Emerging Markets Stock Picks, Tweets and Podcasts (December 2023)

We’ve chosen a variety of emerging market stocks to highlight in late December (among others mentioned later in this post). Some quick actions include:

-

a few Singapore listed stocks These are topics that have been recently upgraded or downgraded by local brokers.

-

all Recently Listed Indian Fashion Stocks that “There’s a lot of headroom” to grow in India before expanding overseas, details one recent Twitter thread Big IT service stocks.

-

all 12+ Indian Small & Mid Cap Infrastructure Stocks It is positioned to benefit from the upcoming election and associated infrastructure spending.

-

several Indian railway stocks It will benefit from modernization. indian railways. Five of these stocks already have YTD returns of 100-200% or more.

-

not Indian Shipyards and Shipyard Stocks This will benefit the Indian government’s space development efforts.

-

six Indian Stock Recommendations Used in finance, cement, oil and gas, mining and pharmaceutical sectors. All have performed well recently and are said to have further upside in 2024.

-

several south africa stocks It’s a top pick for 2023 and has achieved mixed results.

-

all Helium and LNG inventory Become a global leader in helium production.

-

part Canadian listed mining stocks The focus was on detailed presentations from Latin America (Mexico and Ecuador) and recent European mining conferences.

-

Updated analysis of colombian stocks Guaranteed by one of us tear sheet Early this year.

It’s a quiet time at the end of the year, so money focused posts An email will be sent out early this week to paid subscribers only. Focuses on published funds, fund managers, research and stock recommendations, and other related material (EM Fund Stock Recommendations and Country Commentary (December 28, 2023)). This means they are bulletproof The summary includes direct links to more interesting material covered later in the post. (To save time) you can also check whether updated monthly or quarterly fact sheets and commentary have been posted on the fund’s website.

Other interesting tweets, podcasts, studies, articles, and more Ideally, you’ll want to mention emerging market stock recommendations. (Added company description, technical charts, forward P/E and dividend yield, etc.) or other relevant information for EM investors will be published in a separate post, most likely a paywalled post later in the week depending on the volume of material. do. (There’s still so much crap on Twitter that it’s a little easier to navigate on YouTube etc).

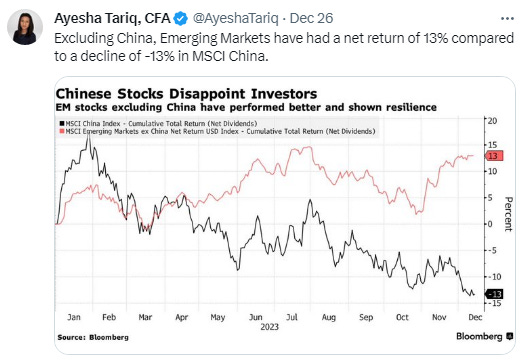

One recent tweet covered in this post worth mentioning observed how China’s economy is fundamentally different today. Investors are still excited about the growth stocks of yesterday. (aka big tech names, etc.). The tweet ended with China saying: At the macro level, no investment is possible at all.; However, as the world’s second largest economy, Always have pockets available for investment.

That means looking for new investment ideas both there and in other markets (like India, where many stocks trade at a premium).

Now for the disclaimers etc (links require further editing).

disclaimer. The information and views contained on this website and in our newsletter are provided for information purposes only and do not constitute investment advice and/or recommendations. Your use of any Content is entirely at your own risk, and it is your sole responsibility to evaluate the accuracy, completeness, and usefulness of the Content. For investment advice, seek out a fully licensed professional. I may have a position in that investment. This is not a recommendation to buy or sell any of the investments mentioned.

For additional disclaimers and an explanation of the reason for this post, see: Disclaimer: EM fund stock recommendations and country commentary posts.

memo: Where possible, company links will direct you to the appropriate investor relations or company page. Region and country links are on the next page. ADR or ETF Pages with additional country-specific resources, such as links to local stock markets and media websites. Please report invalid links in the comments section.

