Weekly Outlook: NIFTY may remain calm during truncated week. Defensive play may seem obvious | India analysis

Over the past week, the market was expected to rise slightly. However, at the same time, while gradual formation of highs was expected, runaway movements were not expected to occur. During the last four trading sessions, the market traded along precisely analyzed lines. Nifty has hit a new lifetime high of 22775 but has also moved away from that high at the same time. The trading range also narrowed as Nifty oscillated in the 271-point range. Volatility increased slightly. India Vix rose slightly by 1.72% to 11.53. Headline Index Nifty closed flat with a meager weekly gain of 5.70 points (-0.03%).

The previous week was skipped as Thursday was a trade holiday. Eid ul fitr. Next week is also cut off. Wednesday is a holiday. Ram Navmi. Due to this, Banknifty options have the shortest expiration time as they expire on Tuesday. The 22775 level creates a new intermediate high in the market. No runaway gains are expected in the coming days as long as Nifty remains below this point. At the same time, the nearest support for the index is well below the current level of the 20-week MA, located at 21827. Overall, the market is likely to remain in a wide trading range.

Markets could have a soft start to the week starting Monday. The 22650 and 22775 levels are likely to act as potential resistance points. Support is provided at the 22400 and 22280 levels.

Weekly RSI is 69.87. It crossed the 70 mark from the overbought zone. If we analyze the pattern, RSI continues to show negative divergence against the price. It also formed a new 14-period low, indicating a bearish trend. Weekly MACD is bearish and remains below the signal line.

Pattern analysis shows that the index continues to resist the rising trend line on the weekly chart. Due to the rising nature of the trend line, Nifty may form gradual highs. However, it is providing strong resistance to the index as it tries to move higher. Currently, the index has been resisting this pattern resistance every week and is facing selling pressure this time too. The bearish gap in RSI continues to exist. The closest support for the index can be found at the 20-week MA at 21827.

By and large, the risk-averse setup may continue to persist for some time. A technical rebound in the market may occur. However, it is better to take advantage of such a bounce to create an exit at higher levels and protect your profits. Any new purchases may be limited to defensive funds, with greater emphasis placed on entering stocks with greater relative strength, which tend to provide resilience during corrections. Overall, we recommend a cautious outlook for the coming week while keeping leverage exposure at a moderate level.

