Why ETH Could Soon Surge to $15,000

Ethereum, the second-largest cryptocurrency by market cap, is starting to show signs of a bullish trajectory. In particular, insight According to CoinSignals, a popular cryptocurrency analytics platform, Ethereum is set for a significant price increase.

The platform suggests that Ethereum’s value could soon rise to between $12,000 and $15,000. This prediction is based on positive market trends and strong fundamental performance indicators that support continued appreciation.

References

ETH Basic Strengths

CoinSignals’ optimism is supported by several key factors that differentiate ETH from other cryptocurrencies, especially Bitcoin. According to CoinSignals, unlike Bitcoin, which experiences about 450 BTC of selling pressure every day, Ethereum enjoys much lower selling pressure.

This reduced pressure plays a significant role in Ethereum’s ability to grow more sustainably and potentially explosively. The platform is also gaining popularity as Ethereum becomes more involved in decentralized finance (DeFi) and tokenization of real-world assets (RWA), he points out.

Perhaps the most bullish number for the Ethereum price rally comes from one of the strongest indicators: ETH staking. According to Coinbase data, about 27.65% of Ethereum’s total supply is currently staked.

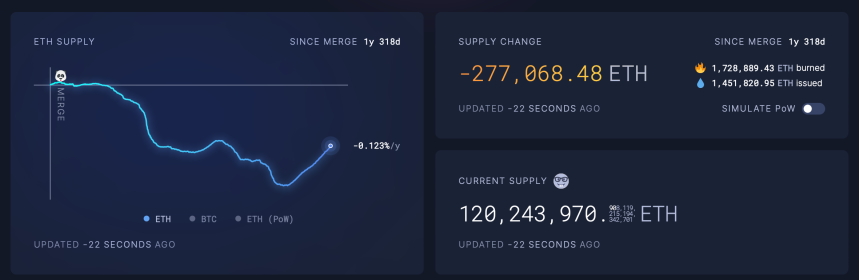

In the last 24 hours alone, staked tokens have increased by almost 4%. What is notable is that this staking activity not only shows confidence in the future of Ethereum, but also helps further promote a deflationary economy by reducing the available supply.

According to data from Ultrasoundmoney, the available supply has plummeted since the ETH merger in September 2022, with around 300,000 ETH disappearing from circulation.

Moreover, real-world asset tokenization, a sector that has attracted the attention of numerous institutional investors, is still dominated by Ethereum, CoinSignals noted.

#Ethereum Blow Off Top Target: $12k – $15k 🚀

– Approximately 30% of the supply is staked.

– No daily selling pressure like BTC (450 BTC Day)

– Deflationary assets.

– All narratives are born in ETH.

– Leader in RWA and tokenization.Average recent purchase price: $2900 pic.twitter.com/S2HO3lrzR1

— CoinSignals (@CoinSignals_) July 29, 2024

Major corporations such as BlackRock have expressed interest in the tokenization market, particularly platforms leading initiatives such as Ethereum.

The platform’s essential features provide an ideal foundation for DeFi projects and RWA initiatives experiencing rapid growth and innovation.

Ethereum Market Sentiment

Over the past 24 hours, ETH has seen a mix of bullish and bearish price performance. After rising to $3,395 early on Monday, the asset faced a notable bounce, dropping to $3,253 before stabilizing at $3,293, up almost 1% at the time of writing.

What’s notable is that not only CoinSignals is predicting a bullish future for ETH, but other prominent analysts in the cryptocurrency community are also of the same view.

References

For example, Elja, a famous cryptocurrency investor, recently said: Revealed X said that ETH trading above $10,000 was already “programmed” for this cycle. The investor added that buying ETH at the current market price is like buying it at $400 in 2020.

purchase #ethereum It’s like ~ now

– Purchased for $400 in 2020

with $Ethereum ETF trading begins tomorrow, with over $10,000 programmed for this cycle! pic.twitter.com/Mq4CzNGonO

— Elsa (@Eljaboom) July 21, 2024

Featured image made with DALL-E, charts from TradingView