Will the S&P 500 surpass 4600 before the end of the year? | a cautious investor

key

gist

- The S&P 500 is stalled near its July high of 4600, and an overbought reading on the RSI indicates a decline is possible.

- The breadth indicator reached bullish extremes, confirming the long-term bullish, short-term bearish thesis.

- Both growth and value stocks are overbought, suggesting a downturn is imminent before the uptrend resumes.

There is no denying the strength of risk assets since the October market lows. When my market trend model turns bullish It was hard to deny the overwhelming positive momentum for stocks in all three periods in mid-November. This strong upward momentum has now pushed major indices up to key resistance levels. Will there be enough gas left in the tank to push SPX above 4600 and retest all-time highs around 4800?

There are three ways to think about this particular scenario. First, we can consider the technical makeup of the S&P 500 itself. What can the SPX chart tell us about the potential for further upside? Second, market breadth conditions can be explored. Are we seeing signs of extreme wide readings that tend to mimic previous market highs? Finally, you can review the key companies in the growth sector. Are Magnificent 7 Stocks Still in Their Leadership Role? What about celebrities in other fields?

Prudent investors take time to reflect on their experiences. What worked and what didn’t? What makes you successful on a trade, and what did you learn from a deal that didn’t go so well?

I’ll be sharing my content in the next free webcast. Top 10 Questions Every Investor Should Ask at the End of the Year. I review 10 questions like these at the end of each year to help me focus on celebrating my wins, learning from my losses, and improving my routine. Join me on Tuesday, December 12th at 1pm ET. Here we reveal 10 questions, share the answers, and empower you to write your own year-end review!

Sign up here Join this free event and prepare yourself for success in 2024 and beyond!

After all, we are in a transition period. The days of the Fed raising rates appear to be behind us, and 2024 will almost certainly bring rates lower and the Fed taking a more dovish turn. Season Playbook (Did you choose 2024? Stock Trader’s Almanac yet?!?) accurately indicated strength in November and December. What can price analysis tell us about trends in early 2024?

S&P 500 stalled at 4600

During the bull market phase, charts are not just for trading. to Although I resist through resistance. As the S&P 500, Nasdaq 100 and many other major charts approach a retest of summer highs.I was skeptical of the possibility of further upside given the potential for at least a small decline from such significant levels.

It’s amazing that the S&P 500 essentially recovered three months of losses in about five weeks. Not a bad move off the October lows! RSI also confirms the strength of the recent uptrend, which went from oversold in late October to overbought in early December.

There are two things I would point out about RSI rising too quickly. First, it is generally a negative sign in the short term. To be clear, the market can go much higher after being initially overbought, but if the RSI falls back below the 70 level, it could mean that a downtrend has begun.

Second, this is generally a positive sign for medium-term trends. Charts can indeed become overbought during bear market phases, but it is much more common to see this during broad rallies. So the simple fact that the market is overbought is usually an encouraging sign.

Market breadth suggests a downturn is imminent.

83% of all S&P 500 members are currently above their 50-day moving average. A quick review of this indicator in 2023 will show you how it correctly identified markets in an upward trend in the fourth quarter and not the first.

The pink shaded area in the bottom panel highlights when the indicator moves above 85%, a level it barely reached earlier this month. It has been above 85% three previous times (July 2023, November 2022, and August 2022), all coinciding with meaningful market highs.

Now, just because this metric hits 85% doesn’t mean it’s the end of the world. In practice, breadth indicators like this often serve as an early warning of an impending high, rather than confirming a high that has already occurred. So SPX definitely has some additional upside. In fact, the panel above shows the percentage of stocks exceeding their 200-day moving average, which is well over 50%. This means that a long-term bullish trend is still underway as long as the indicator remains above the 50% level.

