Why 7.5%-Yielding TC Energy Is A Compelling Investment For Value Investors? (NYSE:TRP)

Richard Drury/DigitalVision via Getty Images

All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

As some might know, Berkshire Hathaway (BRK.B) just had its annual conference in Omaha, Nebraska. As usual, Mr. Warren Buffett shared his views on his company, the economy, and a wide range of other issues, including potential future investments.

One of the things that got a lot of investors’ attention is Buffett’s comments on Canada.

CNBC

According to CNBC (emphasis added):

Warren Buffett hinted that the conglomerate was evaluating a possible investment opportunity north of the border.

We do not feel uncomfortable in any way shape or form putting our money into Canada. In fact, we’re actually looking at one thing now,” said Buffett.

The Berkshire CEO did not reveal what the investment was and whether it was public or private.

Needless to say, when one of the world’s most famous investors says he’s working on an investment in a specific sector/industry or country, investors start to speculate.

Where is Mr. Buffett putting his money?

As I cover a wide range of Canadian companies, I spent a lot of time answering messages from people who had questions or opinions on where Buffett could make his next big move.

After all, the company is now sitting on US$189 billion in cash.

Based on this context, this article will be about a company I believe is perfect for Buffett.

That company is TC Energy (NYSE:TRP), one of the largest midstream operators in North America.

My most recent article on this Canadian giant was written on March 20, 2024, when I wrote the following:

With a strong dividend track record and a focus on resilient, contracted midstream operations, TRP offers stability and potential for long-term growth.

Meanwhile, the company’s spin-off plans and commitment to debt reduction further enhance its value proposition.

Despite uncertainties, including economic factors like interest rate developments, TRP’s attractive valuation and solid fundamentals make it an attractive opportunity for income-focused investors.

With that said, this article isn’t a lame attempt to get attention for a stock on my radar using Buffett’s name.

I truly believe that TRP is a superior Buffett-style value play, as it comes with wide moat operations in an extremely critical supply chain (energy), long-term growth opportunities, a predictable business model, and increasingly healthy financials, making the valuation very attractive.

So, even if I’m wrong and Berkshire is looking for a different company, I believe TRP offers tremendous shareholder value.

Furthermore, on May 3, the company reported its earnings, which gave me a lot of new and important data to incorporate into my longer-term thesis.

So, let’s get to it.

With Or Without Buffett, TRP Is Fantastic

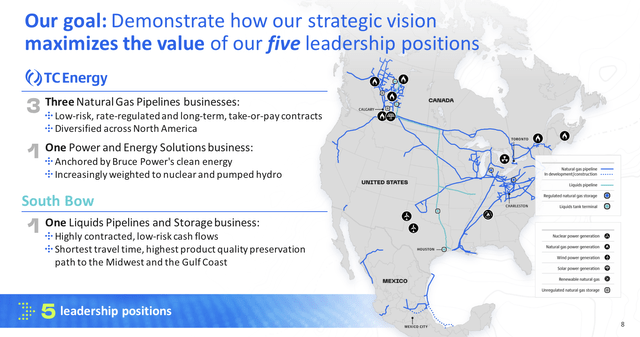

TC Energy would be perfect for both Buffett’s company and my portfolio, as it is a wide-moat business and a backbone of the North American energy sector.

The company, which aims to spin off its liquids pipelines and storage business this year, owns some of the most important infrastructure assets in North America, including roughly 58 thousand miles of pipelines and more than 650 billion cubic feet of natural gas storage.

TC Energy Corporation

It also owns a 3,000-mile crude oil & liquids pipeline network that supplies Alberta crude oil to U.S. markets, including Illinois, Oklahoma, Texas, and the Gulf Coast.

On top of that, it owns power storage facilities and energy solutions.

TC Energy Corporation

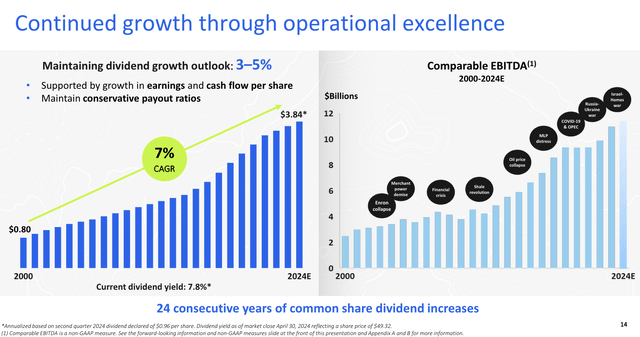

Moreover, because the midstream business is not as prone to commodity prices as upstream companies (oil and gas producers), the company has a stellar dividend growth history, growing its dividend by 7% annually since 2000.