🗄️ Funding Documents/Updates; ⚠️ Public or limited access available depending on your location, investor status, etc. 🎥 Video; 🎙️Podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 🗃️ Archived articles; 📯 Press Release; 🔬 Research analysis (including articles/blog posts by fund managers, etc.)

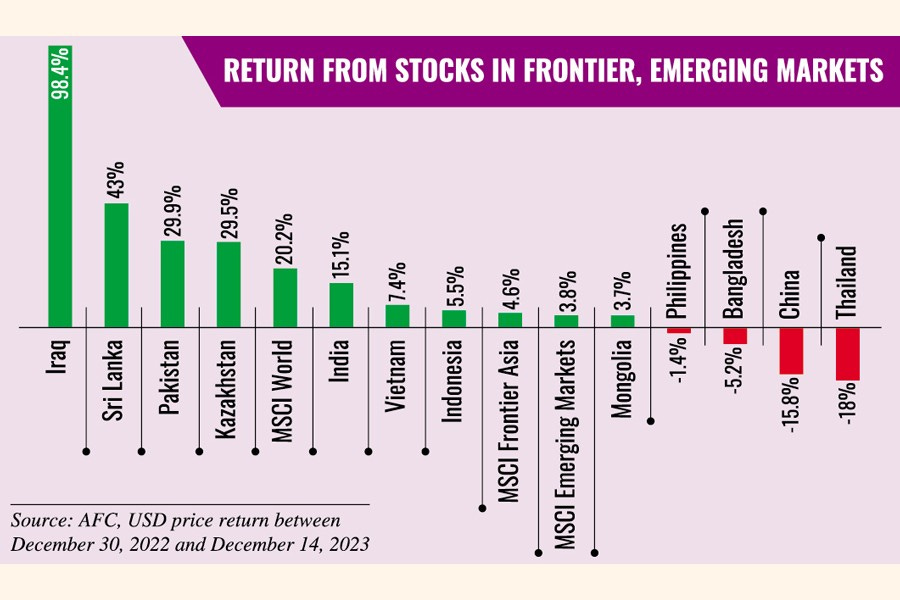

This is an interesting chart.

📰 In 2023, Bangladesh lags far behind its frontier market peers. What will happen in 2024? (Financial Express) December 2023

Hong Kong based Asia Frontier Capital It said monetary easing had led to profitable returns in Pakistani and Sri Lankan stocks.

