Why Resistance Breaks in Forex – Trading Strategy – December 21, 2023

When a bulldozer breaks through a brick wall: Why resistance breaks down in foreign exchange investment

We’ve all been there when we look at a chart and see that the price is hovering just below a seemingly impenetrable resistance level. The order is ready, the adrenaline rush, the bounce, the analysis awaits confirmation. And… crack! Those stubborn barriers are shattering like old baguettes, and prices are soaring with the force of a runaway bulldozer. What just happened? Why did resistance, once so resolute, crumble like a sandcastle beneath the malevolent waves?

Have no fear, fellow traders. Understanding these breakthroughs is the key to unlocking hidden opportunities and avoiding painful false dawns. So grab a coffee and fasten your seatbelt. Five main reasons Why resistance levels in Forex are pulverized into trading dust:

1. Gathering Storm: changing market sentiment

Imagine a fight between a buyer and a seller. If resistance persists, it equates to a stalemate. Neither can overpower the other. But sometimes outside forces tip the scales. Sudden economic stability, a geopolitical earthquake, or even a juicy rumor can shift market sentiment like the winds of a hurricane. Suddenly, that stubborn line of resistance turns into a flimsy beach umbrella in the face of a tidal wave. Fueled by newfound optimism, buyers are surging and booming! Resistance is history.

2. Arrival of the cavalry: institutional intervention

Imagine this: The market’s powerful cavalrymen, the big banks and hedge funds, have been quietly accumulating positions before key resistance levels are reached. They wait patiently, like wolves circling their prey. Then, at the right moment, they pour in a huge amount of buy orders that overwhelm the existing selling pressure. Resistance breaks down under the weight of the combined forces, paving the way for a continued upward trend.

3. The power of technology: Confirmation candles and breakouts

Sometimes the reason resistance breaks down can be as simple as a purely technical verification. A series of bullish confirmation candles, such as engulfing patterns or breakouts, can trigger buying momentum and push price through a barrier like a battering ram through a cardboard door. Conversely, a bearish sweeping candle or a failed breakout on a lower time frame could warn of impending weakness and trigger a selling wave that breaks resistance below.

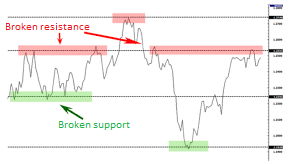

4. Illusion of Power: False aborts and retests

Not all resistance brakes are created equal. Sometimes prices surge and quickly reverse, leaving panicked traders scratching their heads. These “false breaks” can be caused by temporary bursts of buying or selling pressure that quickly evaporate. Remember that a true breakout usually has volume confirmation and follow-up over a higher time frame. So don’t jump the gun just because price sticks its head above resistance. Wait for the cavalry to arrive before charging directly.

5. The invisible hand: Fundamental changes and long-term trends

So here we are, merchants. Remember that the level of resistance is a psychological line in the sand, not an iron fortress. By understanding the forces that can break them, you can turn these breakthroughs from booby-trapped trades into profitable opportunities. Listen to changing sentiments, institutional measures, technical confirmations and never forget the whispers about the basics. Armed with this knowledge, you will be prepared to ride the waves of volatility and conquer even the strongest levels of resistance. Now move forward with confidence, knowing that even the strongest walls can crumble when the right forces collide with them.

Bonus Tips:

Remember that context matters. We analyze resistance breakouts within the broader market environment, taking into account time frames, technical indicators and fundamental news. Don’t blindly chase every breakout. Wait for confirmation and trade with appropriate risk management.

Happy trading!