DXJ: A Great Fund at a Bad Price (NYSEARCA:DXJ)

rzelich/E+ via Getty Images

japanese stocks It has been one of the best investments outside the United States in recent years. WisdomTree Japan Hedged Equity Fund ETF (NYSEARCA:DXJ) Provides exposure without worrying about the yen Movement and expensive fences.

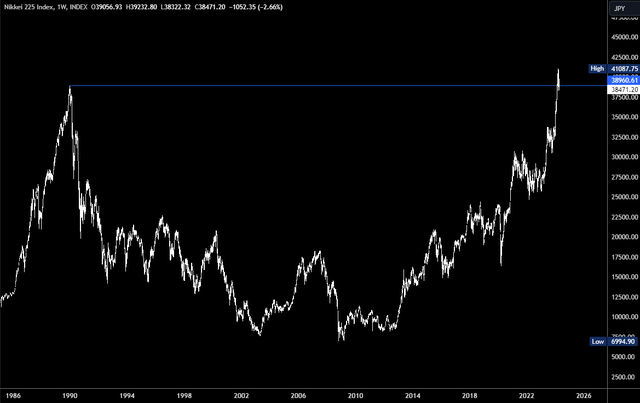

But all good things come to an end, or at least stop for a while. Japanese stocks are currently facing tremendous resistance, with the Nikkei index hitting its highest level since 1989. DXJ may have trouble maintaining gains.

DXJ Overview

DXJ is a passively managed ETF with AUM of $4.19 billion and average daily dollar volume of $99 million. According to the fund’s page, DXJ “seeks to provide exposure to the Japanese stock market while hedging risk against fluctuations between the U.S. dollar and the yen.”

This time, the yen fell -8.81% against the US dollar. As it is a volatile currency, the added hedging is a welcome addition, although it does add costs. For that matter, the expense ratio is 0.48%, which is high for a passive ETF, but not prohibitively high.

The indices are very complex, but they are structured around a rules-based methodology that can be summarized as follows:

The index consists of dividend-paying companies incorporated in Japan and traded on the Tokyo Stock Exchange, with less than 80% of their revenue coming from Japanese sources. By excluding companies that generate more than 80% of their revenue in Japan, the index is biased toward companies with a more important global revenue base.

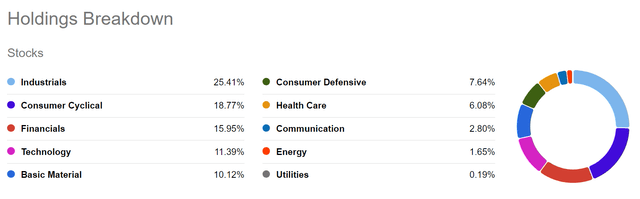

Industrials feature highly in the sector breakdown, which is a departure from technology-focused ETFs in the US.

retention history (Look for alpha)

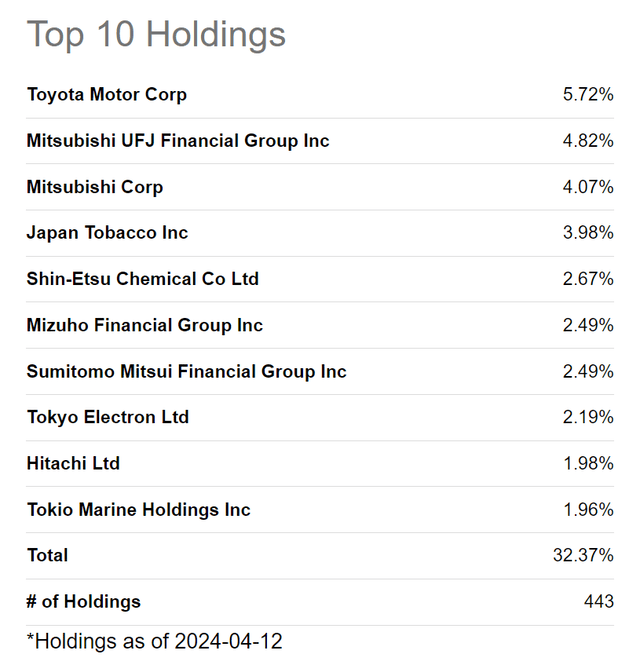

The top 10 holdings are:

Top 10 Holdings (Look for alpha)

The portfolio is well-diversified. The top 10 holdings make up 32% of the portfolio, which is lower than many other funds. The fund also holds 443 stocks.

