Why Antero Resources is one of the ideas I’m most confident in (NYSE:AR)

DenisTangneyJr/E+ (via Getty Images)

introduction

On May 28th, I wrote the following: “My Favorites! 3 Very Attractive Stocks for the Natural Gas-Fueled AI Boom.”

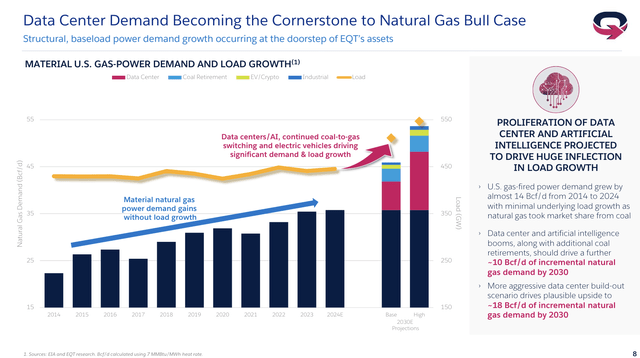

In that article I focused on what I think will be a very, very long time coming. Natural gas prices are strengthening due to massive growth in energy demand driven by new AI applications.

The report added that up to 8.5 billion cubic feet of additional natural gas per day could be needed to meet increased demand.

(…) The report estimates Current data center electricity demand is 11 gigawatts (GW).In the base case: Expected to grow to 42GW by 2030.

The report added that in the base case: Incremental natural gas of 2.7 bcfd needed by 2030. – Reuters (emphasis added)

According to EQT corporation(EQT), AI alone, one of the world’s largest natural gas producers, could see demand increase by 10 billion cubic feet per day by 2030!

A more optimistic estimate indicates a gradual increase of 18 Bcf/d.

EQT Co., Ltd.

Again, that’s just from AI!

This excludes:

- World population growth.

- Middle class growth in emerging markets.

- Ongoing transition from coal to natural gas.

Overall, export demand is very positive.

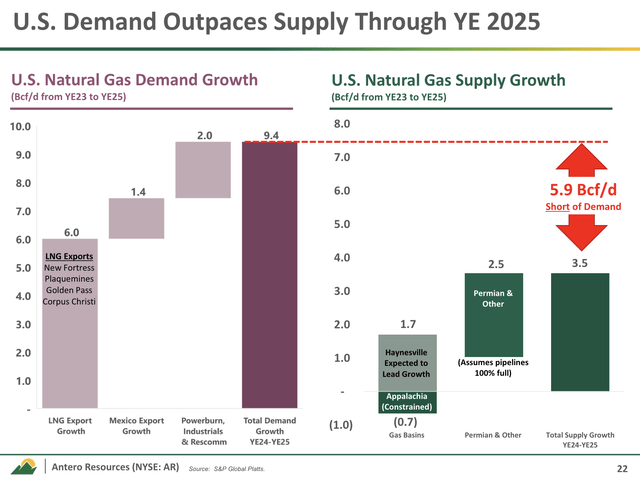

Antero Resources (New York Stock Exchange: AR), the subject of this article, estimates that increased liquefied natural gas (LNG) exports will account for 6 Bcf/d of new demand by 2025. Add in increased domestic demand and increased exports to Mexico, and the company has a supply shortfall of approximately 6 Bcf/d.

Antero Resources

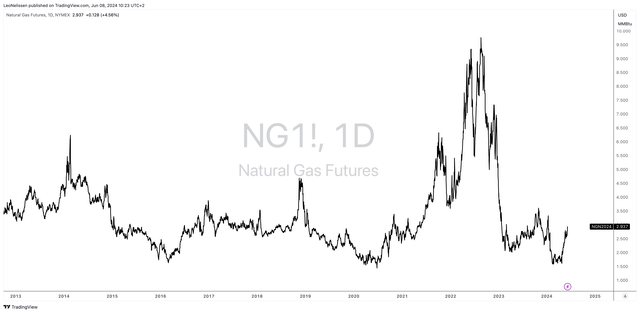

This is very optimistic and is one of the reasons natural gas prices are starting to recover.

Although prices have normalized so far, the momentum we are seeing is truly amazing.

