Why Donald Trump is unlikely to get his wish for a US stock market crash in 2024

Donald Trump is unlikely to get his wish for a US stock market crash this year.

I am referring to the former US president’s statement last week that he hopes the market will crash by 2024. Because if he’s elected in November and takes office a year later, he doesn’t want to be another Herbert Hoover. Hoover was president when the stock market crashed in 1929.

Since stock markets have plummeted in two of the past four years during presidential election years, it’s understandable why there’s concern that the same could happen again in 2024. In 2008, at the height of the global financial crisis, the S&P 500 SPX fell 38.5% during the year. In 2020, the S&P 500 fell 34% in less than a month as the COVID-19 pandemic brought the economy to a halt.

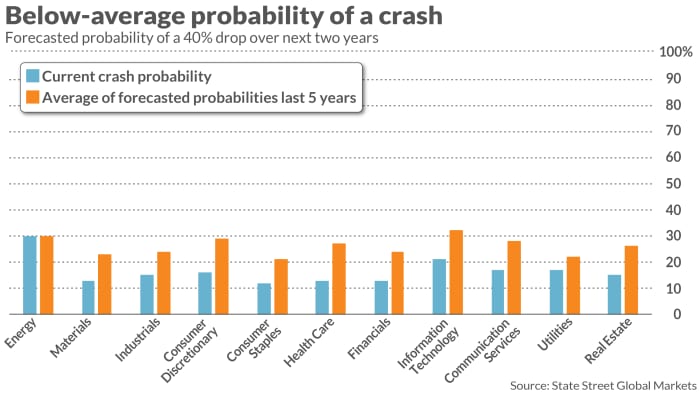

Of course, a crash can happen at any time, so a crash this year cannot be ruled out. Nonetheless, the odds of it occurring this year are significantly lower than average. That’s according to the latest “State Street US Froth Forecasts,” derived from a study of crashes conducted by Robin Greenwood, a professor of banking and finance at Harvard Business School.

In the study, Greenwood and his co-authors found that it was possible to identify times when collisions were most likely. In an interview, Greenwood said “the likelihood of a crash is low” “overall” for individual market segments as well as the current market as a whole.

Greenwood’s model is based on a variety of factors such as performance over the past two years, volatility, stock turnover, IPO activity, and the price path of the past two years’ gains. For example, he and his fellow researchers found that if an industry outperforms the market by more than 150% over a two-year period, there is an 80% chance that the industry will collapse. They define this as a drop of at least 40%. For the next two years. As you can see in the attached chart, State Street is reporting low crash probabilities for all sectors. Each case is significantly lower than the average expected crash probability over the past five years.

These odds don’t mean that stocks will have a good year in 2024. A new bear market could begin this year without a decline that meets the researchers’ definition of a collapse.

Still, the takeaway from the State Street US Froth Forecasts is that there is more to worry about this year than the possibility of a crash.

Mark Hulbert is a regular MarketWatch contributor. His Hulbert Ratings tracks investment newsletters that pay a flat fee for audits. He can be contacted at: mark@hulbertatings.com

more: Trump hopes for market crash in 2024 under Biden… “I don’t want to be Herbert Hoover.”

Also read: Iowa caucuses determine Donald Trump’s success or failure