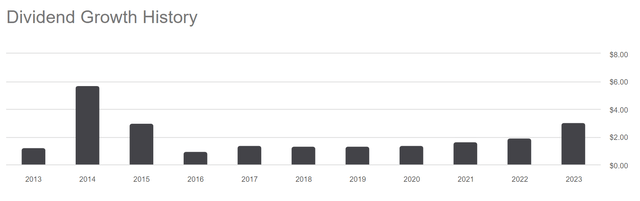

Dividends are paid quarterly at 2.5%, which has been increasing every year since 2019.

Dividend growth history (Look for alpha)

DXJ Performance

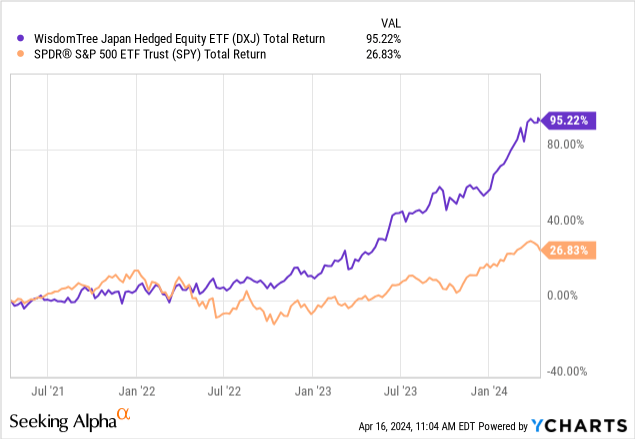

The rest of the world has generally underperformed U.S. stocks and the S&P 500 (SPY). But that hasn’t been the case in Japan or DXJ, at least for the past three years.

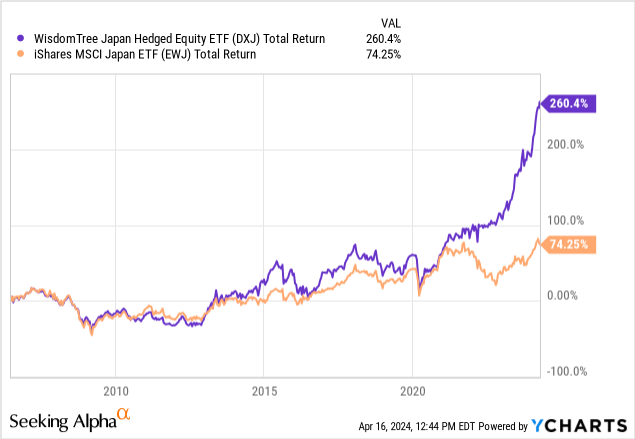

Much of this outstanding performance can be attributed to the collapse of the yen. When comparing DXJ to similar unhedged funds such as the iShares MSCI Japan ETF (EWJ), the differences are significant. Note the correlation and similar returns between the two funds until the end of 2021 when the yen collapses.

To be clear, USD:JPY is up about 50% since its 2020 lows. Big move in terms of currency.

USDJPY Chart (Trading View)

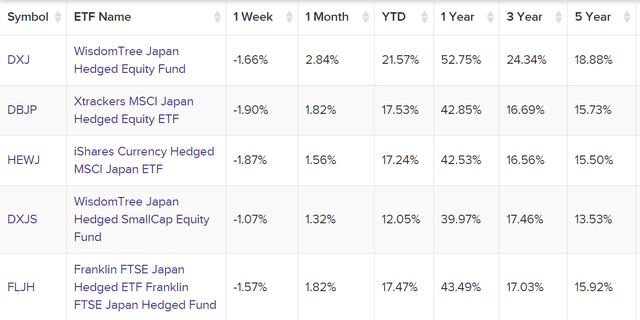

The plunge in the yen is a major tailwind for DXJ, but even without this, its performance is impressive. There are five different currency hedged ETFs that focus on Japan, and DXJ has been the best performer in almost every time period.

Currency Hedged ETFs (ETFdb.com)

3 reasons to be careful

DXJ has performed well and has all the characteristics of a good fund, but there are three reasons to be cautious and perhaps wait for a better entry.

- One of the reasons for the big rally in Japanese stocks comes from retail buying (and less retail selling). This has been facilitated by an increase in the limits to which Japanese individual investors can invest in tax-free accounts. This is a change aimed at increasing household wealth and encouraging households to invest in riskier assets such as stocks. Although this has had a positive effect in the short term, increased retail purchases are generally a red flag. In fact, the Nikkei 1989 Top Index was formed as an institution distributed to speculative retail investors.

- As already mentioned, the decline in the value of the yen was a big tailwind for DXJ. However, this move appears likely to be prolonged and the Bank of Japan has finally begun to tighten financial conditions. Last month, interest rates were raised for the first time in 17 years, ending the era of negative interest rates. Meanwhile, the Federal Reserve is expected to cut interest rates this year. The differing policies suggest that the USD:JPY rally may lose steam further.

