Is Taiwan Semiconductor A Buy After Q1 2024 Earnings Outperformance? (NYSE:TSM)

BING-JHEN HONG

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) valuation has surged more than 50% over the past year. The upsurge’s momentum continues to be buoyed by increasing artificial intelligence, or AI, optimism, which has gradually overshadowed the drag from Apple’s (AAPL) – its largest customer – demand setback.

This is consistent with TSM’s earnings update this morning, which attributed most of its Q1 revenue growth outperformance to strong AI momentum, partially offset by the smartphone seasonality drop-off. Management had also maintained confidence in a strong AI demand outlook, which will be the key compensatory factor to a slower-than-expected recovery in consumer end-markets (e.g., smartphones). This has assuaged concerns over the potential implications of Taiwan’s recent earthquake on TSM’s volumes for the year as well, and reinforced confidence in its AI-driven opportunities ahead.

TSM currently trades at 7.7x estimated sales and 20.8x estimated earnings, which slightly underperforms averages observed across peers with a comparable growth and profitability profile in the Philadelphia Semiconductor Index (SOX). Considering its robust outlook and mission-critical role in enabling next-generation developments in the multi-year AI transformation, we believe TSM continues to present as an attractive risk-reward opportunity at current levels.

Do Not Overlook Near-Term Execution Risks

Admittedly, TSM has had to deal with its fair share of company-specific risks, spanning revenue concentration headaches and being in the center of an ongoing geopolitical crossfire.

Revenue Concentration Risks

Specifically, the slowing demand environment for smartphones worldwide – particularly iPhones – has highlighted revenue concentration risks at TSM, whose largest customer is Apple. Said concerns have likely delayed TSM’s participation in the AI rally, despite owning the technology critical to producing all the world’s most advanced processors.

There is almost all the AI innovators are working with TSMC and we are observing a much higher level of customer interest and engagement at N2 as compared with N3 at a similar stage from both HPC and the smartphone applications.

Source: TSMC 4Q23 Earnings Call Transcript.

And said revenue concentration risks persist. Specifically, the smartphone end-market accounts for 38% of TSM revenues, the second-largest sales contributor for the company after high-performance computing (“HPC”) applications. And management’s latest update expects a slower pace of industry semiconductor demand growth at 10% y/y for 2024, dragged primarily by continued weakness in smartphone recovery. This is consistent with recent data on the -10% y/y slump observed in iPhone sales during Q1, while broader market volumes improved.

However, management has cited TSM’s continued strength in capturing strong AI-related data center demand. Specifically, management has highlighted robust hyperscaler budgets attributable to the transition from traditional CPU servers to accelerated AI servers, which is favorable to TSM’s advanced technology portfolio. This is corroborated by management’s reiterated revenue growth guidance in the low- to mid-20% range for 2024, despite the downward-adjusted outlook on industry semiconductor demand (ex-memory). As such, we expect the stock to remain a beneficiary of emerging AI tailwinds, while underlying fundamentals attributable to consumer-facing end markets gradually recover.

Geographic Concentration Risks

In addition to the adverse impact of concentrated revenue from its largest customer, TSM’s inherently elevated exposure to geopolitical tension due to its concentrated geographic footprint in Taiwan also represents another multiple compression risk. And the latest earthquake in Taiwan brings to light incremental concerns about TSM’s heavily concentrated geographic footprint on the island, which is prone to seismic activity.

TSM currently manufactures almost all the world’s most advanced processors, and commands more than 60% of the global foundries market share. This inadvertently exposes a critical component of the global semiconductor supply chain to significant risks of seismic activity that do not bode favorably for chip manufacturing due to the precision required. The increasingly complex chip designs that go into advanced AI processors, for instance, consist of billions of transistors, whereby a “single vibration can destroy entire batches of the precision-made semiconductors.”

Yet, TSM’s swift recovery and actions taken to mitigate the latest earthquake’s impact continues to cap the multiple compression risks stemming from geographic implications. Specifically, management has confirmed that TSM was able to recover 70% of its operations in the first 10 hours post-earthquake, and has now fully resumed productions with no structural damage to its infrastructure and critical manufacturing tools. While some wafers and processes were impacted, which management expects to result in a 50-bps headwind to Q2 gross margins, TSM is expected to recover all lost production within the quarter with nominal impact to the period’s revenue outlook.

Margin Dilution Risks

For now, navigating margin dilution risks stemming from TSM’s vast technology portfolio remains a priority. Specifically, management has made clear for several quarters that the continued ramp of 3nm production volumes will remain a headwind to gross margins in the near-term.

