Bank of America raised its S&P 500 target to 5,400. Here’s how:

Futures suggest a cautious start to the new week on Wall Street, even though major stock indices remain at record highs.

Over the past three months, the Nasdaq Composite COMP Index is up 13.8% and the S&P 500 SPX Index is up 11.8%. Worrywarts is looking for a synonym for bubble.

But the Bank of America team, led by equity and quantitative strategist Savita Subramanian, remains bullish and increased its year-end S&P 500 target from 5,000 to 5,400.

To be clear, Subramanian said a market decline is a possibility, noting that since 1929, a 5% decline has occurred on average three times a year and a 10% correction has occurred once a year.

“We have expirations in four months with no meaningful decline and our chief U.S. technologist is seeing a bearish differential,” she wrote in a note Sunday. CBOE VIX VIX is the same.,

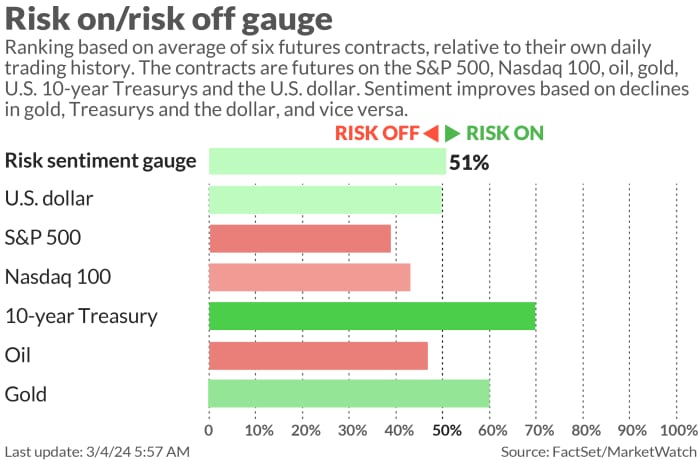

A measure of volatility known as Wall Street’s fear gauge tends to increase 25% from the second quarter of previous election years through November, a sign that uncertainty is building. However, with uncertainty removed after the vote, the possibility of a year-end rally has increased.

So, setting that caveat aside, how did Subramanian arrive at the conclusion that the S&P 500 has about 5% additional upside this year?

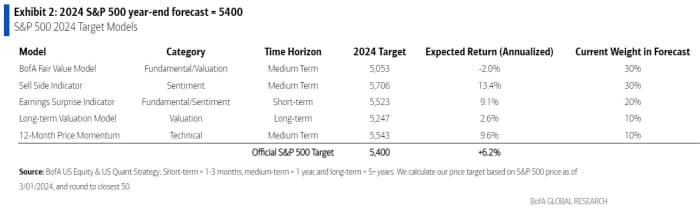

The BofA team achieved its S&P 500 goal by considering five ways to predict market levels. We then apply weights to each of these factors, which can fluctuate depending on market conditions and investor preferences at the time. This is shown in the table below.

Source: Bank of America

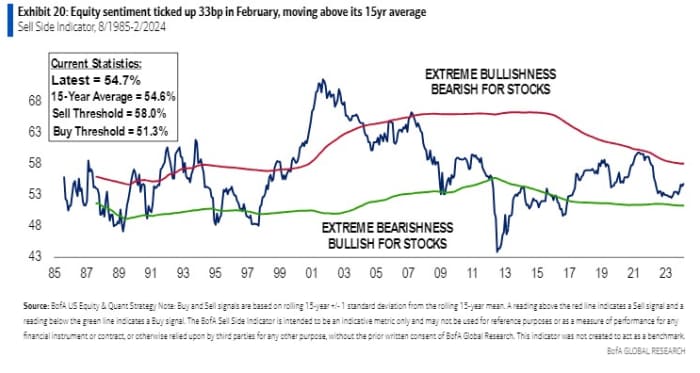

Currently, the most bullish of the five indicators is the sell-side indicator, which has an equal weight of 30% and yields a 2024 S&P 500 target of 5,706. However, the weight was lowered from 40% because SSI analysts had already shown that they were too optimistic.

