Allianz: 4 more upside (OTCMKTS:ALIZF)

Sineberg

Following our analysis of Zurich Insurance Group, we revisit Allianz’s stock story and raise our Buy rating target on (OTCPK:ALIZF, OTCPK:ALIZY) thanks to its potential for further price upside. Our Allianz investment is supported 1) With “Attractive and Predictable Dividends” Development, 2) valuation supported by the PIMCO division (a world leader in asset management), 3) lower expense ratios and higher reinvestment returns due to the evolution of interest rates. This year, our institute has already published an analysis of the company’s first quarter (a sure start) and second quarter results (Solid numbers and solvency strength). For this reason, we will be providing a brief update to our readers in the third quarter, but more importantly, we have decided to update a follow-up note with four additional supporting points.

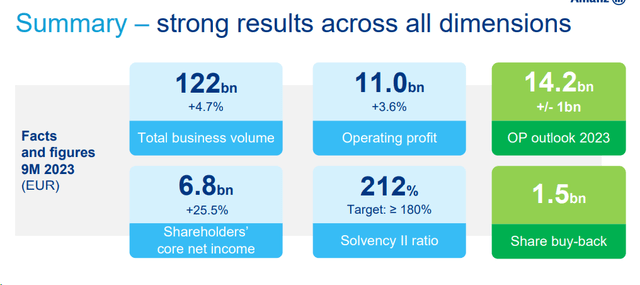

Noteworthy areas. In the third quarter, the German insurer reported a 29.5% decline in net profit. A profit of 2.02 billion euros. This is primarily due to higher claims resulting from natural disasters. Nonetheless, Allianz’s numbers beat analysts’ consensus forecast for net profit of 1.99 billion euros. Operating profit also fell 14.6% to €3.47 billion, while compensation related to natural disasters reached €1.3 billion. Allianz explanation The claim level is “unusually high“Unfortunately, continental Europe was hit by unprecedented flooding and hail storms over the summer. P&C profitability declined from 92.5% in the third quarter of 2022 to 96.2% this quarter. Despite this, Allianz maintained its 2023 targets. Our company According to the company, taking losses into account, Allianz’s operating profit was 8% higher than expected. We were impressed by an 11% increase in non-life insurance revenue and asset management flows amounting to €10 billion. Solvency II ratio increased by 212% compared to 208. .% for the second quarter of 2023.

Allianz Q3 financial status and outlook

Source: Allianz Q3 Results Presentation

Why do we support?

In its Inside Allianz series presentation, the company showcased three units with strengths in each area. We also reported positive views on Allianz’s M&A options and IFRS regulatory framework.

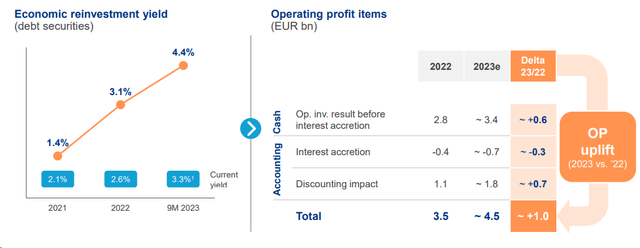

- (IFRS on the rise) Starting with the latter, as already reported in Zurich through the following analysis. IFRS 17 may offer some positive aspects., we also believe that Allianz will benefit from the IFRS 17 discount. IFRS 17 means that the charges included in the combined ratio calculation must be reduced accordingly. Specifically, the present value of the claim must be less than its final cost. This high uncertainty results in a discount being deducted from insurance investment returns. The Institute believes that this new regulatory framework will be detrimental to the valuation of non-life insurers. Nonetheless, combined rates will be reported after discounting future claims, and Allianz is increasing the prices of its insurance product portfolio. For this reason, the company has confirmed a combined ratio of 93% in 2023 and 92% as a mid-term outlook. The company provided an update in its recent Inside Allianz series presentation, reducing the combined ratio by 2.6 basis points despite higher discounts going forward (Figure 1). However, this did not lead to a decrease in operating profit. Instead, there may be further upside. As interest rates begin to slow, billing discounts should decrease, increasing Allianz’s profits.

- (Higher pricing activity) Insurance prices are expected to increase by an average of 10% through the third quarter and Allianz’s recent presentation. This is also supported from an IFRS 17 perspective, where pricing activity is currently accelerating to offset discount dilution.