While it had previously taken 8–10 quarters to ramp the 7nm and 5nm process nodes towards corporate margin levels, management expects an expanded timeline of 10–12 quarters for 3nm to reach the same level of scale. This is mainly due to several reasons – namely, the growth in corporate margins achieved since the 7nm/5nm ramp and the adverse margin profile of the 3nm node. Specifically, management detailed that prices for 3nm node were set years before the start of volume production, and had underestimated the cost pressures that have followed recently. This has resulted in a lower margin profile than previous advanced node developments, hence the extended ramp timeline towards corporate profitability levels.

However, we remain confident in TSM’s 3nm ramp trajectory towards becoming margin accretive to the company’s profitability profile by the end of this year. This is corroborated by 53% gross margins observed in Q1, which remains stable from levels observed in 4Q23 as 3nm volumes continue to ramp.

Meanwhile, management also expects a stronger margin profile for 2nm given improved pricing, supported by strong customer interest and developments already observed for the next-generation process technology. As near-term margin dilution expected from 3nm ramp subside entering 2025, combined with a better margin profile for 2nm output to follow, bottom-line expansion progress is likely to trend very well in line with management’s target for 53%+ long-term gross profitability.

Technological Leadership Remains TSM’s Competitive Advantage

The TSM stock surge this year has been primarily driven by increasing market optimism about its AI opportunities. And this was reinforced during TSM’s latest earnings update, whereby management has attributed much of Q1’s strong performance to continued AI momentum, which is expected to become more prominent in 2H24.

TSM currently produces almost all the world’s most advanced AI processors and their components, given its node leadership. And the continued ramp of advanced 3nm process nodes, alongside next-generation 2nm nodes in 2025 will likely help to drive sustained long-term margin expansion at scale for TSM. This will also be complemented by the company’s ongoing initiatives aimed at optimizing capital efficiency. They include greater utilization of AI to improve operational cost-benefit ratios, as well as the conversion of TSM’s 5nm tools to support the ramp up of 3nm volumes at scale.

More importantly, we view TSM’s technology leadership as a key competitive advantage, especially in the AI-first era. Notably, Intel (INTC) has been working to recapture the crown in chip manufacturing with its “five nodes in four years” product roadmap. And Intel is expecting its upcoming 18A process node – the last of its five nodes in four years roadmap – to be the most advanced chip making technology in the industry when it enters production later this year.

However, TSM management has repeatedly reiterated that its upcoming N3P node will be competitive in performance and cost efficiency in comparison to Intel 18A. The N3P process node, which builds on N3 already ramping since late 2023, is expected to enter volume production later this year as well. Meanwhile, TSM also had previously claimed that N2 will offer better performance than its own N3P process and Intel 18A coming 2025. Instead, TSM suspects that Intel 18A may only be right when applied to its own products – which starts with next-generation client product “Lunar Lake” CPUs and the Xeon “Clearwater Forest” server CPUs.

The comment stays the same, so that they are new is the technology would be very similar or equivalent to TSMC’s N3P. We further check again with all the specs or the possible published in technology, transistor technology and everything. My comment stays the same with a big advantage in the technology maturity. Because of, in 2025, when they say that their newest technology will be go on production. For TSMC, that will be the third year with a very high-volume production in the fabs.

Source: TSMC 4Q23 Earnings Call Transcript.

In addition to an anticipated technology advantage, TSM is also likely to win by capacity. Specifically, Intel’s foundry capacity attributable to 18A is unlikely to be sufficient in addressing both external and in-house demand at early ramp-up when productions start later this year. Admittedly, Intel has only recently disclosed five customers for 18A. But recent industry reports suggest that Intel may not even have sufficient 20A and 18A capacity at initial ramp to address its own needs for the roll-out of next-generation Arrow Lake and Lunar Lake client CPUs, and Clearwater Forest server processors.

This could mean additional outsourced capacity to TSM’s 3nm technology, on top of about $19 billion per year that Intel has likely already committed to, according to estimates from Goldman Sachs. Specifically, recent notes from JPMorgan expect up to $3 billion in additional outsourcing from Intel to TSM in 2025 for its next-generation client CPUs. This is expected to bolster TSM’s 90%+ market share in AI-related processors through the end of the decade, with Intel potentially becoming TSM’s second-largest customer in the longer-term.

And TSM’s capacity advantage is expected to be further reinforced by its continued investments into diversifying its geographic footprint. This is further corroborated by $11.6 billion in grants and loans recently received from the U.S. government to support TSM’s ongoing expansion efforts in Arizona. When relevant volumes come online later in the decade, TSM expects the technological capabilities, quality and capacity at the new fabs to be comparable to those currently exhibited across its Taiwan operations.

