Winning With Trump: My Top Dividend Picks For Your Portfolio

johan10/iStock via Getty Images

Introduction

It’s time to talk about politics.

As most of my readers may know, my investment strategy is based on the “big picture,” which includes being on top of major trends in macroeconomics, supply chains, and politics – including market sentiment, valuations, and other factors.

Leo Nelissen

Politics may be one of the most important, as it influences everything else as well.

However, it’s also one of the most tricky topics, as politics isn’t a very transparent issue – we can only guess what is being discussed behind closed doors. It can also quickly turn into an emotional issue – especially as we get very close to the 2024 General Election on Tuesday, November 5.

Hence, I have to admit that it took me a while to figure out how to write this article.

- Politics are unpredictable.

- Politics are highly emotional.

- I’m not here to pick sides or tell you who to vote for/support.

Although I tend to be very political on social media, I pride myself on writing objective articles on Seeking Alpha.

What we’ll do in this article is dive into what a Trump presidency could look like for our portfolios. I’ll show you what we can expect from him in terms of economic decisions and how we can position ourselves to potentially be prepared.

I strongly believe that this is the most important political article I have written about the upcoming elections.

So, as we have a lot to discuss, let’s get to it!

Why Did I Go With Trump In The Title?

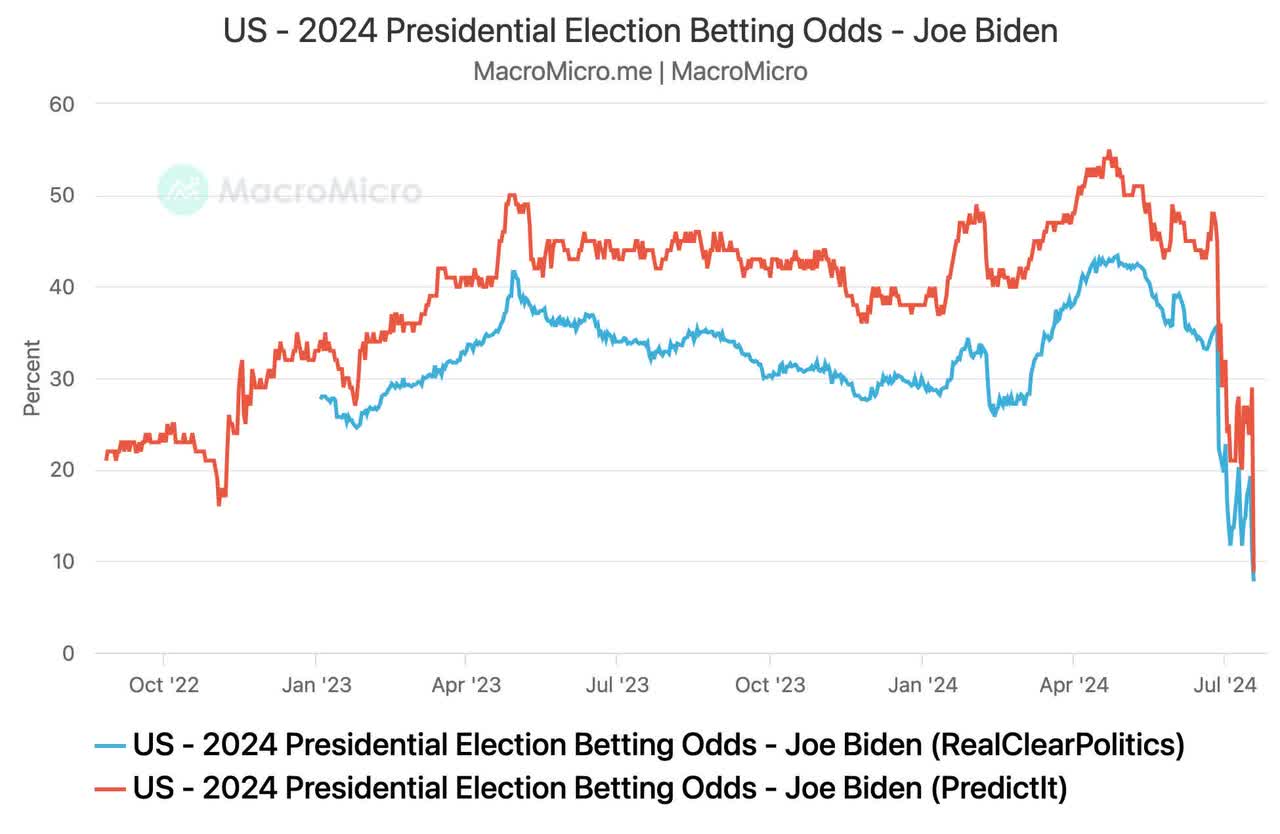

Just because I went with Trump in the title does not mean I won’t cover Democrats. However, right now, the odds are former President Trump could lose the “former” in his title soon.

