Emerging Market Links + The Week Ahead (February 3, 2025)

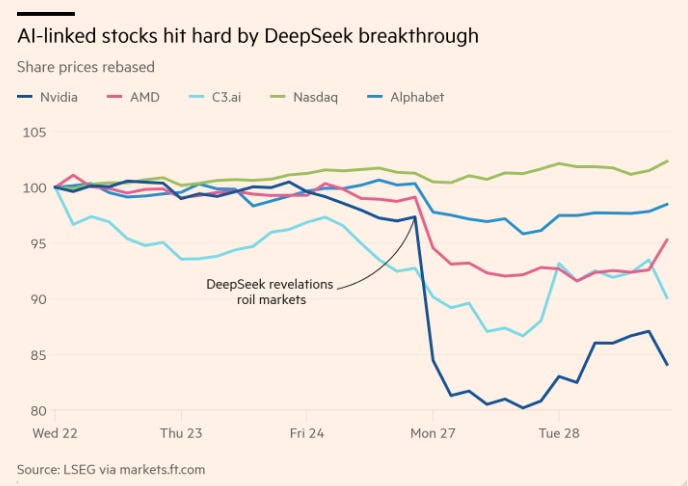

More DeepSeek analysis (and fallout) with Momentum Works having two interesting pieces (No Bullshit takeaways from China’s AI trenches: Why DeepSeek scares and excites everyone and a very lengthy and much more technical piece Why big techs didn’t use the DeepSeek approach) with the first takeaways piece making a couple of interesting points:

DeepSeek is the first LLM chatbot our friends find usable on a daily basis: it is fast and demonstrates the full reasoning process. In comparison, ChatGPT is slow, hallucinating, poor in real-time online search, and often too conservative in its response… (I will also start using DeepSeek to help with research or checking some facts for this Substack)

…There is enough engineering, operations, and business talent in China to allow DeepSeek to continuously build on. A related point is that DeepSeek’s team employs young engineers rather than big shots—its star engineer (a 29-year-old woman) was poached by Xiaomi with a >4X salary increase, causing no impact on DeepSeek’s ability to carry on…

…It is unlikely that DeepSeek will cause deflation of demand for NVIDIA and others’ chips. While DeepSeek has plausibly proven that the demand for training compute should not be as high as previously thought, it also shows reasoning that might end up consuming a lot more computing power…

The second (lengthy and more technical) piece sort of missed the elephant in the room e.g. the sheer amount of corruption/grifting + politics (DEI hiring, the need to use/hire politically connected or in favored people/groups/companies, etc.) that any Big Tech-US government relationship inevitably has these days. Trump will need to address the corporate-government rot (something that Empress Dowager Cixi failed to do in China over 100 years ago…) in the USA before throwing more taxpayer money/incentives at AI or AI related projects…

Finally, the archive.today site seems to be malfunctioning or not accepting new URL saves late this evening Asia time. 🗃️s without a link to an archived article are denoted by a (?) and I will check back later or Tuesday to see if the site has stopped hiccupping.

UPDATE: I’ve updated the links as the site is working again…

$ = behind a paywall

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 AI, Automation, and the Impact on Investment Opportunities (The Great Wall Street – Investing in China) $

How AI and robotics are reshaping industries in China and elsewhere, creating new investment risks and opportunities

Take Meituan (HKG: 3690 / 83690 / FRA: 9MD / OTCMKTS: MPNGF / MPNGY), one of my favorite companies in China. In China, you can swap JD.com (NASDAQ: JD) for Alibaba (NYSE: BABA), Alibaba for PDD Holdings (NASDAQ: PDD) or Pinduoduo—no problem. But try living without WeChat or Meituan? Good luck, my friend. Their edge is a huge army of riders who deliver everything, from noodles to nail clippers, in minutes. This “instant delivery” is something no other e-commerce giant has quite managed to commoditize at scale. But Meituan’s management is no fool. They (and of course also others) are already testing autonomous delivery vehicles in Shenzhen.

🇨🇳 How to Judge Management in China- When Saying Less is More (The Great Wall Street – Investing in China)

Case Study: PDD Holdings (NASDAQ: PDD) or Pinduoduo’s Silent Execution vs. China MeiDong Auto Holdings (HKG: 1268 / FRA: 55M / OTCMKTS: CMEIF)’s Grand Speeches

As I wrote in one of my latest articles, one of the biggest concerns investors have with Pinduoduo is that they give away absolutely nothing. No strategic plans, no key metrics, no capital allocation roadmap—just the bare minimum. They don’t do distractions, they don’t entertain outside noise, and they sure as hell don’t tell competitors what’s coming next. On the rare occasions they make public statements, it’s to acknowledge their own mistakes—things that offer no competitive edge to rivals. This level of secrecy is frustrating for investors but makes perfect sense from a business standpoint. Why reveal anything when the results speak for themselves?

Now, this brings me to the rather amusing contrast that prompted me to write this follow-up. I keep getting pitched the same stock: China MeiDong Auto Holdings 1268.HK..

🇨🇳 Suntien picks up as it digests massive wind power buildup (Bamboo Works)

The wind farm operator said its power generation stabilized in the second half of last year as it curbed its spending on new projects

China Suntien Green Energy Corp (SHA: 600956 / HKG: 0956 / FRA: 9C6 / OTCMKTS: CSGEF) said its green power generation dropped 0.93% last year, easing from 3.57% decline for its core wind power in the first half of the year

The company’s profits from its wind and solar power business fell 10% in the first half of last year, as its utilization and tariff rates sagged

🇨🇳 Vanke’s woes reignite fears for China’s property sector (FT) $ 🗃️

🇨🇳 Mainland Chinese Banks Post Valuation Gains As Stimulus Pushes Shares Higher (Seeking Alpha) $ 🗃️

🇨🇳 Sam’s Club’s good days in China might be numbered! (Momentum Works)

You can also refer to this article “Sam’s Club is the real winner in China’s new retail war?” for perspectives explaining the Walmart Inc (NYSE: WMT) subsidiary’s success in China.

I predict that Sam’s Club’s good days in China are numbered—only three years left.

Walmart China CEO Christina Zhu once said in an internal meeting that Hema (Freshippo) is Sam’s Club’s only competitor in China because its innovative business model poses a potential threat.

However, Sam’s Club actually faces far more threats than just Hema.

🇨🇳 Chinese Restaurant Stock Analysis Series Part 3: DPC DASH (1405.HK) (Dragon Invest)

(DPC Dash (HKG: 1405 / FRA: X12 / OTCMKTS: DPCDF))

Global giant trying to leverage its excellent leadership and tested strategy in the hyper-competitive Chinese market

So what differentiates Domino’s in China from Domino’s in the rest of the world:-

the main competitor, Pizza Hut, is disorganized, uninterested, and probably uninterested because YUM China (NYSE: YUMC) loves milking its KFC brand which is super popular in China

its the only operator that has direct investment from DPZ US

excellent management

low store count relative to TAM and parabolic demand

While it isn’t profitable in the slightest I believe that it has the potential to either become the largest or the second pizza chain in China and this is due to the above listed reasons and more which I’ll elaborate on throughout the course of this article.