Going forward, the company aims for 3-5% annual growth, which isn’t bad for a company yielding 7.5%.

TC Energy Corporation

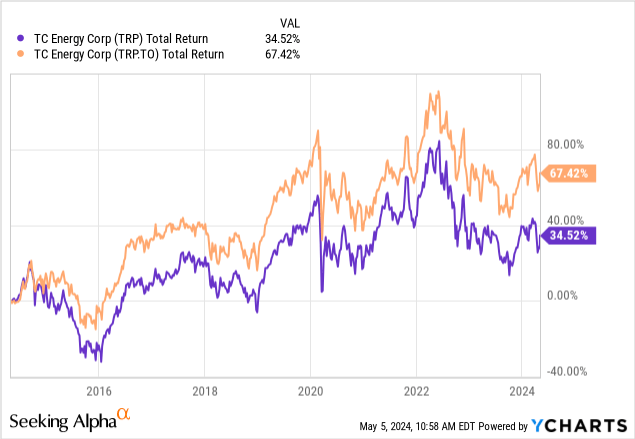

As good as that sounds, TRP has not been a great place to be.

Even including its juicy dividend, New York-listed TRP shares have returned just 35% over the past ten years, as the chart in the introduction showed.

The good news is that TRP is in the process of turning its business around.

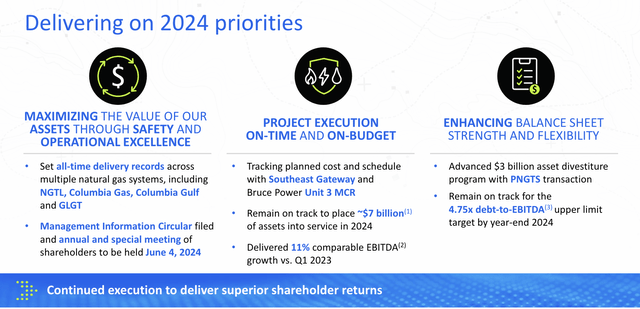

For example, in the just-reported first quarter of 2024, the Canadian midstream giant reported record earnings with comparable EBITDA increasing by 11%.

TC Energy Corporation

This growth was attributed to a strategic focus on safety and operational excellence, resulting in high availability and utilization across the company’s asset base.

To add some color here, the company noted progress in key projects, including the Southeast Gateway and the Bruce Power Unit 3 MCR.

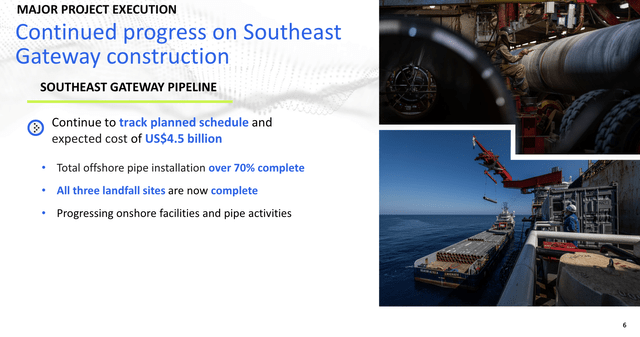

The Southeast Gateway construction is on track. So far, 70% of the offshore pipe installation has been completed, including all three landfall sites. The company is now progressing with onshore facilities and piping.

TC Energy Corporation

This pipeline is a huge deal. According to the company (emphasis added):

It consists of the construction of a marine pipeline that will transport natural gas, connecting the supply from Tuxpan, Veracruz, to delivery points in Coatzacoalcos, Veracruz, and in Paraíso, Tabasco.

This project represents a significant long-term investment into the future for the population of southeastern Mexico by providing them with a new dedicated pipeline with state-of-the-art technology for transportation of natural gas that covers the country’s growing energy demand.

Moreover, in March, the company placed its US$300 million Gillis Access project into service. This project is a pipeline system connecting producers in the Haynesville basin at Gillis, Louisiana, to other markets in the state.

This project is part of $1 billion worth of projects that were placed into service in the first quarter – mainly on budget. TRP also spent $200 million on maintenance.