According to RealClearPolitics and PredictIt, the odds of President Joe Biden winning re-election are below 10%. That’s down from more than 50% in April (PredictIt).

MacroMicro

Obviously, this does not fully show the popularity of Donald Trump, as these odds include the increasing doubts that Mr. Biden may be fit enough to take on the challenge of four more years in the White House.

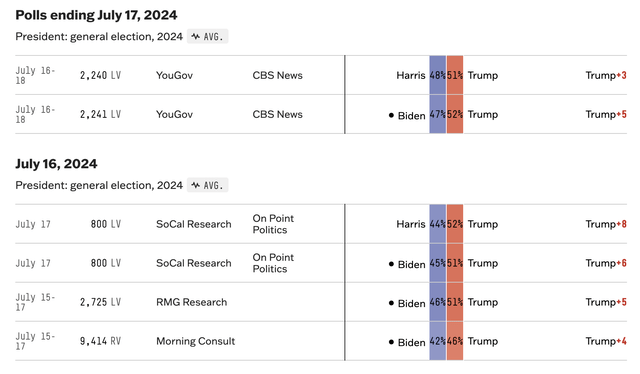

The problem for Democrats is that Trump is also beating Vice President Harris in recent polls, boosted by the recent assassination attempt.

FiveThirtyEight

This assassination attempt not only boosted Trump’s popularity but also made it much harder for Democrats to “attack” the Republican candidate.

If you were to ask me who’s winning in November, I would say Trump. He just gained a lot of popularity, benefits from Biden’s health issues (and lack of backing from his party), and economic challenges like sticky inflation, which have pressured a lot of (lower-income) voters.

Hence, this article is about what may happen if Trump wins.

However, this is by no means a way to say that Trump has won already. Remember in 2016 when everyone thought there was no way Hillary Clinton could lose?

There’s a lot of time until November 5. A lot can happen, and it certainly won’t help the GOP to believe they have won already.

Nonetheless, as the odds are in their favor, this article is about Trump.

More Inflation Under Trump?

Trump is all about the domestic manufacturing industry. When he was President, he went after companies moving production to Mexico and overseas, implemented tariffs, and focused on returning growth to the struggling Rust Belt.

A Trump 2.0 Presidency could be similar, as both Trump and his Vice President candidate Vance are looking to use the dollar to strengthen U.S. exports.

The New York Times

As reported by the New York Times (emphasis added):

In most cases, Mr. Trump likes his policies to be “strong,” but when it comes to the value of the dollar, he has long expressed a different view. Its strength, he has argued, has made it harder for American manufacturers to sell their products abroad to buyers that use weaker currencies. That’s because their money is worth so much less than the dollars that they need to make those purchases. – New York Times

Mr. Trump is not wrong. Europe, which has a massive manufacturing industry, has used a weaker euro to increase its exports. It’s very common. Trump wanting to do the same makes sense – theoretically speaking.

While the question is how Trump would achieve this, Bloomberg quoted macro expert Kevin Muir, who said: “I don’t buy for one moment that the president can’t lower the value of the U.S. dollar.”

In fact, calls for a weaker dollar are supported by nations like Japan and China using their currencies to grow exports – especially as a nation like China faces slower domestic growth in former growth engines like construction. This is not great for the U.S. (and Europe).

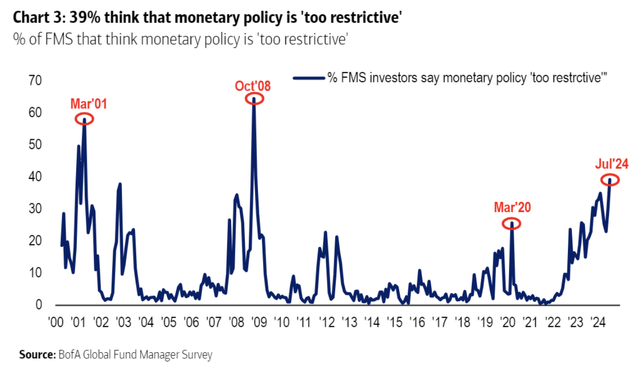

One way to get the dollar down is by easing monetary policy. As inflation is slowing (although not as fast as the Fed would like to), the percentage of fund managers who say the central bank policy is “too restrictive” has reached the highest level since the Great Financial Crisis.

