What this means for leading stocks of major industry groups | Exchange places with Tom Bowley

sample report

A few days ago we provided a sample of the Weekly Market Report (WMR) that is sent to EarningsBeats.com members on Mondays. Below is a sample of the Daily Market Report (DMR) sent to our members Tuesday through Thursday. A very brief market update is sent on Fridays.

Thank you for following me on StockCharts.com as I’ve been publishing articles for 17 years. If you’d like to get started with EarningsBeats.com, take advantage of our 30-day free trial. Now is a great time to join. Spring specials begin next week. If you like our service, you can take advantage of this year’s best deals and extend your membership. Click here to start your free trial!

Executive Market Summary

- Major indices fell overnight but reversed after initial claims rose unexpectedly.

- This increase in claims caused the 10-year Treasury yield ($TNX) to fall quickly, helping equity futures.

- The commodity is surging today as silver ($SILVER, +2.71%) moves within 2% of its recent high.

- The dollar ($USD) reversed yesterday after rising in the previous session, likely boosting interest in commodities.

- Crude oil ($WTIC, +0.23%) also reversed yesterday. Any higher from here and there will be a lot of congestion around $82 a barrel.

- Today’s stock strength is currently centered in two defensive sectors: Real Estate (XLRE, +1.81%) and Utilities (XLU, +1.12%).

- Technology (XLK, -0.18%) is the only sector currently in negative territory, with computer services ($DJUSDV, -3.16%) weighing on the group.

- Airbnb (ABNB, -6.62%) was one of the worst performers in the S&P 500 index after reporting quarterly results. ABNB recently broke below price support at 155 in the broadly deteriorating Travel & Tourism Group ($DJUSTT).

market outlook

The only time in the last 12 years that I’ve ever suggested it was a good time to sit still was right before one of the worst cyclical bear markets heading into 2022. Otherwise, I would suggest to anyone investing for the long term to stay bullish and invest for the long haul. Of course, the final decision is entirely yours. We provide guidance based on independent research and signals, but the decision is always up to you. We cannot take your risk and we are not interested in your personal financial situation and risk tolerance. Trying to manage other people’s money is foolish and also ill-advised since you are neither a registered investment advisor nor licensed to do so.

Again, if you have a natural tendency to short the stock market, I would simply keep this next to your computer screen as a reminder of how the stock market changes over time. Then decide whether you would be better off thinking positively or negatively about U.S. stocks.

That’s why I think it’s important to ignore the news and follow the charts. There is always a reason why the stock market plummets. It is the one constant that never changes. To be a successful investor/trader, you need to be able to look at the stock market objectively and only put your head down when most signals are bearish. In my humble opinion, that is not the case now.

Sector/Industry Focus

Here are several industries that are hitting new highs or threatening to break out among the five aggressive sectors: XLK, XLY, XLC, XLI, and XLF. When we talk about trading major stocks within major industry groups, this is how you start the process. Find the best industry groups:

Internet ($DJUSNS):

Broadline Retailers ($DJUSRB):

Bank ($DJUSBK):

Investment Services ($DJUSSB):

Comprehensive Insurance ($DJUSIF):

Heavy Industries ($DJUSHV):

Electrical Components and Equipment ($DJUSEC):

Chart List/Strategy

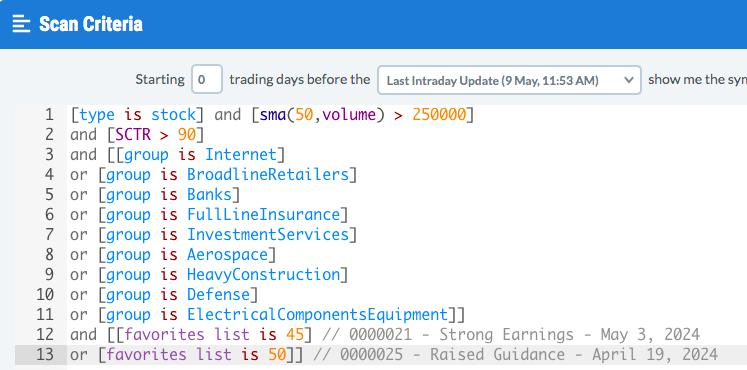

Okay, so if we truly remain in a long-term bull market and the recent sell-off/consolidation period is coming to an end, how do we find individual stocks to consider for the next step up in the stock market? Well, first of all, we know that the above industry groups are currently strong and strengthening. Defense ($DJUSDN) and Aerospace ($DJUSAS) aren’t shown above, but two other industries are really strong right now. Second, let’s scan for stocks in the above industries with a SCTR of 90 or higher (excellent relative strength). Let’s add a minimum average volume filter and run this scan against the Strong Earnings ChartList (SECL) and Raised Guidance (RGCL). If you wish, you can run this scan on your entire stock population. However, by including SECL and RGCL, we know that these companies are fundamentally strong in addition to their technological strengths.

…..Results are sorted first by SCTR and then by industry group.

These are 27 companies with excellent relative strength (as measured by high SCTR scores) belonging to industries with excellent strength. These stocks are the collective “poster children” of “leading stocks of leading industry groups.”

earnings report

Here are the key earnings reports for the next two days, including stocks with market caps over $10 billion. It also includes noteworthy companies with a market capitalization of less than $10 billion. Finally, the portfolio stocks for which results will be reported are highlighted. brave. If you decide to hold stocks for income, understand the significant short-term risk you are taking. Be sure to check the earnings dates of any companies you own or are considering owning.

Thursday May 9th:

BN, CEG, TAK, SLF, MTD, TEF, RBLX, WPM, TU, ARGX, PBA, WBD, EDR, WMG, RPRX, AKAM, H, EPAM, VTRS, SUZ, BAP, RBA, PODD, USFD, GEN, EVRG, CRL, NTRA, SOLV, ONTO, TREX, TPR, DBX, HRB, MARA, NXST, PLNT, FOUR, HAE, FROG, INSM, TSEM, SYNA, ALRM, VCTR, CLSK, YETI, YELP, SG, VERA, TGLS, NTLA, DNUT, PLUG, SOUN, NTCT, WRBY, VITL, CSIQ, Automotive, SBH, ZIP

Friday May 10th:

ENB, CRH, DOCN, LOAD

economic report

First-time unemployment claims: 231,000 (actual) vs. 212,000 (estimated)

Happy trading!

tom