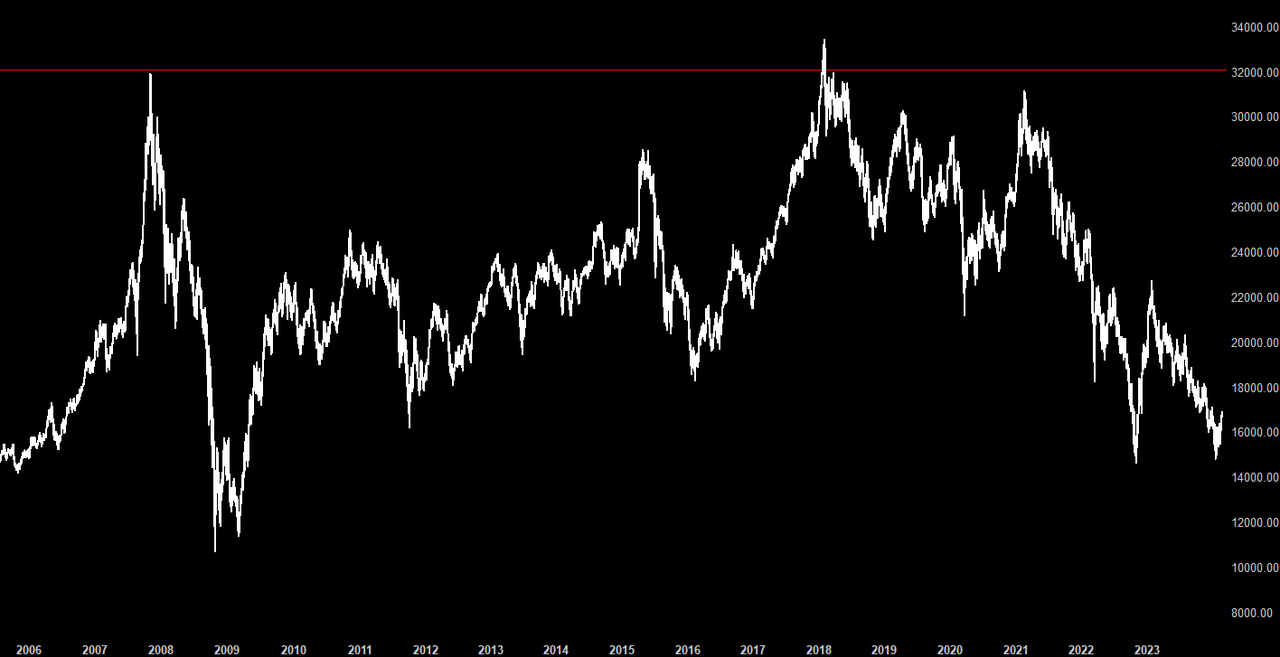

- The Nikkei index has reached its previous high in 1989, which could act as resistance.

Nikkei Chart (Trading View)

After an initial breakout and a surge to 41,087, it has now fallen below its previous high of 38,960 and is currently trading at 38,471.