Bank of America

Going back to the Bloomberg article I just mentioned, it highlighted a five-item “wish list” we may expect him to work on if he wins.

- Tariffs

- Lower interest rates

- A weaker dollar

- Fiscal expansion

- Lower inflation

While some of these are related (like lower rates and a weaker dollar), one of them stands out (item 5). Items 1-4 are all inflationary.

It’s a bit like wishing to go to the pool with a deep desire to stay dry.

Moreover, tariffs, lower interest rates, a weaker dollar, and higher fiscal spending are all inflationary factors that could eventually result in a stronger dollar as the market starts to bet on higher rates again.

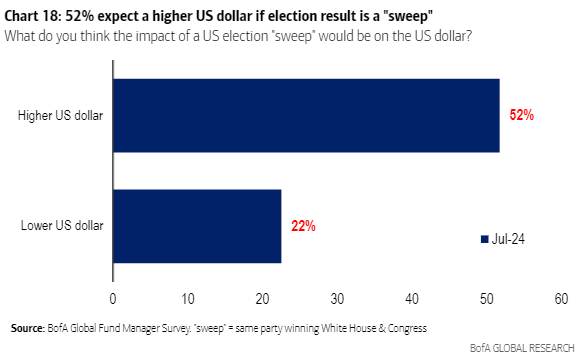

Interestingly enough, fund managers surveyed by Bank of America expect a situation where President Trump enjoys a united Congress to be bullish for the dollar.

Bank of America

With regard to other issues, the quotes below show what USA Today wrote recently with regard to expected Trump 2.0 policies. I added emphasis.

On tariffs:

Trump has mentioned the idea of 10 percent and higher tariffs on all goods imported into the country, claiming it will eliminate trade deficits. He also wants to implement a four-year plan to ensure the U.S. “no longer needs to rely on China for essential medical and national security goods” and prohibit Chinese ownership of any critical infrastructure in the U.S. – USA Today

On energy:

The former president plans to boost domestic energy production, lower fuel costs, eliminate the Green New Deal, and allow drilling in the Arctic National Wildlife Refuge. According to the U.S. Energy Information Administration, fossil fuels accounted for 81% of US energy production in 2022. – USA Today

According to The Wall Street Journal, Deutsche Bank estimates that tariffs could add 1-2% to inflation.

That said, all of these are just estimates based on what we know.

- Trump hasn’t won yet.

- If he wins, it needs to be seen how many plans he can implement.

- He may change his mind on certain issues.

- Some things could work out better/worse than expected.

- The economy, in general, is prone to countless factors that no politicians can influence (like the pandemic).

Also, Trump has vowed to end the war in Ukraine. Let’s assume he’s right and the war ends – that would be disinflationary, as it would likely restore supply chains like energy flows to Europe.

In other words, there is so much uncertainty. Even the smartest, richest, and best-connected investors are just guessing.

However, just like in 2016, I believe there’s data we can work with, which is why I’m looking into a few specific areas that I expect to do well when Trump wins.

Moreover, there are two very important things I need to share with you.

- I expect the investments I’m about to give you to do well regardless of who occupies the White House.

As a long-term investor with a multi-decade outlook, I do not bet on specific events. I merely try to improve the chances of generating alpha.

- Because Trump is doing so well in the polls, the market expects him to win. If he wins, we can expect the “surprise” factor to be lower. In other words, if some stocks are obvious “Trump trades,” they are already being bought.

Now, let’s look into some dividend picks I expect to benefit from a Trump presidency.

Drill, Baby, Drill – The Case For Kinder Morgan (KMI) and ONEOK (OKE)

Republicans are more supportive of oil and gas than Democrats. That’s no secret.

However, the implications for investors are less obvious.

Right now, a major part of the energy bull case (as I wrote in this article) is supply growth pressure. Especially in the U.S., the “shale revolution” is seeing headwinds from companies running out of Tier 1 inventories.

In a scenario where Trump would accelerate new drilling licenses to boost output, the bull case could actually weaken a bit.

