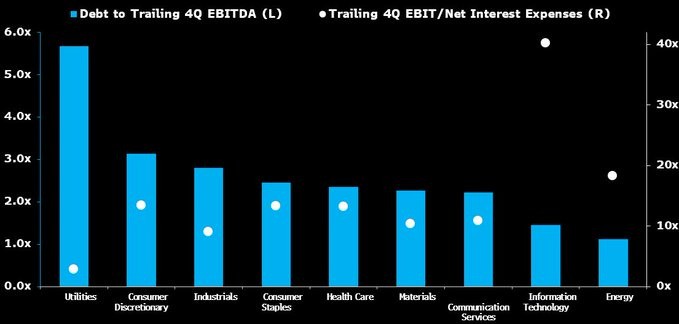

In the long term, higher Fed interest rates may be less of a problem for technology stocks than commonly thought. The S&P 500 technology sector has a higher-than-average cash flow turnover compared to the rest of the market, but it also has relatively less debt and a higher interest coverage ratio.

Debt to EBITDA in the fourth quarter of 2023 and interest coverage ratio to EBIT in the fourth quarter of 2023 by segment

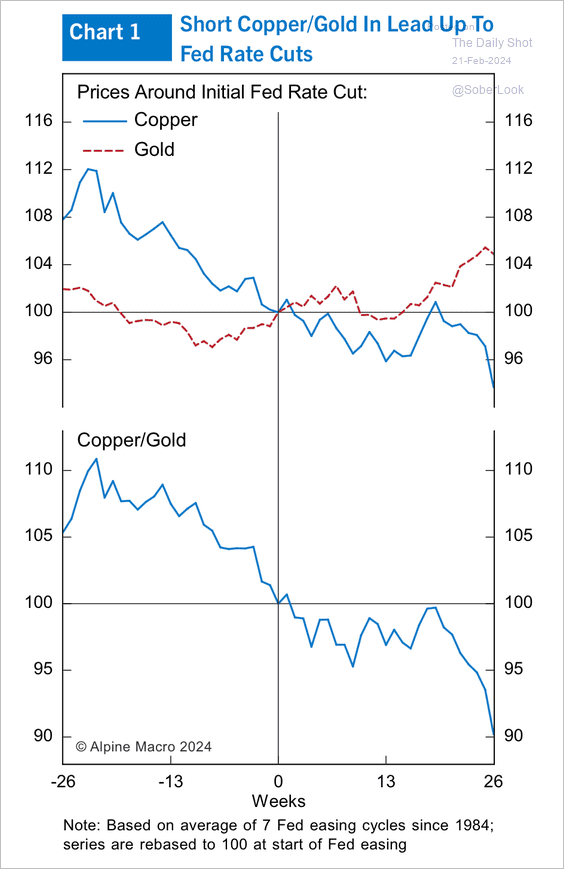

The copper-gold ratio typically falls after the Fed’s first interest rate cut, regardless of whether there is a recession or not.

Copper, gold prices and rates before first Fed rate cut

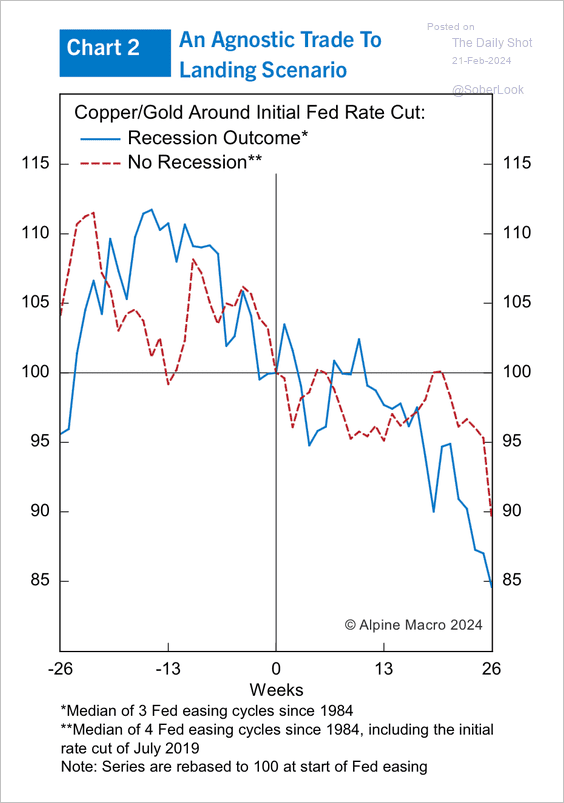

SeedGold price and ratio prior to the first Federal Reserve interest rate cut (which may or may not have led to a recession)

The DXY Dollar Index has a close relationship with the Industrial Purchasing Managers Index and outperforms it by approximately 126 trading days. Judging by the movement of DXY, we expect a significant uptick in business activity in the coming months.

