XLI: The Forgotten Industrial Sector ETF

Dmitriy Voronov/iStock via Getty Images

So far, 2023 has proven to be a truly bullish year for the market. Using the S&P 500 as a barometer of the market, performance so far this year has been positive to the tune of 22.6%. In fact, the ETF dedicated to following the S&P 500, the SPDR S&P 500 ETF Trust (SPY), is up 23.6% year to date, which has allowed it to hit an all-time high. But of course, not every aspect of the market has performed equally well. A lot of attention has been paid to the technology sector, with the ETF dedicated to it, Invesco QQQ Trust ETF (QQQ) hitting an all-time high. Year to date, it has surged 52.7%. One part of the market that not many have been paying attention to but that did just recently hit its own all time high is the industrial sector.

Using the Industrial Select Sector SPDR Fund ETF (NYSEARCA:XLI) as a barometer for the industrial space, we can see that performance has been quite impressive. Although it falls far short of what the SPY or the QQQ have seen, it’s up an impressive 13.5% so far this year. But what’s really interesting is when you narrow that time frame down to just a single month. Over the past month, XLI has seen an upside of 9.1%. That dwarfs the 4.9% increase seen by the SPY and it even beats out the 7.4% experienced by the QQQ. Digging into the weeds, we can see why some of the performance has been as impressive as it has been. And with us now in an environment in which interest rates are on the verge of dropping, it’s likely that further appreciation is on the table.

A look at XLI

If you haven’t heard of XLI before, the most important thing to take away is that it is an ETF that’s dedicated to tracking the performance of the Industrial Select Sector Index. This index, in turn, seeks to represent the industrial sector of the S&P 500. The industrial market has not been a terribly exciting place for investors, especially growth investors, for several decades. No longer is that where the bulk of economic growth is taking place. And when dealing with an inflationary environment in which higher interest rates are needed, it’s not expected for the industrial space to fare all that well in the short run.

This has to do with what constitutes industrial firms. By and large, they are companies that require significant amounts of tangible assets in order to operate. Many, though certainly not all, of the products and services within this market are commoditized. This, combined with their asset intensive nature, makes margins typically low. Again, you can find exceptions to this, but this is just the general rule of thumb. When interest rates increase, it not only threatens to reduce economic activity that can directly reduce the demand for the goods and services that the industrial market offers, but it can also make it difficult for companies to make investments in asset-intensive spaces. This is because the significant costs involved often require the use of leverage in order to be economically optimal. And as interest rates rise, deals that once looked attractive no longer do.

The latest news coming out from the Federal Reserve indicates that we are now at the peak of the interest rate cycle. The current expectation is now for the country to see three interest rate cuts next year as core inflation drops to 2.4%. The expectation is for it to eventually drop to 2% by 2026. This is guiding us toward a soft landing and, when you combine this with a resilient consumer in a market with consistently low unemployment, it’s looking more probable now than ever that the economy might continue to expand even as interest rates come down. This is the perfect recipe for a rebound in the industrial sector. Markets that were hit particularly hard, such as the housing market, are already coming back to life. And I have seen no evidence that suggests any material slowdown anywhere else in this space.

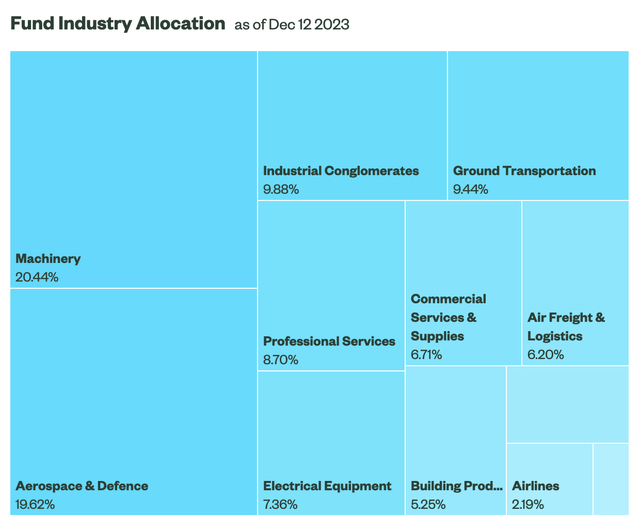

State Street Global Advisors

Given these facts, it’s not surprising to see outsized performance from XLI. But it might be helpful for the purpose of analyzing it and the opportunity it offers to understand more about it. I already mentioned conceptually what it is. But we have not covered its composition. From an industry perspective, about 20.4% of its weight involves companies that produce machinery. Another 19.6% of its weight involves the aerospace and defense market. About 9.9% involve industrial conglomerates. And rounding out the top five largest sectors in terms of exposure, we have ground transportation at 9.4% and professional services at 8.7%. All combined, the top five largest sectors account for 68.1% of the weight of the XLI. You also have smaller sectors like building products, airlines, construction and engineering, and more. But those are fairly small in the grand scheme of things.

