What are the downside risks of QQQ? | a cautious investor

key

gist

- The bearish momentum gap and the decline in the bullish percentage index suggest a tough future ahead for QQQ.

- The 50-day moving average and Chandelier exit system can serve as trailing stops to lock in profits from recent uptrends.

- Once the stop is broken, Fibonacci retracements can be used to identify potential downside targets for the Nasdaq 100.

The Nasdaq 100 ETF (QQQ) is starting to show further signs of deterioration, from a bearish momentum gap between price and RSI to breadth weakening using the Bullish Percent Index. How can you determine if a downturn could turn into a bigger disaster for stocks? Let’s take a look at how the 50-day moving average, chandelier clearing, and Fibonacci retracement can help predict QQQ’s downside risk.

To start, we need to acknowledge how QQQ occupies a distinct place in the growing list of charts showing bearish momentum differentials.

Typical signs of a bull market This is when the price continues to rise while RSI (or another momentum indicator) begins to fall. Think of this pattern as a train running out of steam as it reaches the top of a hill. This waning momentum usually occurs at the end of a bullish phase when buyers are tired and there is not enough momentum to push the market much higher.

But this isn’t just about weakening momentum. Broad conditions, which have remained fairly constructive for the broader equity space, have actually worsened over the past 10 weeks.

