Why Nvidia’s Soaring Stock Could Lead to Higher Dividends

With a market capitalization of $2.35 trillion, NVIDIA Corporation (NVDA) It’s been an exceptional year so far. After a stellar 2023, NVDA’s stock price has already surged nearly 92% since January. Moreover, the stock price has risen more than 200% over the past year.

NVIDIA’s surge has been fueled by explosive growth in the AI and data center markets, making it one of the most talked-about and desirable stocks. The stock price rose slightly below $955 in yesterday’s session. Soon to hit four figures.

Ahead of Nvidia’s earnings, Stifel analyst Ruben Roy raised his price target on the stock. From $910 to $1,085He noted that he expects Nvidia to again beat expectations on its top and bottom lines and raise its guidance for the coming quarters.

The company’s performance was boosted by robust demand for its chips from hyperscalers, including: Amazon (AMZN), Alphabet Inc. (GOOGL), Metaplatforms (META), Microsoft Corporation (MSFT), Others. As a result, the first quarter earnings report will be an important gauge of the industry’s commitment to investing in AI.

Additionally, Bank of America analyst Vivek Arya increased his price target on NVDA stock. From $925 to $1100 The investment opinion was maintained at ‘buy’.

Let’s analyze how Nvidia’s rising stock price could lead to dividend payments.

Dominance of the AI and data center markets

The United States, led by NVIDIA, dominates the generative AI (GenAI) technology market. With the launch of ChatGPT in November 2022, the rise of GenAI gained significant momentum.

From consumer-facing applications to foundational technologies such as large-scale language models (LLMs), cloud infrastructure, and operationally critical semiconductors, U.S. companies hold market shares across multiple segments of the generative AI landscape, ranging from 70% to an impressive 90%.

According to Statista, the global generative AI market is expected to reach $36.06 billion by 2024. CAGR 46.5% growthAccordingly, the market size is expected to reach $356.1 billion by 2030. In a global comparison, the United States is estimated to hold the largest market share this year with a total of $11.66 billion.

Additionally, NVDA, a leading technology company, Market share about 92% Data Center GPU Market for GenAI Applications.

Nvidia’s success goes beyond cutting-edge semiconductor performance thanks to its software capabilities. Introduced in 2006 and widely adopted, the CUDA development platform has become a fundamental tool for AI development and has a user base of over 4 million developers.

The company’s chips are essential for powering technologies such as Google’s Gemini and OpenAI’s ChatGPT. META also placed a significant order of 350,000 H100 GPU graphics cards from Nvidia. Accordingly, MSFT has spent billions of dollars purchasing chips from chip manufacturers.

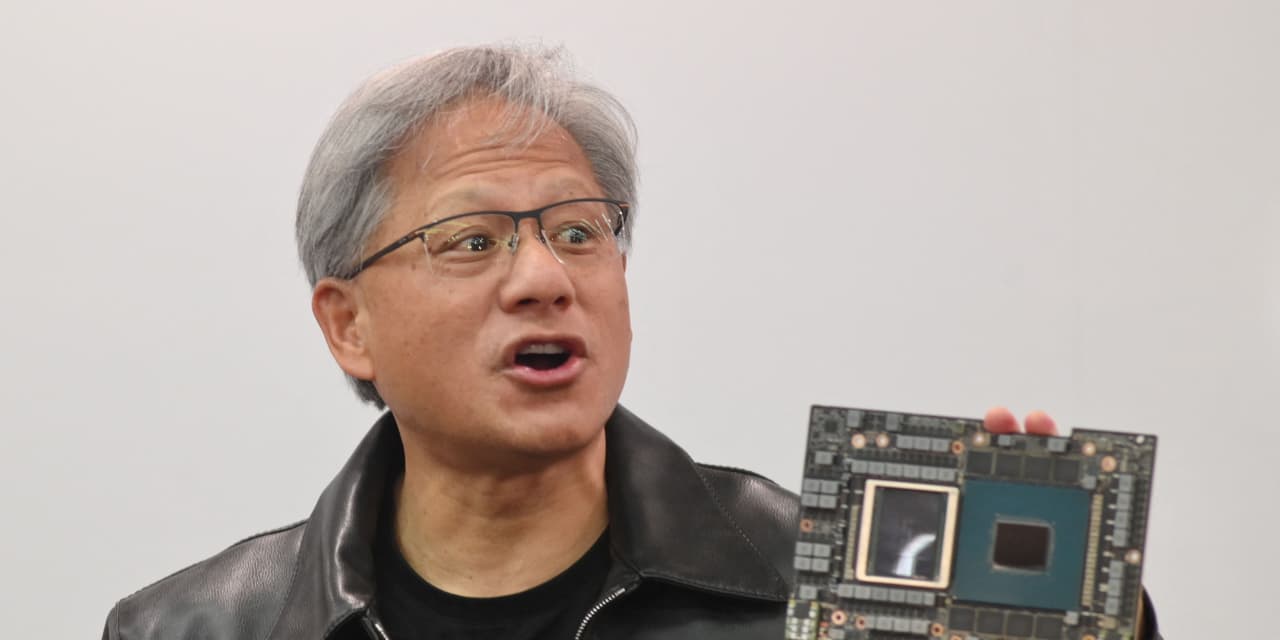

Next-generation AI graphics processor unveiled

In March 2024, NVDA will Next-generation chip architecture called Blackwell It has related products such as the latest AI chip B200. Modern GPUs are expected to dramatically improve developers’ ability to build advanced AI models.

