YINN ETF: Even Contrarians Should Avoid This Trap (NYSEARCA:YINN)

Ronichua

In recent months, I have been bullish on emerging markets (“EM”) stocks due to their low valuations. We are bullish on Chinese stocks because China is almost by default a large weight in emerging market indices. Does that mean you have to do it? Direxion Daily FTSE China Bull 3X Shares ETF(NYSEARCA:YINN)?

The short answer is no.

Leveraged ETFs are only suitable for short-term trading.

A more nuanced answer is that leveraged ETFs like YINN only provide advertising exposure over very short time horizons. The YINN ETF offers 3x the daily return of the FTSE China 50 Index (the “Index”), the same index that underlies the iShares China Large-Cap ETF (FXI).

If an investor holds a leveraged ETF like YINN for more than 1 day, positive convexity and volatility collapse may occur. Serious tracking errors occur.

For example, last year the YINN ETF returned -74.4%, which is three times better than the -29.5% return of the FXI ETF (losing less money than expected) (Figure 1). Positive convexity is the main reason why YINN’s losses have been smaller than expected, as the YINN ETF’s exposure has become exponentially smaller over time due to ongoing losses in the underlying index.

Figure 1 – YINN has large tracking error. (Look for alpha)

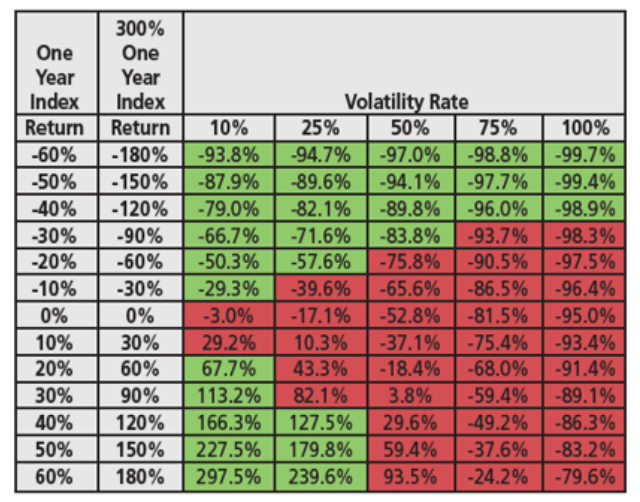

In fact, the past year has been notable in that the FXI ETF has declined essentially in a straight line. However, in most years, volatility collapse will eat into YINN’s returns. The more volatile the underlying index returns, the more likely it is that they will miss expectations (Figure 2).

Figure 2 – Theoretical performance of YINN vs. underlying indices considering various volatility (YINN Guide)

Investors interested in learning more about the mechanics of the YINN ETF can read my introductory article written in November 2022 and the warnings from FINRA and the SEC.

Chinese stock sentiment continues to be poor

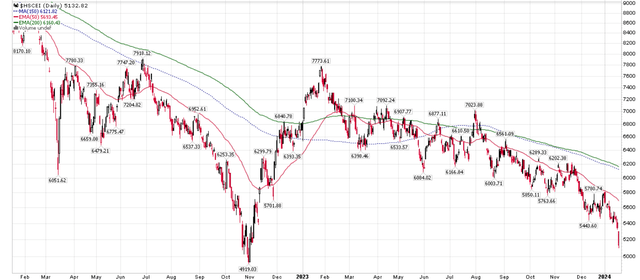

Unfortunately, my optimism about China seems misplaced. The recent slump in Chinese stocks has deepened and the Hang Seng China Enterprises Index already appears to be down more than 10% YTD in less than 15 trading sessions (Figure 3).

Figure 3 – Chinese stock rout deepens (Stockchart.com)

The main reason for the poor performance of Chinese stocks is weak economic data coming out of China. For example, China recently reported GDP growth for the fourth quarter of 2023 at an annualized rate of 5.2%. This GDP growth rate was faster than the 4.9% in the third quarter, but lower than the 5.3% expected by analysts.

Likewise, China’s December retail sales rose 7.4% year-over-year, missing the consensus estimate of 8.0% and slowing from a 10.1% increase in November.