DXY Dollar Index and ISM Industrial PMI

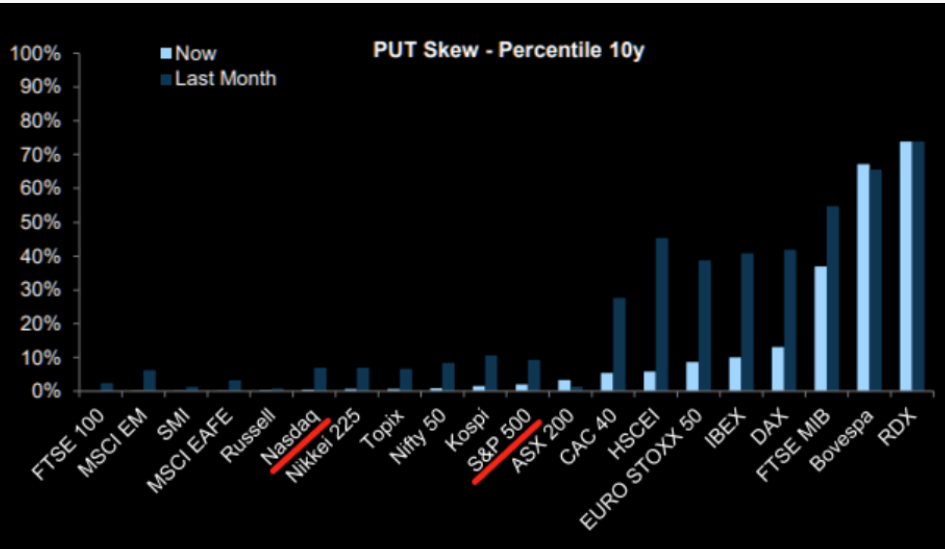

Put option prices on risky assets were relatively cheap just a month ago. Put option costs on the world’s major stock indices are at their lowest today.

Compare the current put option value of major stock indexes with the value one month ago