While I would still be bullish on oil producers, I believe midstream companies would be perfect for a Trump presidency. Midstream companies do not produce oil and gas – they transport and process it.

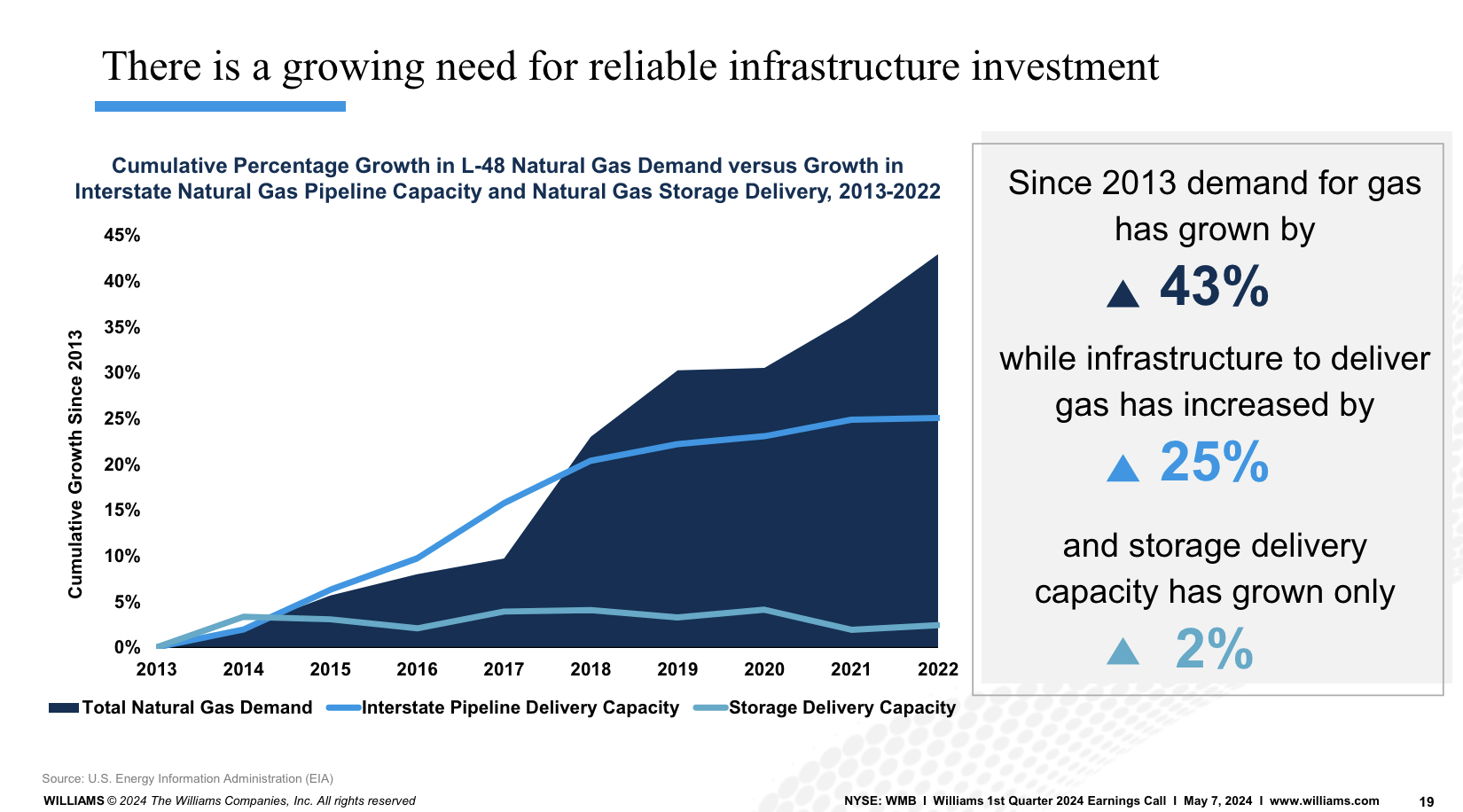

According to the Williams Companies (WMB), infrastructure investments have lagged growth in gas production. This bodes well for pipeline pricing and future demand – especially if production continues to rise!

The Williams Companies

So, in general, I like midstream.

