Will the S&P 500 hit a new all-time high by the end of June? | a cautious investor

We have been covering signs of weakness in stocks from the bearish divergence in March.Mega cap growth stocks It broke the 50-day moving average.even sudden increase in volatility Often associated with major market tops. While the first quarter saw broad market strength and numerous new 52-week highs, the second quarter has offered investors a much different playbook so far. Both bulls and bears felt validated by the recent instability of major market averages.

Over the past week, the S&P 500 has risen about 2.7% despite stronger-than-expected inflation data and mixed returns from the Magnificent 7 stocks. Does this give us an opportunity to make even more gains and hit new all-time highs as we continue into the second quarter? Or are we currently experiencing a “dead cat bounce” phase, where a countertrend takes off before a major bear market continues?

Shh! Please confirm January 2024 version of this walkthroughand Guess what scenario actually played out?!

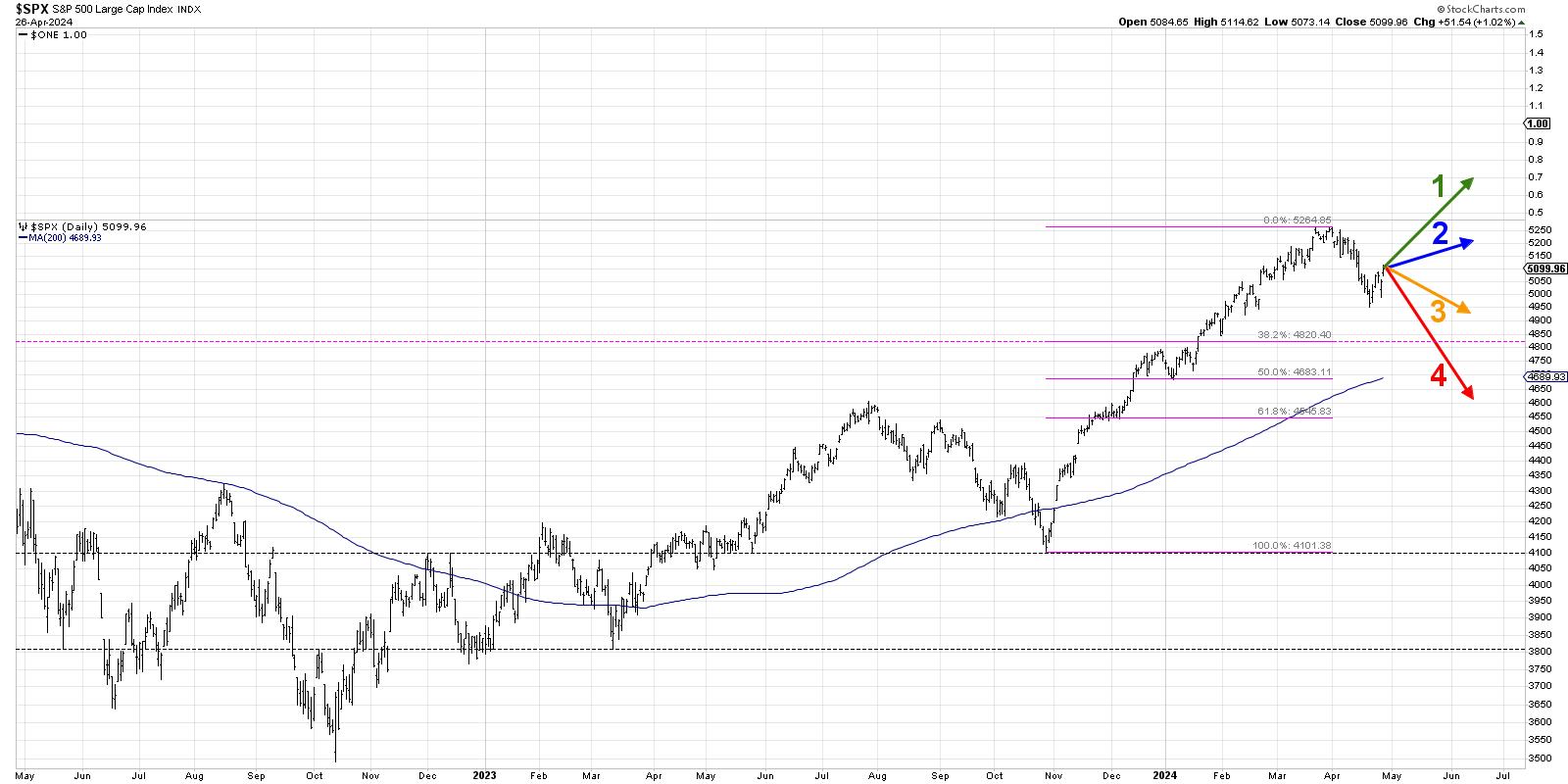

Today we will present four potential outcomes for the S&P 500 Index. As I share each of these four future paths, I’ll explain the market conditions that may be involved and also share projected probabilities for each scenario. And remember, the point of this exercise is three-fold.

- Consider all four potential future paths for the index, think about what could cause each scenario to unfold in terms of macro drivers, and examine which signals/patterns/indicators confirm the scenarios.

- Decide which scenario you think is most likely and why. Don’t forget to leave me a comment and let me know your vote!

- Consider how each of the four scenarios would affect your current portfolio. How would you manage the risk in each case? When and how will you take steps to adapt to this new reality?

Let’s start with the most optimistic scenario, which involves a move to new all-time highs over the next 6-8 weeks.

Option 1: Highly optimistic scenario

If you think the April decline is another buyable decline within a major bullish trend, the very bullish scenario is appropriate. This scenario is only possible if Magnificent 7 stocks return to their old great ways, with stocks like AMZN and NVDA following GOOGL to new all-time highs.

We should see much weaker economic indicators, especially inflation numbers, which would give the Fed confidence that it can begin cutting interest rates at its June Fed meeting. By the end of June, the S&P 500 is expected to break above 5,500 and could even rise to 6,000.

Dave’s vote: 10%

Option 2: Mildly bullish scenario

What happens if the S&P holds its April low near 4950 but is unable to hit a new all-time high? Scenario 2 could mean a resurgence in value-driven sectors such as industrials and materials, outpacing growth leaders in the first quarter. However, because these sectors are so much smaller in the S&P 500, they don’t have enough market capitalization to move the needle on major benchmarks.