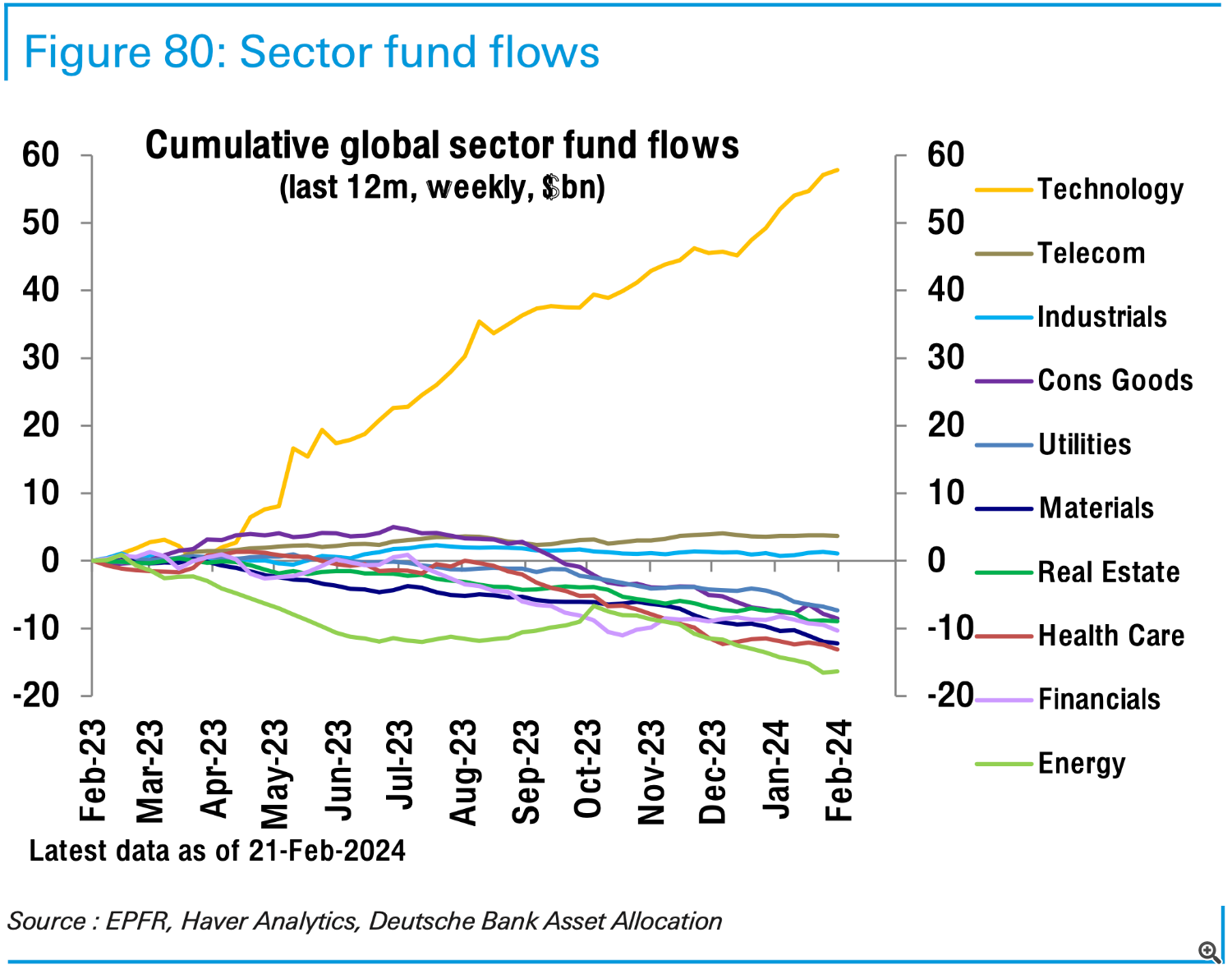

While inflows into the technology sector (+$0.7 billion) slowed, the financial sector (-$800 million) experienced outflows for the fourth week in a row.

