When is the next Bitcoin halving?

introduction

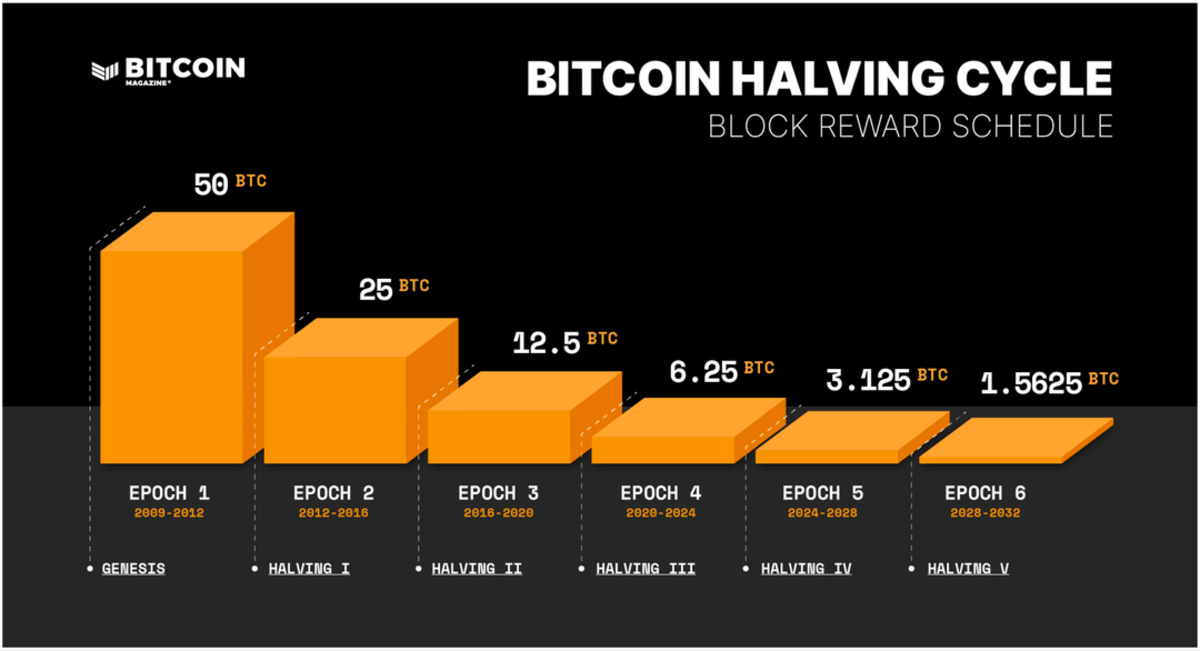

As the third era nears its conclusion, the countdown to the next Bitcoin halving is firmly underway. Halving (also known as “halving”) is one of the most important and innovative features of Bitcoin. The Bitcoin network mints new Bitcoin every 10 minutes, and the amount issued (the “block subsidy”) is halved approximately every four years (every 210,000 blocks, to be exact). Block subsidies are rewards miners receive for validating and recording new transactions on the blockchain.

Halving the block subsidy is a critical factor in Bitcoin’s final supply cap of 21 million Bitcoin. Additionally, miners collect transaction fees that users attach to transactions, which incentivizes miners to include those transactions in the next block. Therefore, miners often earn more Bitcoin by mining blocks than by subsidizing them. .

When is the next Bitcoin halving?

The next Bitcoin halving is expected to occur on or around April 20, 2024 (ET), reducing the block reward from 6.25 BTC to 3.125 BTC. During this halving period (or epoch), supply increases by 164,250 Bitcoin (from 19,687,500 to 20,671,875). This is just 328,124 Bitcoins short of the maximum supply limit of 21 million Bitcoins.

To calculate the next halving date

- Determine Block Interval: While it is true that Bitcoin’s block time (the time between each block) is approximately 10 minutes, times may vary slightly due to hash rate and network adjustments.

- Find the current block height: You need to know the current block height, which can be found on various blockchain explorer websites or directly if you are running a Bitcoin node.

- Calculate the number of blocks remaining until the next halving. Bitcoin halving occurs every 210,000 blocks. Subtract the current block height from the next half block height.

- Calculate estimated time remaining: Multiply the number of blocks remaining by the approximate block interval in seconds to estimate the time remaining until the next halving.

- Convert Time to Date: Find out when the next halving is expected by converting the estimated time remaining to date format.

