What do Bitcoin miners expect next?

Bitcoin miners have always been a reliable indicator of overall sentiment within the market. By tracking their earnings and activity, we can see where the BTC price is headed next. This article covers the latest trends in Bitcoin mining, how miners are reacting to current market conditions, and key indicators to gauge how Bitcoin miners position themselves over the coming weeks and months. Let’s take a look at what you can learn from:

Miner Profit Status

One of the best ways to assess the sentiment of Bitcoin miners is to examine their returns in relation to historical data. This can be done using the Puell Multiple, which measures the current miner’s earnings compared to the annual average of the previous year.

Based on the latest data, the Puell Multiple is hovering around 0.8. This means miners are earning 80% of what they earned on average over the past year. This is a marked improvement from a few weeks ago, when the multiple was as low as 0.53, indicating miners are earning more than half of their previous year’s average.

This sharp decline early this year is likely to put financial pressure on many miners. However, despite these challenges, the fact that the Puell Multiple is recovering suggests that miners’ prospects may be improving.

Hashrate and network growth

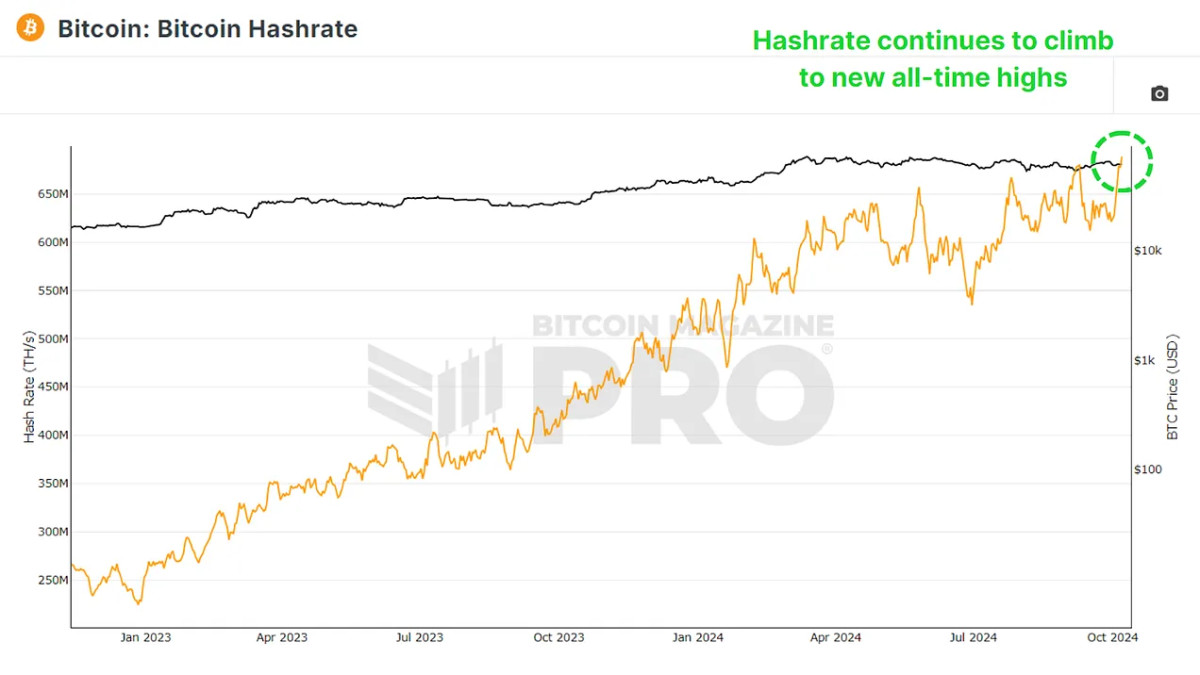

Despite the decline in profits, there are no signs of miners leaving the network. In fact, Bitcoin’s hashrate, which is the total computing power used to secure the network, has been steadily increasing. This surge in hashrate indicates that more miners are entering the network or that existing miners are upgrading their equipment to compete for block rewards.

