WFC Stock: Step-by-Step Analysis for a Better Time to Enter | Don’t ignore this chart!

key

gist

- Wells Fargo stock hits an all-time high.

- The financial sector is showing strength with several large banking stocks posting positive moves.

- WFC’s momentum may be strong right now, but since the stock is trading above its average price movement, a slowdown could mean a big downside.

Wells Fargo’s (WFC) stock price has been trending upward since November 2023 after breaking a downward trend line. The company is experiencing difficulties that are evident in the choppy movement of its stock price. But overall, the stock trended upward along with other large banks and hit record highs.

So is the stock worth buying? Let’s analyze the financial sector and take a look at WFC’s stock chart.

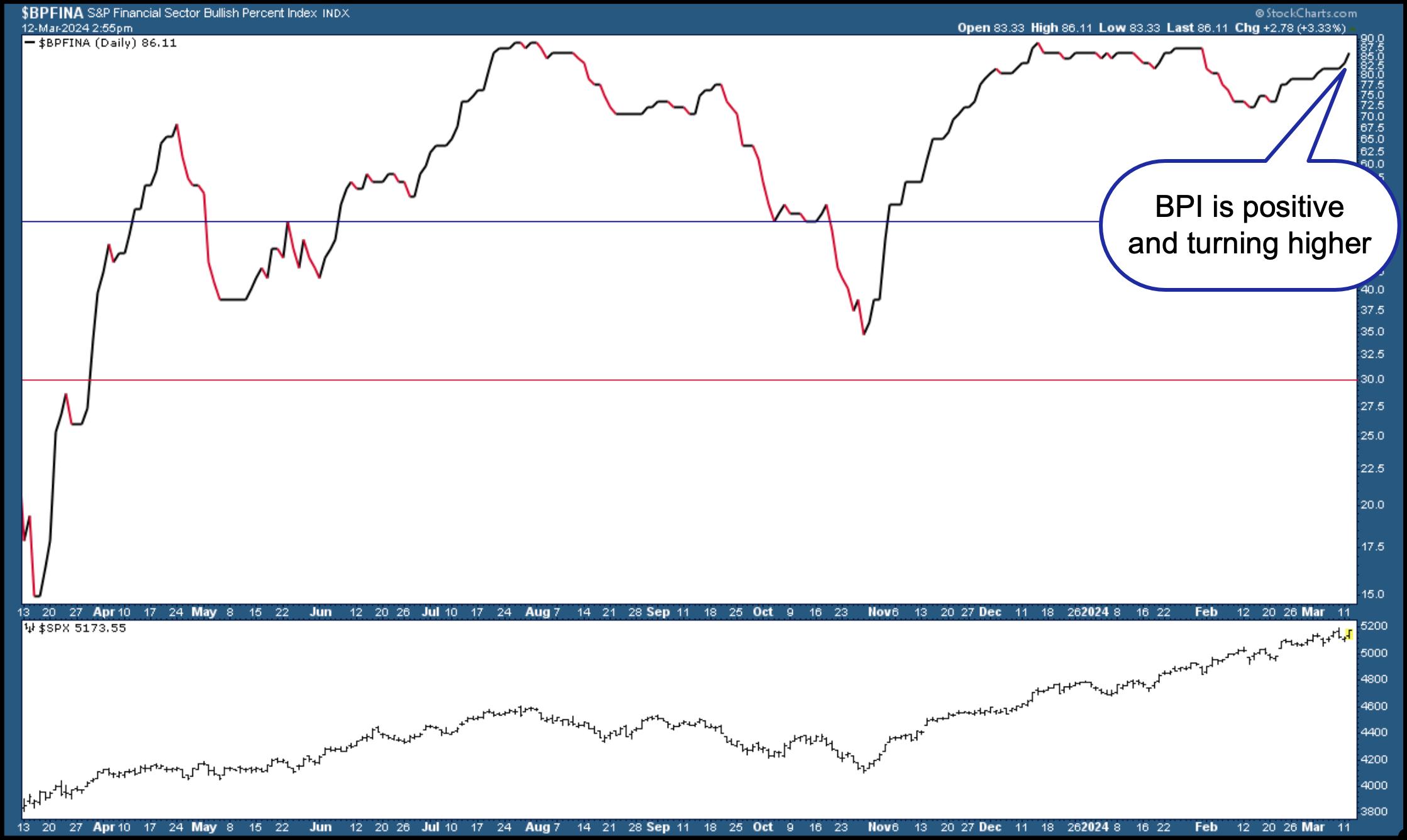

Bullish Percentage Index

The S&P Financial Sector Bullish Percent Index ($BPFINA) chart below shows strength in the financial sector at 86.11. Indicators are rising, which suggests that financials can still maintain an upward trend.

Chart 1. S&P Financial Sector Bullish Percentage Index (BPI). The financial sector is optimistic and may remain that way for a long time.Chart source: StockCharts.com. For educational purposes.

