Apple: Dead Money Thesis Plays (NASDAQ:AAPL)

akiyoko/iStock via Getty Images

Just two years ago, Stone Fox Capital warned investors: apologize (NASDAQ:AAPL) was dead money for up to four years. The tech giant’s stock was set for trouble. The strong new product development needed to warrant current prices at the time ensures even higher prices over the years. my investment thesis Extreme bearishness remains on stocks due to lack of growth and still disconnected valuations.

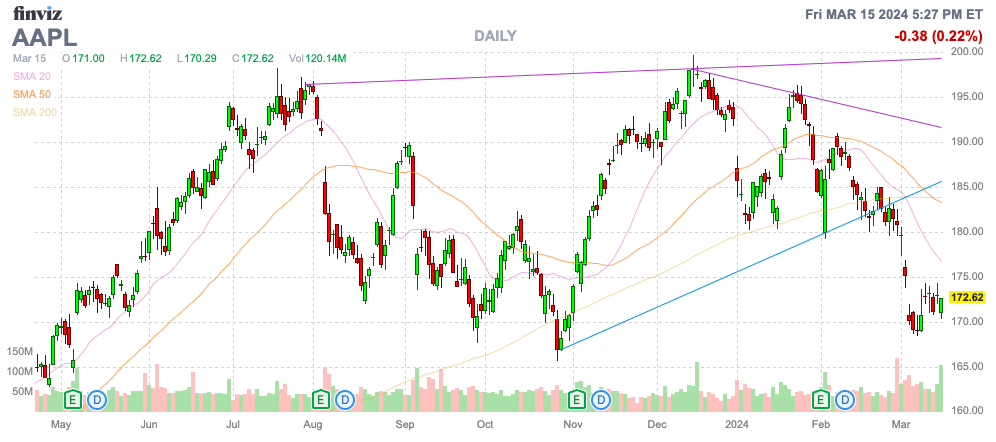

Source: Finviz

product development issues

In March 2022, analysts predicted that Apple would achieve minimal growth over the next four years, but its stock price has already recorded tremendous growth. The big question was whether the tech giant could achieve these growth rates.

Apple really needed new products like AR/VR devices and autonomous EVs to generate growth. This is the interest rate needed to secure a stock transaction of $166. In this regard, the Vision Pro was recently released with minimal sales prospects due to production limitations, and the long-vaunted Apple Car plan was ended.

The company enters the midpoint of FY24, with neither product expected to deliver significant returns for Apple over the next few years, which were future growth drivers in its FY22 investment thesis. The Vision Pro certainly received positive feedback upon launch, but its $3,500 price point and the complexity of creating an AR/VR device limited both supply and demand. Needless to say, Apple hasn’t released a roadmap for its AR/VR device segment, similar to how the iPhone launches new products every year.

Top analysts such as Dan Ives of Wedbush Securities and Wamsi Mohan of BofA Securities have predicted Vision Pro sales in the 400K to 600K range. At $3,500 per unit, 2024 sales would be just $1.4 billion to $2.1 billion, which would probably include the December quarter included in FY25 sales.

Ming-Chi Kuo, an influential Apple analyst, went so far as to say that concerns about demand strength led to a significant slowdown in sales following the rush of early adopters. Analysts suggest that the MR device product roadmap has limited visibility, with cheaper versions expected in the first quarter of 2026 and new models with advanced technology expected until 2027.

Mohan provides an estimate of 4 million units for the low-end model in FY26. At a $2,000 cost, the Vision Pro line would only generate $8 billion in sales, and considering the demand equation for early devices has slowed dramatically and $2,000 for AR/VR devices are still very expensive for consumer adoption, these numbers seem aggressive. .

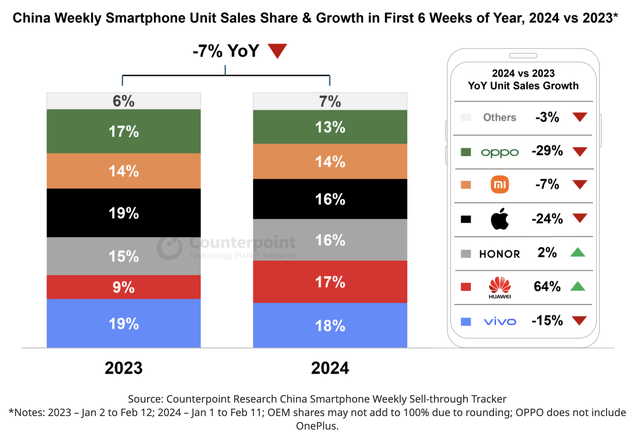

At the same time, Apple faces an existential threat in China as iPhone sales plummet. Counterpoint Research recorded a 24% decline in iPhone sales in China in the first six weeks of 2024 after Huawei surprised the market with competitive smartphones despite US chip restrictions.