🇨🇳 TAL Education Group: Expansion of Enrichment Learning Programs Driving Our Bullishness! – Major Drivers (Smartkarma) $

TAL Education Group (NYSE: TAL) reported strong financial performance for its third quarter of fiscal year 2025, showcasing a marked year-over-year revenue growth of 62.4% in USD terms to $606.4 million.

This growth is primarily attributed to its various learning services and products, including traditional in-person classes and newer digital platforms and devices.

Notably, the Peiyou Small Class Enrichment programs emerged as a significant contributor, thanks to growing customer acceptance and demand for enrichment learning.

🇨🇳 Lifestyle China (2136 HK): Expectations of a Deal Break with a Vote on 20 February (Smartkarma) $

(“Fashionable Lifestyle” department stores + a commercial complex) Lifestyle China Group Ltd (HKG: 2136)’s IFA opines that Mr Thomas Lau’s HK$0.98 privatisation offer is fair and reasonable. The vote is on 20 February.

The IFA analysis is flawed. The revised and final offer is light compared to precedent transactions, peer multiples and historical trading ranges.

The high AGM minority participation rates remain a vote risk, mainly as retail seems firmly against the offer. The 14.0% gross spread is high but justified.

🇨🇳 🇭🇰 Undervalued and net net investments in the Chinese market: Part 2 (Dragon Invest)

🇭🇰 Beating its rivals but losing to the times, TVB fades on Hong Kong entertainment stage (Bamboo Works) $

The former Hong Kong broadcasting superstar’s business improved slightly in last year’s fourth quarter

Television Broadcasts Ltd (HKG: 0511 / FRA: TBCN / OTCMKTS: TVBCY / TVBCF)’s advertising revenue rose 10% year-on-year in the fourth quarter of 2024

Hong Kong’s former leading broadcaster had 1.9 million average monthly active users during the final three months of last year

🇭🇰 CK Hutchison: Telco-Driven Value Creation Potential (Seeking Alpha) $ 🗃️

🇭🇰 Hongkong Land Holdings: New Strategy Could Create Significant Value For Shareholders (Seeking Alpha) $ 🗃️

-

🌏 Hongkong Land Holdings (SGX: H78 / LON: HKLJ / FRA: HLH / OTCMKTS: HKHGF / HNGKY) – 2 segments: Investment Properties & Development Properties. Hotel investment, finance & project management businesses. Subs. of Jardine Strategic. 🇼

🇭🇰 Cathay Pacific In Growth Mode, Stock Is Extremely Undervalued (Seeking Alpha) $ 🗃️

🇹🇼 Himax Technologies: The Recent Rally May Be Just The Beginning (Seeking Alpha) $ 🗃️

🇹🇼 Foxconn Technology Is Not Its High-Flying Parent (Seeking Alpha) $ 🗃️

🇹🇼 Himax: Major Market Position Change Ahead (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: It’s Simple. Let Your Winners Run (Seeking Alpha) $ 🗃️

🇹🇼 TSMC’s Selloff Creates A Buy Opportunity (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: Poised To Hit All-Time Highs (Seeking Alpha) $ 🗃️

🇹🇼 Taiwan Semiconductor Manufacturing: AI Growth Play At A Reasonable Valuation (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: A Trillion-Dollar Firm With Strong Growth Prospects Despite China’s DeepSeek (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: DeepSeek Worries Create Attractive Buying Opportunities, And I’m Adding More To My Portfolio (Seeking Alpha) $ 🗃️

🇹🇼 DeepSeek Panic: Here’s Why I’m Doubling Down On TSMC (Seeking Alpha) $ 🗃️

🇹🇼 TSMC: DeepSeek Opportunity (Seeking Alpha) $ 🗃️

🇹🇼 TSMC founder Morris Chang (Acquired) 2:54:55 Hours

We flew to Taiwan to interview Taiwan Semiconductor Manufacturing Company (TSMC) (NYSE: TSM) Founder Morris Chang in a rare English interview. In fact, the last long-form video interview we could find was 17 years ago at the Computer History Museum… conducted by the one-and-only Jensen Huang! This episode came about after asking ourselves a version of the Jeff Bezos “regret minimization” question: what conversations would we most regret not having if the chance passed Acquired by?

Dr. Chang was number one on our list, and thanks to a little help from Jensen himself, we’re so happy to make it happen. Dr. Chang shares the stories of a few crucial moments from TSMC’s history which have only been written about in his (currently Chinese-only) memoirs, including how TSMC won Apple’s iPhone and Mac chip business and a 2009 discrepancy with NVIDIA that almost jeopardized their relationship, and the lessons he took from them. We can’t think of a better way to kick off 2025.

🇹🇼 Apple Supply Chain Monitor: Latest AAPL Results — Taiwan Suppliers Well Placed for Monday Re-Open (Smartkarma) $

Apple 1Q25 Results — Overall Price-Supportive for Taiwan Supplier Share Prices When the Taiwan Market Re-Opens Monday

Why Zhen Ding Technology Holding Ltd (TPE: 4958) and Kinsus Interconnect Technology Corp (TPE: 3189) Could Be in a Favorable Position Relative to Apple’s AI Trajectory

Increasingly sophisticated Apple products require significantly more complex PCBs & interconnect solutions, especially as advanced packaging has become a key enabler of high-performance computing.

🇰🇷 Hyundai Motor: Value Emerging Through The Headwinds (Seeking Alpha) $ 🗃️

🇰🇷 Rise of DeepSeek – Impact on SK Hynix and Other Major Korean Stocks (Douglas Research Insights) $

🇰🇷 Naver: CHZZK Increasing Market Share in the Korean Live Game Streaming Sector (Douglas Research Insights) $

NAVER (KRX: 035420 / OTCMKTS: NHNCF)‘s CHZZK has been increasing its market share in the Korean live game streaming sector. This improving momentum is likely to continue to positively impact Naver’s share price.

CHZZK was the top ranking live streaming platform in Korea in December 2024 with about 2.5 million MAU.

Naver is currently trading at EV/EBITDA of 11.4x and P/E of 18.3x, which are 50% and 51% lower respectively than its historical average valuation multiples from 2020 to 2023.

🇰🇷 Samsung Fire & Marine Insurance: Strong Corporate Value Up Plan (Douglas Research Insights) $

On 31 January, Samsung Fire & Marine Insurance (KRX: 000810 / 000815) announced a comprehensive corporate value up plan.

The three major areas of focus include K-ICS ratio (220%), ROE targets of 11-13%, and total shareholder returns to 50% by 2028.

The company plans to reduce the treasury shares as a percentage of total outstanding shares from 15.9% to 5% by 2028 (10.9% of total outstanding shares over over four years).

🇰🇷 SGIC IPO Valuation Analysis (Douglas Research Insights) $

Our base case valuation of Seoul Guarantee Insurance is target price of 32,463 won per share, which is 2.1% higher than the high end of the IPO price range.

All in all, we are not particularly impressed with SGIC’s lack of top-line sales growth and worsening operating profit and margins in 1Q-3Q 2024.