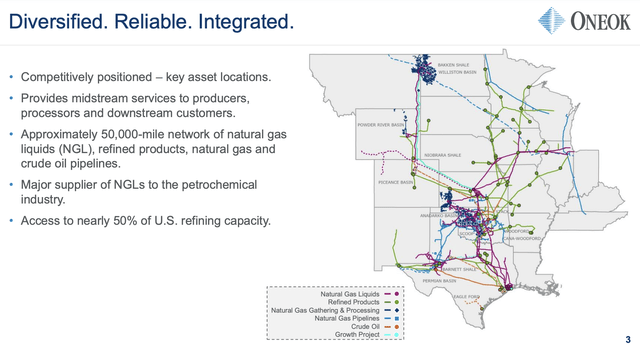

One of the companies I like is ONEOK. As I wrote on July 16, the company owns more than 50 thousand miles of pipelines, shipping natural gas, natural gas liquids, refined products, and crude oil.

ONEOK Inc.

ONEOK is in a fantastic position to benefit from an overall increase in output and lower resource quality, which benefits volume growth from natural gas liquids.

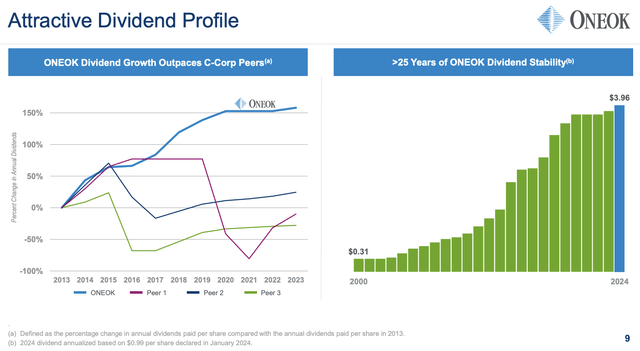

Currently yielding close to 5%, the company has plans to grow its dividend by 3-4% per year, supported by accelerating buybacks.

ONEOK Inc.

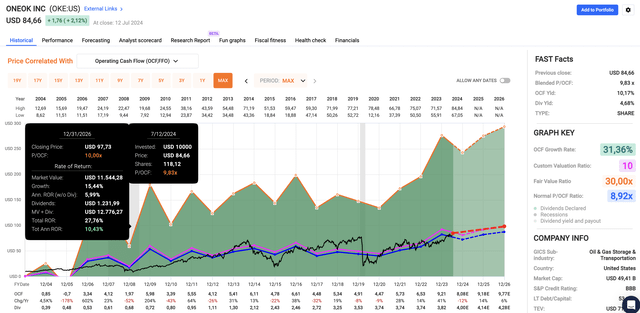

Moreover, even in the current environment, applying a 10x operating cash flow multiple, I believe the stock has 16-20% room to run.

FAST Graphs

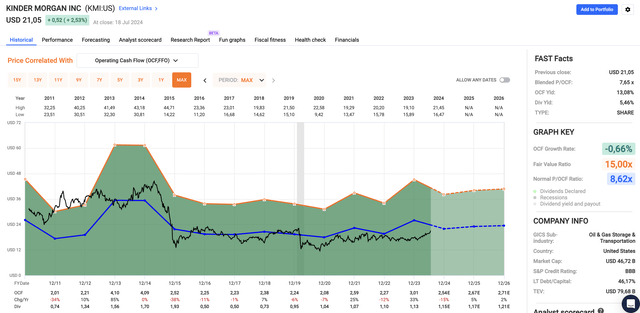

I also believe Kinder Morgan is back. On March 28, I wrote an article titled “Kinder Morgan: 6.3% Yield + 29% Upside Potential? Here’s Why It’s A Buy.”