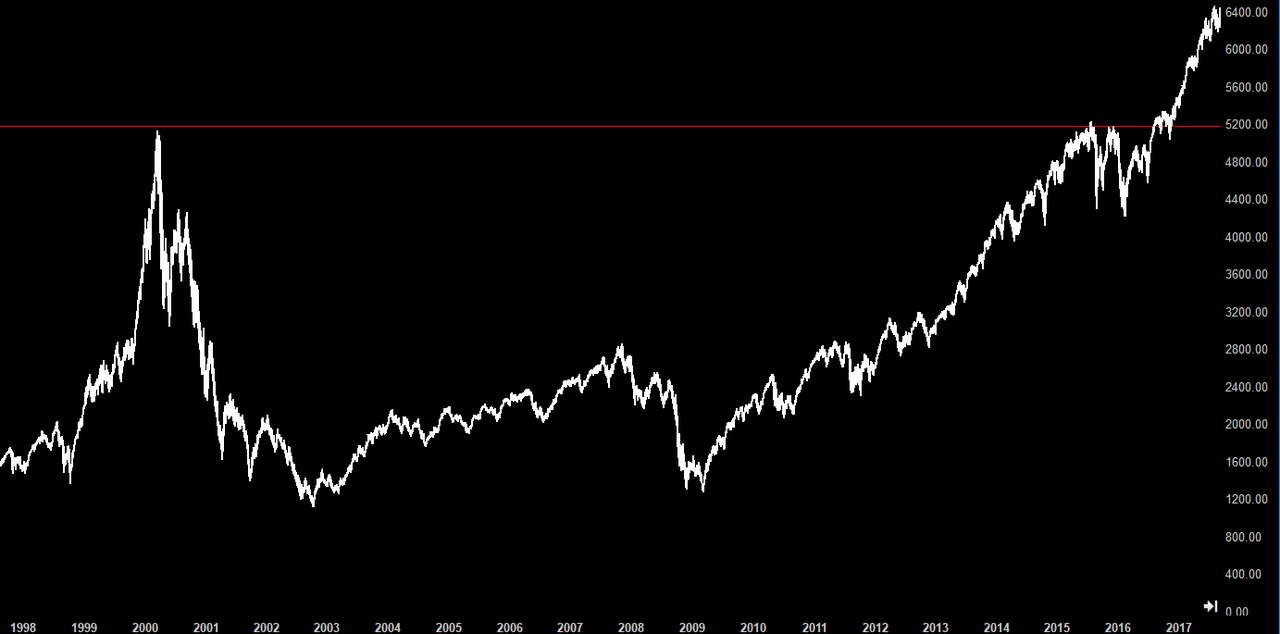

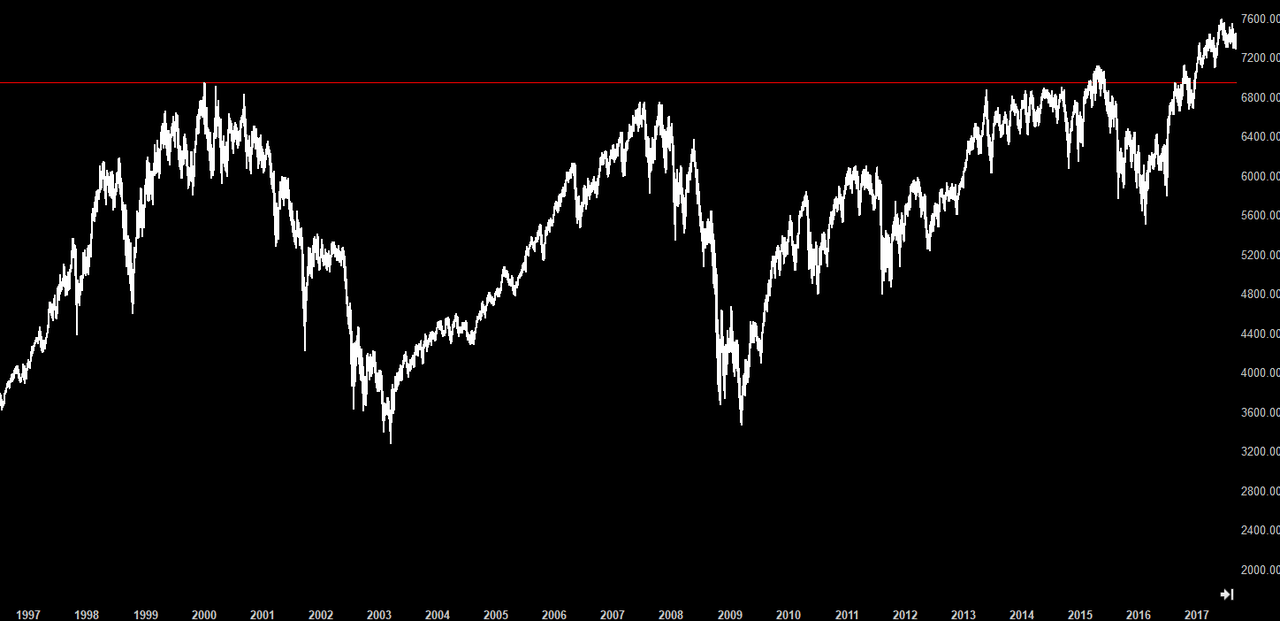

When the stock market returns to previous highs after making low highs for several years, it often has a hard time completely breaking out of those levels. An example comes from the Nasdaq Composite Index (COMP:IND).

Nasdaq Composite Chart (Trading View)

FTSE –

FTSE Chart (Trading View)

And Hang Seng –

Hang Seng Chart (Trading View)

All of these stock markets have experienced varying degrees of decline after failing to hit new all-time highs. Of course, we don’t know if Nikkei will take similar action, but this chart suggests caution.

conclusion

DXJ has all the characteristics of a good fund and its performance is impressive. However, I have reservations about buying at current levels. Japanese stocks could fall due to significant resistance, and the yen’s collapse could begin in earnest. DXJ will be on my shopping list if a major correction occurs, but I won’t be a buyer in the second quarter.

Editor’s note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.