What AstraZeneca gains from acquiring Fusion Pharmaceuticals (AZN)

sorry

AstraZeneca (NASDAQ:AZN) announced that it would take over. Convergence Pharmaceutical (NASDAQ:FUSN) of $21 per share, or approximately $2 billion, plus contingent value rights (“CVR”) of $3 per share payable upon achievement of certain regulatory milestones, bringing the total potential value That’s about $2.4 billion, a premium to Fusion’s closing price yesterday of 97% and 126%, respectively. The transaction is expected to close in the next quarter.

This is the end of a somewhat unsatisfying story for Fusion’s IPO investors, as the company went public at $17 per share in June 2020, but it’s generally the end of a good story for all investors who purchased the stock at least a few months after the IPO. Because the stock has spent all this time trading at prices well below its IPO price.

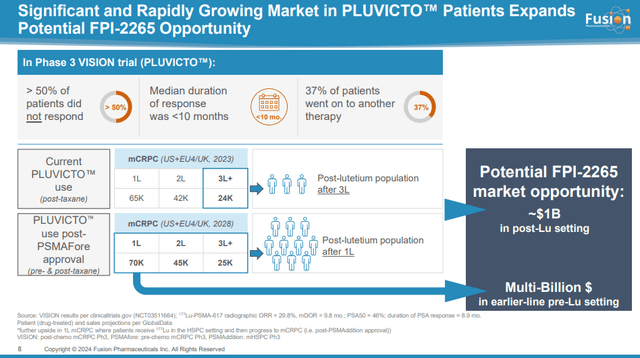

In a December 2023 article about AstraZeneca, I wrote that the company We have built an enviable product portfolio and pipeline. The acquisition of Fusion gives AstraZeneca an early-stage radiopharmaceutical company under its FPI-2265 program. The company is on track to achieve its initial goal of $1 billion in peak annual sales in third-line + metastatic castration-resistant prostate cancer.mCRPC‘) And if the candidate can move to a previous line of treatment, this can rise to billions.

The acquisition also provides full access to Fusion’s radiopharmaceutical manufacturing expertise, two early-stage clinical candidates, and FPI-2068, a Phase 1-ready candidate that AstraZeneca has already licensed from Fusion.

Fusion Pharmaceuticals Investor Relations

Expansion into the potentially lucrative and expanding radiopharmaceutical market

