Which sectors benefit most from the rotation from large-cap to mid- and small-cap stocks? | RRG chart

key

gist

- Money is spinning in large-cap stocks

- Redistribution and new inflow of small and medium-sized stocks

- We found that most sectors prefer equal-weighted ETFs over cap-weighted ETFs.

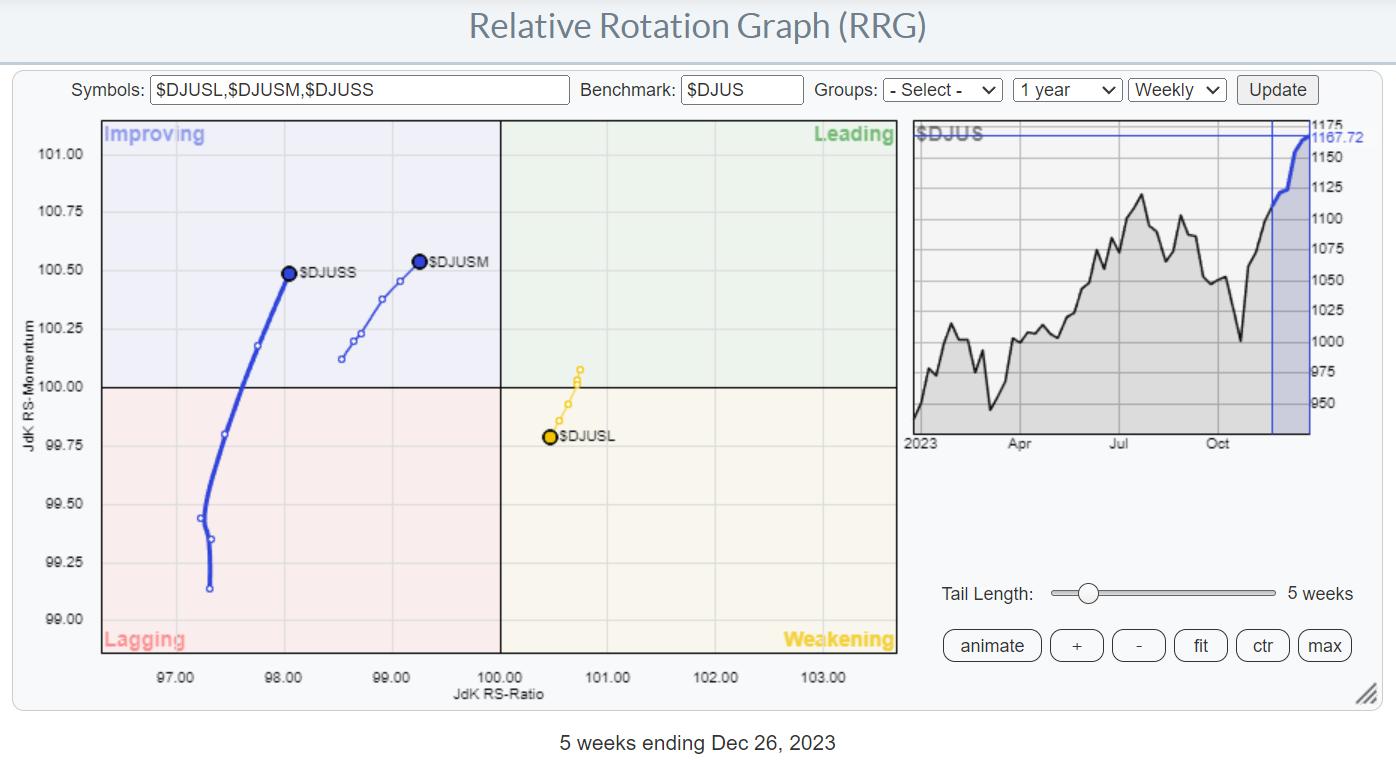

I have been using this relative rotation graph regularly over the past few weeks to represent the ongoing rotation from the large-cap to mid- and small-cap sectors.

This is happening while the market as a whole, in this case the US Dow Jones Indices ($DJUS), continues to rise.

What this means is that investors are taking money out of large-cap stocks and redistributing it to the small and mid-cap sector. while also adding new money to the market (otherwise we wouldn’t be able to go higher).

For my last RRG article of the year, I’d like to review the relative rotation graph that we featured in Sector Spotlight a few weeks ago.

Sector Spotlight 11/7/23

This particular RRG uses ratio symbols to visualize the difference in rotation between market capitalization weighted and equal weighted sectors.

You may need a few seconds to adjust and understand what you’re seeing here.

Each of the 11 tails represents a comparison of the capital-weighted sector divided by the equal-weighted sector. For technology, it’s XLK:RSPT.

As that ratio gets higher, cw surpasses ew and vice versa. So we are interested in the absolute direction of the tail. Therefore, we use $ONE as our benchmark.

*If you are a StockCharts.com subscriber, clicking on the image will take you to this RRG and you can bookmark it in your browser for later retrieval.

Now take another look at RRG.

What is immediately noticeable, at least to me, and I’m sure you too, is that the large tail group inside the weakening quadrant is heading in a lagging direction. We can also include XLI:RSPN in that group. Because it crosses in a bearish direction and moves in a negative direction. XLF:RSPF is already inside the lagging quadrant and is moving deeper into the negative direction.

For all these sectors:

- finance

- industrial goods

- ingredient

- technology

- consumer goods

- consumer discretionary

- health care

- telecommunication services

The bottom line is that the equal weight version should be preferred over the limit weight version.

This leaves only three sectors where the capital-weighted version may have better prospects in the coming weeks. these are

- Real Estate Inside Quadrant 1

- Utilities within the Improvement Quadrant

- Energy is moving back from lagging to improving.

At the start of the new year, there was a clear shift from market capitalization weighted stocks, i.e. large cap stocks, to the second and possibly third largest market capitalization stocks.

I’ll leave you to think about this observation. We wish you a Happy New Year, and we look forward to seeing you back in 2024 with more RRG blog articles and Sector Spotlight videos.

–Julius, thank you again in 2023.

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.

Julius de Kempenaer is the creator of Relative Rotation Graphs™. This unique way to visualize relative strength within the world of securities was first launched on the Bloomberg Professional Services Terminal in January 2011 and made public on StockCharts.com in July 2014. After graduating from the Royal Netherlands Military Academy, Julius served in the Dutch army. Airmen of various officer ranks. He retired from the military in 1990 with the rank of captain and entered the financial industry as a portfolio manager at Equity & Law (now part of AXA Investment Managers). Learn more