Critical Resistance of S&P 500 and Nasdaq Composite Approach; Watch out for this important level! | chart watcher

key

gist

- The Nasdaq Composite Index is trading above its last high, which could be the first sign of a bullish reversal.

- The S&P 500 is facing resistance from its 50-day moving average and downward trend line.

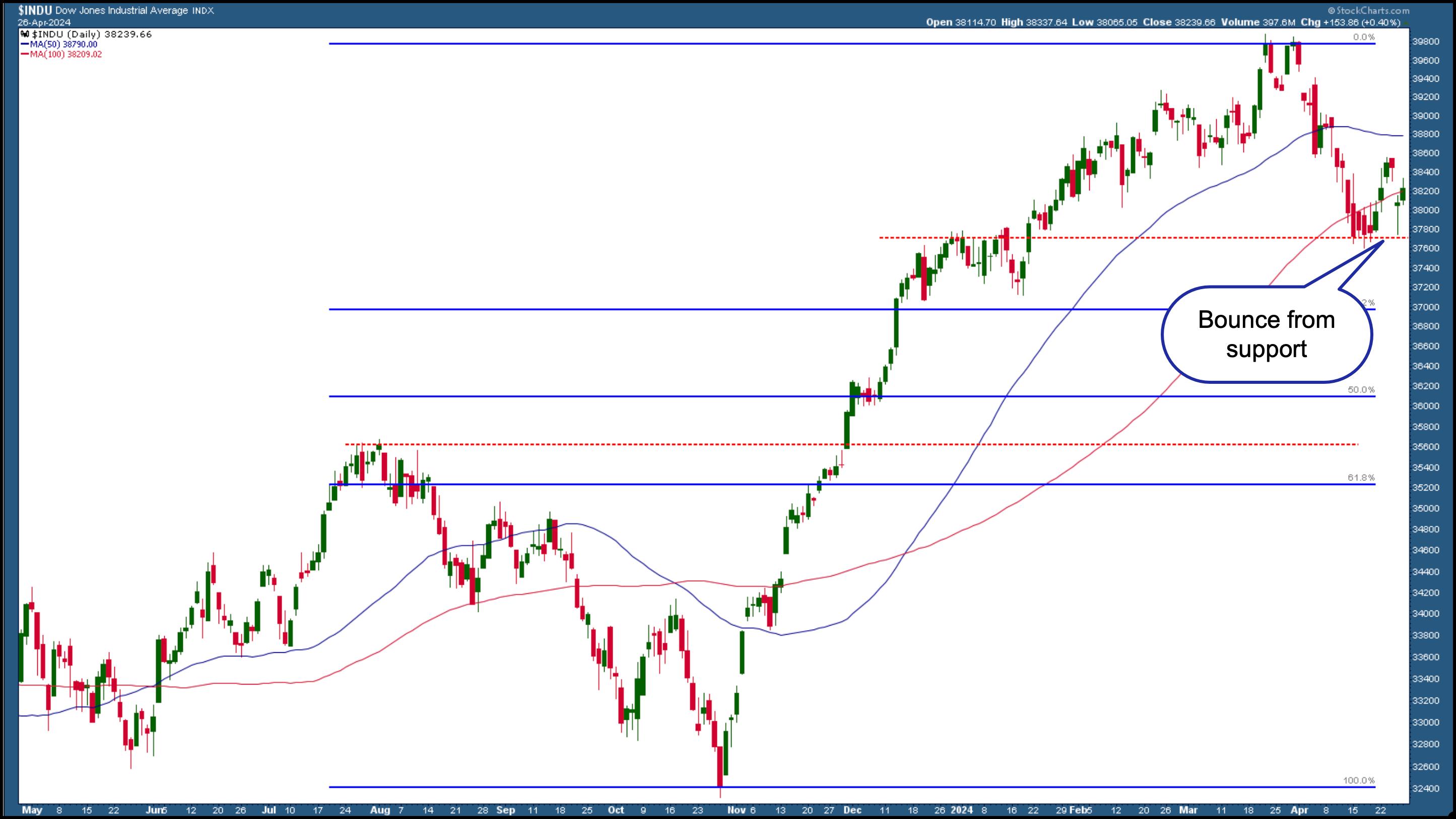

- The Dow Jones Industrial Average reversed from the support line and exceeded the 50-day moving average.