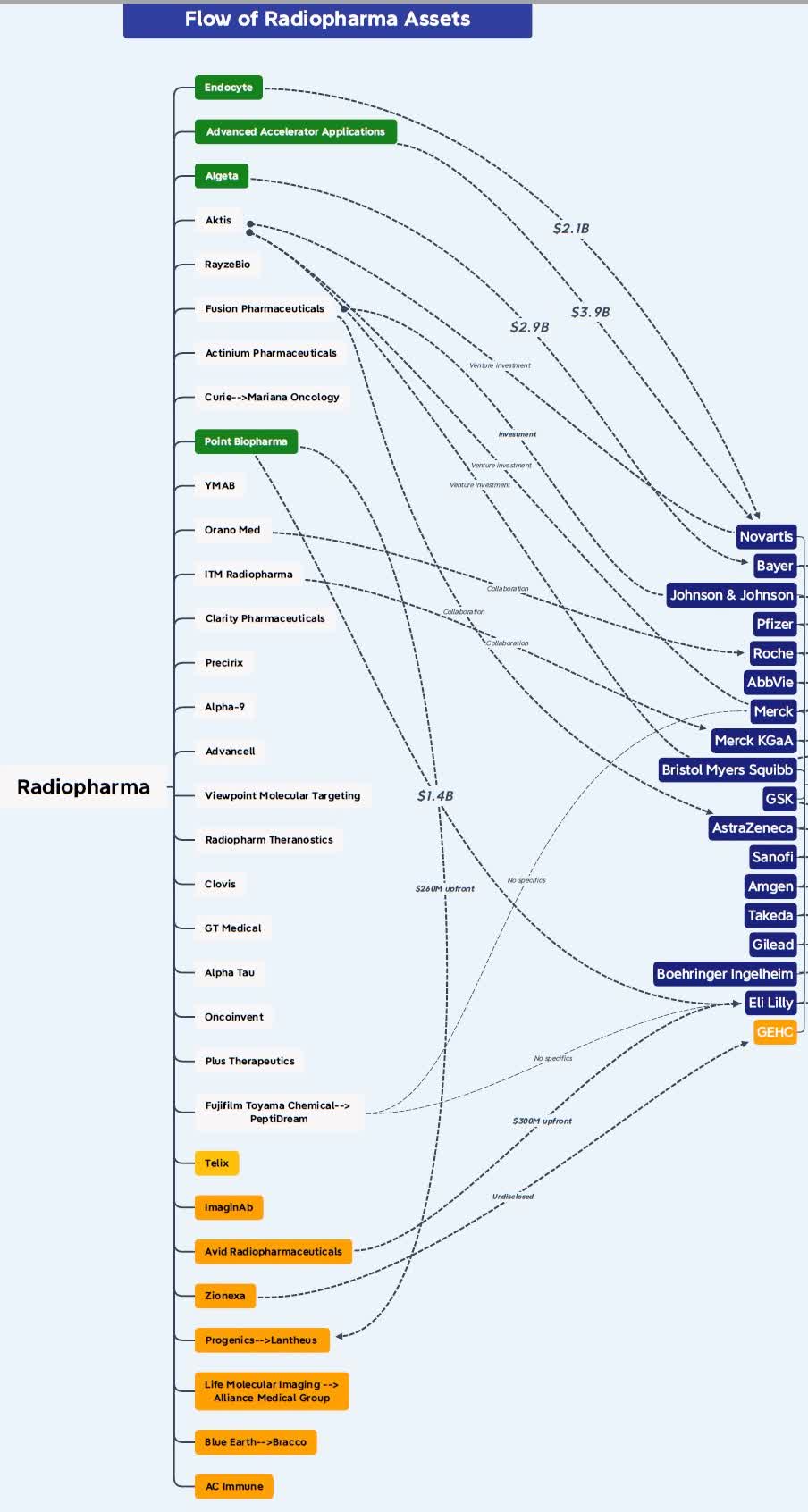

The radiopharmaceutical market is emerging as a hot place for biotechnology M&A. The deal follows Bristol Myers Squibb’s $4.1 billion acquisition of RayzeBio and Eli Lilly’s $1.4 billion acquisition of POINT Biopharma. AstraZeneca decided to join its ranks by acquiring Fusion.

Fusion itself acquired FPI-2265 from RadioMedix in February 2023 and targets prostate-specific membrane antigen (PSMA). Prostate-specific membrane antigen (PSMA) is found in greater amounts on the surface of prostate cancer cells than on normal prostate cells and is a proven target for prostate cancer treatment. . PSMA is expressed in more than 80% of men with prostate cancer, and higher PSMA expression is correlated with worse outcome.

FP-2265 is as follows: of Novartis (NVS) Pluvicto, a lutetium-177 PSMA targeted therapy approved for the treatment of mCRPC. Fluvicto, approved in 2022, generated net sales of $271 million and $980 million in 2022 and 2023, respectively.

FPI-2265 is an actinium-225-based PSMA targeting radioconjugate, emitting higher radiation doses over shorter distances. Fusion believes that alpha particles like actinium-225 (compared to Pluvicto’s beta approach) “may have a more potent cancer-causing potential.” “It kills cells and minimizes damage to surrounding healthy tissue through targeted delivery.”

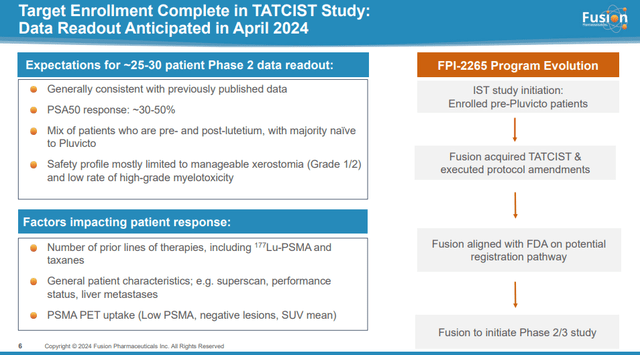

FPI-2265 is now a final stage candidate. Fusion had planned to begin Phase 2/3 clinical trials in the second quarter, with the potential for FDA approval, assuming the data were positive.

Interestingly, this acquisition occurred shortly before the expected data readout from the TATCIST trial for Fusion’s lead asset, FPI-2265, last April. That’s just my guess, but I think it’s likely that AstraZeneca will look at these data and decide to pull the trigger before they become public, pushing the price of Fusion higher. Fusion sets expectations for data from 25 to 30 patients by saying PSA50 response (defined as a 50% PSA reduction from baseline) should be in the 30 to 50 percent range and the safety profile is manageable at grade 1/2. I did. Dry mouth (xerostomia) and low-grade high bone marrow toxicity. Although unlikely, it is possible that the data due to be released next month may have exceeded the threshold set by Fusion.