TradingView (NYMEX Henry Hub)

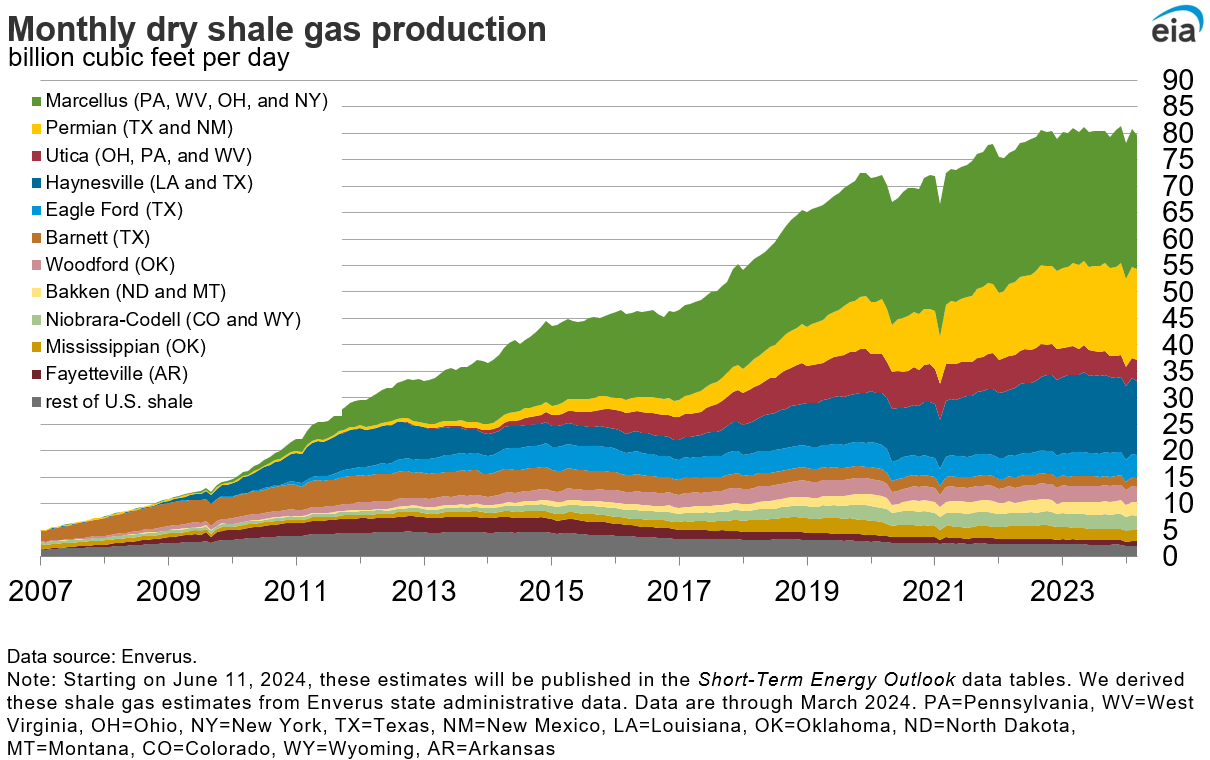

The shale revolution has brought about unprecedented increases in natural gas production in the United States, transforming the supply side across the board.

Now it’s over.

Natural gas is still very abundant (especially compared to oil), but production growth has slowed dramatically.

Energy Information Administration

In light of these changes, Goehring & Rozencwajg argue that there will be a major shift in inventory, which could cause prices in North America to converge with much higher international prices.

The United States is about to transition from a long period of severe oversupply to a structural deficit of historic proportions. Although inventories remain high, our model predicts they will reach critical levels much sooner than we think is possible. Against this backdrop, it is difficult for us to understand that U.S. natural gas is trading at a record discount to energy equivalent prices, even considering two consecutive mild winters. Investors should take note.

In essence, the end of the shale revolution is to meet demand for natural gas, which is growing at the fastest rate in history.

Back to Goehring & Rozencwajg:

Although it is still early days, we believe North American natural gas, with less liquefaction and transportation, will converge to global prices currently at $10 per mcf. Investors are extremely bearish after two consecutive mild winters but are ignoring the ongoing bullish shift in supply and demand. This is the most asymmetrical investment we can remember.

This is where Antero Resources comes into play.