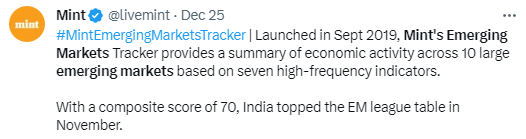

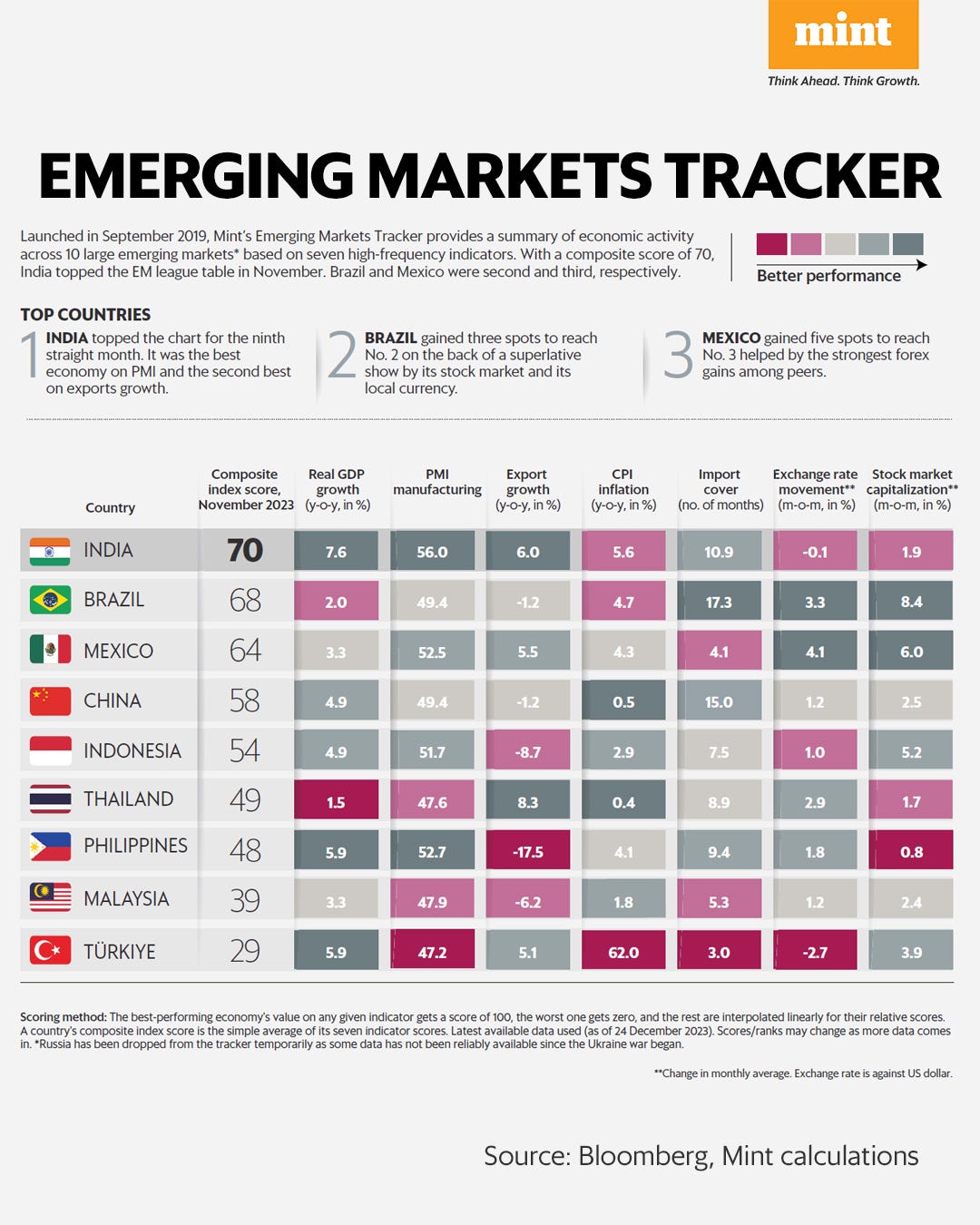

Mint’s Emerging Markets Tracker for November:

Most of the accompanying articles are behind a paywall.

📰 India sizzles to first place on Mint Tracker, taking first place on Trot for 9 consecutive months (livemint.com) December 2023