Fusion Pharmaceuticals Investor Presentation

The addressable market, which can also be addressed in the third and subsequent population groups after Pluvicto, is significant with more than 24,000 patients and a $1 billion opportunity, based on Pluvicto’s annual price per patient exceeding $200,000. AstraZeneca will likely adopt Fusion’s development plans and attempt to expand them into first- and second-line treatments for mCRPC. This will significantly expand the market to almost six times the initial addressable market.

Fusion Pharmaceuticals Investor Presentation

Of course, this is not a simple proposition, and AstraZeneca is taking on development and competitive risks because this is not the only approach for treating mCRPC and it is a very attractive and increasingly competitive market. And the radiopharmaceutical market is developing rapidly, with several large pharmaceutical companies currently active. Bayer (OTCPK:BAYZF), Novartis, Johnson & Johnson (JNJ), and most recently Bristol-Myers Squibb (BMY) and Eli Lilly (LLY) acquired RayzeBio and POINT Pharma. that much graph October 2023 Jacob Plieth on X (formerly Twitter) (now needs update) shows the flow and congestion of radiopharmaceutical assets.

X (formerly Twitter)

But securing Fusion’s radiopharmaceutical expertise, manufacturing operations and early-stage pipeline, along with a valuable late-stage shot at achieving its goal with FPI-2265, is worth the risk of spending between $2 billion and $2.4 billion. It appears to be.

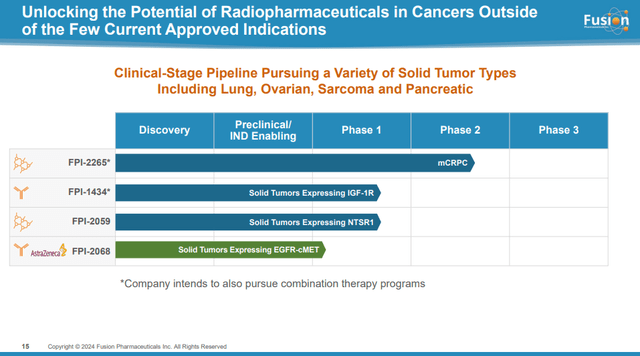

Fusion’s Early Stage Pipeline

Fusion’s early-stage pipeline consists of three candidates:

- FPI-1434 is the ‘first antibody-based targeted alpha therapy’ for solid cancer. Fusion believes that the use of alpha emitters instead of chemical toxins in antibody-drug conjugates (‘ADCs’) represents an untapped opportunity. Candidacy is meant to make IGF-1R antibodies “hot.” IGF-1R is a well-established cancer biomarker. However, IGF-1R antibodies were previously tested extensively in cancer patients, but were discontinued in the 2000s due to lack of therapeutic efficacy. In June 2023, Fusion presented preliminary data on two of three ovarian cancers receiving a dose of 15 kBq/kg, indicating stable disease. The dose was then increased to 25 kBq/kg and the disease stabilized in one of the three patients, while the other patient showed lesion shrinkage after the first dose. This is some encouraging data, but it’s really hard to predict whether this candidate has a future or not.

- FPI-2059 is a small molecule targeted alpha therapy targeting neurotensin receptor 1 (‘NSTR1’) acquired by Fusion from Ipsen and is currently in the phase 1 dose escalation phase. Preclinical data demonstrated tumor regression achieved at significantly lower doses than lutetium-based compounds such as Pluvicto.

- FPI-2068 is an AstraZeneca candidate licensed from Fusion and all rights reserved. FPI-2068 combines precision targeting of actinium and bispecific antibodies to address both EGFR mutant and wild-type cancers. This is a Phase 1-ready candidate, and preclinical data in a non-small cell cancer model has demonstrated sustained tumor regression in mice.

The early-stage pipeline is unproven, but it gives AstraZeneca something to fall back on if FP-2265 disappoints in later-stage trials in mCRPC patients.

conclusion

The acquisition of Fusion Pharmaceuticals expands AstraZeneca’s presence in the radiopharmaceutical market beyond the initial FPI-2068 candidate licensed from Fusion. At the very least, AstraZeneca has Fusion’s radiopharmaceutical expertise, manufacturing operations, and foundation for future expansion. But that alone isn’t enough to justify the price tag, and the company needs to show clinical success with FPI-2265 or another early-stage candidate. The benefits of FPI-2265 in mCRPC are significant and success in the third-line and beyond populations could be a huge payoff, and expansion of FPI-2265 into mCRPC early-line and early-stage pipeline success could be a major plus for AstraZeneca’s top and bottom line in the late 2020s. may be added. Early 2030s.

And for most Fusion Pharmaceuticals investors, this will be a satisfactory outcome considering the stock has traded since its June 2020 IPO and all risk has now been transferred to AstraZeneca shareholders.