Despite the much lower IPO price range and a promise for higher shareholder returns, we remain Negative on this IPO.

🇰🇷 TXR Robotics IPO Valuation Analysis (Douglas Research Insights) $

According to our valuation analysis, it suggests a base case implied price of 19,673 won per share (46% higher than the high end of the IPO price range).

Our base case valuation is based on target P/S of 5.4x using our estimated sales of 57.7 billion won.

To value TXR Robotics, the target P/S of 5.4x is based on a 30% discount to the comps’ valuation multiple.

🇵🇭 Asian Dividend Gems: Cosco Capital (Asian Dividend Stocks)

Cosco Capital Inc (PSE: COSCO)‘ stakes in Puregold Price Club (PSE: PGOLD / OTCMKTS: PGCMF / PRGLY) and Keepers Holdings Inc (PSE: KEEPR) is worth US$1.1 billion, which is 176% higher than Cosco’s current market cap.

Cosco Capital’s dividend yield and dividend payout have been increasing nicely in the past several years from 1.5% in 2021 to 3% in 2022 and 8.8% in 2023.

We found Cosco Capital using Smartkarma’s Smartscore Screener. We used three criteria including market cap, dividend score of 4 or more, and total SmartScore of 4 or more.

🇵🇭 International Container Terminal: 2025 Prospects Are Favorable Despite Trade Concerns (Seeking Alpha) $ 🗃️

🇸🇬 Singapore Technologies Engineering: A Buy On Higher Valuation Multiple And Growth (Seeking Alpha) $ 🗃️

🇸🇬 Sea: Great And Distinct Business Model (Seeking Alpha) $ 🗃️

-

🌏 Sea Limited (NYSE: SE) – 3 core businesses: Garena (global online games developer & publisher), Shopee (largest pan-regional e-commerce platform in SE Asia & Taiwan), SeaMoney (leading digital payments & financial services provider in SE Asia). 🇼 🏷️

🇸🇬 Grab. The Makings of a SuperApp! Equity Research! Part 1/3. (Global Equity Briefing)

42M Users, $17B GMV, and an Exploding Fintech Business!

In Part 1 of this Deep Dive, we look at how Grab Holdings Limited (NASDAQ: GRAB) conquered the region and its business model.

🇮🇳 MakeMyTrip: Long-Term Double-Digit Growth Is Worth The Premium Price (Seeking Alpha) $ 🗃️

🇮🇳 Gujarat Fluro’s New Growth Lever: Battery Chemicals, Fluoropolymers and Aim for 4x EBITDA in 3 Years (Smartkarma) $

Gujarat Fluorochemicals Ltd (NSE: FLUOROCHEM / BOM: 542812) new Fluoropolymer(FP) segment is projected to be a key revenue growth driver for the company in the medium term.

The company is committed to significant capacity expansion in the FP segment and aims to commercialize new FP products, particularly EV battery chemicals, in the second half of fiscal 2025.

While the FP segment holds strong growth potential, the ramp-up of new-age FPs and the potential reliance on debt-funded capex are areas to monitor.

🇮🇳 The Beat Ideas: Frontier Springs, A Proxy Play to Capitalizing on Indian Railway Capex Boom (Smartkarma) $

Frontier Springs Ltd (BOM: 522195) is poised for growth, driven by India’s robust railway sector expansion and increased demand for LHB coaches which is reflected in their expanding margins and profitability.

Company is aiming for 250Cr by FY25 and 500Cr by FY27 with sustainable margins for 18-20%.

Company is completely booked for next 6-8 months and air spring division is booked completely for next year. Also looking for acquisition in the segment.

🇮🇳 United Breweries On and Off with Telangana Government (Smartkarma) $

United Breweries (NSE: UBL / BOM: 532478) resumed beer supplies in Telangana after earlier suspending them due to unprofitable pricing and unpaid dues.

Resolution ensures vital revenues for both state and brewery, while highlighting persistent regulatory and pricing hurdles in India’s top beer market.

This standoff reveals the leverage breweries hold in regulated regions, where strategic halts can push authorities toward fairer policies and improved business conditions.

🇮🇳 Dr. Reddy’s Lab: Near-Term Worries And Underappreciated Potential Could Lead To Huge Returns (Seeking Alpha) $ 🗃️

🇮🇳 360 ONE WAM to acquire Batlivala & Karani Securities (The Asset) 🗃️

Acquisition of B&K, one of India’s leading brokerage houses will bolster 360 One WAM (NSE: 360ONE / BOM: 360ONE)’s broking platforms across all market segments

🇮🇳 The Beat Ideas: Goodluck India Accelerating Margin Growth with Value-Added Products & Defence (Smartkarma) $

Goodluck India Ltd (NSE: GOODLUCK / BOM: 530655) is expanding into high-value defense and precision tube segments, aiming to diversify beyond its low-margin steel products and capitalize on India’s growing domestic manufacturing push.

These strategic moves can enhance margins, reduce commodity price exposure, and capture rising demand from auto, defense, and infrastructure sectors, strengthening Goodluck’s long-term profitability.

Aiming for 2x revenue in next 3-4 years with margin expansion in all the segments apart from commodity segment.

🇮🇳 What the Airtel-Bajaj Finance Partnership Means for Their Growth Plans? (Smartkarma) $

Bharti Airtel (NSE: BHARTIARTL / BOM: 532454)–Bajaj Finance Limited (NSE: BAJFINANCE / BOM: 500034) partnership is a game-changer in the digital financial services sector in India. It combines the strengths of both companies to create a powerful platform.

By leveraging Airtel’s extensive distribution network and Bajaj Finance’s financial expertise, this collaboration has the potential to disrupt the market and challenge established players.

It follows the successful playbook of other global partnerships and demonstrates how digital platforms and financial institutions can work together to enhance financial accessibility

🇮🇳 Can Krishca Strapping Solutions Maintain Momentum Amidst Steel Price Volatility? (Smartkarma) $

Krishca Strapping Solutions (NSE: KRISHCA) is India’s first “Lead-Free” and eco-friendly production line for the heat treatment of steel strapping.

The company is aggressively pursuing growth, aiming for a 25% revenue increase in the current financial year and EBITDA margin is anticipated to stay between 15% and 20%

The company is investing in a new special steel production plant in Chennai and launching subsidiaries in the UAE and Singapore to tap into new markets

🇮🇳 Whirlpool Corporation’s Big Exit: What’s Behind the Stake Reduction? (Smartkarma) $

Whirlpool Corp (NYSE: WHR) plans to sell a 31% stake in Whirlpool Of India (NSE: WHIRLPOOL / BOM: 500238) reducing ownership to 20% by 2025, triggering a 20% decline due to valuation concerns.

The implied sale valuation is lower than market expectations, raising concerns about growth, profitability, and stock overvaluation, while the parent company capitalizes on an asset arbitrage opportunity.

Short-Term stock pressure due to stake sale overhang, declining profitability, and reduced parent control, but potential long-term re-rating if operational performance improves.

🇮🇳 The Beat Ideas: Blue Jet Healthcare- Rising CDMO Player (Smartkarma) $

Blue Jet Healthcare Ltd (NSE: BLUEJET / BOM: 544009) is a science-led pharmaceutical company that has evolved into a strategic partner for the CDMO of advanced Pharmaceutical Intermediates and APIs.