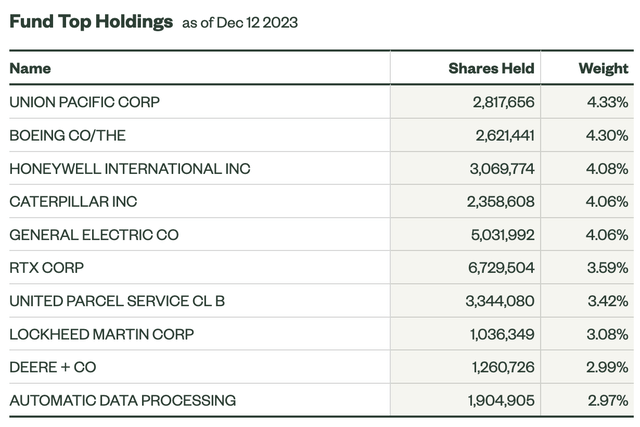

State Street Global Advisors

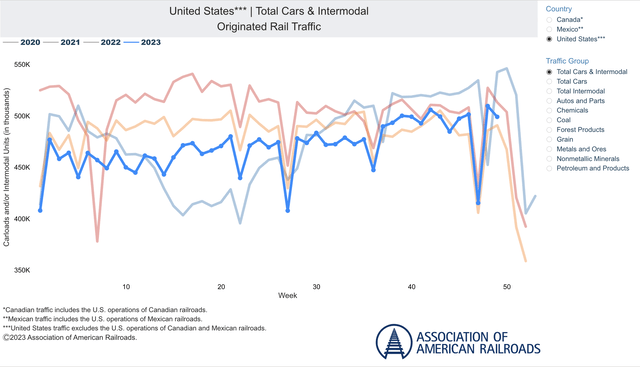

When it comes to individual firms, the greatest exposure is to Union Pacific Corp (UNP), accounting for 4.33% of its weighting. And this is where we can start to get some insight into the performance of the fund. Year to date, Union Pacific has seen its share price jump 12.2%. But over the past month, shares are up a whopping 12.7%. This is interesting because the actual fundamental performance achieved by the company has been somewhat disappointing. For the first nine months of this year, revenue was down 3.6%. Profits were down a rather significant 11.8%. We have, unfortunately, seen a lot of weakness in this market. Total combined carloads and intermodal traffic in the US, for instance, happen to be down about 3% for the first 49 weeks of this year. But we are seeing some improvements. In the most recent week for which data is available, total US traffic was up 0.1% year over year. Intermodal traffic is still experiencing a lot of weakness, coming in down 5.8% compared to the same time last year. But carload traffic is up a rather robust 1.7%. This shows that the weakness seen earlier in the year might be finally letting up. And the market clearly thinks this trend will continue.