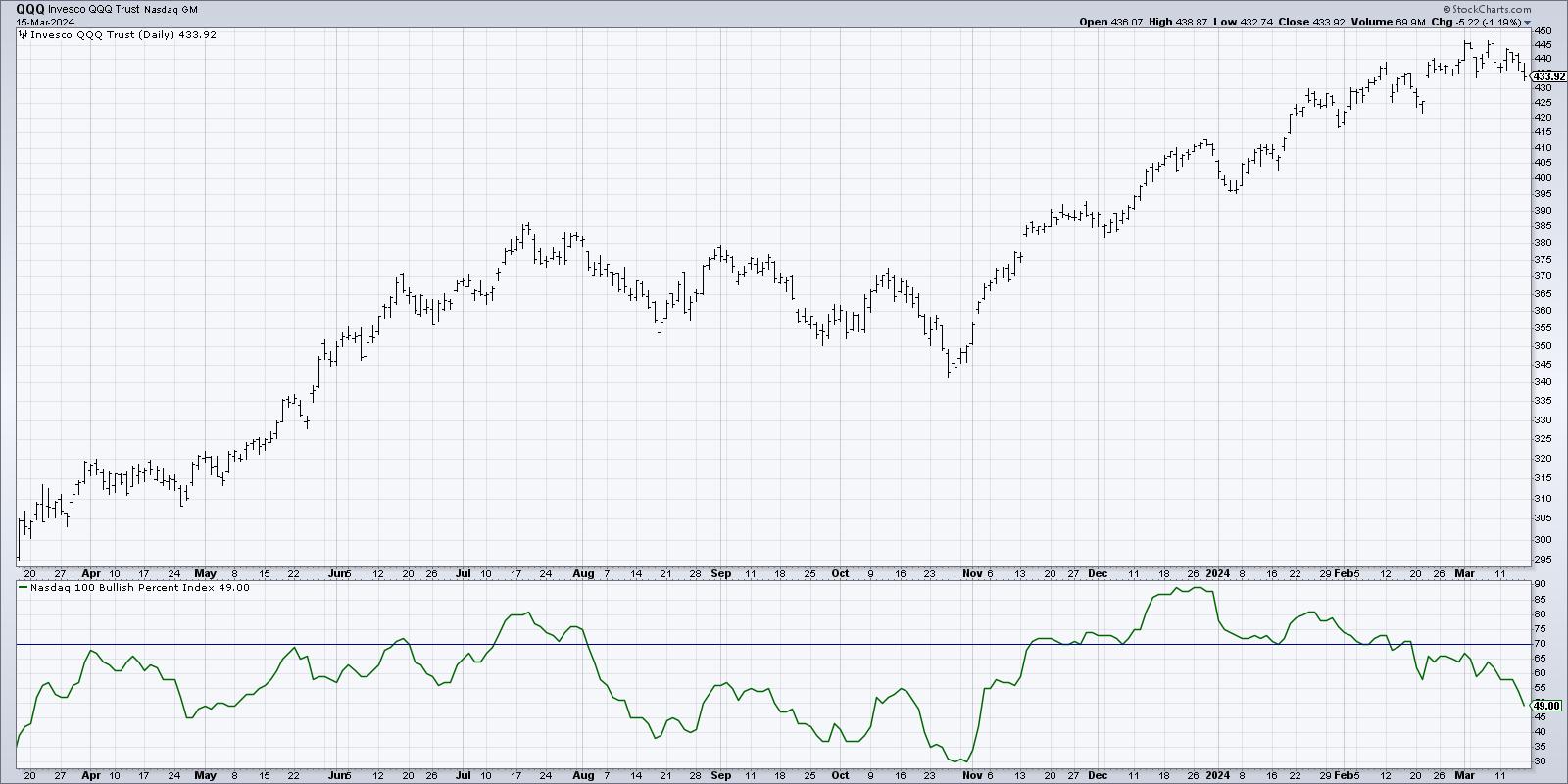

Here we show the Bullish Percent Index of the Nasdaq 100. This is a market breadth indicator based on point and numeric charts and basically measures how many stocks in a particular index are currently showing bullish points and numeric signals.

At the end of December, this indicator was around 90%. This means that 9 out of 10 Nasdaq 100 members were in a bullish phase. This week saw the indicator complete just below 50%. This shows that approximately 40% of Nasdaq 100 Index members have generated sell signals on the 2024 Point and Figure chart.

What is very interesting about this particular development is that point and figure charts typically need to show significant price weakness to generate a sell signal. Therefore, names like TSLA, AAPL, etc. are collapsing, which suggests that further upside for QQQ will be limited until this breadth indicator improves.

Are you prepared for further declines in QQQ and key growth companies? The first item on my Market Top Checklist has already been implemented. please join me My Upcoming Free Webcast On Tuesday, March 19th, I’ll share the remaining six items on my checklist and reflect on what signs we might see in the coming weeks. Sign up here For this free event!