A tug of war with no clear winner — that’s what the stock market looked like this week. Considering the Federal Reserve meeting, key economic data, additional earnings, etc., will there be a winner next week?

It’s been an interesting week in the stock market. Economic data shows that growth is slowing, but inflation shows no signs of slowing. This “stagflation” scenario paves the way for further uncertainty, especially when it comes to interest rates. And with the Federal Reserve meeting next week, investors are becoming more cautious about making trading or investment decisions.

Looking back over the past week, we can see how Tesla (TSLA) bounced higher. After missing out on revenue. MetaPlatform (META) beat revenue estimates, but weak second-quarter guidance sent its stock price down. This was concerning, as META has enjoyed a strong rally since late 2022. It remains to be seen whether the increase in META stock price will be made up on February 2, 2024. The stock is trading on 100 days simple moving average (SMA) could be a support level from which the stock bounces. But META may eventually break beneath it and slide further.

Investors were concerned about META’s weak guidance. That’s because they expected technology revenue to be a catalyst to boost the market. After META sent most of the market lower, the next worry was whether other tech stocks would follow the same path. Fortunately, that didn’t happen. Microsoft (MSFT), Alphabet (GOOGL), and Snap (SNAP) all outperformed their performance and their stock prices rose, reversing the downward trend.

Is this reversal sustainable?

Positive earnings stimulated the upside, but it felt like it had hit a wall. There wasn’t enough follow-through to push stock market indices higher and the bears didn’t seem interested in putting up much of a fight.

during S&P 500 ($SPX), Dow Jones Industrial Average ($INDU) and Nasdaq Composite ($COMPQ) traded higher on Friday, with the S&P 500 and Nasdaq neither closing above last week’s highs, according to weekly charts. However, the Dow closed slightly higher.

Follow the live charts here.

The daily chart is more attractive. Below is the daily chart of the Nasdaq Composite Index. It shows the index rose after last Friday’s low, then fell on Thursday before recovering its losses by the end of the trading day. Today (Friday, April 26th) the Nasdaq closed above Wednesday’s high.

Chart 1. Daily chart of the Nasdaq Composite Index. After closing higher than its previous high, there are hopes that the Nasdaq could move higher next week depending on developments. Chart source: StockCharts.com. For educational purposes.

The NASDAQ Composite is approaching its 50-day SMA, which would be a strong resistance level for the index.

Follow the live charts here.