Source: Bank of America

A purely technical factor is the 12-month price momentum, which implies a level of 5,543, but given the somewhat increased momentum, the weight has been dropped from 15% to 10%.

The Earnings Surprise Index calculated a target value of 5,523, and its proportion was adjusted upward from 10% to 15%. “Although guidance is weak (due to conservatism early in the year), BofA analysts are bullish on earnings versus consensus,” Subramanian said.

The long-term valuation factor is expected to be at the level of 5,247, and its proportion has been lowered from 15% to 10%. “Valuation may not be a catalyst, but it is a strong predictor of long-term returns,” says Subramanian. “Today’s multiple of 25 times regular earnings implies a compound annual return of +2.6% over the next 10 years based on historical relationships,” she adds.

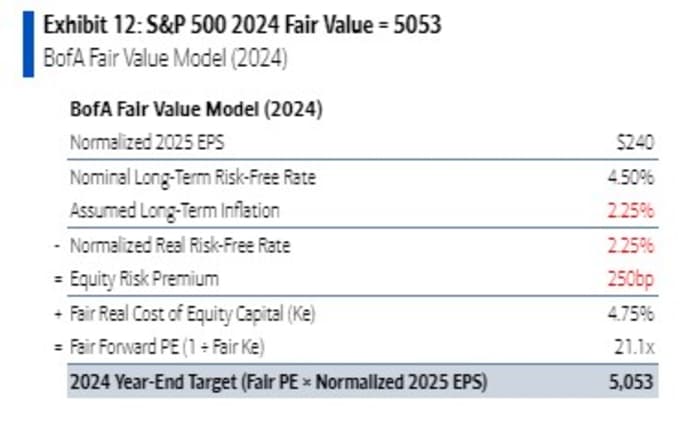

The biggest contributor to the overall S&P 500 target was the fair value model, which increased from 4,400 to 5,050 and doubled its weight from 15% to 30%. According to the BofA team, this reflects a shift in the S&P 500’s mix toward industries with higher margins and lower earnings risk, as evidenced by continued margin stability despite surging volatility in interest rates and inflation.

Source: Bank of America

“We see potential for improved margin stability here as companies shift from global cost arbitrage and free capital driven growth to efficiency/productivity,” they say.

In response to accusations that the market is experiencing a dangerous euphoria, Subramanian and the team said these feelings are primarily “topical and secular” around AI and weight loss drugs, and that they expect the market to expand beyond these topics.

“The sell side is becoming more bullish on stocks. However, pension fund allocations to public equities are still at 20-year lows, and positioning on top market themes such as high-beta stocks and cyclical sectors is at the bearish extreme.”

market

US stock index futures ES00,

YM00,

NQ00,

Blended based on benchmark Treasury yield NQ00.

Move higher. The dollar DXY is much lower while the oil price is CL.1,

It remains close to $80 per barrel and gold is at GC00.

It is trading at about $2,080 per ounce.

|

Key Asset Performance |

last |

5d |

1m |

YTD |

1 year |

|

S&P 500 |

5,137.08 |

0.95% |

3.60% |

7.70% |

26.98% |

|

Nasdaq Composite |

16,274.94 |

1.74% |

4.13% |

8.42% |

39.23% |

|

10 years treasury |

4.212 |

-7.05 |

5.03 |

11.33 |

24.74 |

|

gold |

2,092.90 |

2.54% |

2.52% |

1.02% |

12.98% |

|

Oil |

79.94 |

3.02% |

9.81% |

12.07% |

-0.68% |

|

Data: MarketWatch. Changes in Treasury yields expressed in basis points |

|||||

For more market updates and actionable trading ideas for stocks, options and cryptocurrencies. MarketDiem Subscription to Investor’s Business Daily.

buzz

Apple shares AAPL fell 1.5% after the European Union fined the U.S. tech giant about $2 billion for violating the bloc’s competition laws by unfairly favoring its own music streaming service over rivals.