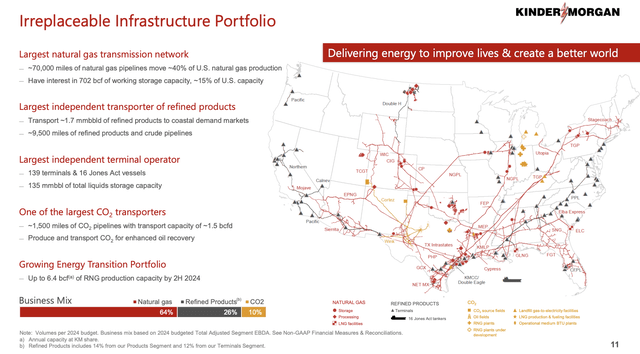

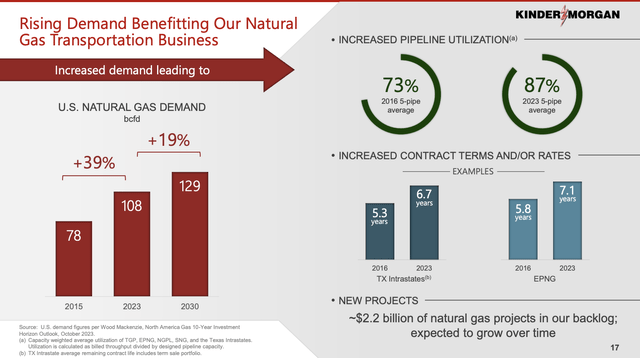

Since then, shares are up 17%, boosted by a huge bull market in natural gas production (prices are not in a bull market yet). This giant owns 70 thousand miles of natural gas pipelines, servicing 40% of U.S. natural gas production.

It also owns 700 billion cubic feet of storage – 15% of U.S. natural gas storage.

Kinder Morgan

Through 2030, the company expects a 19% growth in total U.S. natural gas demand, doubling LNG exports, and a 12% increase in industrial demand.

Even better, because of aggressive investments in the past, it now has a utilization rate that allows it to capture growth without the need to accelerate CapEx in the mid-term.

Kinder Morgan

It also has done a great job lowering debt (it has a sub-4x leverage ratio and an investment-grade BBB credit rating), executing high-growth projects, and returning cash through both dividends and buybacks.

Currently yielding 5.5%, I believe KMI has room to return 10-11% annually, with more upside if Trump 2.0 causes oil and gas production to rise above current expectations.

FAST Graphs

This brings me to the next pick.

Deere (DE) – Agriculture, Exports & Construction

A few things are important for a Trump 2.0 presidency:

- Getting support from the Corn Belt/Midwest. Most of these states are swing states, which means both parties benefit from getting as much support as possible from this area.

- Fiscal spending. As we discussed in the first part of this article, Trump is keen on using fiscal spending to achieve goals. This likely includes infrastructure spending (President Biden did the same).

- As Trump is looking to boost exports, he could benefit manufacturers in the U.S.

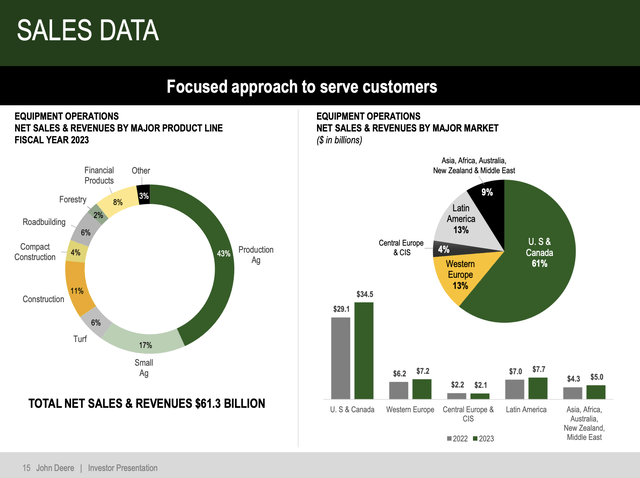

Deere combines all of these tailwinds, as it’s the biggest global producer of agriculture machines (with a focus on farmers in the U.S.), a producer of construction equipment, and a company that produces overseas, which somewhat protects it against potential retaliation tariffs.

Deere & Company

Currently, the giant is struggling from subdued crop prices, elevated rates making it harder for farmers to finance expensive equipment, and cyclical weakness in construction.

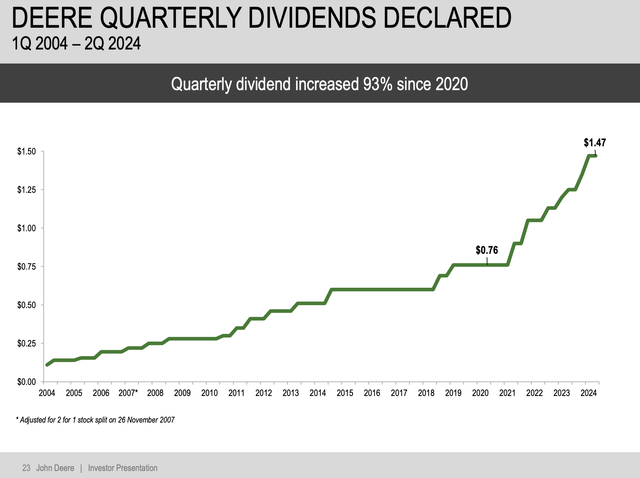

The good news is that in addition to an A-rated balance sheet, it has almost doubled its dividend since 2020, making it one of the most aggressive dividend growth stocks in the industrial sector.