Inflows into U.S. stocks by sector

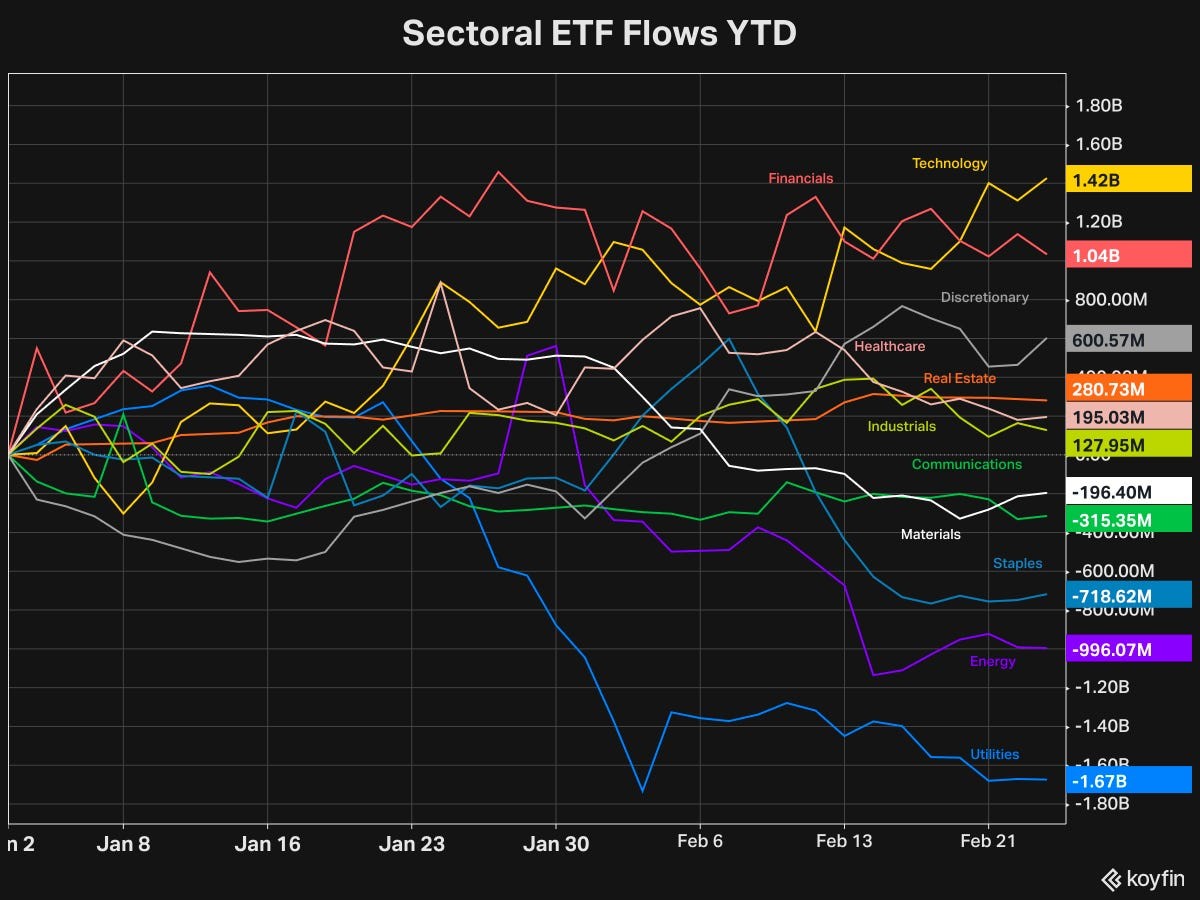

Since early 2024, inflows into US ETFs have seen outflows from the utilities, energy, FMCG, materials and telecommunications sectors. The largest inflows were observed in technology, finance and durable goods sectors.