Accelerating population decline

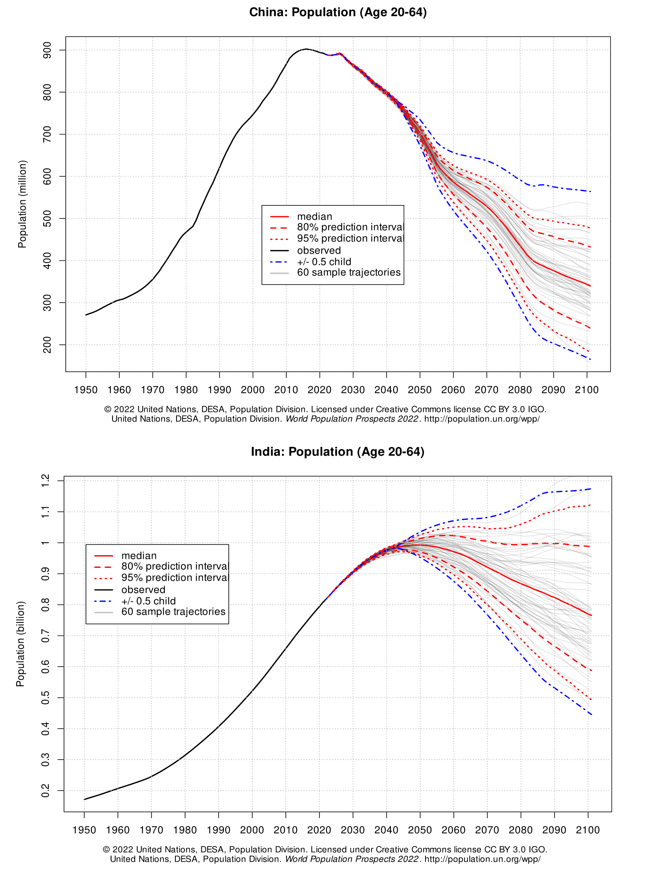

Perhaps the most important macro news about China recently was reports that China’s population has declined for the second year in a row, with record low birth rates and a wave of COVID-19 deaths accelerating the country’s population decline. According to China’s National Bureau of Statistics, China’s population decreased by 2.08 million people (0.15%) in 2023, compared to a decrease of 850,000 people in 2022.

As I wrote in an article about the iShares MSCI India ETF (INDA) over a year ago, China’s population has peaked and is likely to decline over the next few years (Figure 4).

Figure 4 – China’s population has peaked and is expected to decline over the next few decades. (un.org)

The implications for China’s rapidly aging and declining population are far-reaching. First, China will likely cease to be the world’s factory in the coming years as its working-age population declines and companies shift production elsewhere due to geopolitical concerns. This will lead to structural inflation around the world.

More importantly, China’s population is aging before it gets richer. Given China’s weak social safety net, many Chinese older people will not have adequate access to healthcare or pensions. Population decline will further worsen China’s housing problem by reducing demand for new homes. Finally, older populations are generally more risk averse and prone to deflation.

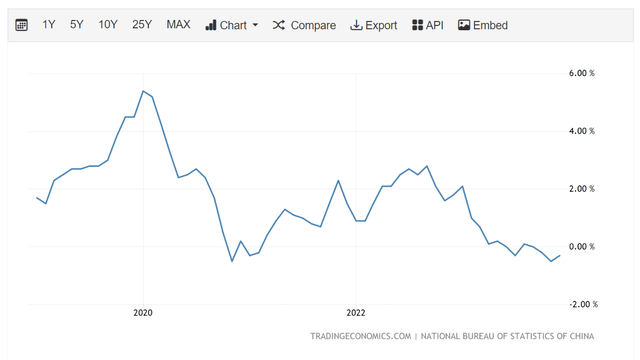

Unlike other worlds fighting inflationChina is currently in crisis. Shrink (Figure 5).

Figure 5 – China is fighting deflation. (tradingeconomics.com)

But valuations argue for a cyclical rebound.

While the long-term outlook for China and Chinese stocks may look bleak (and thus could be a headwind for YINN), investors should not be too discouraged. Stocks often reflect future prospects, and when current economic conditions look the worst, they may actually be the best buying opportunities.

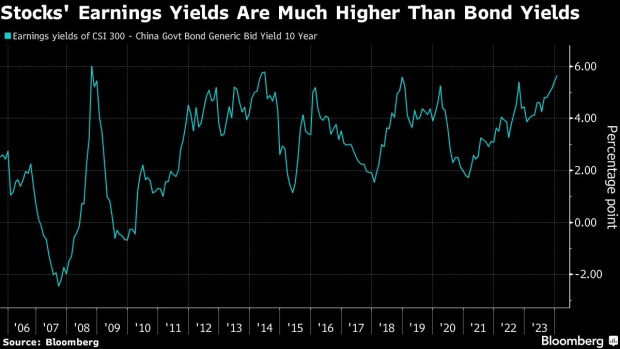

According to a recent Bloomberg article, the current spread between the earnings yields of Chinese stocks and bonds of 5.7% is approaching levels that have historically produced impressive forward returns (Figure 6).

Figure 6 – Chinese stocks are historically cheap. (Bloomberg)

Historically, there have been five instances in 20 years where the stock-bond yield gap has reached more than 5.5%. In each case, Chinese stocks rose, averaging a return of 57% over the subsequent 12 months.

The collapse in volatility has created hesitation about YINN.

However, unless Chinese stocks suddenly rebound and move straight higher in the coming days and weeks, I recommend contrarian investors stay away from the YINN ETF due to the “volatility collapse” I mentioned at the beginning of this article.

For example, if you invested $100 in YINN and the FTSE China 50 index returned 5% on day 1 ($100 x (1+(3 x 5%)) = $115) and -5% on day 2, the investor is left . That’s only $97.75 ($115 x (1 + (3

The timing of a potential Chinese stock rally is very uncertain and likely to fluctuate a lot, so I fear the volatility will erode a lot of potential gains.

Instead, I prefer to hold well-managed, unlevered funds that: Templeton Dragon Fund (TDF) The final rally of Chinese stocks is underway.

conclusion

Given the underperformance of Chinese stocks, investors may be tempted to try a contrarian using the Direxion Daily FTSE China Bull 3x Shares ETF. However, I strongly advise against this action.

YINN ETF is a leveraged ETF that experiences volatility extinction if held for a long period of time. The timing and path of a potential Chinese stock rally are highly uncertain, so investors could suffer large leverage losses in the meantime. For contrarian investors, we believe it may be safer to bet on mean reversion in Chinese stocks using unlevered funds such as the Templeton Dragon Fund or passive ETFs.