Next week’s sector analysis

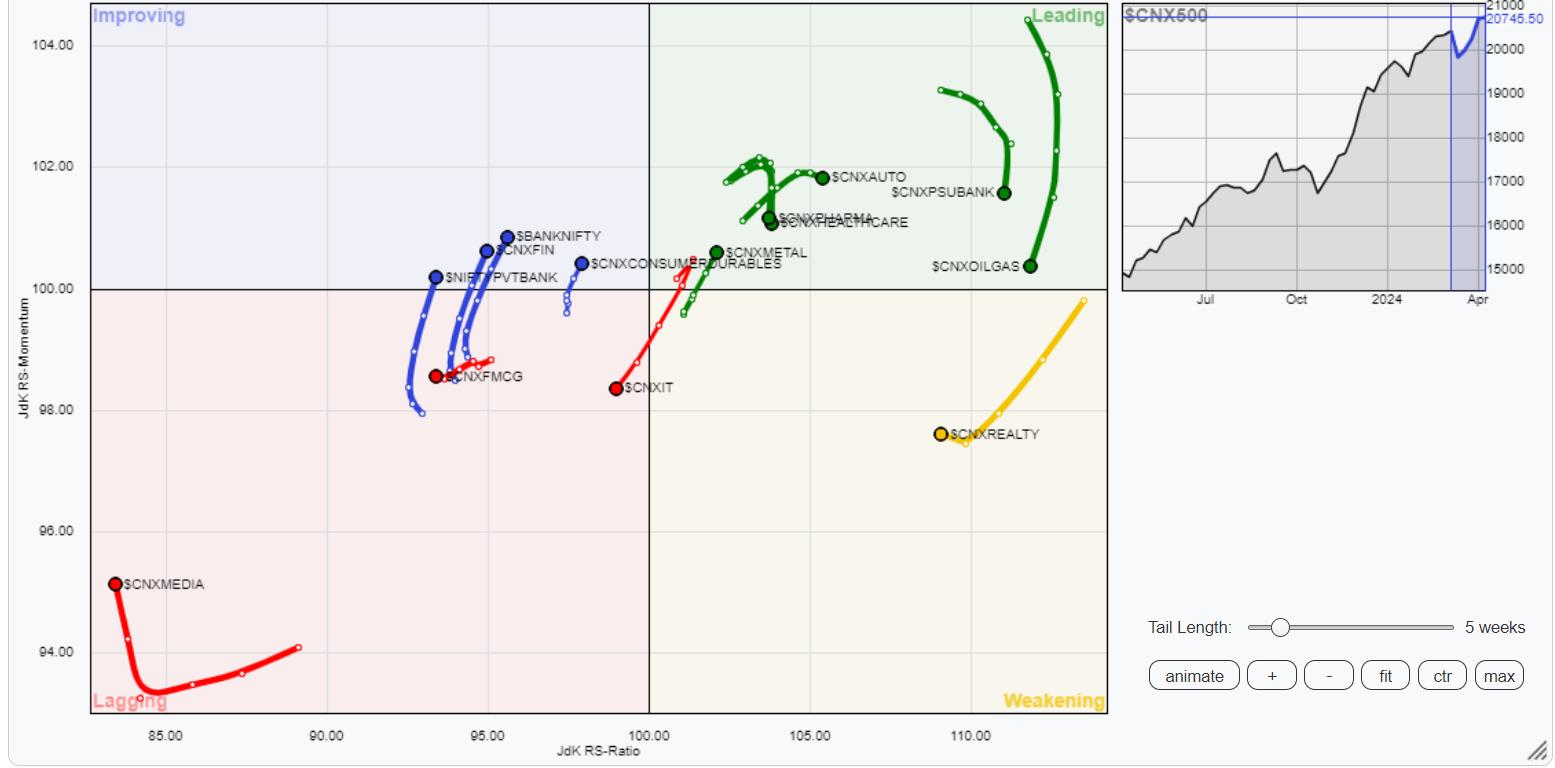

With Relative Rotation Graphs®, we compared various sectors with the CNX500 (NIFTY 500 Index), which represents over 95% of the free float market capitalization of all listed stocks.

The Relative Rotation Graph (RRG) shows the relative loss of momentum between many sectors located inside the leading quadrant. Nifty PSU Banks, Pharma and Commodities are within the major quadrants. However, they appear to be giving up relative momentum to the broader market. The Metal Index and Auto Index appear to be relatively better positioned in the leading quadrant.

Nifty energy and infrastructure indices rolled inside the bearish quadrant. They are likely to begin to see a slowdown in their relative performance. Apart from these groups, PSE and real estate indices are also within the bearish quadrant.

Nifty IT, Media and FMCG indices are within the bearish quadrant.

Nifty Financial Services, Services Sector Index, Banknifty and Consumption Index remain in the improving quadrant and may provide resilient performance compared to the broader market.

Important note: RRG™ charts show the relative strength and momentum of groups of stocks. The above chart shows relative performance against the NIFTY500 index (broad market) and should not be used directly as a buy or sell signal.

Milan Vaishnav, CMT, MSTA

Consulting Technology Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital markets expert with nearly 20 years of experience. His areas of expertise include portfolio/fund management and advisory services consulting. Milan is the founder of ChartWizard FZE (UAE) and Gemstone Equity Research & Advisory Services. With over 15 years of experience in Indian capital markets as a consulting technology research analyst, he has been providing India-focused, premium, independent technology research to his clients. He currently contributes daily to ET Markets and The Economic Times of India. He also writes A Daily/ Weekly Newsletter, one of India’s most accurate “daily/weekly market forecasts”, now in its 18th year of publication. Learn more