Company gave a record breaking Q3FY25 primarily driven by capacity expansion in Contrast media and PI Segment. Strong demand for the cardiovascular product was also witnessed.

Company commissioned an additional manufacturing block during Q3 FY25 at Ambernath for manufacturing Advance Contrast Media with investment around Rs. 100Mn.

🇮🇳 The Beat Ideas: Sigachi Industries- High Growth, Revenue Diversification, New Category Launch (Smartkarma) $

Sigachi Industries Ltd (NSE: SIGACHI / BOM: 543389) has increased MCC capacity to 21,700 MTPA and expects to achieve 80-90% utilization by Q4 FY27 from 50% utilization in Q4FY25.

Sigachi is increasing its focus on the API segment, with a target of 20-25% revenue contribution in next 2-3 yrs and further expanding to 35-40% of revenue in 3-5 Yrs.

Sigachi is introducing new product lines including pharmaceutical coatings like PureCoat and UltraMod and plans to commercialize Croscarmellose Sodium (CCS) by FY26 to enhance drug stability and bioavailability.

🇮🇱 Tower Semiconductor: Why I Am Optimistic Ahead Of Q4 2024 Earnings (Seeking Alpha) $ 🗃️

🇮🇱 G. Willi-Food: Growing Profitable Company, But Not Opportunistic At These Prices (Seeking Alpha) $ 🗃️

🇮🇱 Teva Pharmaceutical: 2025 Guidance Sinks The Stock, But Presents An Opportunity (Seeking Alpha) $ 🗃️

🇦🇪 Yalla Group: Undervalued Tech Giant With A Huge Upside Potential (Seeking Alpha) $ 🗃️

🇲🇺 Alphamin Resources: Continues To Thrill And Disappoint (Seeking Alpha) $ 🗃️

🇿🇦 DRDGold: Stuck In The Starting Blocks, Pan African Resources Leads The Way (Seeking Alpha) $ 🗃️

🇿🇦 Sasol Limited: Running In Place, As Opposed To Breaking New Ground (Seeking Alpha) $ 🗃️

-

🌐 Sasol (NYSE: SSL) – Global chemicals & energy company. 3 distinct market-focused businesses, namely: Chemicals, Energy & Sasol ecoFT. 🇼 🏷️

🇭🇺 Wizz Air: Extremely High Risk And Reward (Seeking Alpha) $ 🗃️

-

🌍🌏 Wizz Air (LSE: WIZZ / OTCMKTS: WZZZY / FRA: WI20 / FRA: WI2) – Ultra low-cost carrier. Short-haul & medium-haul point-to-point routes in Europe, Middle East, North Africa & Northwest Asia. 🇼

🇵🇱 InPost: I Maintain My Buy Rating Despite High-Cost Growth (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Strong 2025 Growth Expected, Shares Hit Key Support (Seeking Alpha) $ 🗃️

🌎 MercadoLibre: Shining On Long Term But Hold In Short Term (Seeking Alpha) $ 🗃️

🌎 MercadoLibre’s Fully Integrated Ecosystem (Business Model Mastery) $ 🗃️

The Engine Behind Latin America’s E-Commerce Giant

In the rapidly evolving landscape of global e-commerce, MercadoLibre (NASDAQ: MELI) stands out as a formidable force in Latin America. What makes it so successful? The answer lies in its fully integrated ecosystem—a seamless blend of e-commerce, fintech, logistics, and advertising. This intricate web of interconnected services not only optimizes user engagement but also creates powerful network effects and multiple high-margin revenue streams. Let’s dive deep into how each component of MercadoLibre’s ecosystem contributes to its dominance and why this model is so difficult for competitors to replicate.

🌎 Ternium: Appealing And Risky At The Same Time (Seeking Alpha) $ 🗃️

-

🌎 Ternium S.A. (NYSE: TX) 🇱🇺 – Manufactures & processes steel products (including for oil & gas) with 18 production centers in Argentina, Brazil, Colombia, United States, Guatemala & Mexico. Subs. of Argentine-Italian conglomerate Techint. 🇼 🏷️

🌎 Millicom International Cellular: Continued Potential For Outperformance Exists In 2025 (Seeking Alpha) $ 🗃️

🌎 Millicom International Cellular: 11% Dividend Yield, Near-Term Catalysts, Potential For Nearly 60% Upside (Seeking Alpha) $ 🗃️

-

🌎 Millicom (NASDAQ: TIGO) – Fixed & mobile, telecommunications services, cable & satellite TV, mobile financial services & local content such as music & sports in Latin America. 🇼 🏷️

🇦🇷 YPF Sociedad: It’s Time To Book Profits On This Foreign Winner (Rating Downgrade) (Seeking Alpha) $ 🗃️

-

🇦🇷 🏛️ Ypf Sa (NYSE: YPF) – Vertically integrated, majority state-owned Argentine energy company. Oil & gas exploration & production + transportation, refining & marketing of gas & petroleum products. 🇼 🏷️

🇦🇷 Banco Macro: Strong Fundamentals But Wait For A Pullback (Seeking Alpha) $ 🗃️

🇧🇷 XP: the leading Brazilian retail broker (Quipus Capital)

A 20-page primer on one of the companies best positioned to capture a Brazilian equities recovery

Initially a growth darling with a nosebleed valuation, XP Investimentos (XP Inc (NASDAQ: XP)) led digital innovation in Brazilian brokerage and retail securities markets when it IPOed in 2020.

Five years after its IPO at $40, the name now trades at $13. Beyond the obvious overvaluation at the IPO, several factors contributed to this drop: Brazil’s macroeconomic environment has been unfavorable, the country’s investment landscape is challenging for brokers, and competition—particularly from BTG—is now stronger and better prepared.

🇧🇷 Gerdau Steel: Solid Balance Sheet Outweighed By Imports Into Brazil (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras Stock Is On Sale, Reiterating ‘Buy’ (Seeking Alpha) $ 🗃️

🇧🇷 Petrobras: Undervalued Stock Meets Undervalued Currency (Seeking Alpha) $ 🗃️

🇧🇷 Atacadao: Trading Well Below Book Value And Betting On 2025 Turnaround (Seeking Alpha) $ 🗃️

-

🇧🇷 Atacadao (OTCMKTS: ATAAY) – Varied retail formats: Atacadão, Sam’s Club, Carrefour Hiper, Carrefour Bairro, Nacional, Super Bompreço & Carrefour Express. 🇼

🇧🇷 Cosan: Rising Rates, Leverage, And The Rocky Road Ahead (Seeking Alpha) $ 🗃️

🇧🇷 WEG: DeepSeek Has Opened An Opportunity To Buy The Best Brazilian Company (Rating Upgrade) (Seeking Alpha) $ 🗃️

-

🇧🇷 WEG SA (BVMF: WEGE3) – Operates worldwide in the electric engineering, power & automation technology areas. Electric motors, generators, transformers, drives & coatings. 🇼 🏷️