Association of American Railroads

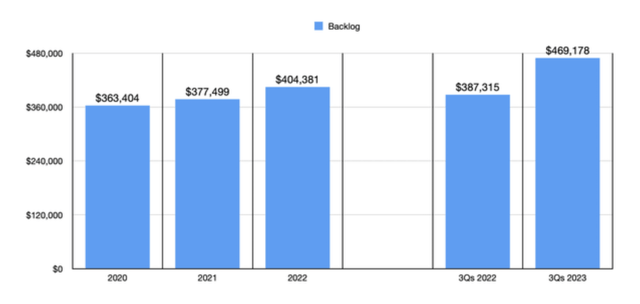

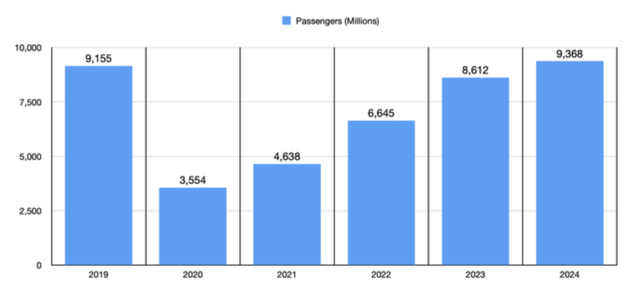

Next in line, we have The Boeing Company (BA) at 4.30%. Shares of it have been up a rather impressive 28.4% so far this year. But in the past month alone, the upside has been 22.1%. For starters, additional orders have been coming in, which has fueled the backlog for the company. In the third quarter of 2022, the backlog totaled $387.3 billion. It rose to $404.4 billion by the end of last year before climbing further to $469.2 billion as of the end of the most recent quarter. The company recently received an order for 40 jets, so the backlog is likely to rise even further from here. Second, air travel is growing rapidly. Globally, 2019 saw 9.16 billion passenger flights. This number plummeted to 3.55 billion in 2020. That was driven by the COVID-19 pandemic. This year, we are targeting 8.61 billion flights. And next year, the current forecast is for us to eclipse what we saw in 2019, with 9.37 billion. Naturally, this would cause an increase in demand for the airline industry, especially when you consider that there have been years of weakness when orders have been low.

Author – SEC EDGAR Data

Author – Airports Council International

Number three on the list is Honeywell International (HON), making up 4.08% of total holdings. Unlike the other two firms that we have discussed so far, Honeywell International is quite diverse in the operations that it has. But there really have been two primary drivers behind the 8.8% increase in price that shares experienced in the past month. There’s optimism, once again, about the aerospace angle. This is a rather significant portion of the company, accounting for 36.6% of revenue and for 42.6% of profits for the first nine months of 2023. Revenue was up 15.4% year over year while profits were up 16.1%. Again, a strong market in the aviation space has been a driver of this expansion.

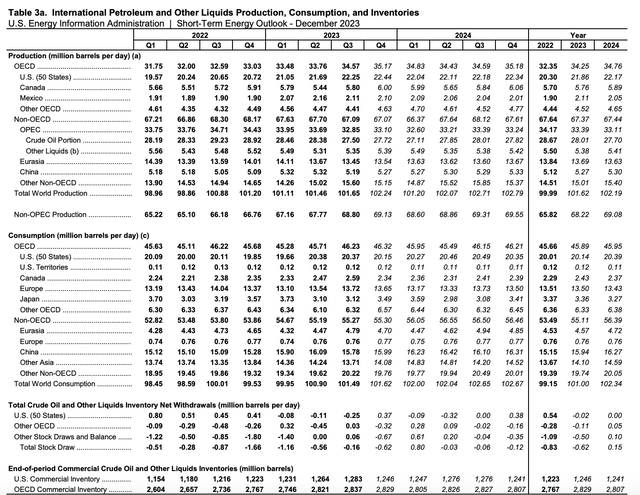

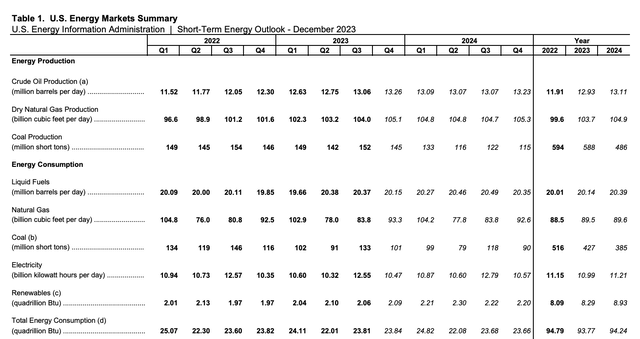

EIA

In addition to this, the company also has a rather significant segment called Performance Materials and Technologies. It is responsible for many different things, including producing chemicals and materials that can be used in various process industries like oil and gas, power generation, the production of biofuels, refining, and more. Revenue for the segment for the first nine months of this year is up 7.8% compared to the same time last year. And profits are up 5.5%. Likely driving this is strength in the energy markets. This year, global oil demand is expected to be about 101 million barrels per day. That’s up from the 99.15 million barrels per day consumed last year. Next year, we should see a further increase to 102.34 million barrels per day. In fact, if the current forecasts by the EIA (Energy Information Administration) are accurate, there should be a supply shortage next year of 0.15 million barrels per day, which would result in inventories declining by nearly 55 million barrels globally. This should increase the demand and value of the goods and services that Honeywell International offers through the aforementioned segment. But that’s not all. US energy consumption for natural gas, renewable energy, and liquids as a group should all increase year over year in 2024. Electricity consumption is also expected to grow nicely.