Current block height: can be found here.

Block times: can be found here.

Current date: xx/xx/xxxx

Blocks per epoch: 210,000

Next Halving Block Height: 210,000 times next half life number

calculate:

((((next halving block height – current block height)*10)/60)/24 = number of days remaining

Hash rate and difficulty scaling are two variables that continuously shape the speed at which blocks are processed and thus the gap between blocks. As a result, the next halving date may vary, so it is important to keep running your calculations.

History of Bitcoin Halving

As of March 2024, Bitcoin has been halved three times.

- On November 28, 2012, Bitcoin’s block subsidy was reduced from 50 BTC per block to 25 BTC per block.

- On July 9, 2016, the second Bitcoin halving reduced the block subsidy from 25 BTC per block to 12.5 BTC per block.

- On May 20, 2020, the third Bitcoin halving reduced the block subsidy from 12.5 BTC per block to 6.25 BTC per block.

Bitcoin Halving 2012

The 2012 halving was Bitcoin’s first halving.

bisector:

Date: November 28, 2012

Number of half-lives: 01

Block height: 210,000

Block Reward: 25

Mining Amount: 10,500,000 (Amount of Bitcoin already issued at the time of halving)

era:

Subsidy: 5,250,000

Mined Supply Percentage: 25%

Bitcoin Halving 2016

The 2016 halving was Bitcoin’s second halving.

bisector:

Date: July 9, 2016

Number of half-lives: 01

Block height: 420,000

Block Reward: 12.5

Mined amount: 15,750,000 (amount of Bitcoin already issued when the halving occurred)

era:

Subsidy: 2,625,000

Mined Supply Percentage: 12.5%

Bitcoin Halving 2020

The 2020 halving was Bitcoin’s third halving.

bisector:

Date: May 20, 2020

Number of half-lives: 03

Block height: 630,000

Block Reward: 6.25

Mined amount: 18,375,000 (amount of Bitcoin already issued when the halving occurred)

era:

Subsidy: 1,312,500

Mined Supply Percentage: 6.25%

Bitcoin Halving in 2024

The 2024 halving will be Bitcoin’s third halving.

bisector:

Date: April 20, 2024 (estimated)

Number of half-lives: 04

Block height: 840,000

Block Reward: 3.125

Mining amount: 19,687,500 (amount of Bitcoin issued when halving occurs)

era:

Subsidy: 656,250

Mined supply percentage: 3.125%

Future Bitcoin Halving

The block time variable introduces some variation in the expected halving date, but it is possible to estimate a rough date until the end of the block grant in 2140. Below we provide a concise overview of the projected halving dates from 2024 to 2060, providing valuable insight into this. An upcoming milestone.