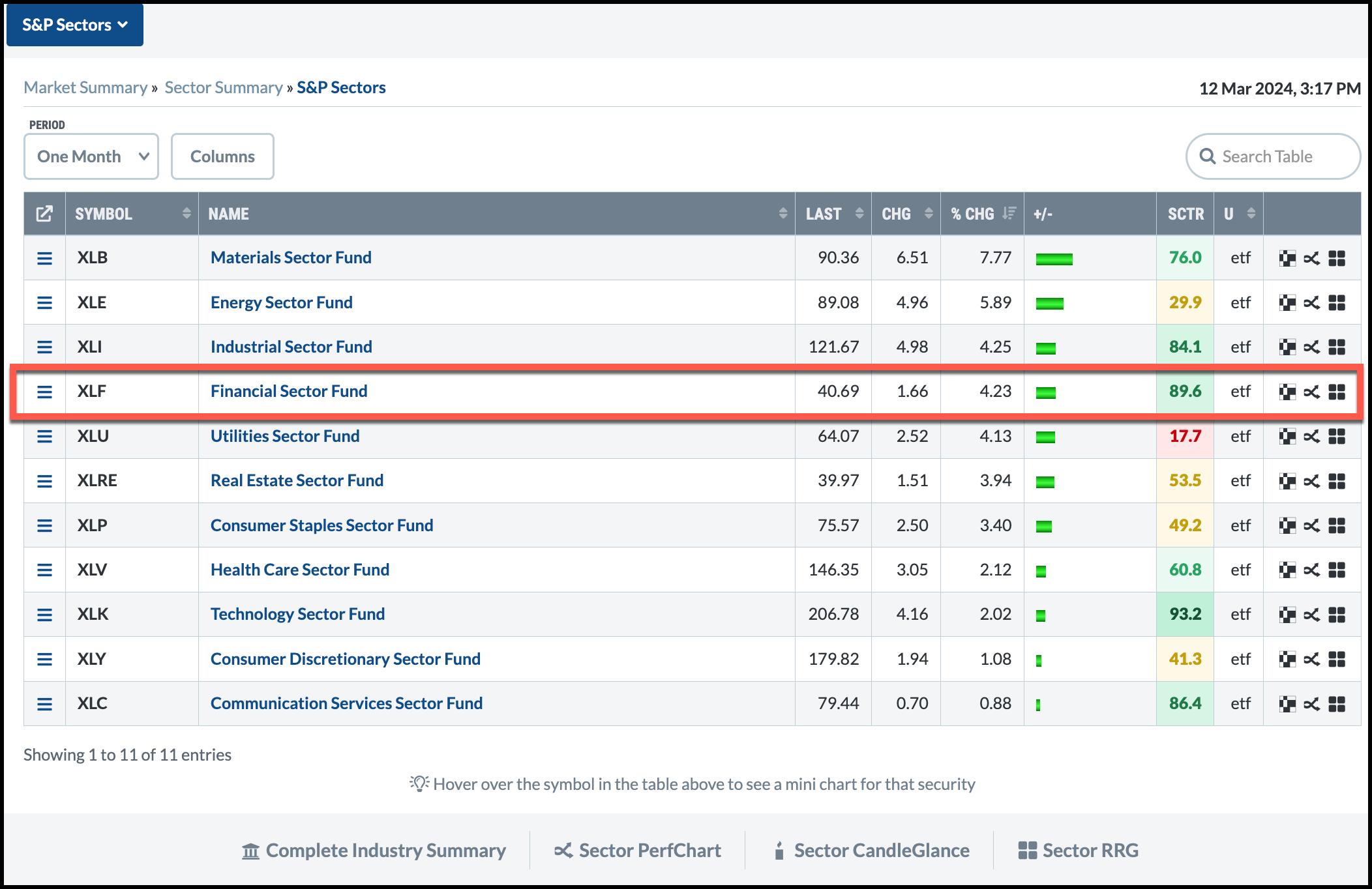

Sector Summary

Looking at one-month sector performance using the StockCharts Sector Summary, the Financial Select Sector SPDR (XLF), a proxy for the sector, is not the best performer, but is the second best performer in StockCharts Technical Ranking (SCTR). The score is 89 points.

Chart 2. One-month segment summary. Although the financial sector is not the highest performing sector, it is a good performing sector as it has the second highest SCTR score.Chart source: StockCharts.com. For educational purposes.

Both data points suggest that the financial sector is strong and WFC stock may be worth checking out.

Symbol summary

that much Symbol summary StockCharts’ tools allow you to get a bird’s eye view of any stock or exchange traded fund. Enter WFC in the symbol box and review WFC’s stock chart, fundamental data, technical data, earnings history, SCTR ranking and predefined scans with WFC. As of this writing, WFC has been filtered into four scans: a new 52-week high, a move above the upper limit channel, a P&F upward triple top breakout, and a P&F double top breakout. The stock appears to be technically strong and gaining strength.

WFC stock monthly chart

Looking at the 20-year monthly chart, we can see that WFC is showing choppy movements.

Chart 3. Monthly chart of WELLS FARGO stock. The stock price is trending upward, but will it fall?Chart source: StockCharts.com. For educational purposes.

If we overlay the 120-month simple moving average (SMA) on a monthly chart (representing 10 years), we can see that despite the choppy price movements, WFC is trending gently upward, with prices reverting to average price movements. The stock is trading well above average, is there a chance it will fall?

WFC stock daily chart