🇧🇷 Bradesco Deserves A Structural Sell For Now (Seeking Alpha) $ 🗃️

🇨🇱 Latam’s Positive Performance Will Likely Suffer As The Company Adds Leases (Seeking Alpha) $ 🗃️

-

🌎 LATAM Airlines Group (NYSE: LTM) – Chile based. Largest airline company in Latin America. Subsidiaries in Brazil, Colombia, Ecuador, Paraguay & Peru. 🇼

🇲🇽 Gruma – Valuation Is More Interesting, But Grain Prices And Competition Are Threats To Consider (Seeking Alpha) $ 🗃️

🇲🇽 Grupo Aeroportuario del Sureste: Unlock Tourism’s Potential In Mexico, Colombia+The Caribbean (Seeking Alpha) $ 🗃️

🌐 Nebius Group: DeepSeek Gives A Golden Buying Opportunity (Seeking Alpha) $ 🗃️

🌐 Nebius: DeepSeek Selloff Uncovers AI Buy Of The Decade (Seeking Alpha) $ 🗃️

🌐 What DeepSeek Means For Nebius And Other AI Data Center Providers (Seeking Alpha) $ 🗃️

-

🌐 Nebius Group NV (NASDAQ: NBIS) – AI-centric cloud platform built for intensive AI workloads. Sold Yandex to a consortium of Russian investors. Retains several businesses outside of Russia. 🇼 🏷️

$ = behind a paywall / 🗃️ = Link to an archived article

🇨🇳 In Depth: The Downsides of China’s Bond Fever (Caixin) $

For China’s mutual fund industry, bonds are in and stocks are out.

As of the end of September, mutual funds held 16.8 trillion yuan ($2.3 trillion) in bonds, constituting more than half of the industry’s over 30 trillion yuan in assets, according to East Money Information Co. Ltd., a financial data compiler. In contrast, stocks accounted for less than a quarter.

🇨🇳 China’s Infrastructure Dead-End (The Emerging Markets Investor)

Below, we review a few examples that characterize the nature of infrastructure spending in China today, many of which are trophy projects driven by politicians and the enormous construction/engineering lobby.

🇨🇳 The global AI race: Is China catching up to the US? (FT) $ 🗃️

🇨🇳 No Bullshit takeaways from China’s AI trenches: Why DeepSeek scares and excites everyone (Momentum Works)

DeepSeek is the first LLM chatbot our friends find usable on a daily basis: it is fast and demonstrates the full reasoning process. In comparison, ChatGPT is slow, hallucinating, poor in real-time online search, and often too conservative in its response. And of course, when accessing ChatGPT from China, you have to worry about the stability of VPNs.

That said, experience shows that GPT 4 overall still has better logic. Also, for business use, the ChatGPT API is still the best in the market: more stable, albeit very expensive compared to DeepSeek.

There is enough engineering, operations, and business talent in China to allow DeepSeek to continuously build on. A related point is that DeepSeek’s team employs young engineers rather than big shots—its star engineer (a 29-year-old woman) was poached by Xiaomi with a >4X salary increase, causing no impact on DeepSeek’s ability to carry on.

It is unlikely that DeepSeek will cause deflation of demand for NVIDIA and others’ chips. While DeepSeek has plausibly proven that the demand for training compute should not be as high as previously thought, it also shows reasoning that might end up consuming a lot more computing power.

🇨🇳 Why big techs didn’t use the DeepSeek approach (Momentum Works)

This article, originally published in Chinese, was excerpted from the notes of a discussion that took place in Beijing on Sunday 26 Jan 2025. The discussion was organised by Guangmi Li who is CEO of Shixiang Cap, an investment services company focused on deep research.

The offline discussion drew more than 10 people on a Sunday afternoon. The viewpoints of the notes are of the participants.

🇲🇴 Over 4,000 hotel rooms planned, being built in Macau (GGRAsia)

There were 2,928 hotel rooms being built in Macau as of the end of 2024, according to data disclosed on Friday by the city’s Land and Urban Construction Bureau.

The figures show there were four hotel projects under construction and a further 10 undergoing government approval as of the three months to December 31. Those would together provide the Macau market with 4,229 new hotel rooms. The data did not give estimated completion dates for the new hotel projects.

🇹🇼 What does Taiwan have to do with US mortgage rates? (FT) $ 🗃️

The weird financial dance between Taiwanese life insurers and US homebuyers

To quickly recap the last post, Taiwan has stealthily become the fifth largest foreign creditor in the world, with a net international investment position (external claims minus liabilities) of $1.7tn. That puts it in league with China, Germany, and Japan, despite being an economic minnow compared to those countries.

How did the Taiwanese life insurance industry get so enormous? They offered policyholders attractive alternatives to their bank deposits — higher yields but many of the same liquidity features.

Perhaps most strikingly, these insurers are not only massive but also running an equally massive currency mismatch.

🇰🇷 A Chaebol’s Fast Rise and Even Faster Fall (Asianometry)

South Korea’s Yulsan Group (율산그룹) really speed-ran the rise and fall of a business empire. Founded in 1975 with nothing. Two years later, $165 million in export revenue. 14 subsidiaries, 8,000 employees. A year after that, bankrupt. In this video, the story of a chaebol. They never even made it five years.

🇹🇭 Thailand still blank slate to casino investors: Umansky (GGRAsia)

There are many unanswered questions for any foreign investors interested in the possibility of running casino resorts in Thailand, and they might not immediately be answered even if an enabling law is passed this year.

He (Vitaly Umansky (pictured), senior analyst at Seaport Research Partners) observed that from his understanding, the Thai government “is having right now very limited advisory (input) coming in from third-party expertise,” regarding its plan for entertainment complexes, each to have casino.

Mr Umansky observed to GGRAsia: “The bill that’s out there right now is immensely short. It deals with policy from the perspective of setting up governing bodies. That’s a large part of it.”

In Thailand, where local media has reported there could be five licences on offer, there were “various political interests that are trying to push and pull things,” said Mr Umansky.

🇮🇳 Thematic Report: How Indian Hotel Sector Is Bucking the Trend of Slowdown? (Smartkarma) $

India’s economy is facing a temporary slowdown but there is one sector which ditched the slowdown trend

The leader of sector just said their upcoming quarter Q4FY25 will be similar to Q3FY25.

The hotel sector is slowly turning into a non-cyclical sector from a cyclical sector.

🌐 Guide to dividend withholding taxes (Asian Century Stocks)

A reader called JackB asked whether I’ve ever written a post on withholding taxes on dividends. So, I thought I should discuss the issue once and for all.

Withholding taxes can add up quickly if you invest in dividend-paying international stocks, so it’s an issue worth paying attention to.