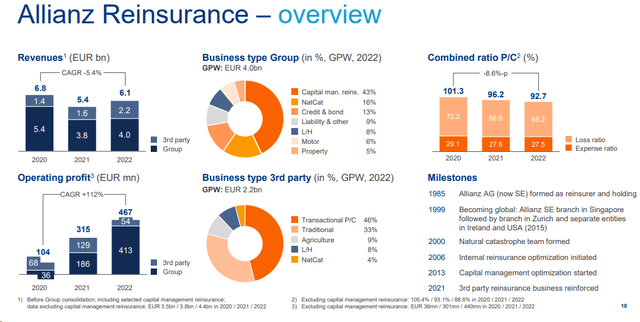

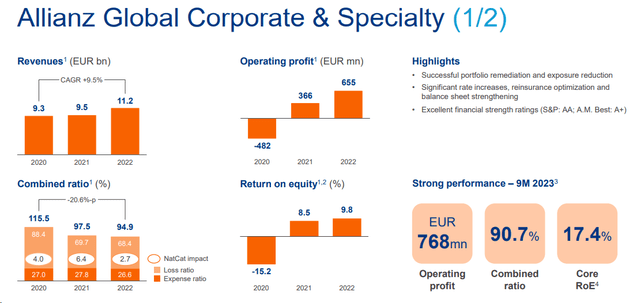

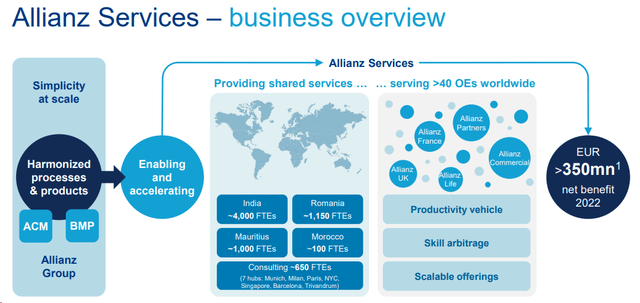

- (Higher savings and synergies) Looking at three units with upside potential, we note 1) Allianz RE development (Figure 2), 2) Allianz Commercial’s AGCS formation (Figure 3), and 3) Allianz Services evolution (Figure 4). Operating profit of existing business units is expected to increase by 50%. The division aims to optimize Allianz’s capital allocation through internal reinsurance. Nonetheless, Allianz Re is also leveraging external third-party reinsurance to increase its operating profit by €150 million. AGCS also aims to increase core operating profit from 100 million euros on the back of increased sales. The latter, Allianz Services, increased its efficiency savings to more than $350 million by 2025, according to an Allianz Series presentation. According to our estimates, savings will reach €500 million by 2025, up from €150 million more. Therefore, we split our operating profits accordingly.

- (M&A selectivity) In the fourth quarter, Allianz agreed to acquire Tua Assicurazioni from Asicurazioni Generali. This inorganic acquisition has a total value of EUR 280 million. Tua Assicurazioni’s premium portfolio is 60% based on car policies and is distributed through a network of approximately 500 agents. Regulatory approval is expected in early 2024. Allianz’s market share in the P&C insurance market is expected to increase by approximately 1% to 11%, solidifying its third position in Italy.

Allianz discount upside potential

Source: Allianz Inside Series Presentation – Figure 1

Allianz RE Third Party Upside

Figure 2

AGCS update

Figure 3

Allianz service savings

Figure 4

Conclusion and Evaluation

Our core operating profit for the year was set at €14.6 billion, slightly below consensus expectations of €14.7 billion. Taking into account the company’s supportive revenue growth, we have decided to raise our 2024 outlook to an operating profit of approximately €15.5 billion, reaching our 2024 EPS estimate of €28.5 billion. Allianz is trading at 8.8x 2024 P/E (8.3x 2025 P/E), 10x below its five-year historical average. We have therefore increased our Buy rating target from €235 to €285 per share ($30.50 in ADR), based on an unchanged 10x P/E multiple. Downside risks include credit rating downgrades, increased earnings volatility from expensive M&A transactions, increased leverage, and a lower-than-expected Solvency II evolution. The second quarter update includes additional risks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.