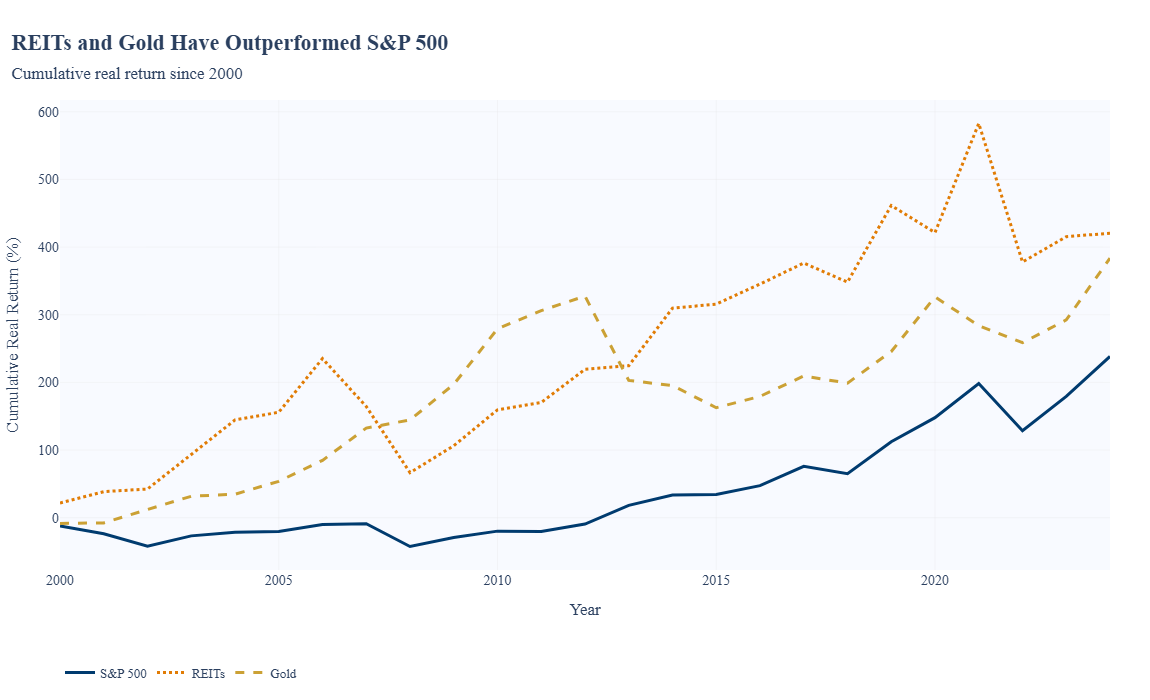

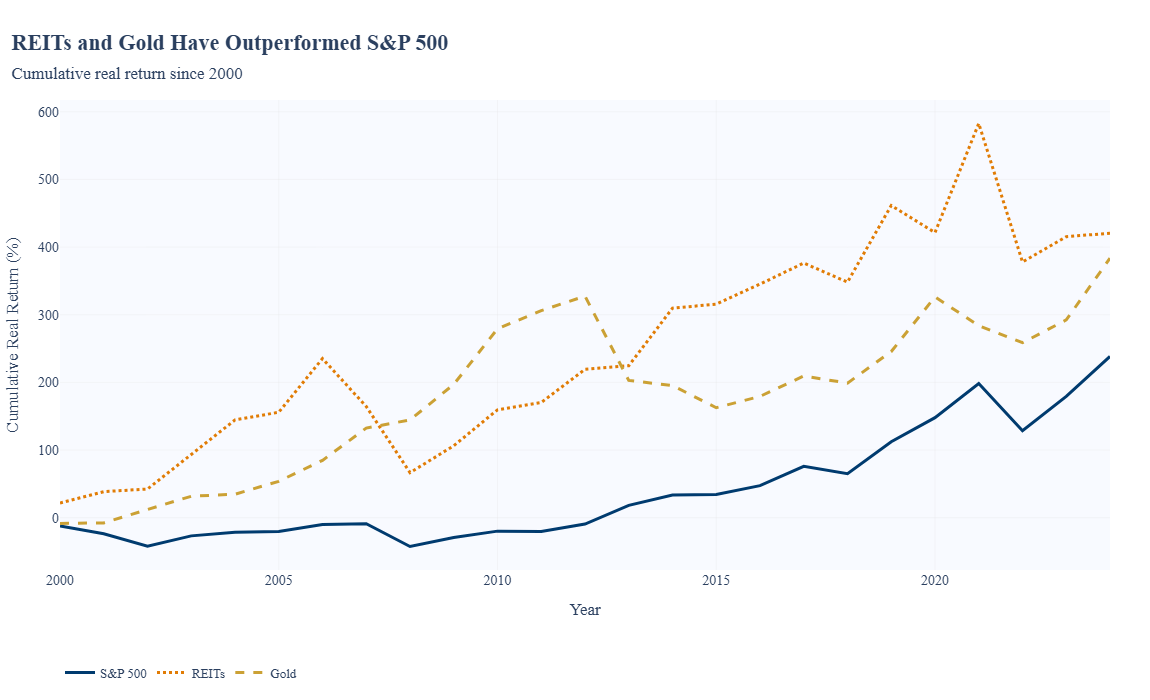

#7- “Reits and Gold surpassed American stocks.” -Meb Faber Research

Let’s rewind to Y2K. Britney was toppings of the charts, and people were building water to prepare for a digital apocalypse, and American stocks blocked the bleak market of the 1990s. The S & P 500 was invincible. Or it was seen.

But the reality hit. Technology bubble. 9/11. Two recession. Housing collapse. Then there is a 15 -year bull market in the US stock where S & P 500 crushed everything from the ruins.

And what can we see now after all dust is settled after 1/4 century?

Despite the long lasting inventory, real assets, such as Reits and GOLD, surpassed S & P 500 since the beginning of the century.

Submit it.

American stocks have been a theater since 2009, especially since the magnificent seven years, but longer lenses tell a cooler story. If you posted on the spy at the end of 1999, you will follow the brilliant rocks and commercial real estate proxy.

It is not to knock on American stocks. It reminds us of market cycle and diversification.

Recently, the bias will chase our shares into the stratosphere. But when zoomed in, the result is darker. Gold should not surpass stocks. Lights are just for income.

Of course, before someone shouts that we choose the start date. But the point is all asset classes, even premier Asset classes, an American stock, can achieve other assets for a long time. Most of them are longer than being willing to accept.

The lesson here is not to abandon our stocks. It is to recognize that portfolio construction is more than chasing a hot hand. The same is true for any regime if you own a global asset (stock, bond and real assets).