Whales withdrew $64 million ETH from exchanges. Is this a bullish signal?

According to data On Lookonchain, an on-chain analytics platform for Ethereum (ETH), whales withdrew approximately $64.2 million worth of ETH from major exchanges.

This significant movement of funds coincides with a notable rise in the price of ETH, indicating growing interest in the asset.

Ethereum whale movement signals confidence.

Lookonchain’s findings show that the majority of ETH supply has moved from exchange wallets to custodial wallets. The on-chain analytics platform reported that an Ethereum address identified as 0x8B94 withdrew 14,632 ETH, worth approximately $45.5 million, from Binance.

Lookonchain reports that these funds were actively staked within 6 days, indicating a deliberate move to adopt a long-term investment strategy.

Another two new Whale wallets have transferred 6,000 ETH worth $18.7 million from Kraken to an undisclosed wallet address in the past two days, according to platform analytics.

The whales are gathering $ETH!

0x8B94 withdrew 14,632. $ETH($45.5 million) #Binance Staking for the past 6 days: https://t.co/bywnrZ2glt

2 fresh whale wallets withdrew 6K $ETHFrom ($18.7 million) #kraken For the past 2 days.https://t.co/0kEvOmiv3hhttps://t.co/90fqjJXsSu pic.twitter.com/J0ewl8S3OX

— Lookonchain (@lookonchain) February 26, 2024

This trend suggests an increase in major investors looking to secure significant amounts of Ethereum away from exchange platforms, potentially as a means of long-term asset valuation.

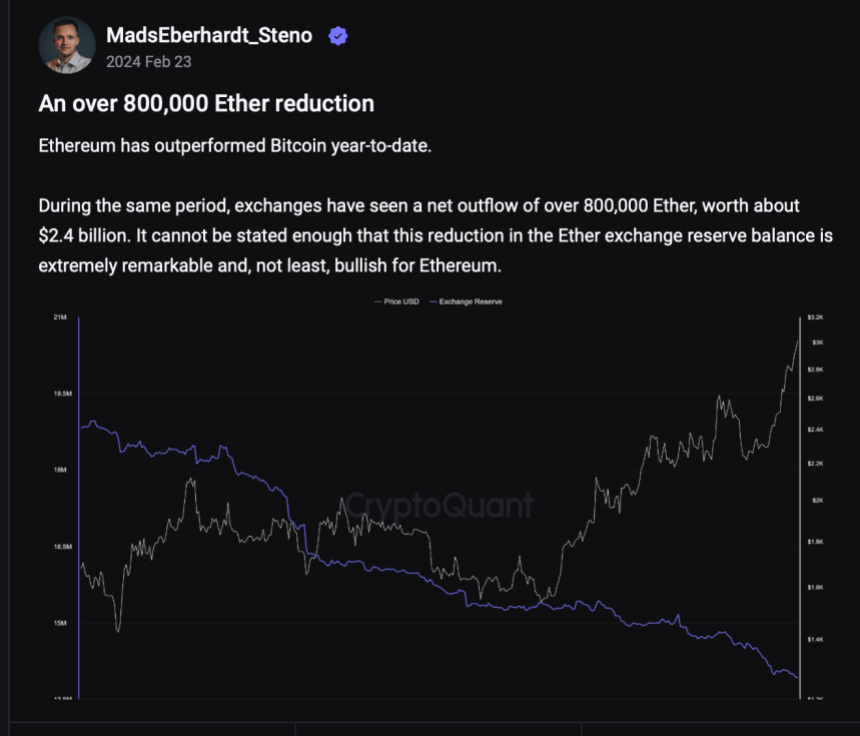

Further reflecting this is a recent analysis by CryptoQuant’s Quicktake, which highlights notable trends related to Ethereum withdrawals from exchanges over the past few weeks. This observation relies on the “Exchange Reserve” indicator, which monitors the quantity of ETH tokens held in the wallets of all centralized exchanges.

If the value of this metric increases, it means that investors are depositing more assets than withdrawing them from centralized exchanges, indicating that their Ethereum reserves are building up. Conversely, a decline in the metric indicates a net outflow of assets from these platforms.

According to data from CryptoQuant, more than 800,000 ETH, worth about $2.4 billion, has exited cryptocurrency exchanges since the beginning of the year. Such significant outflows from these platforms indicate a surge in investor confidence in the Ethereum network and its native tokens in general.

Ethereum’s price momentum and potential for a significant breakout

Meanwhile, the price of Ethereum showed bullish momentum last week, rising 5.5% and reclaiming the important $3,000 level.

Financial expert Raoul Pal noted the potential for a big breakout for Ethereum, pointing out the “double chart pattern” observed on the ETH/BTC chart.

The ETH/BTC charts are truly amazing…and ready for the next big move, a breakout of the mega wedge…let’s see how it plays out… pic.twitter.com/5x4tJLjtJy

— Raoul Pal (@RaoulGMI) February 25, 2024

Pal highlights a “mega wedge” pattern with an internal descending channel, indicating a consolidation phase with bullish potential.

Featured image by Unsplash, chart by TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.