5 million long-term holders signal major market changes.

According to a recent report by IntoTheBlock: exposed The number of long-term holders of the Litecoin (LTC) network has surpassed 5 million. This achievement accounts for approximately 62.5% of all LTC addresses and highlights Litecoin’s widespread adoption and long-term viability within the cryptocurrency community.

An upward long-term holder trend indicates optimism.

The surge in long-term holders has been particularly noticeable in recent months, indicating a growing tendency to hold LTC for long periods of time. The number of long-term holders soared to 170,000 at the February deadline alone, indicating strong investor confidence in Litecoin’s long-term prospects.

As the number of long-term holders has rapidly increased, the number of individuals holding LTC for more than a year has also steadily increased, now reaching a total of 2.54 million addresses. In addition to the numerical growth, the profitability of holding LTC for a long period of time adds another dimension of interest.

Litecoin’s Amazing Milestone!

💎The network currently has over 5 million long-term holders. $LTC.

👉This figure represents 62.5% of all Litecoin addresses with balances. pic.twitter.com/K5FHz3Ivjs— IntoTheBlock (@intotheblock) April 12, 2024

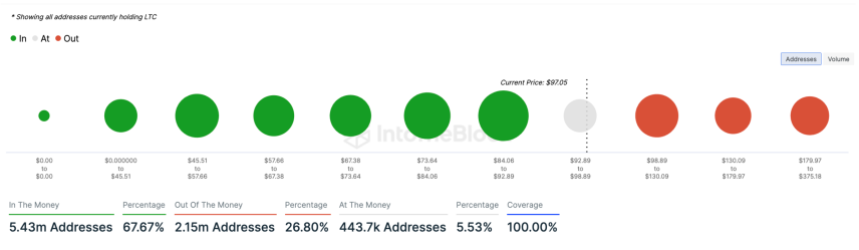

According to on-chain data, approximately 67.67% of all LTC addresses are currently profitable and hold a total of 49.76 million LTC. On the other hand, approximately 26.8% of LTC holders, or a total of 2.15 million addresses, are currently suffering losses.

Meanwhile, the smaller segment, which makes up 5.53% of holders, is positioned to break even, meaning neither loss nor profit.

Bullish sentiment surrounding Litecoin amid rumors of ETF approval

until now, Litecoin has shown relatively steady movements, with a slight decline of 0.1% over the past 24 hours, after rising slightly by 0.3% last week. At the time of writing, LTC is trading at $96.72.

Despite the altcoin’s current price stability, analysts such as World of Charts predict that the price is likely to surge in the coming months, possibly reaching $400. This bullish momentum has been fueled by increased institutional interest, particularly rumors of a potential LTC exchange-traded fund (ETF).

Fox Business journalist Eleanor Terrett hinted at an institutional conspiracy against a Litecoin ETF, citing LTC’s functional similarities to Bitcoin as a potential factor in its approval by the U.S. Securities and Exchange Commission (SEC).

🚨SCOOP (with fixed ticker) 🙂: We’re hearing some institutional buzz that there may be interest in a Litecoin ETF. The logic is as follows: $LTC functional similarities $BTC, @SECGov You may be more inclined to approve, perhaps even more so. $ETH.

last week… https://t.co/nsrhE87OLm

— Eleanor Terrett (@EleanorTerrett) March 26, 2024

Additionally, the recent launch of Litecoin futures contracts by Coinbase Derivatives is further contributing to the buzz surrounding the cryptocurrency.

Renowned cryptocurrency analyst Luke Martin echoed this sentiment, suggesting that the approval of the Ethereum ETF could pave the way for other “old altcoins” like Litecoin to receive regulatory approval. Martin highlights that LTC and Dogecoin may have a stronger case for not being classified as securities, especially when compared to Ethereum.

Featured image by Unsplash, chart by TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.