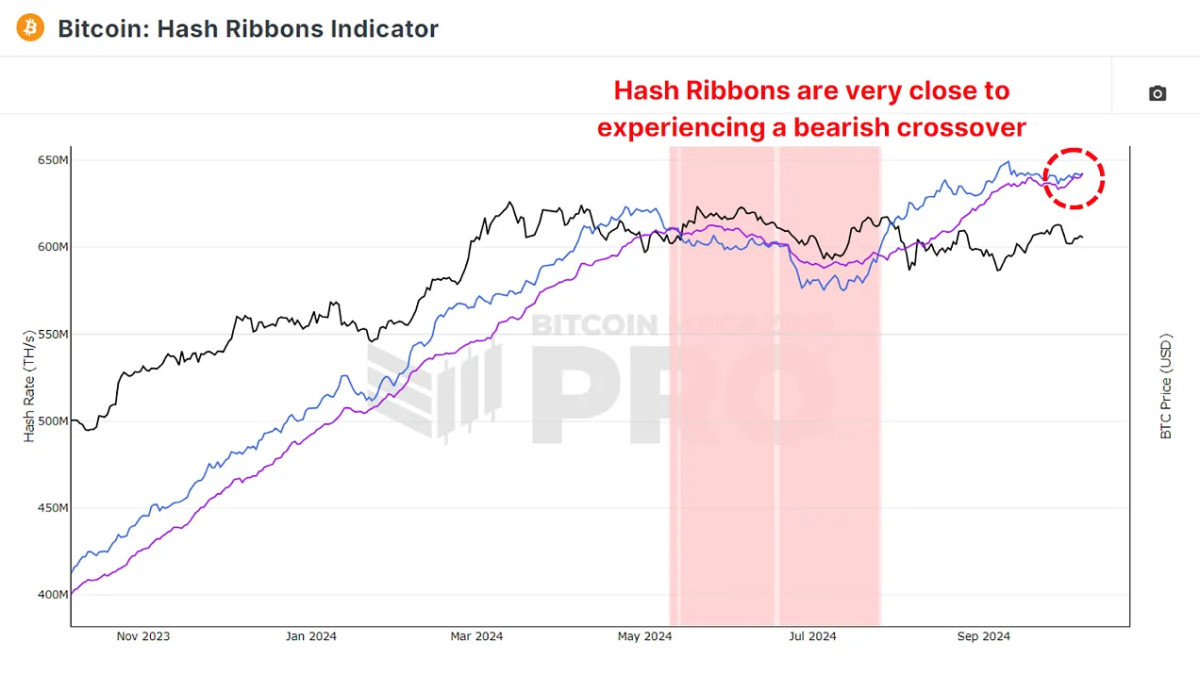

However, looking at the Hash Ribbons Indicator, which tracks the 30-day (blue line) and 60-day (purple line) moving averages of Bitcoin hashrate, we see that these two averages are approaching a crossover point, a potentially bearish outlook. can represent . In the short term. When the 60-day average rises above the 30-day average, it signals miner capitulation, historically the point at which miners shut down their equipment under financial pressure.

There are no immediate signs of weakness until a bearish crossover appears. One positive thing is that whenever this happens, it is usually preceded by a period of accumulation followed by a rise in the price of Bitcoin. Investors often see these surrender periods as good opportunities to buy BTC at lower prices.

How much do miners earn?