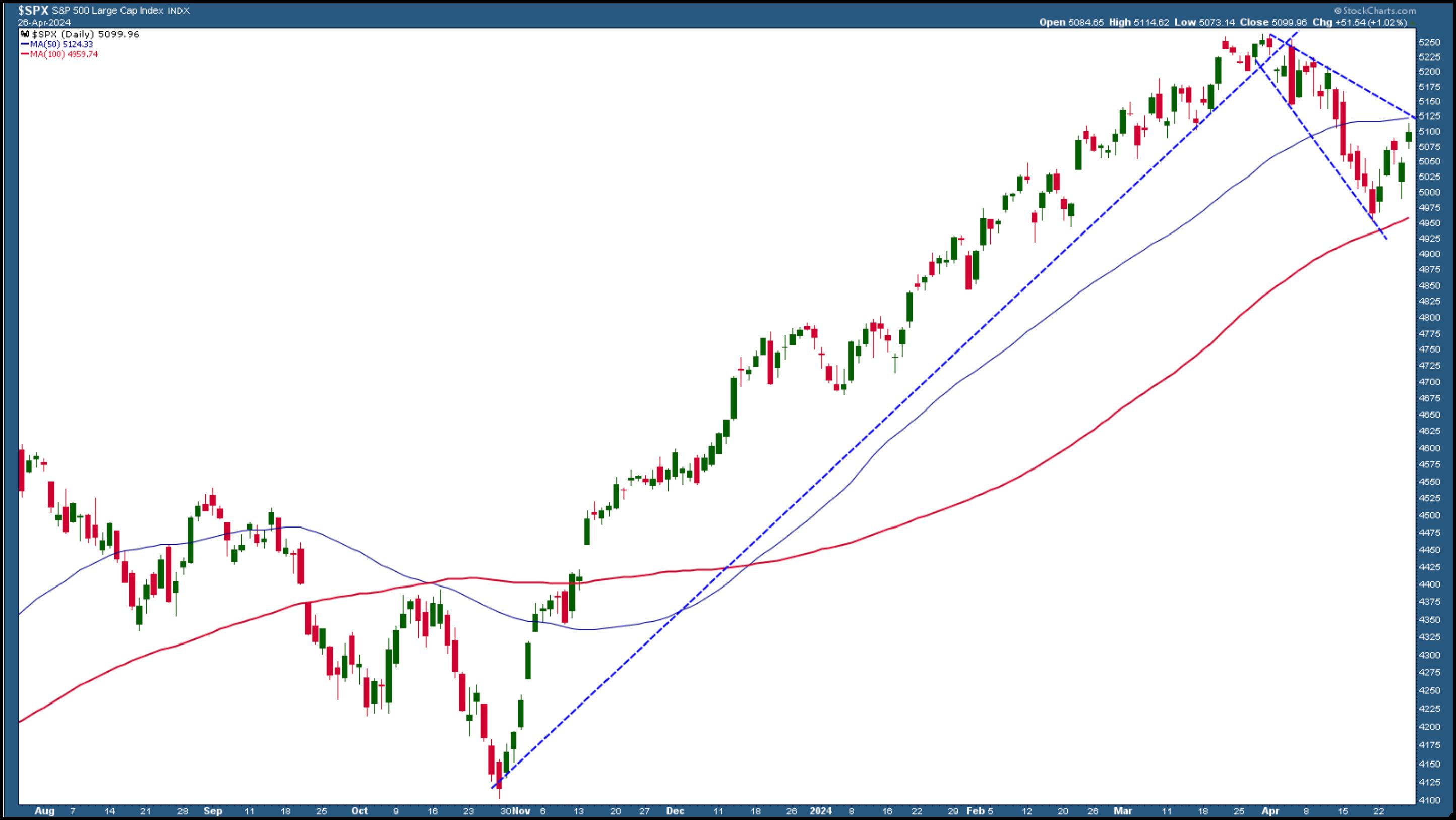

Moving to the S&P 500, the index is facing resistance at its 50-day SMA, which coincides with its downward trendline.

Chart 2. S&P 500 index daily chart. The S&P 500 could continue its uptrend if it breaks above the downward trend at the top of the channel and the 50-day moving average. Chart source: StockCharts.com. For educational purposes.

Follow the live charts here.

The Dow is the most optimistic of the three major indices. There has been a clear reversal in support levels (red dotted line) and any bullish news in the coming week is likely to push the index higher.

Chart 3. Daily chart of the Dow Jones Industrial Average. A clear bounce from a significant support level could mean that the Dow faces more buying pressure than selling pressure. Chart source: StockCharts.com.

Which direction will the stock market move?

The bulls seem hungry to become a more dominant player. If any news prevents the bulls from taking this market higher, the bears will quickly take over. Remember, the market goes up the stairs and the elevator goes down. Markets will likely remain volatile until Wednesday afternoon when the Federal Reserve sets interest rates. That will probably push the stock market down or up.

weekend wrap up

- The S&P 500 rose 1.02% to 5,099.96, while the Dow Jones Industrial Average rose 0.4% to 38,239.66. The Nasdaq composite index closed at 15,927.90, up 2.03%.

- $VIX was down 2.28% at 15.02.

- Top performing sector this week: Technology

- Worst performing category this week: Materials

- Top 5 Large Cap Stocks SCTR Stocks: Super Micro Computer, Inc. (SMCI); Coinbase Global Inc. (COIN); Vertiv Holdings (VRT); MicroStrategy Inc. (MSTR); Vistra Energy (VST)

On the radar next week

- April ISM Manufacturing PMI

- Fed interest rate decision

- Fed Chairman Powell press conference

- March JOLTS Recruitment Report

- April Nonfarm Payroll (Employment) Report

- April ISM service

- Earnings season continues with Amazon (AMZN), Advanced Micro Devices (AMD), Eli Lilly (LLY), Barrick Gold (GOLD), and Booking Holdings (BKNG) reporting.

disclaimer: This blog is written for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting with a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Prior to that, she served as editor-in-chief of Stocks and Commodities Technical Analysis magazine for over 15 years. Learn more