ZoomInfo Stock: Sell Rating (NASDAQ:ZI) due to weak growth and expensive valuation.

Luis Alvarez

Investment summary

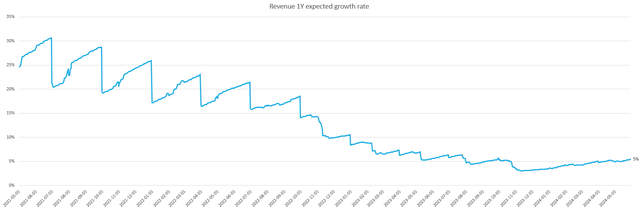

My Recommendations for ZoomInfo Technologies (NASDAQ:ZI) is rated Sell because we have a negative outlook for near-term growth due to the macro environment causing slowing growth. Relative evaluation of ZI We don’t think this makes sense, as it would also be costly for other peers facing similar growth weaknesses. As ZI’s growth continues to be weak, its valuation is expected to be further adjusted downward to the level of its peers.

business overview

ZI is a leading go-to-market platform provider that helps sales and marketing professionals better understand their customers and prospects. Essentially, businesses can use ZI’s platform to retrieve personal contact information and company profiles to connect with them. In other words, ZI helps with lead generation and marketing research. By segment, ZI reports subscription revenue (99% of total revenue) and the remainder as usage-based revenue and other revenue. In terms of geography, ZI serves all over the world. customers, but the majority of its revenue comes from the US (87% in FY23).

afternoon

1st quarter 2024 performance update

We provide a brief update on ZI’s latest financial information released on the 7th.Day In May, ZI reported total revenue of $310.1 million (3.1% growth) for the first quarter of 2024, down from 5% growth in the fourth quarter of 2023. Gross profit margin increased 20 bps to 89.9%, and non-GAAP operating margin increased 90 bps to 38.5%. However, due to the decrease in tax benefits in 1Q24, EPS was flat at $0.27 and $0.25 compared to 1Q23. ZI ended the quarter with total debt of $1.23 billion and cash (including STI) of approximately $440 million, resulting in a net debt balance of approximately $791 million.

Very negative outlook for ZI

I have a negative outlook on ZI as the macro conditions remain unfavorable for the company. At a high level, the lack of employment capacity in the U.S. economy will continue to strain ZI’s ability to re-accelerate growth. There are two main indicators that prove my point. Job postings fell to a three-year low in March, and large tech companies (with over 30% exposure, as ZI noted in its 2Q23 earnings call) continued to reduce hiring in 2024. It is not an indicator of a future recovery.

The dominant bullish case is that the Fed will cut interest rates, which will spur a macro recovery and lead to more hiring as companies have a lower cost of capital. However, I think the bull case is gradually losing ground over the medium to long term.

- Inflation rates turned out to be much higher than expected.

- The U.S. housing shortage is unlikely to be resolved in the near term. If interest rates fall (i.e. mortgage rates fall, which increases demand for housing, which will cause the CPI to continue to rise), the CPI will rise.

- The U.S. economy remains strong, which gives the Fed little reason to cut interest rates.

Renewal rates clearly show the pressure on ZI’s customer base. In the 4Q23 and 1Q24 quarters (a typical renewal season), ZI retained only approximately 85 (1Q24) to 87% (4Q23) of its multi-year and SMB renewals on a net revenue retention basis. This shows that customers are either massively downsizing or moving away from the ZI platform. Neither is positive. At the micro level, the situation has clearly not improved. At a recent technology conference held just 10 days ago, executives pointed to continued noise and volatility in the SMB sector and that hiring is not universally returning.

Our SMB business continued to struggle in the quarter with respect to maintaining net revenue and performed worse than the prior period. Announcement of performance for the first quarter of 2024

We do not see any tangible catalysts that could turn things around in the near term for this set of customer base (i.e., NRR for this customer base is likely to remain in the ~85-87% range). There was a lot of pressure on ZI to find new customers to hit its FY24 guidance (implied revenue growth of 1.6% at the midpoint).

ZI’s relative valuation is expensive.

Redfox Capital Ideas Redfox Capital Ideas

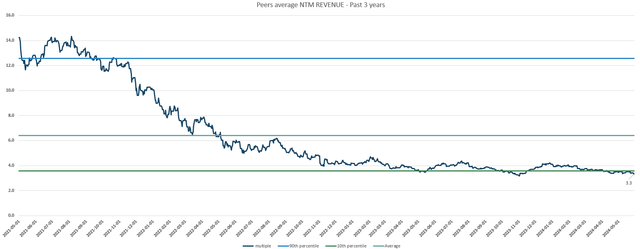

The main reason I give ZI a Sell rating is because it is overpriced compared to its peers (which are exposed to macro recruiting strength). These peers include TechTarget, Definitive Healthcare, Dropbox, Five9 Inc., Dun & Bradstreet Holdings, Zoom Video Communication, RingCentral, Twilio, and Robert Half Inc. The reason we use this peer set is because we all expect growth. It is expected to slow down (per the chart below) and trade at approximately 3.3x next 12 months (NTM) earnings, with ~5% NTM earnings growth. On the other hand, ZI, which is expected to grow in the low single digits (FY24 guidance implies 1.6%), is trading at a 32% premium (4.4x forward earnings) to its peers, which doesn’t make sense to me. .

I think they’re pricing at a premium because the market is anticipating rate cuts in the coming months that will reignite ZI’s growth. But I don’t think that will happen. As ZI continues to report lackluster results, I expect its valuation to fall back to where its peers are trading today (or even lower, given its lower expected growth). The market did something like this when ZI announced its 1Q24 results. Valuation fell 30% from ~6x to 4.2x. Assume ZI trades at 3.3x (FY24 sales), in line with its peers, from its current 4.4x. This equates to an enterprise value of ~$4.16 billion, which equates to a market capitalization of ~$3.4 billion (target stock price for fiscal 2024). (about $9).

danger

ZI’s CoPilot product could fuel more growth than expected. This is an AI-powered product that leverages GTM data to provide merchants with insights and automate workflows. I think this product has a very strong value proposition. On average, users reduced the time they spent on account research and manual tasks by 10 hours per week, and Copilot users created nearly twice as many opportunities compared to non-users. As a result, ZI was able to see strong upsell traction and leverage this to reach customers where previously it was not possible.

conclusion

My view on ZI is a sell rating given its weak growth prospects and relatively high valuation. Current macroeconomic conditions, particularly the lack of employment in the United States, will continue to strain ZI’s ability to reaccelerate growth. This is evident in declining renewal rates and recent comments from management. Additionally, ZI’s valuation is expensive compared to peers facing similar headwinds. Considering the risk of further valuation decline, we recommend a Sell investment opinion.