We’ll probably see mixed results for the remainder of earnings season, and the Fed’s inability to commit to aggressive rate cuts will leave us with more questions than answers at the end of the second quarter. Interest rates are still rising, which creates a big headwind for growth stocks.

Dave’s vote percentage: 30%

Option 3: Bearish scenario

Now we have two scenarios that point to further declines in the coming weeks. Scenario 3 means that the S&P 500 cannot hold the April low near 4950, but remains within the 38.2% retracement level near 4820. The Fed will delay its first rate cut or use language that leaves little certainty about multiple additional rate cuts in the following years. 2024.

Magnificent 7 stocks are likely to be choppy at best, and with a stalled attempt to hit new all-time highs, investors see this as a sign that upside is limited. Gold and gold stocks have become the deal of the day as investors look for things other than stocks to generate positive returns.

Dave’s vote percentage: 45%

Option 4: Super bearish scenario

You should always include an apocalypse scenario, and our last option means that the April selloff is really just the beginning. May and June will see lower lows and lower highs, and the second quarter will feel very similar to September and October 2023. The S&P 500 breaks through Fibonacci support near 4820 and even falls below its 200-day moving average for the first time since the second quarter. Lowest in October 2023.

What causes this last scenario? Economic data could be much higher than expected, and the Federal Reserve may be reluctant to cut interest rates while the economy shows signs of strength again. The market expects “the higher the longer” interest rates, growth-oriented sectors such as technology and telecom services begin to lead lower, and the defensive sector as investors ignite “flight-to-safety” trades. It gets higher.

Dave’s vote percentage: 15%

What probability would you assign to each of these four scenarios? Watch the video below and leave a comment telling us which scenario you chose and why!

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting with a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

David Keller, CMT, is Chief Market Strategist at StockCharts.com, where he helps investors minimize behavioral bias through technical analysis. He is a frequent host of StockCharts TV and links mindfulness techniques to investor decision-making on his blog, The Mindful Investor. David is also President and Chief Strategist at Sierra Alpha Research LLC, a boutique investment research firm focused on risk management through market awareness. He combines strengths in technical analysis, behavioral finance, and data visualization to identify investment opportunities and strengthen relationships between advisors and clients. Learn more