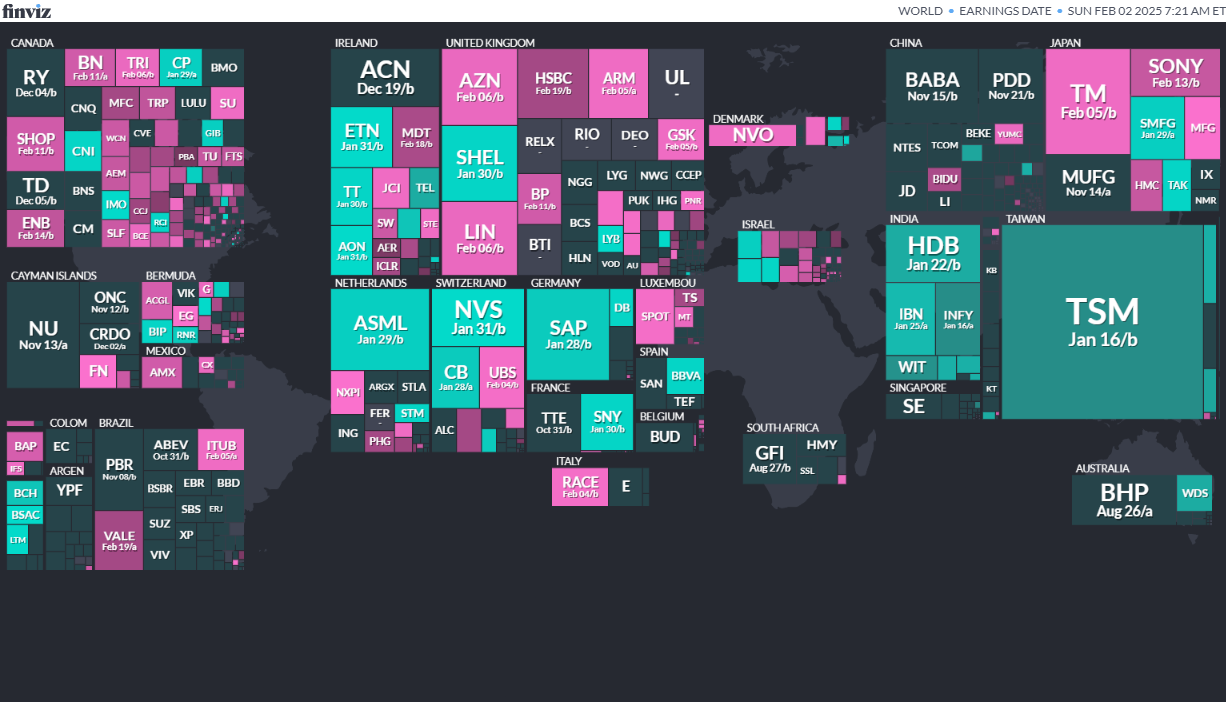

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

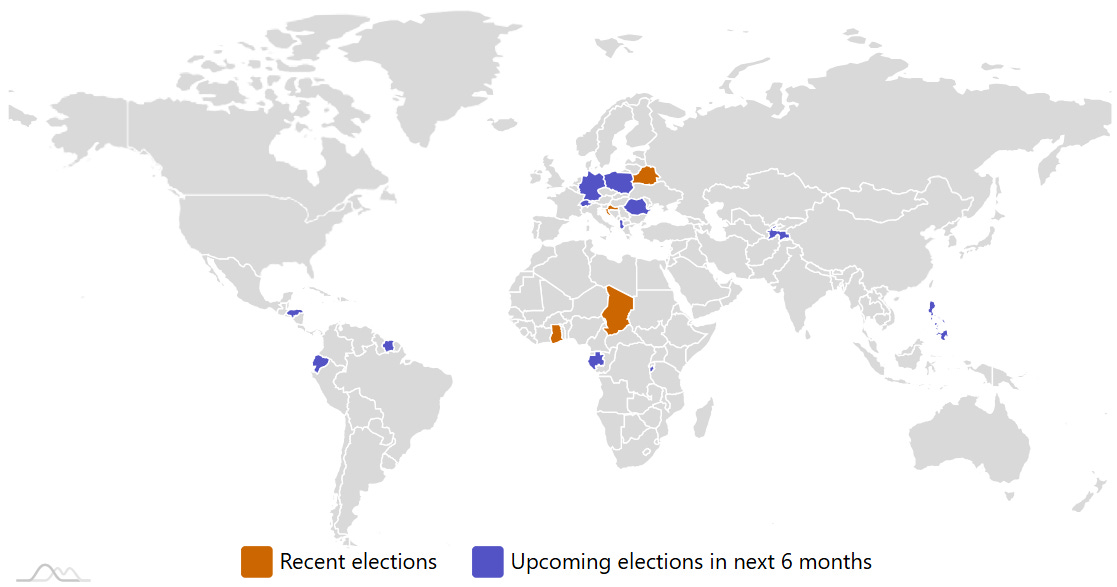

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

Frontier and emerging market highlights from IPOScoop.com and Investing.com (NOTE: For the latter, you need to go to Filter and “Select All” countries to see IPOs on non-USA exchanges):

BeLive Holdings BLVE R.F. Lafferty & Co., 1.8M Shares, $4.00-4.00, $7.0 mil, 2/3/2025 Week of

BeLive Holdings is a holding company with no material operations of its own. It conducts its operations of providing live commerce and shoppable short videos through its indirect wholly owned subsidiaries, BeLive Singapore and BeLive Vietnam. (Incorporated in the Cayman Islands)

Our mission is to be an industry leader in designing, developing and providing technology solutions for live commerce and shoppable short videos.

Our Operating Subsidiaries are BeLive Singapore, which was incorporated on June 18, 2014, under the laws of Singapore, and BeLive Vietnam, which was incorporated on June 16, 2021, under the laws of Vietnam, and which has been a wholly owned subsidiary of BeLive Singapore since incorporation. Through our Operating Subsidiaries, BeLive Cayman primarily engages in the development and provision of live commerce and shoppable short videos solutions.

Our Group’s history began in 2014 when we launched a social streaming mobile application with a focus on empowering users to share their lives while interacting with their audience in real time.

Recognizing a significant potential in e-commerce, we redirected our focus in 2018 towards business-to-business and providing live commerce and shoppable short videos solutions (“BeLive Solutions”) to international retail companies and e-commerce marketplaces. Our BeLive Solutions enable our customers to leverage the power of interactive and immersive live and video commerce to their online business and enable our customers to curate unique videos that may also be aired real-time as they are simultaneously being recorded, for anytime instant replay. We categorize our BeLive Solutions into(i) an enterprise-grade White Label solution (“BeLive White Label Solution”) which is customized to meet a customer’s unique requirements and which can be integrated into their existing internal system and (ii) a cloud-based software-as-a-service (SaaS) solution (“BeLive SaaS Solution”) for customers who are looking for a quick and cost-effective live commerce and shoppable short video solution without the necessity of building their own infrastructure and technology stack.

On June 9, 2023, as part of a reorganization prior to the listing, BeLive BVI acquired all of the shares of BeLive Singapore from FTAG Ventures Pte. Ltd, a controlling shareholder, Kenneth Teck Chuan Tan, and several other minority shareholders in exchange for shares of BeLive Cayman in the same proportion as their respective shareholdings in BeLive Singapore. Upon completion of such reorganization, BeLive Singapore became a wholly owned subsidiary of BeLive BVI.

Note: Net loss and revenue are in U.S. dollars (converted from Singapore dollars) for the 12 months that ended June 30, 2024.