Why I’m So Bullish About Antero Resources

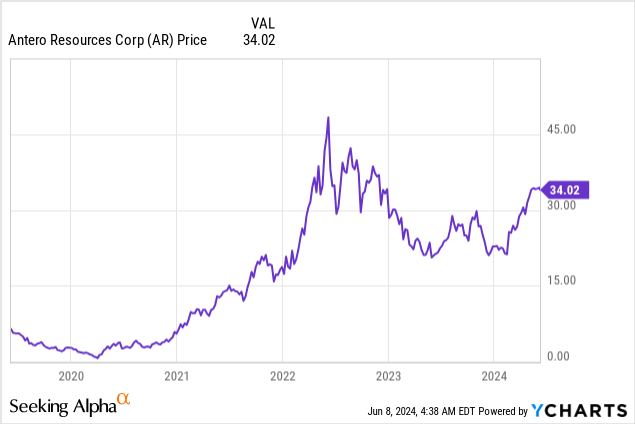

I have been bullish on Antero Resources since I started reporting on it in 2023.

My most recent article was written on February 19th. Strong buy evaluation.

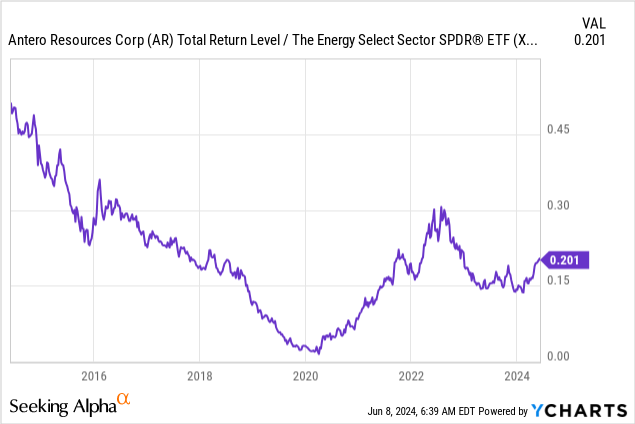

Since then, the stock has soared 43%, dwarfing the S&P 500’s 7% return.

We believe this is just the beginning, as AR brings several characteristics to the table that make it the perfect stock to benefit from natural gas strength.

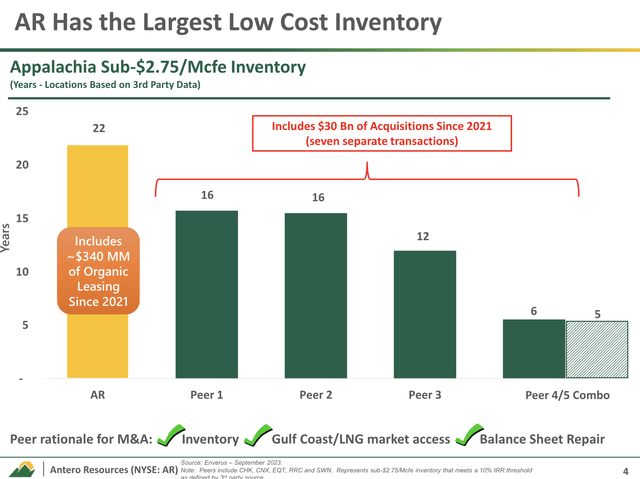

First of all, the company has had premium inventory in the Marcellus Basin (Appalachia) for over 20 years, making it one of the most efficient producers there.

To be precise, excluding new developments, the company has a breakeven inventory of less than $2.75/Mcfe ($2.85 MMBtu – Henry Hub unit) for 22 years.

Antero Resources

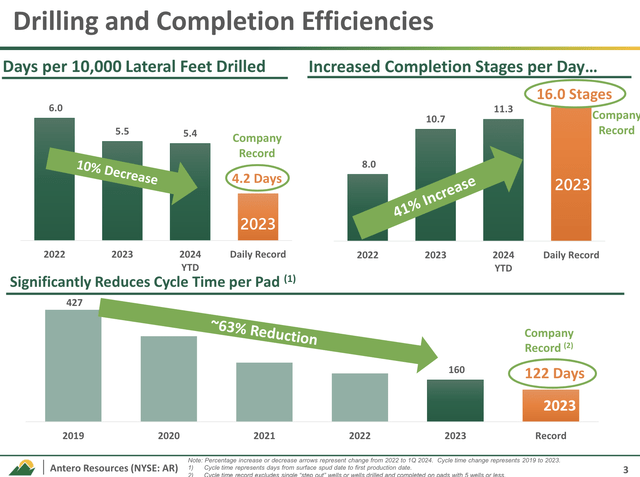

In the watershed, the company is very efficient.

