GE Aerospace stock has 19% upside, according to one Wall Street analyst.

The growth of the new company is just beginning.

GE Aerospace (GE 1.22%) The stock has performed very well since becoming a separate company. all barclays The analyst recently set a $175 price target and an “Overweight” rating on the stock, indicating an upside of nearly 19% for the next 12 months.

GE Aerospace’s Optimistic Case

Analysts are optimistic about GE Aerospace’s long-term earnings growth and cash generation potential. The aircraft engine business model involves selling the engines initially at a loss and then generating profitable aftermarket revenue for decades, especially through custom service agreements (CSAs). It takes time for an engine to become sufficiently utilized to require maintenance and inspection. Therefore, there may be a period when aggressively increasing engine production will create margin pressure and aftermarket revenues for legacy engines will begin to slow.

That’s why CEO Larry Culp told investors that guidance for 2024 operating profit of $6 billion to $6.5 billion “implies flat margins year-over-year when factoring in the growth of LEAP, initial 9X shipments of the 777X platform and other growth investments.” . ” LEAP Engine is the only engine option for LEAP Engine. boeing 737 MAX, Comac C919 and one of two options airbus A320 Neo Family.

The good news is that new engines mean new aftermarket revenue going forward. Barclays analysts see significant opportunity for margin expansion going forward as lucrative aftermarket revenues take off.

I agree with that assessment and point out two things. First, every new engine delivered (GE plans to increase LEAP supply by 20 to 25 percent in 2024, following a 38 percent increase in 2023) is negative for short-term profit margins but builds long-term value. Therefore, the negative engine margin pressure must be: welcome.

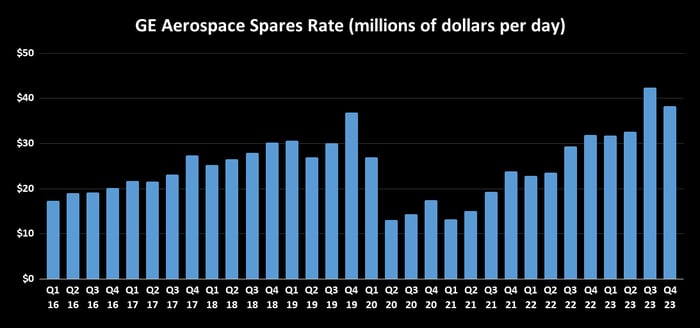

Second, GE Aerospace continues to see strong growth in spare parts sales.

Data source: GE Aerospace presentation. Chart by author.

Continued growth in spare parts sales will help offset margin pressure from higher engine deliveries in 2024. There will likely be substantial margin expansion in a few years when LEAP aftermarket sales begin to pick up and engine deliveries begin to slow. opportunity.

Isamaha does not have any positions in these stocks. The Motley Fool recommends Barclays Plc. The Motley Fool has a disclosure policy.