(Note: BeLive Holdings cut its IPO’s size to 1.75 million shares – down from 3.0 million shares – and reduced the assumed IPO price to $4.00 – the bottom of its previous price range of $4.00 to $6.00 – to raise $7.0 million, according to an F-1/A filing dated Oct. 30, 2024.)

(Note: Unless otherwise noted, the share and per share information in this prospectus reflects a 5-for-1 reverse stock split (the “Reverse Split”) of our outstanding Ordinary Shares effective as of February 18, 2024.)

(Note: BeLive Holdings filed its F-1 on July 10, 2024, and disclosed the terms for its IPO: The Singapore-based company is offering 3.0 million shares at a price range of $4.00 to $6.00 to raise $15.0 million. Background: BeLive Holdings submitted confidential IPO documents to the SEC in December 2023.)

FBS Global Ltd. (New Filing December 2024) FBGL WallachBeth Capital, 2.3M Shares, $4.50-5.00, $10.7 mil, 2/4/2025 Tuesday

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing on Dec. 5, 2024. Background: This filing followed the company’s withdrawal of its previous IPO plans in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO. FBS Global’s path to going public began in mid-September 2022 when the Singapore company submitted confidential IPO documents to the SEC.))

(Note on corporate structure: The predecessor of our principal operating company was incorporated on March 9, 1996, in Singapore under the name Finebuild Systems Pte Ltd. Pursuant to a restructuring that took effect on August 2, 2022, FBS Global Limited, an exempted company incorporated in the Cayman Islands, through its wholly owned subsidiary, Success Elite Developments Limited, a company incorporated in BVI, became the ultimate holding company of our current principal operating subsidiary referred to herein as FBS SG. (Incorporated in the Cayman Islands) )

From its beginning as a construction company since 1996, FBS SG has developed into a premier integrated engineering company that provides a full suite of construction and engineering services. These services include the supply of building materials and precast concrete components, recycling of construction and industrial wastes, research, and development, as well as pavement consultancy services.

We are an established interior design and build (also referred to as “fit-out”) specialist in Singapore with a track record of over 20 years in institutional, residential, commercial and industrial building projects. Our scope of services comprises design, supply and installation of ceilings, partitions, timber deck, carpet, lead lining, acoustic wall panel, built-in furnishing, carpentry and mechanical & electrical services of a building. We also undertake main construction and building works projects.

**Note: Net loss and revenue are in U.S. dollars (converted from Singapore’s currency) for the 12 months that ended June 30, 2024.

(Note: FBS Global Ltd. revived its IPO plans with a new F-1 filing dated Dec. 5, 2024, in which it kept the same terms from its original IPO filing: The company plans to offer 2.25 million shares at a price range of $4.50 to $5.00 to raise $10.69 million.)

(Note: FBS Global Ltd. withdrew its IPO filing in a letter to the SEC dated Nov. 4, 2024, stating that the company did not intend to pursue the IPO.)

(Note: FBS Global Ltd. revived its micro-cap IPO and disclosed its revised terms on Aug. 13, 2024, in an F-1/A filing: The company increased the number of shares to 2.25 million – up from 1.88 million shares – and raised the lower end of its price range to $4.50 – up from $4.00 – so the new price range is $4.50 to $5.00 – to raise $10.69 million. The company named WallachBeth Capital as its sole book-runner, replacing Eddid Securities USA.)

(Note: FBS Global Ltd. postponed its IPO in April 2024, when it had been expected to price its micro-cap initial public offering on or around April 13, 202r. Background: FBS Global Ltd. says its assumed IPO price is $4.00 – the low end of its $4.00-to-$5.00 price range – on 1.875 million shares, according to an F-1/A filing dated Feb. 23, 2024. Background: FBS Global Ltd. cut its IPO’s size to 1.875 million shares – down from 2.75 million shares – and set the price range at $4.00 to $5.00 to raise $8.44 million, according to an F-1/A filing dated Dec. 29, 2023. In that Dec. 29, 2023, filing with the SEC, FBS Global Ltd. also disclosed that it has changed its sole book-runner to Eddid Securities USA from Pacific Century Securities.)

(Note: FBS Global Ltd. filed an F-1/A dated July 27, 2023, in which it trimmed the size of its IPO to 2.75 million shares – down from 3.75 million shares – at US$4.00 to raise $11.0 million. The number of shares – 2.75 million – will all be offered by the company – and this is the same as in the previous prospectus (F-1/A) filed on June 26, 2023. The difference: The selling stockholder’s 1.0 million shares are not highlighted in the July 27, 2023, prospectus. However, in the July 27, 2023, filing, there is a note that the selling stockholder still intends to sell up to 1.0 million shares. Background: FBS Global Ltd. filed an F-1/A on June 26, 2023, and updated its financial statements for the year ended Dec. 31, 2022. FBS Global Ltd. filed its F-1 on Jan. 30, 2023, and disclosed terms for its IPO: 3.75 million (3,750,000) shares at US$4.00 to raise $15.0 million. Of the 3.75 million shares in the IPO, the company is offering 2.75 million shares and the selling stockholder is offering 1.0 million shares. FBS Global Ltd. will NOT receive any proceeds from the sale of the selling stockholder’s shares. FBS Global Ltd. filed confidential IPO documents on Sept. 13, 2022.)

Huachen AI Parking Management Technology Holding Co., Ltd. HCAI Benjamin Securities/D. Boral Capital (ex-EF Hutton), $1.5M Shares, 4.00-6.00, $7.5 mil, 2/5/2025 Wednesday

We specialize in smart parking solutions in China. We also provide equipment structural parts. (Incorporated in the Cayman Islands)

We offer several types of automated parking systems: PSH (lifting and horizontal sliding), PJSA (convenient lifting) and PCS Vertical Lifting, designed to maximize space in urban environments. We also provide equipment structural parts, including conveyor belt components, feeder system parts, and railroad accessories, along with product design consultation and maintenance services for parking systems.

Note: Net income and revenue are for the 12 months that ended Dec. 31, 2023.

(Note: Huachen AI Parking Management Technology Holding Co., Ltd. whacked its IPO’s size by 70 percent to 1.5 million shares – down from 5.0 million shares initially – and kept the price range at $4.00 to $6.00 – to raise $$7.5 million, according to an F-1/A filing dated Dec. 31, 2024.)

(Note: Huachen AI Parking Management Technology Holding Co., Ltd. filed its F-1 on Aug. 14, 2024, and disclosed its IPO’s terms: 5.0 million shares at a price range of $4.00 to $6.00 to raise $25.0 million. Background: Huachen AI Parking Management Technology Holding submitted confidential IPO documents to the SEC on Dec. 19, 2023.)

Plutus Financial Group PLUT R.F. Lafferty/Revere Securities, 2.1M Shares, $4.00-6.00, $10.5 mil, 2/5/2025 Wednesday

We are a holding company whose Hong Kong operating subsidiaries, Plutus Securities and Plutus Asset Management, provide financial services. (Incorporated in the Cayman Islands)

Plutus Securities is a licensed Hong Kong securities broker whose services include brokerage services and margin financing services as well as underwriting and placement services.