For example, in the first quarter of this year, the company reduced drilling time to 5.4 days per 10,000 feet. It is shorter than 5.5 days in 2023.

Additionally, Antero recorded an average of 11.3 steps completed per day. This is slightly less than the previous year’s 11 steps per day.

Antero Resources

The company also improved new completion technologies, saving more than an hour of pumping time each day, and leveraged Antero Midstream’s (AM) advanced water infrastructure to reduce congestion.

This infrastructure eliminates the need for water trucks.

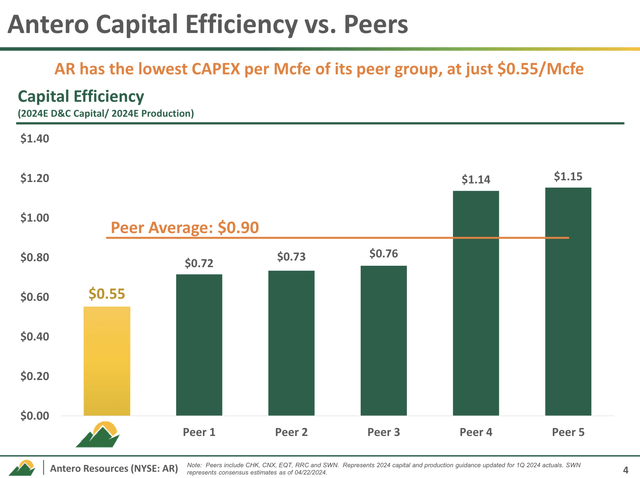

The company typically requires only $0.55 per Mcfe to maintain production, leading its industry in capital efficiency. The peer average is almost twice as high!

Antero Resources

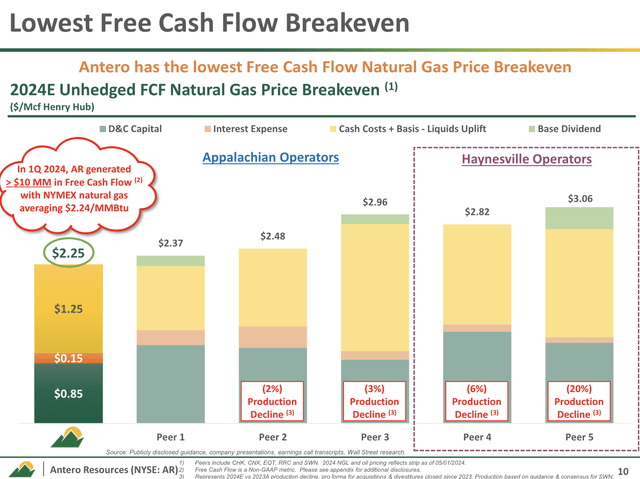

On an unhedged basis, the company broke even at $2.24 Mcf. This outperforms its main competitors, especially in high-cost watersheds like Haynesville.