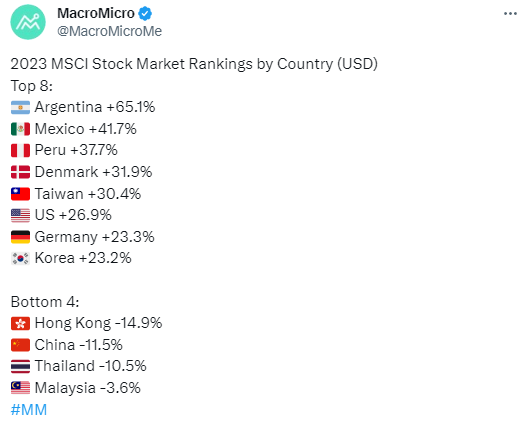

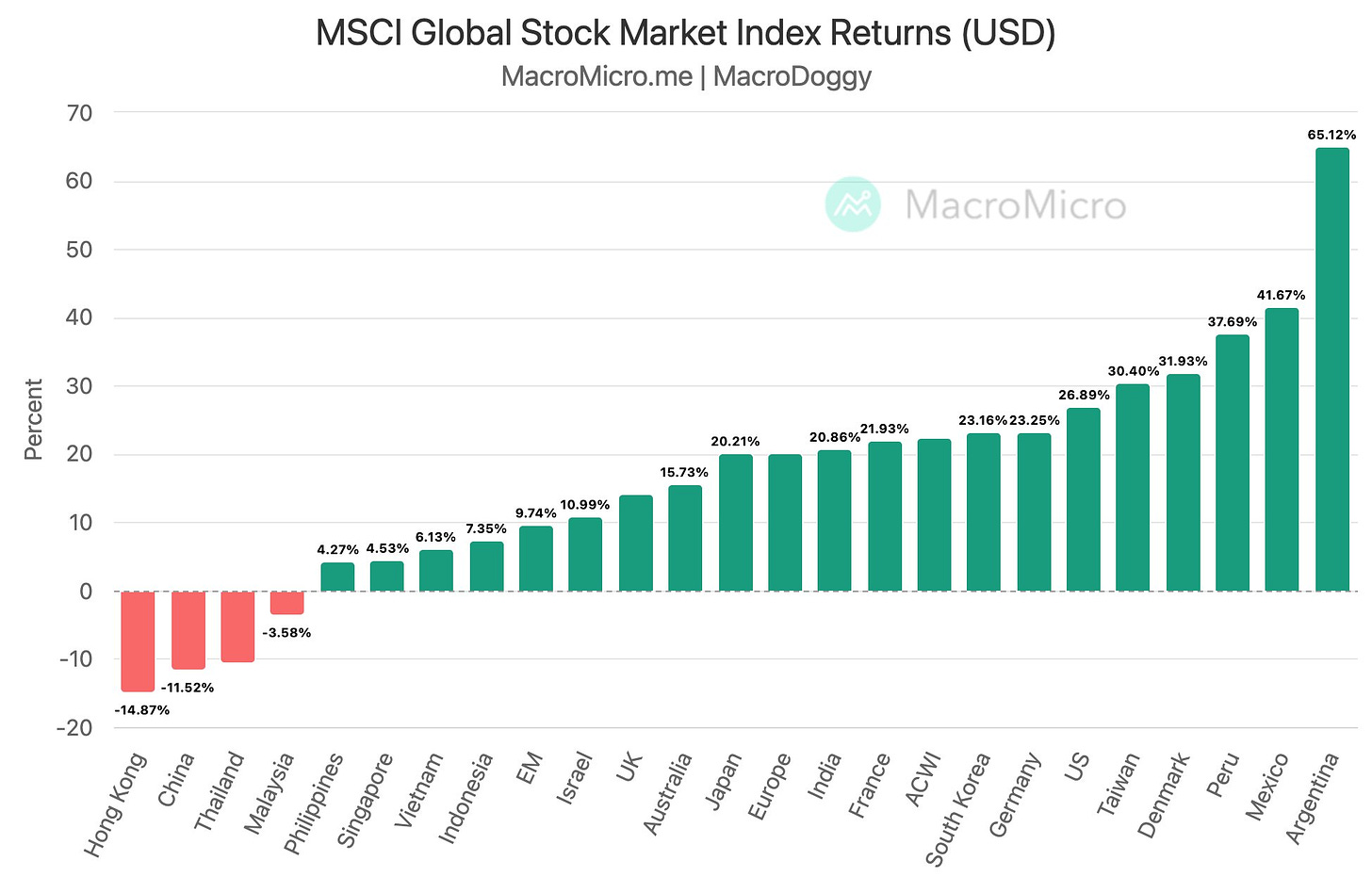

The world turned upside down – Argentina on top, China on the bottom

This chart is also worth highlighting:

Here is a tweet listing the best performing emerging market stocks. Brazil, China, India, Korea, Mexico, Poland, Saudi Arabia, Taiwan) But I think we’re missing some smaller stocks.