Downgrade for the Dow: We Like Air Products and Chemicals (NYSE:DOW)

jetcityimage/iStock editorial via getty Images

Dow stocks return about 5%

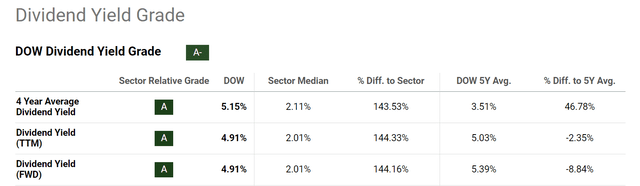

In a recent regular audit, Dow Inc. (New York Stock Exchange: Dow) stock has appeared on our radar. In this screening, we search for stocks that have returns that are noticeably higher than the normal range compared to historical averages. Or compare to the sector median. Looking at the chart below, it’s easy to see why the Dow passed these filters.

The chart below shows DOW’s dividend yield compared to its historical average and sector median. As you can see, DOW’s current dividend yield is significantly higher than the sector median, which generally indicates undervaluation. Specifically, the TTM dividend yield is approximately 4.9%, which is more than 144% higher than the industry median of ~2%. Moreover, the four-year average dividend yield is 5.15%, which is more than 46% higher than the five-year average of 3.51%. This is a common sign of rapid dividend growth and/or undervaluation.

pursue alpha

When we see the results of these reviews, we feel an obligation to dig in. In the remainder of this article, our goal is to share our findings. For those who can’t wait, our conclusion is that the stock isn’t as attractive as its dividend yield appears on the surface.

DOW Stock: A Closer Look at Dividends

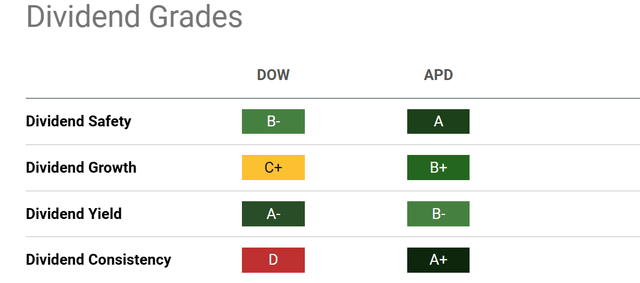

We think the best approach to presenting the results is to compare it to its close peer, Air Products and Chemicals (NYSE:APD). This stock was recently written about by Envision Research.

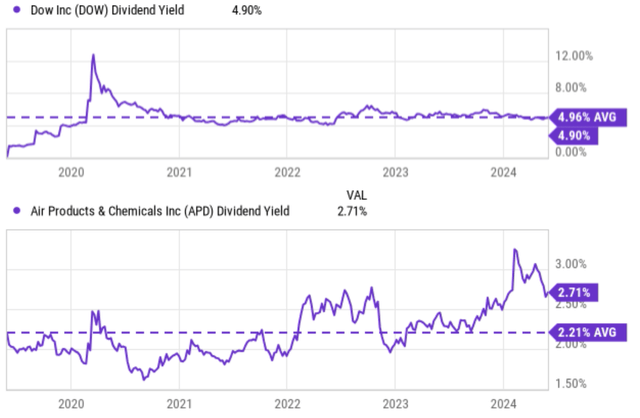

The charts below detail Dow’s dividend yield compared to its historical average (top panel) and APD’s dividend yield compared to its historical average over the past five years (bottom panel). As you can see, Dow’s current TTM dividend yield of 4.9% is actually slightly lower than its five-year average of 4.96%. This represents a fair assessment or a slight overestimation. Note that the five-year average return shown in this chart (4.96%) is different from the return shown in the chart above (5.03%), but the difference is very small and does not change the essence of this comparison. The data above sends the opposite signal, mainly due to the Dow’s unethically low dividends in 2020. Dow was the result of a merger in 2019. Dividend payments were reset following the merger, leading to the rapid growth hike implied in the chart above. Aside from this, the bias created by this reset is: Dow Growth is very lukewarm, as detailed in the next section.

On the other hand, APD’s current dividend yield is 2.71%, which is significantly higher than the five-year average of 2.21%, making it undervalued. Additionally, dividend champion APD has higher dividend ratings across all categories. Dow (That is, excluding the low dividend yield) As you can see in the next chart below.