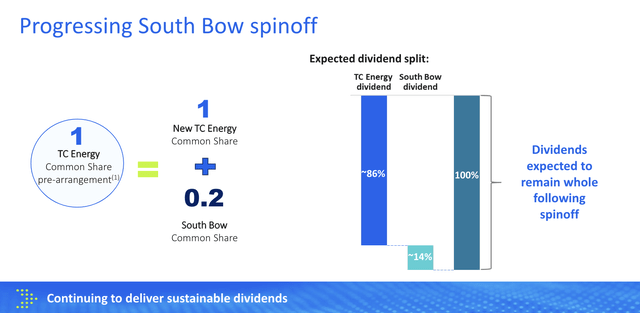

On top of that, the company is actively divesting non-core assets worth $3 billion, with the additional planned South Bow (liquids business) spin-off to occur at the end of the third quarter or the early fourth quarter. This spin-off is expected to keep the total dividend unchanged.

TC Energy Corporation

Adding to that, the company’s Keystone pipeline achieved 96% operational reliability, supporting a 28% increase in comparable EBITDA of the Liquids business.

TC Energy Corporation

In general, the company is very upbeat about natural gas demand, which aligns with my own expectations and bullishness on the sector (for both demand/throughput and pricing).

This is leading to very strong throughput (emphasis added):

Natural gas demand growth is continuing in powering the U.S. as electricity demand grows. 2023 was a record year for power burn across the U.S. and that strength is continuing into 2024. Mirroring that, our assets continue to support the record demand and we set a first quarter record for deliveries to power generators of 2.9 Bcf per day, up 11% versus the first quarter of 2023. New growth drivers like data centers will help continue that positive growth momentum. In Mexico, average daily throughout was nearly 3.0 Bcf per day, up 13% versus the first quarter of last year. – TRP 1Q24 Earnings Call

A Great Outlook, Debt Reduction, And Undervalued Equity

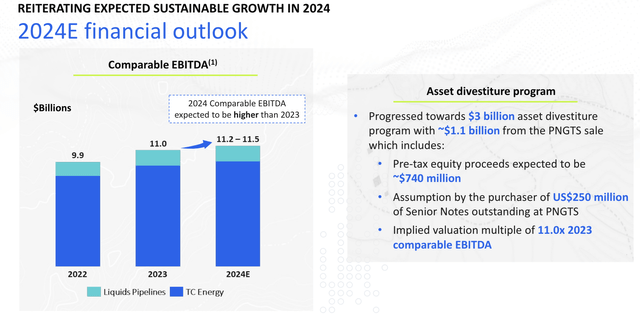

Based on everything said so far, the company reaffirmed its outlook for 2024, expecting comparable EBITDA in the range of $11.2 billion to $11.5 billion. The midpoint of that range is roughly 4% above last year’s result.

TC Energy Corporation

This outlook is supported by a range of factors, including expected growth in the NGTL system (the company’s Western Canadian Sedimentary Basin assets), the full-year impact of projects commissioned since last year, and an estimated $7 billion worth of new projects expected to be completed in 2024.

Earnings per share are expected to be slightly lower compared to 2023, mainly due to higher net income attributable to noncontrolling interest related to the company’s Columbia sale – this was a multi-billion dollar sale last year.

That said, the outlook slide above shows that the company is also working toward a $1.1 billion sale of PNGTS, which is the Portland Natural Gas Transmission System. This deal includes US$250 million of debt, which will help the company further reduce debt.

This transaction implies a valuation multiple of approximately 11x 2023 comparable EBITDA. We remain committed to achieving our 4.75x debt-to-EBITDA target in 2024, the upper limit to which we will manage to and expect to announce incremental asset sales in the coming minutes. – TRP 1Q24 Earnings Call

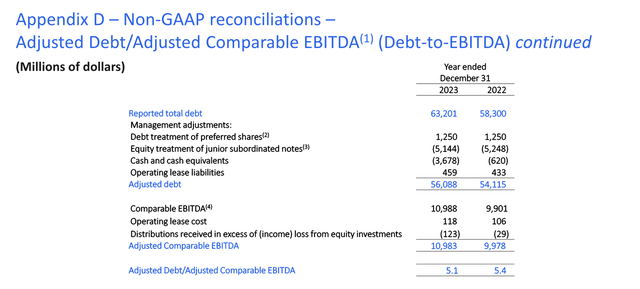

In light of its 4.75x net leverage target, the company had a 5.1x leverage ratio going into this year – down from 5.4x at the end of 2022. So, there’s clearly progress in de-risking the balance sheet.