Deere & Company

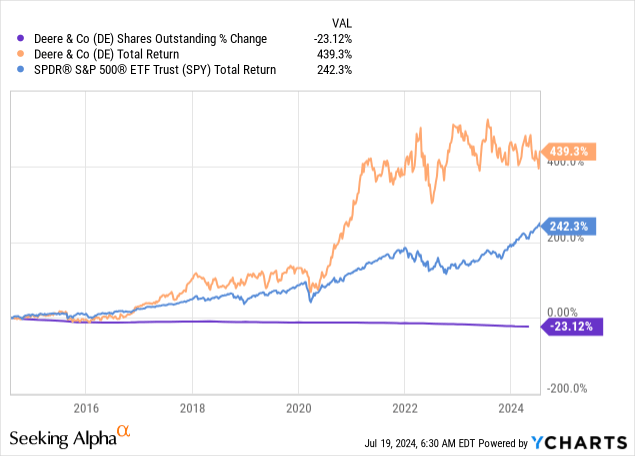

Currently yielding 1.5%, it has also bought back close to a quarter of its shares over the past ten years, which contributed to a 439% total return, almost 200 points above the S&P 500’s return.

Another reason I’m so bullish is its focus on innovation. Although it’s hard to make comparisons with peers, I believe Deere is in the best spot to benefit from agriculture modernization, as it has been at the forefront of agriculture innovation for many decades.

Some call it the “Tesla of agriculture.”

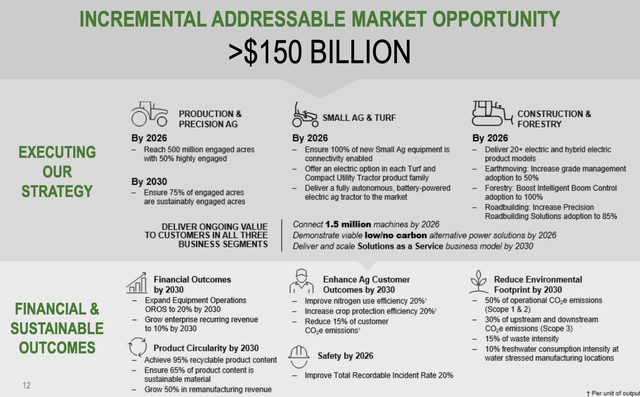

Currently, it sees a $150 billion addressable market consisting of modernization in Production & Precision Agriculture, Small Agriculture & Turf, and Construction.

Deere & Company

In a scenario where rates come down, export demand improves, and farm income rises, I expect the innovation-fueled replacement cycle to accelerate, allowing the Deere stock price to soar again.

UnitedHealth (UNH) – Fewer Regulations & Aggressive Dividend Growth

As reported by Bloomberg, health insurers, including UnitedHealth, are in a good spot to potentially benefit from looser regulations.

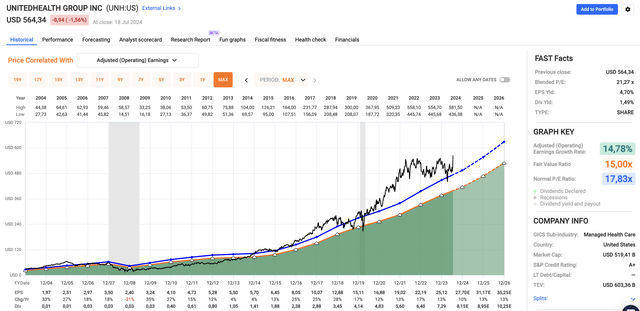

On June 24, I made the case that UNH is “Among The Best Dividend Growers.”