Plutus Asset Management provides asset management services and investment advisory services.

Note: Net loss and revenue are in U.S. dollars for the 12 months that ended June 30, 2024.

(Note: Plutus Financial Group filed its F-1 on Jan. 31, 2024, and disclosed the terms for its IPO – 2.1 million shares at a price range of $4.00 to $6.00 to raise $10.5 million, if priced at the $5.00 mid-point of its range.)

ALE Group Holding Limited ALEH Dawson James Securities/D. Boral Capital (ex-EF Hutton), 1.3M Shares, $4.00-6.00, $6.3 mil, 2/10/2025 Week of

We are a holding company incorporated in the BVI with all of our operations conducted in Hong Kong by our wholly owned subsidiary, ALE Corporate Services Ltd., also known as ALECS. (Incorporated in the British Virgin Islands)

We provide accounting and corporate consulting services to small and medium-sized businesses. Our services include financial reporting, corporate secretarial services, tax filing services and internal control reporting. Our business is operated through our wholly owned subsidiary, ALE Corporate Services Ltd. (ALECS), a Hong Kong company incorporated on June 30, 2014. Our goal is to become a one-stop solution for all the accounting, corporate consulting, taxation and secretarial needs of small and medium enterprises operating in Asia and the U.S.

**Note: Net income and revenue figures are in U.S. dollars (converted from Hong Kong dollars) for the fiscal year that ended March 31, 2024.

(Note: The company disclosed that E.F. Hutton was named the sole book-runner – replacing Prime Number Capital – according to an F-1/A filing dated March 26, 2024.)

Concorde International Group CIGL R.F. Lafferty & Co., 1.3M Shares, $4.00-4.00, $5.0 mil, 2/10/2025 Week of

We provide integrated security solutions and facilities management services in Singapore. (Incorporated in the Cayman Islands)

We deliver security services by combining human expertise with advanced technology. We provide mobile monitoring and response systems, which involve vehicles patrolling designated areas, covering multiple sites within a 24-hour period.

Note: Net income and revenue are for the year that ended Dec. 31, 2023.

(Note: Concorde International Group filed its F-1 on Aug. 27, 2024, and disclosed the terms for its small-cap IPO: 1.25 million shares at $4.00 to raise $5.0 million.)

Fitness Champs Holdings Ltd. FCHL Bancroft Capital LLC, 2.0M Shares, $4.00-5.00, $9.0 mil, 2/10/2025 Week of

(Incorporated in the Cayman Islands)

We believe we are a leading sports education provider in Singapore based on the following: (i) in 2023, we were the largest service provider of the SwimSafer Program based on the number of assessment bookings, accounting for approximately 30% of market share; and (ii) we are one of the few swim education providers in Singapore that provides both services to students under training programs funded by the Singapore Government and provision of customized private swimming training services.

We offer general swimming lessons to children and adults, with ladies-only swimming lessons available, as well as aquatic sports classes such as water polo, competitive swimming and lifesaving. We believe in imparting the correct swim stroke techniques and skills to all of our students so that they can learn to swim within the shortest time span in a variety of strokes, ranging from freestyle, breaststroke, butterfly, survival backstroke and side kick. We are one of the largest providers of swimming lessons to children enrolled in public schools under the MOE (Ministry of Education) in Singapore through the SwimSafer program. We have been offering private swimming lessons to children, youth and adults under our brand “Fitness Champs” since 2012. We aim to make swimming an enjoyable and affordable sport for children and adults, for water safety and as a way of keeping fit and healthy.

Note: Net income and revenue are for the 12 months that ended June 30, 2024.

(Note: Fitness Champs Holdings Limited filed its F-1 on Sept. 9, 2024, and disclosed the terms for its IPO – 2.0 million shares at a price range of $4.00 to $5.00 to raise $9.0 million.)

Climate change and ESG are some recent flavours of the month for most new ETFs. Nevertheless, here are some new frontier and emerging market focused ETFs:

-

12/24/2024 – FT Vest Emerging Markets Buffer ETF – December – TDEC – Options

-

11/19/2024 – Fidelity Fundamental Emerging Markets ETF – FFEM – Equity

-

11/19/2024 – Fidelity Enhanced Emerging Markets ETF – FEMR – Equity

-

11/13/2024 – Dimensional Emerging Markets ex China Core Equity ETF – DEXC – Equity

-

10/07/2024 – First Trust WCM Developing World Equity ETF – WCME – Active, equity

-

09/20/2024 – FT Vest Emerging Markets Buffer ETF – September – TSEP – Options

-

09/11/2024 – Polen Capital Emerging Markets ex-China Growth ETF – PCEM – Equity

-

09/04/2024 – Macquarie Focused Emerging Markets Equity ETF – EMEQ – Active, equity

-

09/04/2024 – iShares MSCI Emerging Markets Value Factor ETF – EVLU – Equity

-

09/04/2024 – iShares MSCI Emerging Markets Quality Factor ETF – EQLT – Active, equity

-

09/04/2024 – SPDR S&P Emerging Markets ex-China ETF – XCNY – Equity, ex-China

-

08/13/2024 – Simplify Gamma Emerging Market Bond ETF – GAEM – Active, Bond, Latin America

-

08/13/2024 – Janus Henderson Emerging Markets Debt Hard Currency ETF – JEMB – Currency

-

07/01/2024 – Innovator Emerging Markets 10 Buffer ETF – EBUF – Equity

-

05/16/2024 – JPMorgan Active Developing Markets Equity ETF – JADE – Equity

-

05/09/2024 – WisdomTree India Hedged Equity Fund – INDH – Equity, India

-

03/19/2024 – Avantis Emerging Markets ex-China Equity ETF – AVXC – Active, equity, ex-China

-

03/15/2024 – Polen Capital China Growth ETF – PCCE – Active, equity, China

-

03/04/2024 – Simplify Tara India Opportunities ETF – IOPP – Active, equity, India

-

02/07/2024 – Direxion Daily MSCI Emerging Markets ex China Bull 2X Shares – XXCH – Equity, leveraged, China

-

01/11/2024 – Matthews Emerging Markets Discovery Active ETF – MEMS – Active, equity, small caps

-

01/10/2024 – Matthews China Discovery Active ETF – MCHS – Active, equity, small caps

Frontier and emerging market highlights:

Check out our emerging market ETF lists, ADR lists (updated) and closed-end fund (updated) lists (also see our site map + list update status as most ETF lists are updated).

I have changed the front page of www.emergingmarketskeptic.com to mainly consist of links to other emerging market newspapers, investment firms, newsletters, blogs, podcasts and other helpful emerging market investing resources. The top menu includes links to other resources as well as a link to a general EM investing tips / advice feed e.g. links to specific and useful articles for EM investors.

Disclaimer. The information and views contained on this website and newsletter is provided for informational purposes only and does not constitute investment advice and/or a recommendation. Your use of any content is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the content. Seek a duly licensed professional for any investment advice. I may have positions in the investments covered. This is not a recommendation to buy or sell any investment mentioned.

Emerging Market Links + The Week Ahead (February 3, 2025) was also published on our website under the Newsletter category.