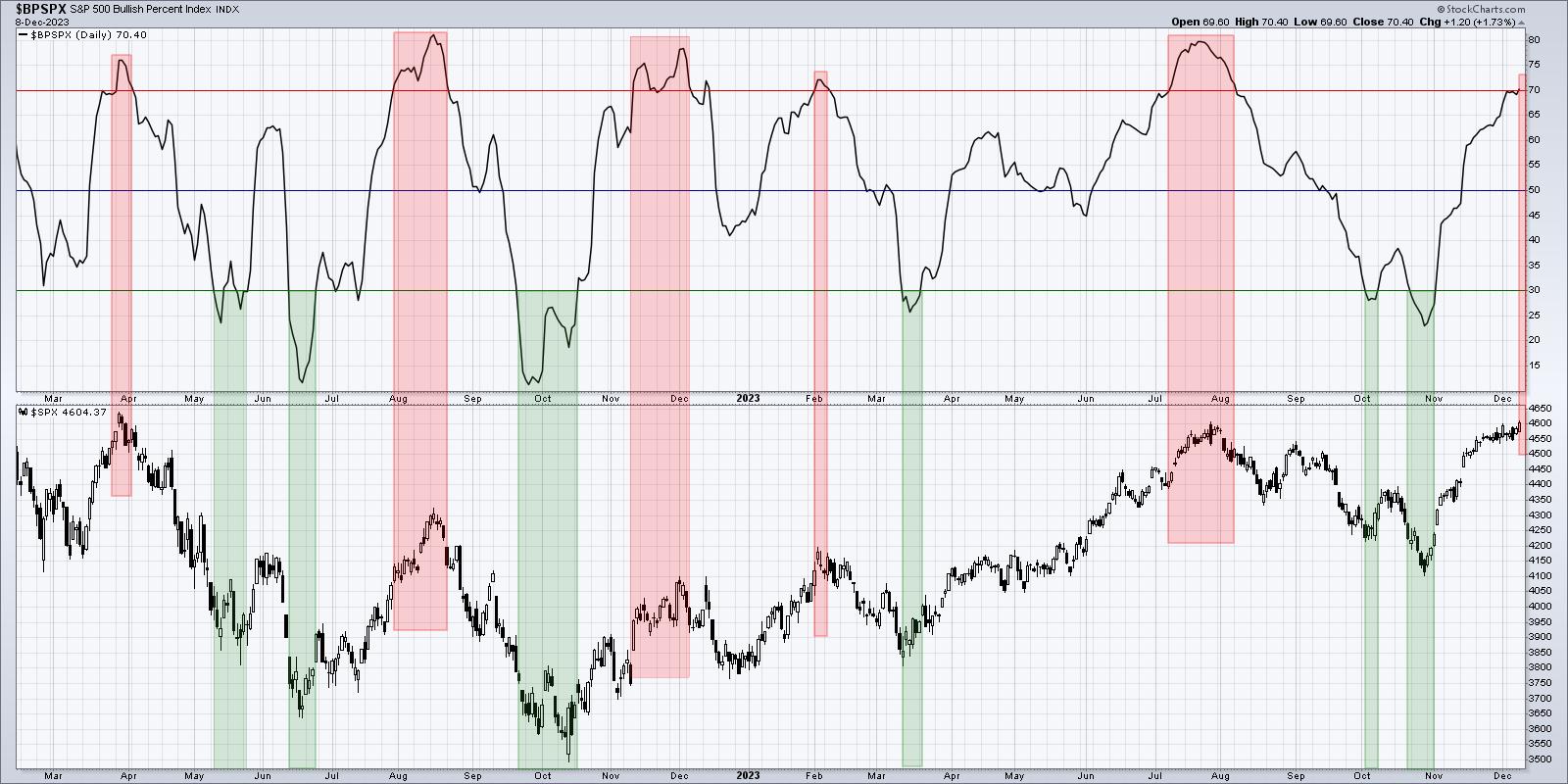

Following the Nasdaq 100’s Bullish Percent Index above the critical 70% level this week, the S&P 500’s Bullish Percent Index is also in extremely bullish territory. If you look at the red shaded area on this chart, you can see that when the indicator rises above 70% and then falls back down, it is usually a good time to be defensive in your positioning.

Almost every stock on the planet is overbought.

These overextended markets are defined not only because the index has reached a key resistance level or market breadth conditions imply overbought conditions, but also because the individual stocks that make up the major index are also showing all signs of exhaustion.

Let’s take a look at some large-cap stocks in growth sectors like technology, as well as more value-oriented sectors.

Home Depot (HD) has bounced back to its 2023 high around $330, with RSI overbought for the first time since the July high.

The financial sector was strong again, with regional banks like Keycorp (KEY) posting solid profits in November. KEY recently hit a new high near $12.50, and RSI rose above 70 as soon as the breakout occurred.

The industrial sector also has some recent strong performers, including airlines and other travel companies, as interest rates and crude oil prices fall. However, MMM and other large-cap stocks in the sector are experiencing overbought conditions as they move above moving average support.

So, is overbought a good or a bad thing? Well, both, it depends on the period. As mentioned above, the market has followed seasonal trends almost perfectly in 2023, with November and December being the two strongest months of the year. So, in my view, the long-term story remains positive.

The Santa Claus Rally period is often incorrectly declared whenever prices rise in December. However, Santa Claus rallies actually only run from late December to early January, closer to the week between Christmas and New Year’s Day. Therefore, there is ample room for seasonal expectations of a brief decline in mid-December in preparation for a bullish move in early 2024.

Ultimately, the most optimistic thing the market can do is go up. And I still see it in the cards, but only after the recent overbought conditions ease!

RR#6,

dave

P.s Are you ready to upgrade your investment process? Check out our free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional.

The author had no positions in any securities mentioned at the time of publication. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.