pursue alpha

pursue alpha

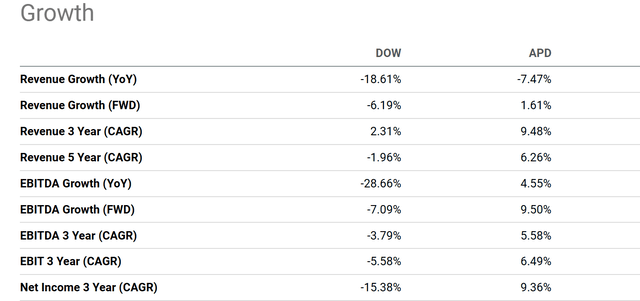

DOW Stock: Growth Outlook

As mentioned earlier, dividend data is grossly exaggerated. Dow Growth over the past 5 years. Excluding this bias, the growth is actually very minimal. The comparison is too unfavorable. Dow This is true both in terms of the top and bottom lines, as you can see in the chart below. for example, Dow’s While the average sales growth rate over the past three years is 2.31%, APD’s growth rate is much higher at 9.48%. Over the past five years, Dow’s earnings have decreased by an average of -1.96%, while APD’s earnings have increased by an average of 6.26%. In conclusion, the situation is even worse. Dow’s average net income has declined at a CAGR of -15.38% over the past three years, while APD’s net income has grown at a CAGR of over 9%.

pursue alpha

In the future we expect Dow We continue to face a challenging operating environment. The company has reported weak comparisons in recent years. For example, in the December 2023 quarter, the Dow experienced declines across all operating segments due to a slowdown in global macroeconomic activity. Local prices fell 13% due to lower feedstock and energy costs. The Industrial Intermediates and Infrastructure business was hit particularly hard, with local prices falling 17% and production falling 2% due to reduced supply availability. Demand for industrial and durable goods is expected to remain weak over the next one to two years due to ongoing geopolitical conflicts and a slowdown in China’s overall economy (particularly the real estate market and infrastructure sectors).

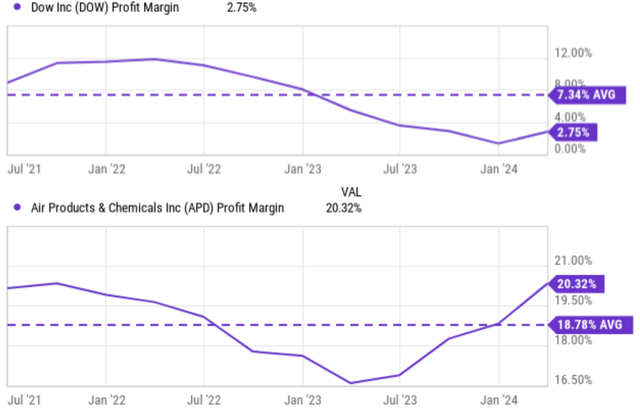

Additionally, there are concerns about margin pressure due to continued inflation, energy costs, and labor costs. Dow’s profit margins aren’t all that great to begin with, as you can see in the following chart. Dow’s profit margins have ranged from a low of about 2% to a high of about 12% in recent years. The average profit margin over the past three years was about 7.34%. The current margin of 2.75% is well below the historical average margin and the APD average margin of approximately 19%.

Investors unfamiliar with these stocks may be surprised by these stark margin comparisons, given that both companies are in the materials sector and both manufacture chemicals. However, these companies are quite different when you look more closely at their business models. In our opinion, the most important differentiating factor is that APD operates in a less competitive niche market (e.g. specialty industrial gases). Dow They are primarily large-scale producers of circular goods. As a result, APD can command higher prices for differentiated products and earn much higher profits by focusing on high-value products.

pursue alpha

Other Risks and Final Thoughts

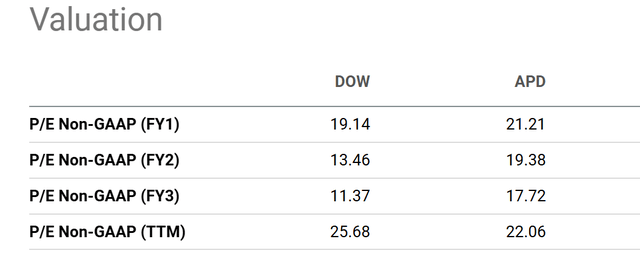

I have mainly focused on the negative aspects. Dow. There are also some positive risks to consider. first, Dow As you can see in the chart below, it trades at a significant valuation discount compared to APD. As you can see, Dow’s P/E ratio is currently lower than APD’s P/E ratio across all future forecast periods for the next three fiscal years. especially, Dow The P/E ratio is 19.14x, about a 10% discount to APD’s FY1 P/E ratio of 21.21x. These discounts partially offset some of the disadvantages described above.

second, Dow We are making a number of strategic growth investments that will support our operating results over the long term. These investments also leverage competitive advantages such as geographic diversity, global scale, and differentiated feedstock flexibility. Two notable examples are the company’s Decarbonize & Grow and Transform the Waste strategies. We expect both to enjoy long-term tailwinds and grow into significant sectors in the coming years.

pursue alpha

as a result, Dow This could be a good holding for income-oriented investors seeking high dividend yields. At the current price, Dow It offers a dividend yield of close to 5%, which is well above the sector median, a sector known for its generous dividend payouts (APD’s current yield, for example, is “only” 2.7%). However, we are not optimistic about its growth potential, especially when compared to other stocks in the sector with more differentiated products and higher margins. APD is a good example (and a stock we own).