The daily chart of WFC below has the 50-day SMA overlaid on the price. The price movement patterns are similar in that the price tends to break out of the SMA and then return to the SMA. So, is WFC too extreme, or is it worth investing in after the decline?

Chart 4. Daily chart of WELLS FARGO stock. The stock may be trending higher, but if momentum is still strong, the stock may continue to rise.Chart source: StockCharts.com. For educational purposes.

When a stock hits an all-time high, there’s a reason it goes higher. As long as momentum supports price action, stocks will continue to rise. This is why it helps to add momentum indicators. There are several to choose from, including Moving Average Convergence/Divergence (MACD), Relative Strength Index (RSI), Average Directional Index, and Rate of Change (ROC).

In this example, ROC is added to the bottom panel below the price chart. Notice the indicator fluctuating above and below the zero line. When ROC is above the 0 line, it indicates positive momentum. The ROC has retreated and could reverse and move higher. When ROC moves below the zero line, it is a sign that momentum is slowing. Notice how the previous drop to the 50-day SMA saw ROC fall below the zero line, then reverse and rise again.

conclusion

Even though WFC stock is at new all-time highs, momentum is showing no signs of slowing down. If you’re nervous about buying a stock that’s on the rise, a look at the chart shows that WFC may be on the downside. As long as it remains above the 50-day moving average on the daily chart, you can enter a buy position if the financial sector is healthy and the upward momentum in stock prices is strong. It may take some patience to wait for WFC to withdraw. These are necessary traits for successful traders and investors.

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as Technical Analysis Editor for Stocks & Commodities magazine for over 15 years. Learn more