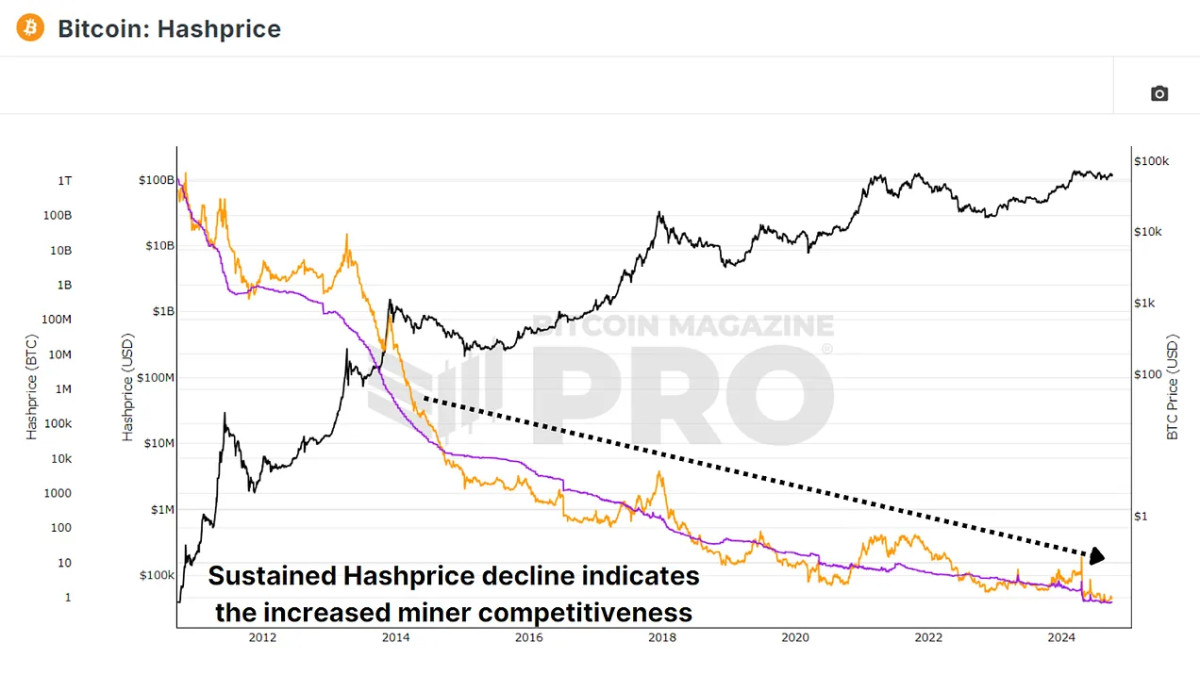

While miner earnings have been discussed in relation to the Bitcoin price, another important factor is the hash price, i.e. the amount a miner can earn in BTC or USD for each terahash (TH/s) of computational power he or she contributes to the network. no see.

Currently, miners earn about 0.73 BTC per terahash, or about $45,000 in U.S. dollars. This amount has been steadily decreasing in the months since the recent Bitcoin halving event, which saw miners’ block rewards cut in half, reducing their profitability. Despite these challenges, miners are still increasing the hash rate, suggesting that they are betting on future BTC price rises to compensate for their low earnings.

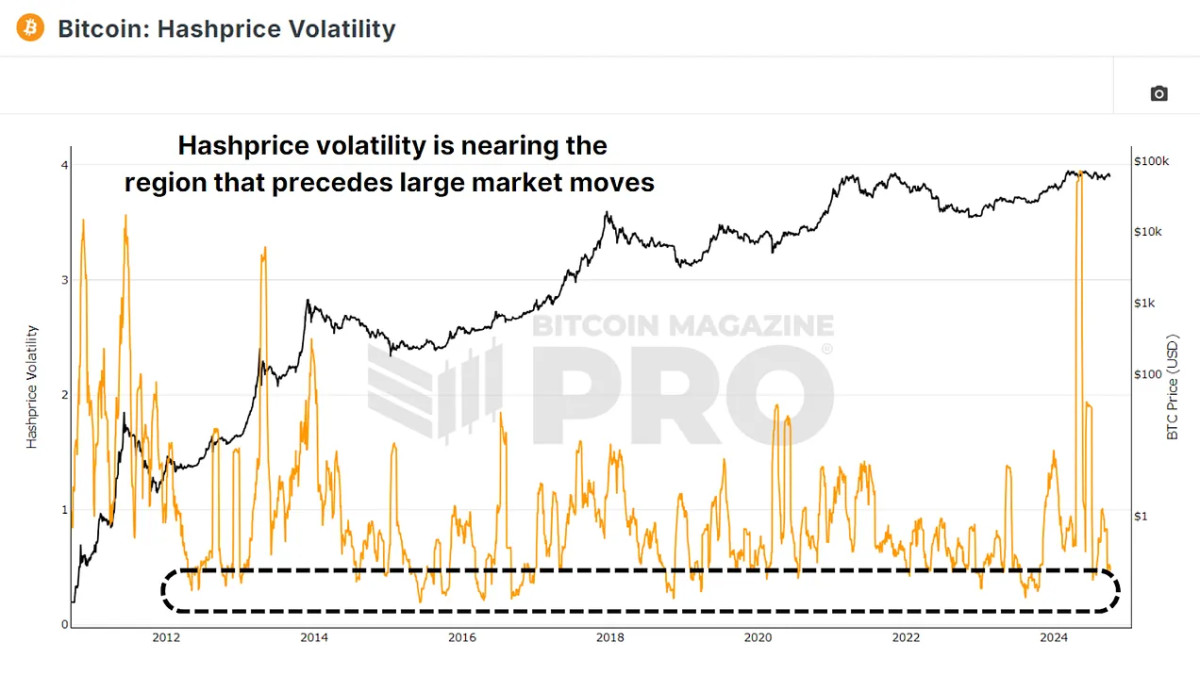

One of the most interesting metrics to keep an eye on is hash price volatility, which tracks how stable or volatile miners’ income is over time. Historically, periods of low hash price volatility have been preceded by significant price movements in Bitcoin. The latest data shows that hash price volatility has started to fall again, suggesting that a period of significant price volatility for Bitcoin is approaching.

conclusion

Bitcoin miners’ profits have declined relative to historical averages since the halving, but have recently been recovering from significantly lower levels. Bitcoin’s hash rate is still rising. This means miners are pouring more computational power into the network despite lower profitability. Hash prices continue to fall, but miners remain optimistic due to expected future price increases. Hash price volatility is decreasing, which historically indicates that a major move in the BTC price is imminent.

Bitcoin miners seem optimistic about BTC’s long-term potential despite its current difficulties. If the current indicator trend holds, most indicators point to a positive outlook and we could be on the verge of a significant price move.

To learn more about this topic, check out our recent YouTube video here.

What do Bitcoin miners expect next?