Source: Counterpoint Research

Huawei’s sales have surged 64% from 2024 compared to the same period last year, while other smartphone manufacturers’ sales have been sluggish. Total sales in China fell 7% year-on-year, contributing to Apple’s material weakness, and in addition to the decline in sales, its market share fell 3 percentage points to 16%.

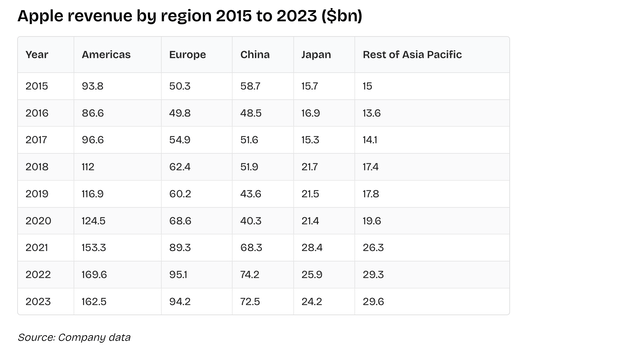

China is a big problem for Apple, with FY23 sales accounting for 19% of total revenue. The country produced $73 billion in annual revenue and was the tech giant’s second-largest region, only behind Europe as a whole at $94 billion.

Source: App Business

In fact, unless the iPhone 16 sees additional demand due to its focus on AI, Apple doesn’t have a bright spot on its product development roadmap. The iPhone 15 faced the problem of not getting any major upgrades from the start, making people indifferent to upgrading phones that cost more than $1,000.

Currently, the iPhone generates $200 billion in annual sales, and the weakness of the Chinese market is a major concern. Despite the launch of 5G iPhones and COVID-19, iPhone sales are still only slightly above FY18 levels of $166 billion, suggesting a demand problem. Apple is still selling roughly the same number of iPhones as it did in FY15, when sales first surpassed 230 million units, and all of the revenue growth is due to higher ASPs.

Stock weakness should continue

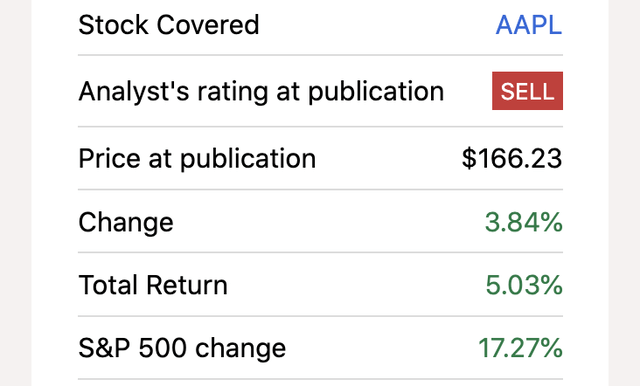

The original dead money theory was written in March 2022, with Apple only up 4% during that period while the S&P 500 index rose more than 17%. During this period, the stock rose to nearly $200, and investors were warned that an irrational rally up to $250 could occur.

Source: Seeking Alpha

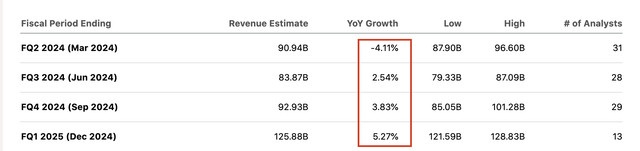

The key here is that Apple has now reported minimal or negative growth for five consecutive quarters, and its forecasts for the year ahead aren’t particularly impressive. The company forecast first-quarter 2024 revenue to be $5 billion lower than second-quarter 2023 revenue levels, a 4% decline. Analysts’ forecasts for growth in the next three quarters appear to be particularly aggressive given iPhone sales issues in China and a lack of new product innovation to boost sales.