Meanwhile, Intel faces continued execution risks pertaining to achieving self-sufficiency in its capital-intensify foundry business, with additional outsourcing likely to weigh on its margins. Although neither of the parties has provided details on the extent of Intel foundry related commitments, the anticipated incremental outsourcing revenue generated from Intel could bolster upside for the TSM stock. The incremental opportunity likely has not been priced into the TSM stock yet, along with existing AI tailwinds.

Fundamental Considerations

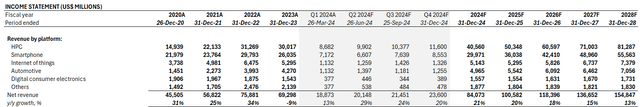

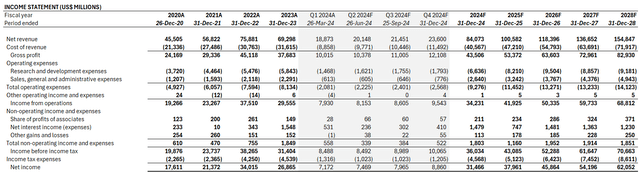

Taken together with consideration of TSM’s latest results and Q2 outlook, we expect revenue to expand at an 11% CAGR through 2033, driven primarily by growth at 12% CAGR over the same period in sales generated from high-performance computing technologies. Specifically, HPC is where we expect the bulk of advanced technologies (i.e., < 7nm nodes) demand will stem from, including AI. This will be additive to TSM’s existing expertise across other verticals, spanning smartphone, internet of things, automotive, and digital consumer electronics applications.

Author

The accretive AI opportunities will also be a tailwind to TSM’s margin expansion trajectory. Specifically, TSM faces near-term pressure on its margins due to higher costs of ramping 3nm and 2nm processes in the next two years, alongside incremental one-time cost headwinds stemming from the conversion of 5nm tools to enable additional 3nm capacity later 2024. However, all of said undertakings are meant to unlock sustained long-term margin expansion opportunities for TSM. This will be key to unlocking pent-up cash flows opportunities, which underpin the stock’s long-term upside potential from current levels.

Author

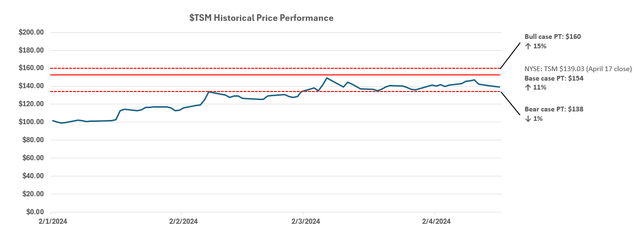

Price Considerations

We are setting a base case price target of $154 on the stock.

Author

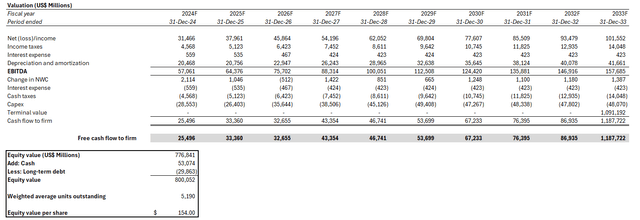

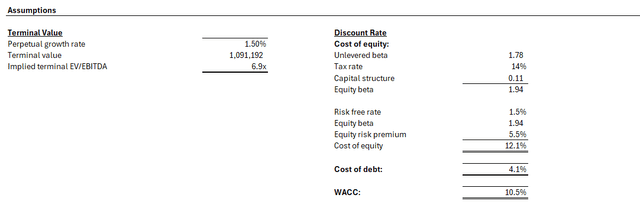

The price is computed under a discounted cash flow analysis. The analysis considers cash flow projections taken with the foregoing fundamental discussions. A WACC of 10.5% in line with TSM’s capital structure and risk profile is applied. The analysis also considers a 1.5% perpetual growth rate on projected 2033 EBITDA, which is when TSM’s growth is expected to normalize. This is equivalent to a premium of 5.9% implied perpetual rate, or 10.9x terminal value multiple on 2028E EBITDA, to reflect TSM’s continued capture of accelerating AI opportunities. We believe the premium is warranted, considering the additive AI opportunities to TSM’s growth trajectory and the competitive advantage of its technology leadership.

Author Author

Conclusion

We believe Taiwan Semiconductor Manufacturing Company Limited remains well-positioned for long-term upside, underpinned by both secular AI tailwinds and a company-specific competitive advantage with process node and capacity leadership. Despite near-term recovery headwinds in consumer-facing end-markets – such as smartphones, IoT and consumer electronics – TSM remains a beneficiary of outsized HPC opportunities underpinned by continued momentum in AI transformation.

Paired with incremental share gains in chip manufacturing anticipated from rivals, underpinned by its technological and capacity leadership, Taiwan Semiconductor Manufacturing Company Limited stock remains well-positioned for further valuation multiple expansion ahead.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.