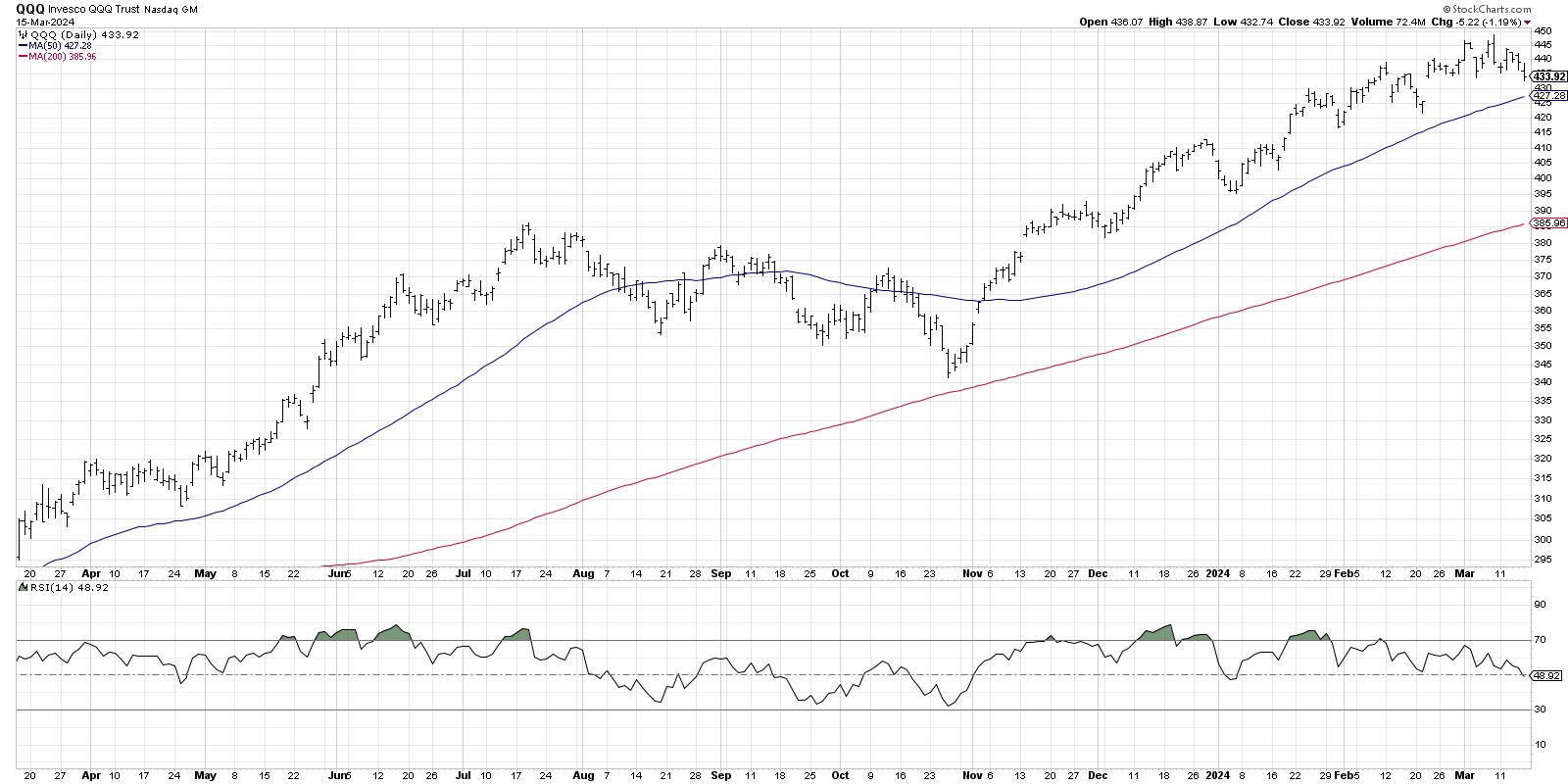

So what if the Nasdaq 100 continues to fall? At what point can you determine when the remediation phase has actually started? I like to keep things simple, so I always start with the 50-day moving average in terms of the initial trigger for a tactical pullback.

The 50-day moving average is currently about $6 below Friday’s close and fairly well in line with the February low of about $425. So as long as this level holds, the short-term trend actually remains good. A drop below the 50-day moving average shows that further price declines are much more likely.

