Why did Bitcoin (BTC) price surge above $41,000? The main reasons are:

The post Why Is Bitcoin (BTC) Price Soaring Above $41,000? Here are the top reasons why it first appeared on Coinpedia Fintech News:

Bitcoin (BTC) has reached a significant milestone, surpassing the Terra Luna UST surrender level after more than 18 months of volatility. The recent surge in the price of flagship cryptocurrencies has been primarily driven by increased demand from institutional investors.

Over the weekend, Bitcoin experienced a strong breakout, posting gains of more than 5% in the last 24 hours and reaching a trading value of around $41,400 in the early session in London on Monday. As a result of this rapid rise, leveraged derivatives trades recorded over $72 million in liquidations, with short-term traders being the most affected.

Factors behind Bitcoin’s rebound:

1. Institutional adoption:

Bitcoin’s recent bullish trend can be attributed to its growing adoption within the U.S. financial system, one of the most sophisticated and developed markets in the world. Notably, MicroStrategy announced in November that it had acquired $593 million worth of Bitcoin in a move funded by selling shares, with prominent fund manager BlackRock among notable buyers. This trend indicates increasing institutional interest in Bitcoin.

2. Endorsement from US Space Force Major:

U.S. Space Force Maj. Jason Lowery urged the Department of Defense to consider adopting Bitcoin as an “offset strategy.” He believes that Bitcoin, along with its underlying proof-of-work (PoW) technology, can serve as a modern tool to redefine the cyber warfare and defense landscape. This endorsement from an influential figure could have a huge impact on the perception and acceptance of Bitcoin.

3. Spot ETF FOMO:

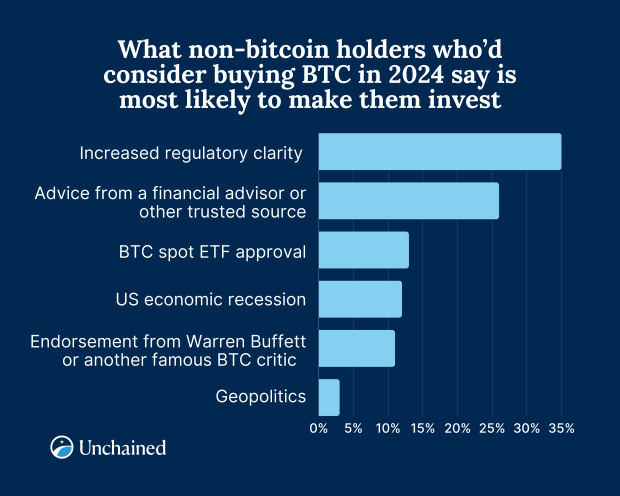

Expectations of Bitcoin adoption in the U.S. market in the form of physical Bitcoin exchange-traded funds (ETFs) have played a pivotal role in driving this rally. Analysts expect the U.S. Securities and Exchange Commission (SEC) to approve any spot BTC ETF by January 10, 2024. This has led to a surge in Fear of Missing Out (FOMO) trading activity as investors aim to capitalize on potential profits. Of these ETFs.

What’s next for BTC price?

Bitcoin price is currently approaching a critical psychological resistance level around $42,000, which many analysts previously identified as a key target. Meanwhile, the altcoin market led by Ethereum (ETH) is also showing strength. Given these dynamics, it is likely that the Bitcoin price will return to the support range between $31,000 and $34,000 before or after the upcoming halving.