TC Energy Corporation

Moreover, 92% of its debt has a fixed rate with a weighted average maturity of roughly 17 years. This buys the company a lot of time in this environment of elevated rates. It also helps that the weighted average rate on its debt is just 5.3%.

If the company hadn’t managed its debt so prudently in recent years, that number would likely be much higher.

Valuation-wise, we’re dealing with a very attractive opportunity.

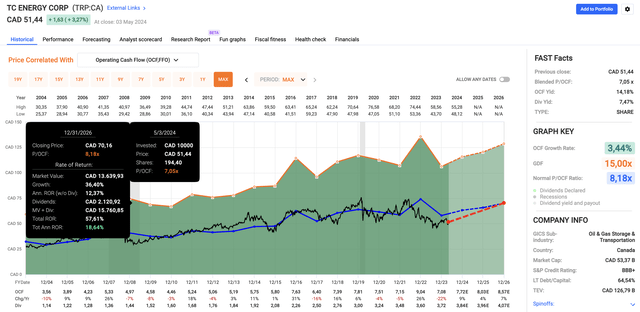

Using the FactSet data in the chart below, the company is expected to grow its per-share operating cash flow (“OCF”) by 9% this year, potentially followed by 4% and 7% growth in 2025 and 2026, respectively.

FAST Graphs

Currently, the company trades at a blended P/OCF ratio of 7.1x, which is below its already subdued long-term OCF multiple of 8.2x. The normalized OCF multiple of its Canadian peer, Enbridge (ENB), is 9.6x.

Given the company’s debt improvements, strategic divestitures, pending spin-off, and investments in growth, I believe it should not trade below 8.2x OCF.

Applying an 8.2x multiple to the expected OCF gives us a price target of roughly $70, which is 36% above the current price. The same applies to New York-listed shares, except that these are prone to CAD/USD currency fluctuations.

When adding its >7% dividend, we get a double-digit annual return outlook.

While these numbers are all subject to change and factors the company cannot influence, I’m very upbeat about TRP and wouldn’t bet against Buffett having this one on his screen as well.

In general, it could be a good fit for Berkshire Hathaway Energy, which includes transmission, renewables, natural gas assets, and a lot more. The company’s consumer base includes Alberta, where TRP has a massive asset base.

(…) Berkshire Hathaway Energy’s portfolio consists of locally managed businesses that share a vision for a secure and sustainable energy future. These businesses deliver low-cost, safe and reliable service each day to more than 13 million customers and end-users throughout the U.S., Great Britain and Alberta, Canada. – Berkshire Hathaway Energy

All things considered, I’m currently assessing how to fit TRP into my portfolio, as I believe it goes very well with my natural gas thesis.

I truly believe it’s a Buffett-style play with a great future – despite what a full decade of disappointing returns may suggest.

Regardless of whether Buffett will buy it or not, I love the long-term value this company brings to the table.

Takeaway

Buffett’s hint at a potential investment in Canada sparked speculation among investors.

While the target remains undisclosed, TC Energy is a target that, I believe, makes a lot of sense.

Beyond the buzz, TRP presents a compelling case for value investors, boasting a wide-moat business in North America’s energy sector.

With strategic divestitures, debt reduction, and promising growth projects, TRP offers an undervalued opportunity.

Despite past performance issues, its steady dividend growth and robust fundamentals align with Buffett’s investment philosophy.

Pros & Cons

Pros:

- Steady Dividend Growth: TRP has a history of consistent dividend growth, appealing to income-focused investors.

- Robust Infrastructure Assets: With ownership of critical infrastructure assets in North America, including pipelines and storage facilities, TRP provides a wide-moat business model.

- Strategic Initiatives: The company’s focus on debt reduction, strategic divestitures, and growth projects enhances its value proposition and aligns with long-term shareholder interests.

- Undervalued Opportunity: TRP’s valuation presents an attractive entry point for value investors, offering the potential for significant upside.

Cons:

- Past Performance: TRP’s historical stock performance, including modest returns over the past decade, has hurt investor confidence.

- Market Volatility: As with any investment in the energy sector, TRP is subject to market volatility and fluctuations in commodity prices, although to a lesser extent than upstream companies.

- Regulatory Risks: Regulatory changes and environmental concerns could impact TRP’s operations and future growth opportunities.