The U.S. corporate earnings season for the fourth quarter of 2023 is mostly complete, but there are some stragglers. GitLab GTLB,

stitch fix sfix,

and Scientific Applications International SAIC;

They are among those announcing results after the closing bell on Monday.

There will be no major US economic data releases on Monday. Philadelphia Fed President Tom Harker is scheduled to comment at noon ET.

The very important Fedspeak of the week is likely to come when Chairman Jay Powell testifies before Congress on Wednesday and Thursday. The February nonfarm payrolls report is released Friday.

Japan’s Nikkei 225 index JP:NIK surpassed 40,000 for the first time as a rally in global technology stocks continued.

The Chinese government said it was scrapping the premier’s annual press conference, which was one of the only times the country’s top leader took questions from the media.

US Crude Oil Futures CL.1,

It is trading at around $80 a barrel as markets absorb news that OPEC+ will extend voluntary production cuts into the second quarter.

Stock of Super Microcomputer SMCI,

It rose nearly 12% after news broke late Friday that it would be added to the S&P 500.

Bitcoin BTCUSD,

It rose above $65,000, helping boost Coinbase Global COIN’s stock price.

The cryptocurrency trading site rose 6.5%.

The Bank for International Settlements says options-selling ETFs are helping to keep the VIX in check.

best of the web

The worst way to get rejected for a job.

Political ‘chaos’ in the United States has prevented Defense Department contractors from experiencing a military supply boom.

America’s defeat in the Micron trade secret lawsuit exposes its struggle against China.

Chart

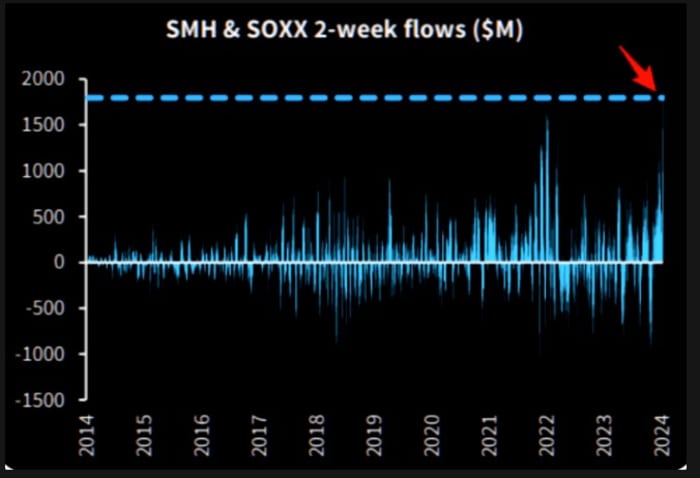

Inflows into the VanEck Semiconductor ETF SMH and iShares Semiconductor ETF SOXX over the past two weeks have hit record highs, according to The Market Ear, showing just how much investors love chips. As TME puts it, “The last time we saw a spike like this was in late 2021, right before the weakness took hold.”

best price

Here are the most active stock market quotes on MarketWatch as of 6 a.m. ET.

|

ticker |

security name |

|

NVDA, |

nvidia |

|

TSLA, |

tesla |

|

SMCI, |

super micro computer |

|

TSM, |

Taiwan Semiconductor Manufacturing ADR |

|

AMD, |

advanced micro devices |

|

Mara, |

marathon digital |

|

GME, |

game stop |

|

AAPL, |

apologize |

|

PLTR, |

Palantir Technologies |

|

Nio, |

Nio |

random read

The origins of Kylie Minogue’s disgusting drinking game.

Living on a train.

Your captain is speaking. Push it in!

Things to know: It starts early and you’ll be updated until the opening bell, but Sign up here Have it delivered to your email box just once. The email version will be sent around 7:30 a.m. ET.

Please confirm Watched by MarketWatch, a weekly podcast about the financial news we’re all watching and how it affects the economy and our wallets. MarketWatch’s Jeremy Owens trains your eye on what moves markets and provides insights to help you make informed money decisions. subscribe spotify and apologize.