EIA

The next company that we need to cover is Caterpillar (CAT). Year to date, shares are up 9.4%. But in the past month alone, they have jumped 11%. So far this year, revenue for the company has spiked 16.7%, while net profits are up 45.9%. The company benefited on the top line to the tune of $4.61 billion from price increases that it placed on its products. But even with those price increases, demand for the equipment that it produces for the energy industry, other natural resource extraction, and more, resulted in increased volumes pushing revenue up another $2.70 billion. Management even said that dealer inventories have been rising. For the first nine months of this year, they increased by $2.9 billion compared to the $1.6 billion increase seen one year earlier.

Author – SEC EDGAR Data

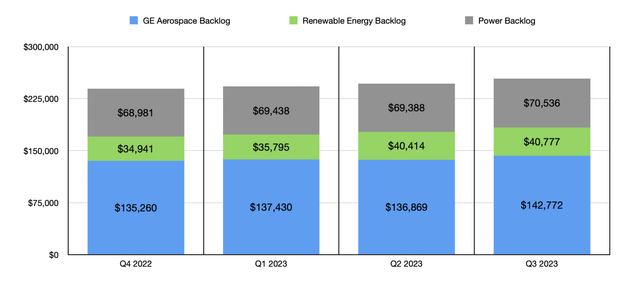

And lastly, we have General Electric (GE). It accounts for 4.06% of the fund. Shares of it are outperforming almost everything in the market right now. Year to date, the stock is up 82.7%. In the past month, the return was much smaller at only 5.2%. There are a few different drivers behind this in my view. For starters, the market is probably getting excited about the spinoff of GE Vernova, the Power and Renewable Energy assets of the company into a separate publicly traded firm. That should happen early next year. That will leave GE Aerospace, which focuses on the production of jet engines like the GE9X and the LEAP, as the main entity that we know today as General Electric. Financial performance for the aerospace portion of the company has been incredibly robust this year. For the first nine months of the year, revenue associated with this portion of the company jumped 26.7%, while profits rose by 35.2%. For the company as a whole, revenue climbed 17.6% while the firm went from generating a net loss of $2.05 billion to generating a profit of $7.59 billion. And backlog for the enterprise has grown from $238.69 billion as of the end of last year to $253.09 billion during the most recent quarter.

I could keep going down the list for the 77 different holdings that make up the XLI, but I think you get the point. Even though technology is often where the growth opportunities are, many of the industrial firms that comprise the XLI have experienced attractive growth in recent quarters. The market clearly has been worried about the prospect of interest rates continuing to increase in order to combat stubbornly high inflation. But when you look at recent economic data and statements by the Federal Reserve, it is clear that the worst is now behind us. As to whether or not these stocks will continue to rise, nobody knows for sure. What I will say is that shares don’t look the cheapest. The weighted average price-to-book ratio of the fund right now is 4.81. The companies in it are trading at a weighted average price-to-earnings multiple of 19.4 and at a weighted average price-to-cash flow multiple of 15.7. I could not find additional data for the price-to-cash flow multiple. But I do know that, from early 2016 through today, the price-to-earnings multiple for the XLI has ranged between 18.9 and 29.4, while the price-to-book multiple has ranged between 3.55 and 5.31. So we do seem to be at least within the historical range.

Takeaway

Based on the data currently available, it seems to me as though industrial stocks are finally coming alive. Many of these firms have actually been performing well fundamentally for some time now. However, the market has been concerned up to this point about their potential to continue on that path in light of potential economic distress. With that picture now looking significantly better, those who own stocks in the XLI have been rewarded handsomely. I don’t see any data that indicates that prices are yet to the point of being overvalued. Given that we are looking at figures that are within the historical range, I would say that we are no worse off than fairly valued. But of course, investors can always use the XLI as a jumping-off point in order to find individual companies if they choose not to acquire the fund itself. Personally, I am rating XLI a soft ‘buy’ because of the impact I think that falling interest rates will have on the space.