Inflows into U.S. ETFs by sector starting in early 2024

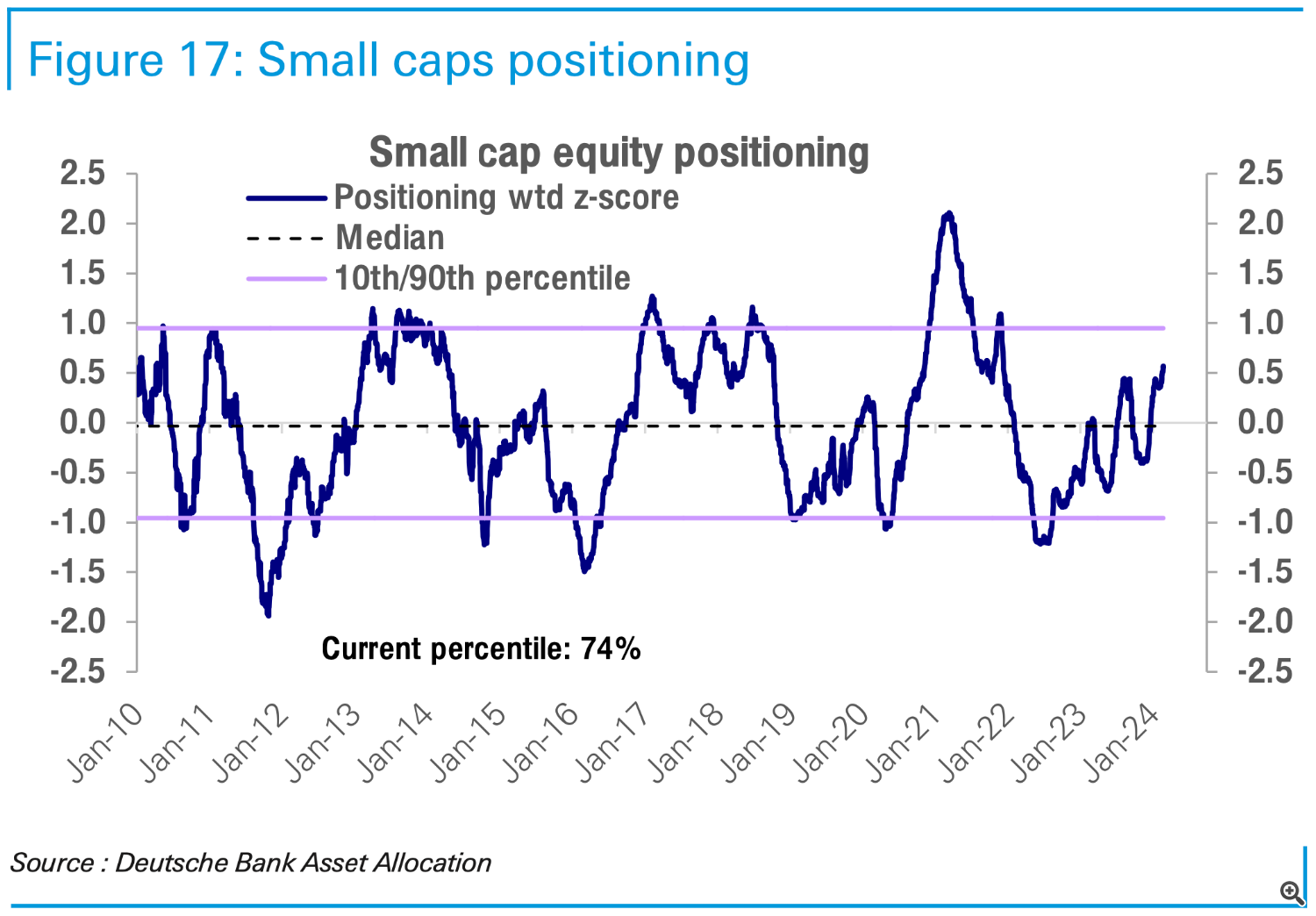

Small Cap Positioning Rises to 26-Month High:

Positioning in small cap stocks

institutional investor

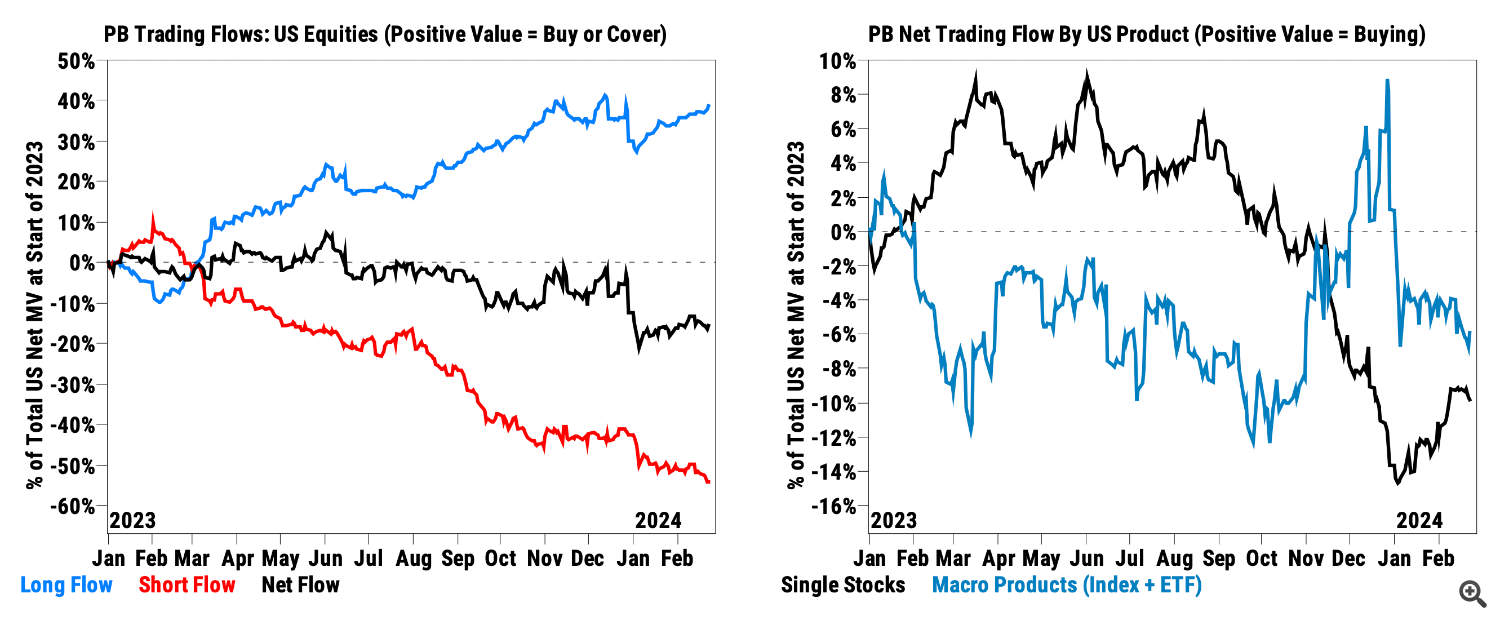

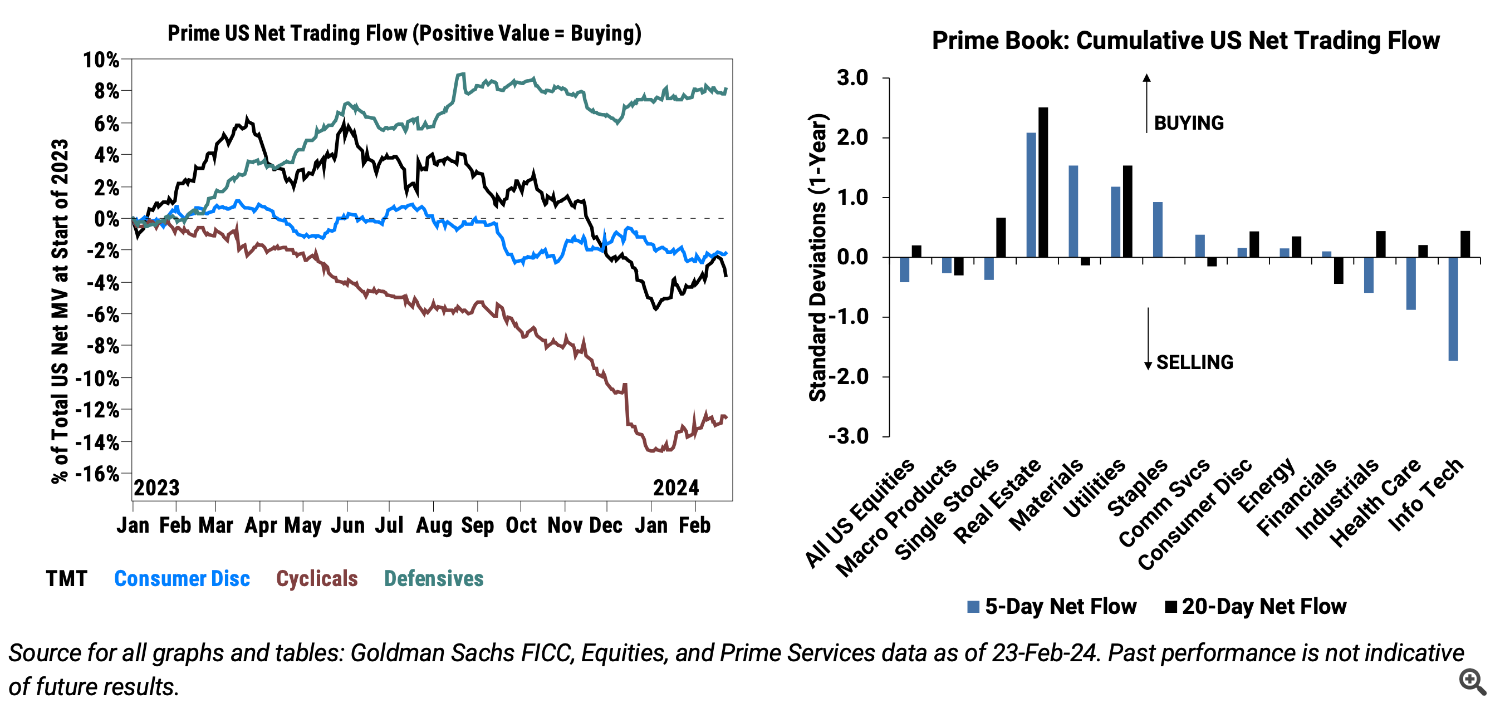

Over the past five weeks, hedge funds have been massive net sellers of U.S. stocks, with short positions in individual U.S. stocks last week being the largest since September 2023.