Source: Seeking Alpha

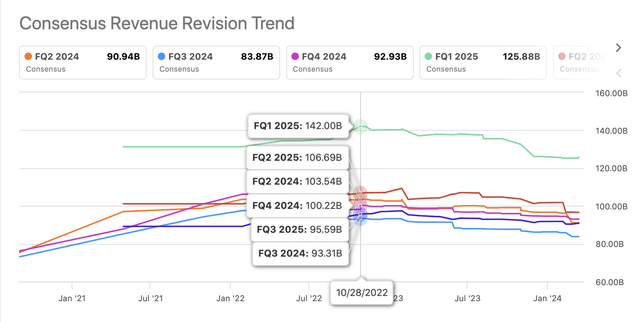

A prime example of where analyst estimates have been overly aggressive for some time is the Q1 2025 revenue target. The agreed target for October 2022 was $142 billion, and that figure has now fallen below $126 billion, with growth of just 5% year-on-year.

Source: Seeking Alpha

As highlighted in our research over the past two years, Apple has a history of generally being consistent with analyst targets for the quarters ahead. The tech giant will slightly beat estimates with limited growth. Only during the Covid period did sales growth accelerate and the company started to beat analysts’ estimates, but that period of excessive growth has likely contributed to some of the current weakness.

The original Dead Money article predicted what Apple’s FY25 EPS estimates would look like if it actually beat analyst estimates by 5% annually. The EPS target is still just $8.82 in the bullish cash scenario, and the current consensus analyst EPS estimate is just $7.16.

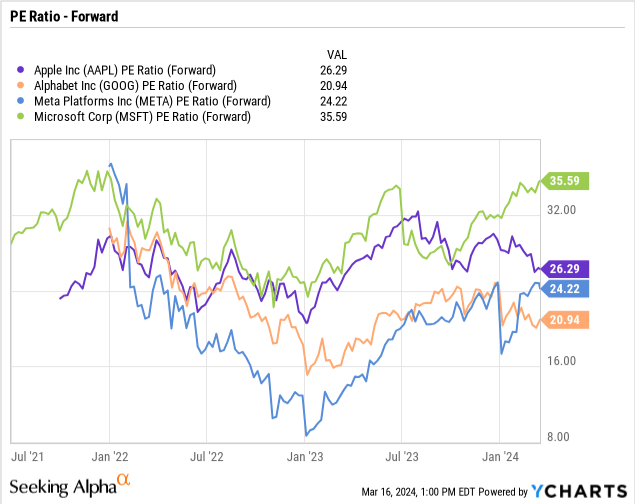

Even in a best-case scenario where Apple achieves 6% annual growth and exceeds analyst EPS targets, the stock still wouldn’t justify its $166 price. Now, Apple is still trading at 26 times this lowered EPS target, and that price is clearly not justified.

The stock still trades at a higher multiple. meta platform (meta) and Google (GOOG) Even though these companies are heavily involved in AI and are already reporting strong growth. microsoft (MSFT) trades in a different mood with a forward EPS target of nearly 36x.

Despite the market’s love for these Magnificent 7 stocks over the past two years, several have lagged the market significantly during this difficult period. Even with a PE multiple of 20x, you really have to question why Apple is getting such a favorable valuation when the stock price is only $143.

Again, the market is probably aggressively assigning 7% to 10% EPS growth for Apple over the next three years. Even if the company achieves these goals, Apple would be lucky to earn a 15x multiple without a clear new product offering a real growth path from its $400 billion revenue base.

Vision Pro is the only product of any interest to consumers, but the general consensus is that it will generate only a few billion dollars in sales over the next few years and that the product will quickly become obsolete by FY26. Apple has shown no signs of updated products so far.

takeout

What’s important for investors is that Apple’s warning to investors that it would have to be dead money for four years was actually overly positive about the results. The stock price is expected to decline significantly due to poor performance and continued product development failures. CEO Tim Cook turns 64 this year, and pressure for his retirement could increase after another year of lack of growth and sluggish product development that weakens the stock.

Investors should still consider stocks trading above $170 as futures. In a normal market, Apple would be lucky to trade at 15 times its EPS target, with a stock price of just $107. Stocks can easily face dead money that continues for two years or more, with the real risk of investors facing negative returns during this period as they watch years of profits disappear.