Antero Resources

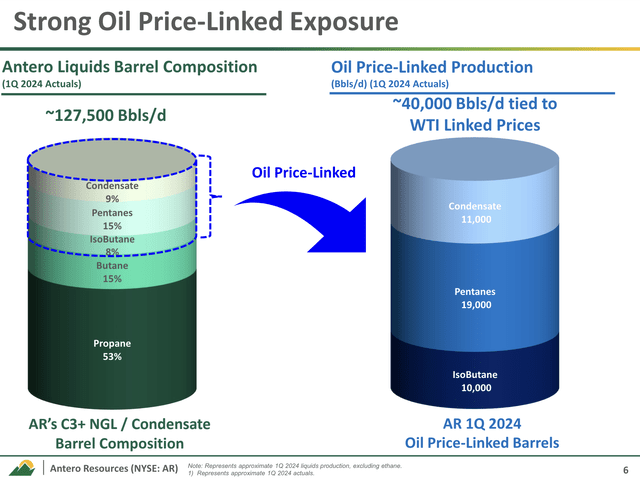

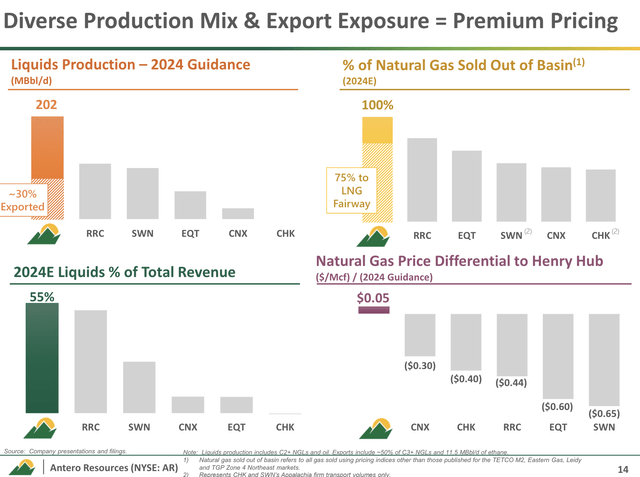

Moreover, AR has another key advantage: product mix.

AR is a natural gas producer, but not all of its production is low-margin natural gas.

The company has a major presence in the liquids and natural gas liquids (NGL) markets.

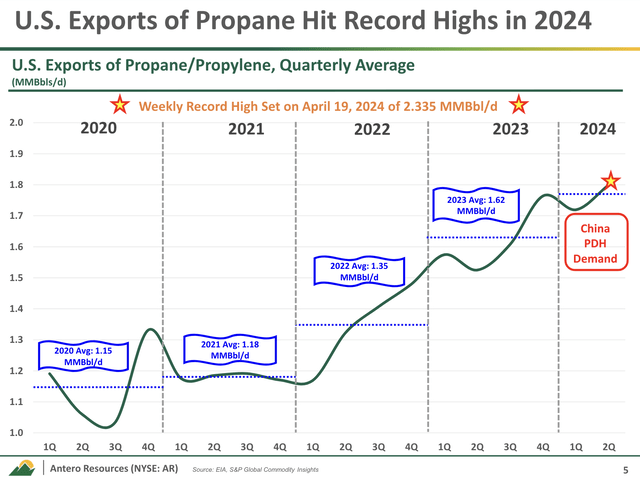

In the first quarter, U.S. propane exports reached a record high of more than 2.3 million barrels per day. This is a 14% increase compared to the 2023 average.

Antero Resources

This increase in exports and strategic pricing decisions have enabled Antero to secure premium prices for its products.

For example, propane prices relative to WTI averaged 44% in early 2024. This is higher than 36% in the fourth quarter of 2023.

Additionally, Antero’s decision to sell more barrels of water on international indices instead of long-term domestic transactions allows it to benefit from better international pricing.

Antero Resources

What I get from this is that AR is not a natural gas producer that relies primarily on Henry Hub prices in its own basin.

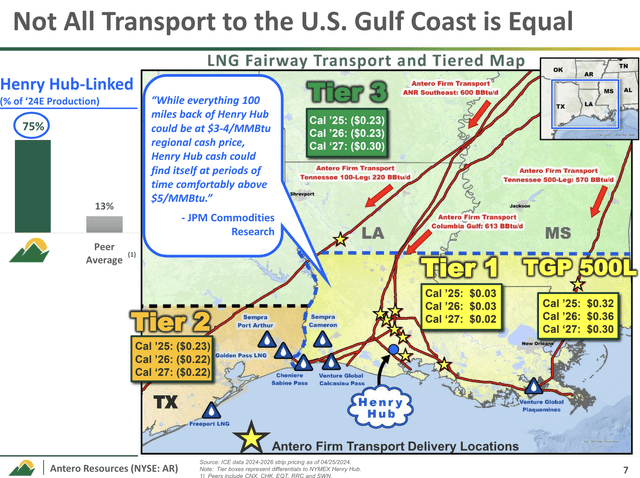

Even better, the company is a major LNG player, selling about 75% of its natural gas from the basin (mainly LNG corridors along the Gulf Coast).

As you can imagine, this puts the company in a good position to access higher prices and benefit from rapidly growing global LNG demand.

Using the company’s own data, its peers sell just 13% to the LNG corridor.

Antero Resources

Apart from this, there are three other main benefits:

- More than half of the company’s production consists of liquids.

- The company is the only major U.S. natural gas producer expected to sell its gas at a higher price than Henry Hub.

- The company sells 100% of its natural gas from the basin.

Antero Resources

I believe these characteristics make the company stand out as one of the best natural gas stocks on the market.