The new GPU platform succeeds the company’s Hopper architecture, which launched two years ago and helped NVDA’s business and stock price soar.

With 208 billion transistors, Blackwell GPUs allow AI models to scale up to 10 trillion parameters. It will be integrated into Nvidia’s GB200 Grace Blackwell Superchip, which connects two B200 Blackwell GPUs to a Grace CPU.

The new AI chip is expected to be released later this year.

“Generative AI is the defining technology of our time,” Nvidia CEO Jensen Huang said during a keynote address at the company’s developer conference in San Jose, California. “Blackwell GPUs are the engine that fuels this new industrial revolution. “We will work with the world’s most dynamic companies to realize the potential of AI across every industry.”

Blackwell’s goal is to solidify its dominance in the data center GPU market based on outstanding performance.

Outstanding fourth quarter financial performance

for fourth quarter For the year ended January 28, 2024, NVDA’s revenue increased 265.3% year over year to $22.1 billion. This figure exceeded analysts’ expectations of $20.55 billion. Our data center segment posted record revenue of $18.4 billion, up 409% year-over-year.

“Accelerated computing and generative AI have reached a tipping point. Demand is surging globally across businesses, industries and countries,” said Jensen Huang.

“Our data center platform is driven by an increasingly diverse set of drivers: demand for data processing, training and inference from large cloud service providers and GPU specialists, as well as enterprise software and consumer Internet companies,” he said. Vertical industries led by automotive, financial services, and healthcare are now multibillion-dollar businesses.

The chipmaker’s total profit was $16.79 billion, up 338.1% from the previous year. Non-GAAP operating income increased 563.2% year-over-year to $14.75 billion. Non-GAAP net income increased 490.6% year over year to $12.84 billion.

Nvidia also reported non-GAAP earnings per share of $5.16, compared to analysts’ estimates of $4.63 and up 486% year-over-year.

NVDA’s non-GAAP free cash flow was $11.22 billion, an increase of 546.1% year-over-year. The company’s total current assets were $44.35 billion as of January 28, 2024, compared to $23.07 billion as of January 29, 2023.

“Basically, the conditions for continued growth beyond 2025 are very good,” Huang told analysts. He noted that strong demand for the company’s GPUs is expected to continue due to the adoption of generative AI and the industry-wide shift from central processors to Nvidia’s accelerators.

NVIDIA also expects first quarter fiscal 2025 revenue to be $24 billion. The company’s non-GAAP gross margin is expected to be 77%.

Increased likelihood of paying dividends

With Nvidia’s sales and profits soaring significantly, the company is likely to consider increasing its dividend payments to benefit long-term investors. NVIDIA paid a quarterly cash dividend of $0.04 per share on March 27 to shareholders of record on March 6. The company’s annual dividend of $0.16 equates to a yield of 0.02% based on the current stock price.

Currently, Nvidia’s dividend yield is modest compared to the tech industry, but with significant cash flow and a strong balance sheet, there is plenty of room to grow. By increasing its dividend, the company can attract a broader base of income-focused investors, further supporting its stock price.

conclusion

NVDA’s notable rise so far this year has been driven by its dominance in the AI and data center markets, fueled by growing demand for its chips from tech giants like Amazon, Google, Meta, Microsoft, and others.

Additionally, Nvidia’s recent announcement of its next-generation chip architecture, Blackwell, and related products demonstrates the company’s commitment to innovation and maintaining a competitive edge. Nvidia aims to strengthen its dominance in the data center GPU market with Blackwell’s outstanding performance.

Analysts are very optimistic about the chipmaker’s prospects. Analysts expect NVDA’s revenue and EPS for the first quarter of fiscal 2025 (ending April 2024) to hit $24.59 billion and $5.58, up 242% and 411.9%, respectively, from the prior year. The company has also surpassed consensus revenue and EPS estimates in all four subsequent quarters, which is impressive.

As NVDA continues to expand its market share and generate higher revenues and profits, the company naturally accumulates more cash reserves. Having sufficient cash on hand allows us to increase our dividend payments without compromising our ability to fund ongoing operations or invest in future growth opportunities.

An increase in dividends would be a positive signal to the market, reflecting Nvidia’s confidence in its long-term prospects and its commitment to returning value to shareholders. The move could boost investor sentiment, especially among those seeking a steady source of income other than capital appreciation.

In conclusion, NVDA is at the forefront of the technology industry, driving innovation and shaping the future of AI. Given its outstanding financial performance, technological leadership, and dividend growth potential, Nvidia is an attractive investment opportunity for long-term investors.