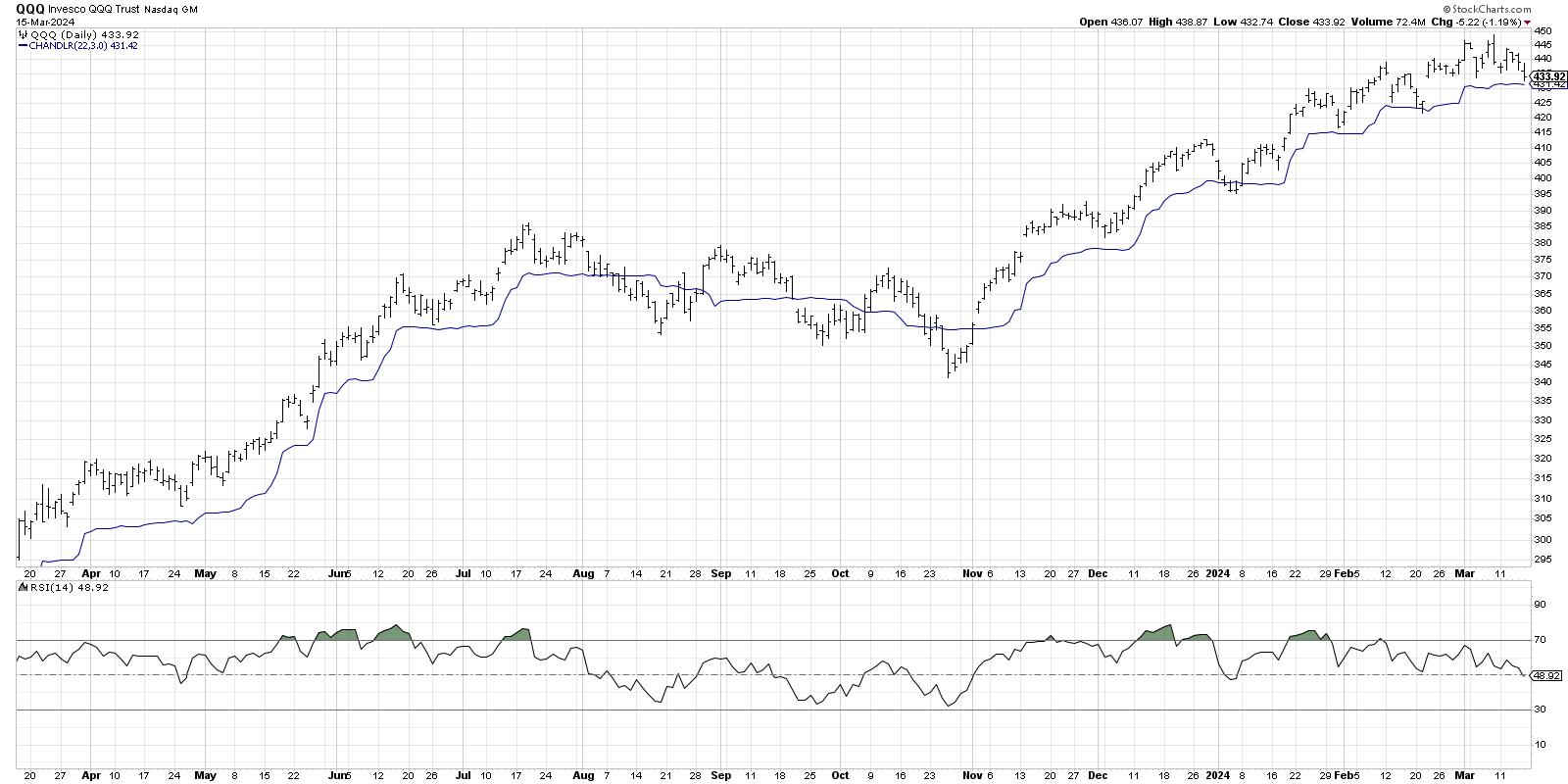

However, while the 50-day moving average is a simple and straightforward situation, it is probably not the most effective way to measure a new downtrend phase. Alexander Elder popularized the chandelier exit system. In his book, it represents a more subtle version of the trailing stop because it is based on: ATR (Average True Range).

Take a look back at the highest prices in July 2023 and see how prices stayed above the Chandelier exit through those highs. Soon after, the price broke below the downtrend, signaling the end of the uptrend and the beginning of a corrective move. After the October 2023 low, QQQ continued to remain above the chandelier exit on a downtrend as the price achieved higher highs and higher lows through March. After Friday’s decline, the Nasdaq 100 remains just above this effective tracking stop mark.

So what happens next week when the chandelier exit is violated and QQQ begins to fall to new lows? What’s next for the Nasdaq 100?

Fibonacci retracements can be very useful in identifying downside risk assessments because they measure how far price may move back in relation to the most recent uptrend. Using the October 2023 low and March 2024 high, the initial downside target would be around $408. Additional support may come at the 50% level ($395) and 61.8% level ($382).

Notice how well this level aligns with previous swing lows, especially the 61.8% retracement level. The last support level coincides with the December 2023 low and the July 2023 high. I call these levels “pivot points” because they act as both support and resistance. This is often an important level to monitor.

A number of large-cap growth stocks, including TSLA and AAPL, have fallen in recent weeks. However, the recent pattern of bearish momentum emanations and downside conditions suggest that further declines for the Nasdaq 100 may be possible. By carefully observing trailing stops and potential support levels, we can probably use our strength to navigate choppy market flows. Technical analysis.

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral bias through technical analysis. He is a frequent host of StockCharts TV and links mindfulness techniques to investor decision-making on his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on risk management through market awareness. He combines strengths in technical analysis, behavioral finance, and data visualization to identify investment opportunities and strengthen relationships between advisors and clients. Learn more