| epoch number | block height | half life year | Expected half-life date |

|---|---|---|---|

|

04 (out of 32) |

840,000 |

2024 |

April 20, 2024 |

|

05 (out of 32) |

1,050,000 |

2028 |

2028 |

|

06 (out of 32) |

1,260,000 |

2032 |

2032 |

|

07 (out of 32) |

1,470,000 |

2036 |

2036 |

|

08 (out of 32) |

1,680,000 |

2040 |

2040 |

|

09 (out of 32) |

1,890,000 |

2044 |

2044 |

|

10 (out of 32) |

2,100,000 |

2048 |

2048 |

|

11 (out of 32) |

2,310,000 |

2052 |

2052 |

|

12 (out of 32) |

2,520,000 |

2056 |

2056 |

|

(continue…) |

Historical significance of Bitcoin halving

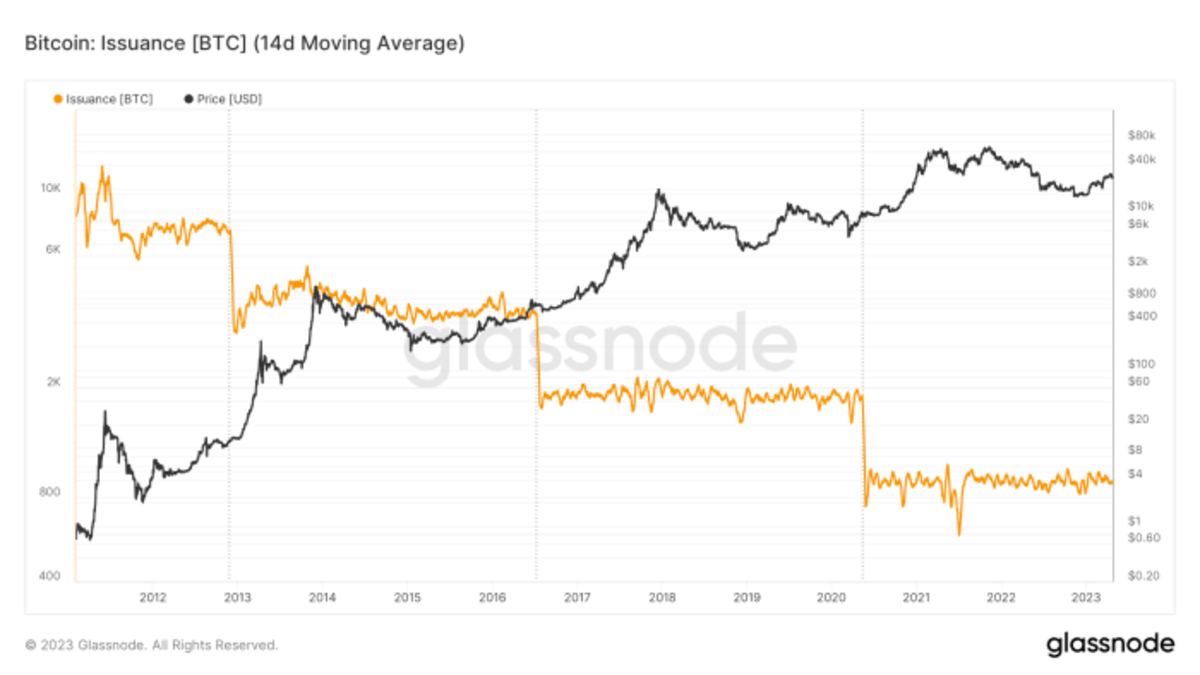

The halving event has consistently preceded significant rises in the price of Bitcoin, making it a focus for market analysts.

price evaluation

Historically, the price of Bitcoin has seen significant gains following halving events due to decreased supply and increased demand. These events can have a significant impact on the overall supply of Bitcoin and therefore its price. Nonetheless, it is important to acknowledge that price dynamics are influenced by many factors beyond the halving event.

- Since the 2012 halving, the price of Bitcoin has risen approximately 9,000% to $1,162.

- Since the 2016 halving, the price of Bitcoin has risen approximately 4,200% to $19,800.

- Since the 2020 halving, the price of Bitcoin has risen approximately 683% to $69,000.

The Bitcoin issuance rate halves roughly every four years.

A challenge for miners

Halving events can cause difficulties for miners because their income is reduced when the block reward is halved. To remain competitive, miners must operate efficiently, potentially fostering the development and adoption of more energy-efficient mining technologies. It is very common for miners to go bankrupt, which often affects the hash rate of the network, the supply of sellable Bitcoin, and ultimately the price of Bitcoin. Through upheaval, difficulty adjustments will eventually restore balance and the Bitcoin network and ecosystem will continue to move forward.

Frequently Asked Questions:

Will Bitcoin rise when it halves?

Bitcoin’s historical performance since the halving has shown an incredible upward trajectory. A decline in the rate of new supply puts Bitcoin on a path toward absolute scarcity. These events often increase interest and demand. However, it is important to exercise caution and not view the halving as a guaranteed route to quick profits. A prudent approach is to understand Bitcoin’s long-term potential and view it as a store of value rather than trying to time the market with purchases and sales.

Is Bitcoin Halving Bullish?

Bitcoin halving is undoubtedly a bullish event as it shifts supply dynamics in favor of higher prices. Although the halving is generally considered a bullish event, it is good to remember that the Bitcoin price is influenced by several factors. Caution is required.

How many days will Bitcoin reach its peak after the halving?

If we look at the past three halving events, we see that significant price increases typically begin within a few months of the halving event occurring. Additionally, before a halving, the price of Bitcoin tends to rise as investors expect a price rebound after the halving. It typically takes more than 12 months for prices to reach their peak after a halving.

Should you buy Bitcoin before the halving?

Rather than trying to understand when to buy or sell Bitcoin, it is better to understand the value of the asset. That said, in the past buying 6-12 months before the halving and selling 12-18 months after the halving tended to yield significant returns. Past performance and actions do not guarantee future performance. The best advice for non-experienced traders is to buy and hold for several cycles.