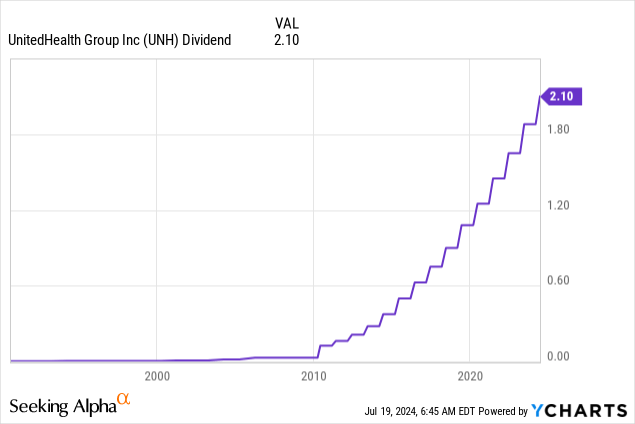

Having grown its dividend by 15.4% per year over the past five years while maintaining a sub-30% payout ratio is fantastic.

Even better, without potential Trump benefits, the company is guiding for 13-16% annual EPS growth!

So just to reiterate from a UHG perspective, as I think many of you will be familiar, we have a long-term goal of delivering earnings per share — adjusted earnings per share at a rate of between 13% and 16%. Historically, we’ve done very well at that. Of course, it doesn’t happen every single year in years where there are different events going on. But as a pattern, that’s something we continue to be very much guided by in terms of the ambition of the organization. – UNH Bernstein Strategic Decisions Conference.

Although UNH shares have risen by 15% since my most recent article, I believe it’s a great buy on weakness and a likely beneficiary of a Trump Presidency.

FAST Graphs

Besides that, the company is also increasingly benefitting from healthcare consumerization, which is one of the reasons why I’m bullish on UNH, regardless of who calls the White House their workplace.

Other Mentions

While I’m writing this, I’m noticing this article will likely be close to 3,000 words, which is why I will add a few honorable mentions. As I still have so much to discuss, I will do a follow-up article soon (including stocks that may do well if Democrats win).

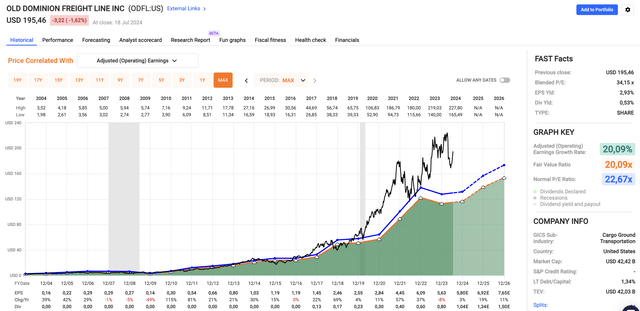

I believe big winners of a Trump Presidency will be industrial-focused, less-than-truckload transportation companies like Old Dominion Freight Lines (ODFL), which I have mentioned in a lot of articles recently.

I bought the company this year as it’s the only high-quality trucking company with a pristine balance sheet, aggressive dividend growth, and a very low operating ratio.

FAST Graphs

On top of that, I like “law-and-order” investments like Axon Enterprise (AXON). Although it’s not a dividend stock, it sells a wide range of products and cloud-based services for law enforcement, including the TASR.

I am also bullish on (dividend) stocks in the steel sector, including Nucor (NUE) and Cleveland-Cliffs (CLF), as I expect Trump to pressure nations like China, who are looking to grow by exporting “cheap” steel.

Speaking of protection, Texas Instruments (TXN) should continue to do well in a scenario of more emphasis on domestic production, a stronger domestic industrial space, and potentially higher exports.

I am also bullish on defense companies. Trump has said many times he wants European NATO members to “pay their fair share.” This bodes well for defense contractors with major exposure to export markets. This includes RTX Corp. (RTX), Lockheed Martin (LMT), Northrop Grumman (NOC), L3Harris (LHX), and General Dynamics (GD) – and smaller players.

Takeaway

As we edge closer to the 2024 General Election, understanding the potential impact of a Trump presidency on our portfolios is crucial.

Politics, which is very unpredictable and emotional, shapes the broader economic landscape.

Hence, my approach focuses on anticipating these changes without bias, aiming to prepare us for possible scenarios.

While we don’t yet know the election outcome, it’s clear that Trump’s policies could significantly influence sectors like energy, agriculture, and healthcare.

By positioning ourselves thoughtfully, we can enhance our chances of generating alpha without having to take elevated risks.

Needless to say, going forward, I’ll continue to cover more ideas, as I have an entire list of ideas – including potential Democrat picks.