Shareholder benefits

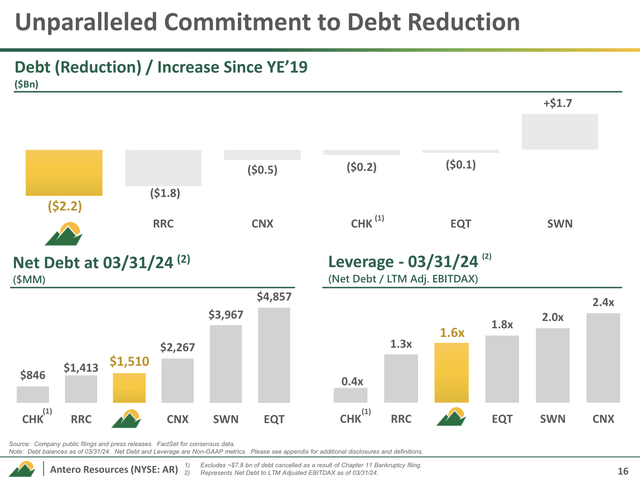

In addition to its great business model, the company has been aggressively reducing debt over the past few years.

It currently has net debt of $1.5 billion. This is less than half of our 2020 debt burden. It also has no debt maturities until 2026 and its leverage ratio is less than 2x EBITDA.

Antero Resources

Going forward, the company’s strategy includes reducing total debt and allocating future free cash flow to share repurchases to further enhance shareholder value.

Doesn’t pay dividends.

AR may not be suitable for income-oriented investors, but it has tremendous free cash flow potential.

Analysts expect the company to generate $290 million in free cash flow this year, based on the current market environment. This is a huge number considering how much natural gas prices have fallen.

This corresponds to 3% of the market capitalization of $10.6 billion.

Next year, this figure is expected to increase to $1.1 billion, or more than 10% of market capitalization.

If natural gas prices rise above $5 over time, the company has the potential to buy back shares at an unprecedented rate, significantly improving the per-share value of the business.

Given the company’s free cash flow capacity of $3 Henry Hub, its growth plans enable it to generate a free cash flow yield of 12-16% in an environment where natural gas prices continue to rise in the $4-$5 range. I think you can expect it.

This also means we expect AR to outperform the Energy Benchmark ETF (XLE) because we believe the natural gas bull case is massively understated.

Therefore I Strong buy We expect the market to find AR and its peers attractive, especially as global economic growth improves.

Personally, I have been holding AR stock since last year, and it has given me good returns. However, I sold because I closed down my entire trading portfolio. I decided to move my cash into a long-term investment portfolio for a variety of reasons.

Now I’m looking into how best to incorporate non-dividend paying stocks into that strategy.

Needless to say, given how much I love AR, I’m looking to make it a “permanent” spot in my long-term portfolio in the coming weeks and months.

So please do not be confused by the fact that we are not disclosing AR buying positions at this time.

I invested in Antero Midstream, not Antero Resources.

takeout

The future of natural gas looks very bright thanks to rising AI-related demand, broader market trends such as LNG exports, and the ongoing transition from natural gas to coal.

Here, Antero Resources stands out as a top choice due to its impressive efficiency, strategic positioning, and strong financial strength.

With ample inventories in the Marcellus Basin, low production costs, and significant exposure to the attractive LNG market, AR is well-positioned to capitalize on growing global natural gas demand.

Moreover, the company’s focus on reducing debt and the potential for significant free cash flow in the future further enhance its investment appeal.

strength and weakness

Advantages:

- Strong Inventory and Efficiency: AR has over 20 years of premium inventory in the Marcellus Basin and leads its industry in capital efficiency.

- strategic positioning: AR improves prices by selling 100% of the natural gas from the basin.

- Diverse product mix: Prices also rise due to the high proportion of high-margin liquids and LNG.

- financial health: Financial risks have been mitigated based on aggressive debt reduction and solid free cash flow potential.

- tailwind of growth: AI, the transition from coal to gas, and rapid growth in LNG exports are driving unprecedented demand growth.

disadvantage:

- No dividends: AR does not provide profits through dividends.

- market volatility: Natural gas prices can be very volatile, so ARs are much more volatile than the “average” stock you invest in.

- industrial hazard: Regulatory changes and environmental issues may impact our operations and end markets.