Hedge funds flow into U.S. stocks

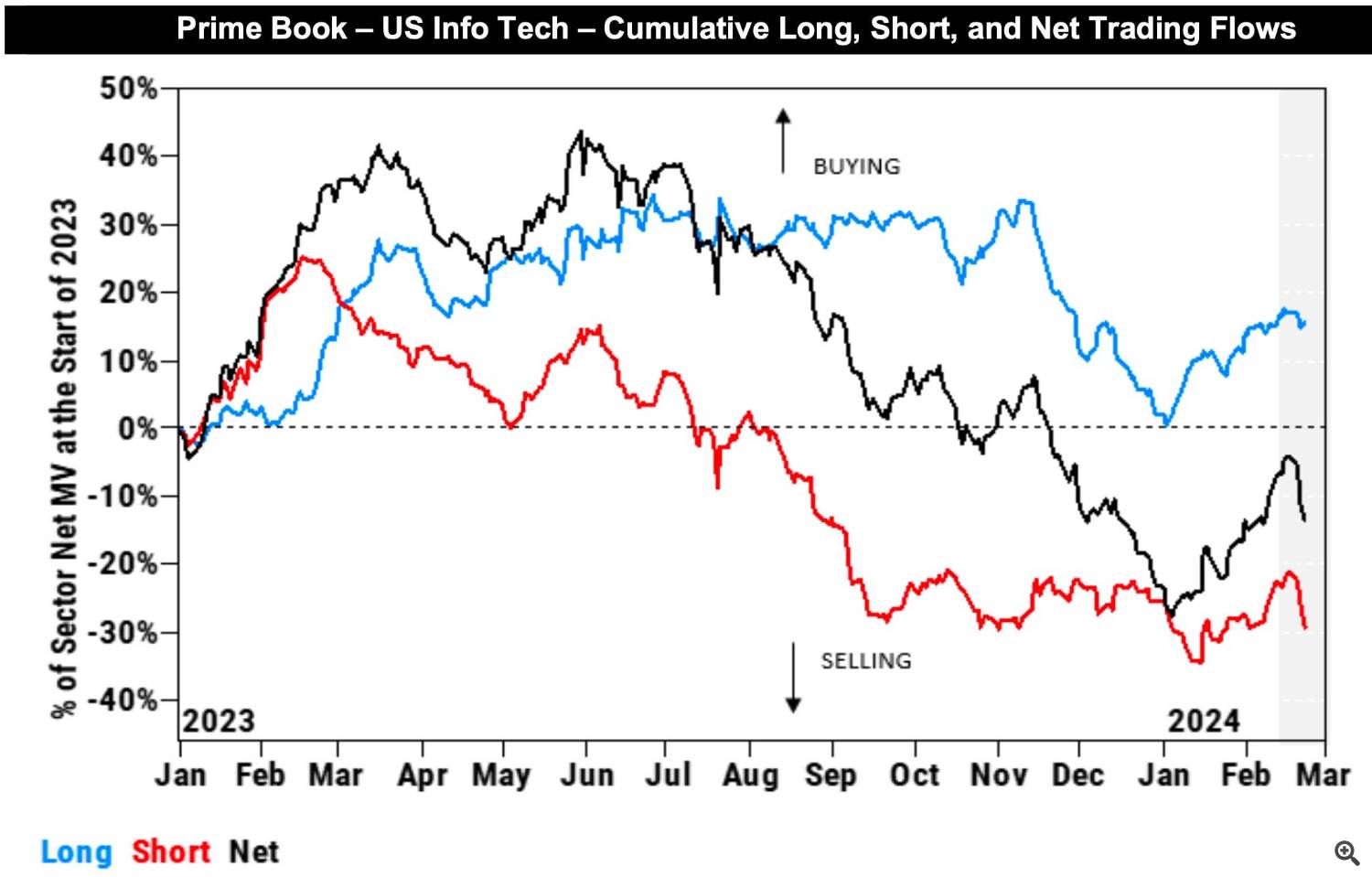

Hedge funds flowing into individual stocks Cycles in technology, healthcare and industry. Net selling of technology stocks last week hit the highest since July.

Hedge funds flow into U.S. stocks by sector

Hedge funds flow into U.S. technology stocks