There will soon be a regulated options market for US Bitcoin ETFs, but what does that mean and how will it affect the Bitcoin price?

On Friday, the U.S. Securities and Exchange Commission (SEC) Green light Nasdaq will list and trade options on the iShares Bitcoin Trust, BlackRock’s $22 billion Bitcoin ETF whose share price tracks the price of Bitcoin. BitcoinAccording to analysts, introducing options would make Bitcoin a more functional investment asset overall.

Options are derivatives that allow investors to acquire an “option” to buy or sell Bitcoin at a predetermined price at a later date. Buy and sell options are called “calls” and “puts”, respectively.

“Investors can now buy put options if they think the Bitcoin price is about to correct,” said Julio Moreno, head of research at CryptoQuant. Decode. “This can generally be done with less capital and at lower costs than opening and maintaining a short position in the perpetual futures market.”

Moreno said investors could profit from what is known as a covered call strategy, which involves selling call options while holding the physical bitcoin. Round Hill Bitcoin Covered Call Strategy ETF For several months, this strategy has provided investors with a 30% annualized yield via a Bitcoin futures ETF.

While there was a lot of anticipation online for this approval, there was also some debate about how bullish Bitcoin options could be.

“We are on the verge of witnessing the most incredible bull run ‘vol of vol’ in financial history,” wrote Jeff Park, head of Alpha Strategies at Bitwise. twitter Posted on Friday: “Without exaggeration, this represents the most monumental advance possible in the cryptocurrency market.”

Park argued that regulated options could exponentially increase Bitcoin’s notional exposure in a market where the OCC protects clearing members from counterparty risk for the first time. He said existing crypto options exchanges like Derebit have failed to achieve widespread adoption.

More importantly, Professor Park argued that combining Bitcoin’s characteristics with options could provide the potential for tremendous upward volatility.

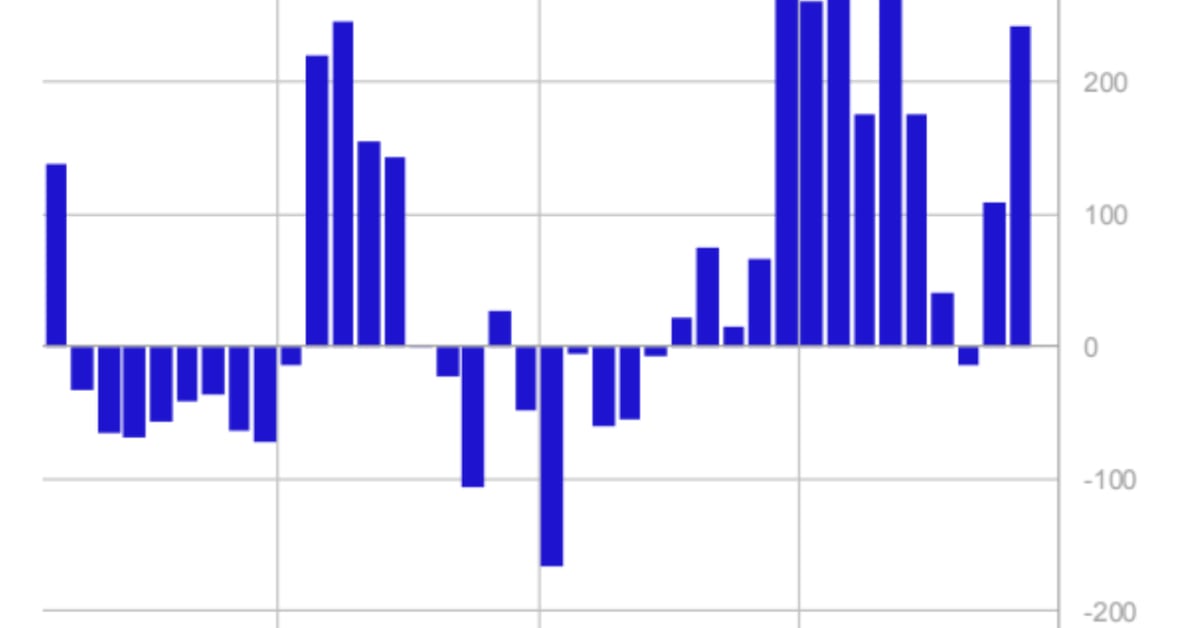

The first is Bitcoin’s “volatility smile,” which describes how derivatives traders are willing to pay a high premium for exposure to large upside or downside price volatility and protection against it. This gives Bitcoin options a “negative bar,” meaning that the asset’s volatility rises with the spot price, making Bitcoin’s rise “explosively reflexive.”

The second is Bitcoin’s fixed supply. When new leverage enters the system, new coins cannot be printed to accommodate it. This is what has historically limited the upside of explosive meme stocks like GME and AMC.

There are markets for other commodities, such as oil and natural gas, but analysts say they are more closely linked to the futures market because they have expiration dates and are also subject to supply manipulation by OPEC and other groups.

“Bitcoin ETF options are the first time the financial community has seen regulated leverage on a perpetual product with a really limited supply,” he concluded. “Things could very well get out of control. In that scenario, regulated markets could shut down.”

But not all analysts were so surprised. James Butterfill, head of research at Coinshares, predicts that options will “smooth” Bitcoin volatility over time, “because they give investors the ability to make more directional trades.”

“They will likely provide significant liquidity improvements as they allow for greater retail participation and leverage,” he said. “However, these options will not provide the same bankruptcy recourse that a physically backed ETF would.”

Minse Bindi, known on Twitter as the Bitcoin bull “British HODL,” made a similar prediction on Monday, arguing that options should require market makers to neutralize the delta of their users’ positions to protect themselves from the risk of loss. In theory, this would dampen volatility overall, but he argued that in practice, it would only reduce downside volatility.

“Because of the certainty and scarcity of the asset on the upside, there’s a huge storm brewing,” Bhindi said. “If you thought GameStop was having an incredible run, what happens when IBIT has a gamma squeeze?”

According to CryptoQuant’s Moreno, options could theoretically introduce more “paper bitcoins” into the market, effectively increasing the supply of bitcoin and suppressing the asset’s price. Nevertheless, he predicted that options would be “net bullish” because they would increase liquidity for bitcoin.

“Whether volatility increases or decreases depends on the balance between speculation and hedging in the market,” he said. “In many cases, the introduction of options can lead to a temporary spike in volatility due to increased trading activity, which then stabilizes as market participants use options to manage risk.”

Daily Debriefing newsletter

Start your day with the most popular news stories, plus original articles, podcasts, videos, and more.