Bullish signal or bear trap?

This article is also available in Spanish.

Ethereum is inching closer to its all-time high and is on the verge of recovering to the $4,000 level. The second-largest cryptocurrency by market capitalization has faced skepticism throughout this cycle, with some analysts predicting it will underperform compared to previous bull markets. However, Ethereum has surprised doubters by rising steadily in recent weeks despite market uncertainty.

Related Reading

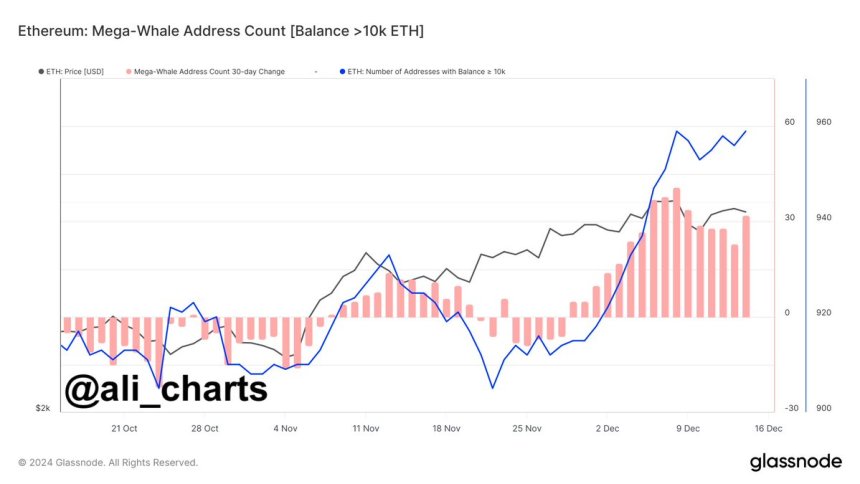

Glassnode’s key on-chain indicators show important trends that could fuel further price rises. Ethereum whales have been accumulating aggressively since late November. This is a sign of growing confidence among major holders that there is potential upside. Historically, whale accumulation has often preceded significant price movements, suggesting a potential near-term breakout for whales.

The market is still divided on Ethereum’s trajectory, but its ability to maintain upward momentum near $4,000 will determine its performance in the coming weeks. A break above this critical resistance could open the door to new highs and further solidify ETH’s role as the leader of the ongoing bull cycle.

Ethereum giant whale balance increases

Ethereum has been on a steady, albeit modest, upward trend since November 5th, but the real spark for ETH appears to have yet to be ignited. As Bitcoin soars on price discovery and several altcoins surpass expectations, Ethereum investors are looking for clear signs that a bull market is imminent for the second-largest cryptocurrency.

Key on-chain data shared by X chief analyst Ali Martinez provides interesting insights into the current state of Ethereum. Martinez highlights that Ethereum whales, which hold significant amounts of ETH, have been accumulating aggressively since the price broke above the $3,330 level.

This accumulation trend suggests the smart money is positioning itself for a huge upside in the coming months. Historically, whale accumulations have often been a precursor to strong price increases. That’s because these large investors tend to anticipate major market changes before retail traders.

But the narrative is not entirely optimistic. A buildup of whales can signal confidence, but it also raises concerns about potential bull traps. These large holders can quickly pivot and offload their ETH into other assets if market conditions change or Bitcoin’s dominance stifles altcoin growth. Such a move could catch smaller investors off guard and result in a sharp correction.

Related Reading

For Ethereum, breaking key resistance while maintaining above a critical level like $3,800 could be the catalyst needed to trigger a true bull market. Until then, ETH remains a favorite on the watchlist, balancing potential and uncertainty.

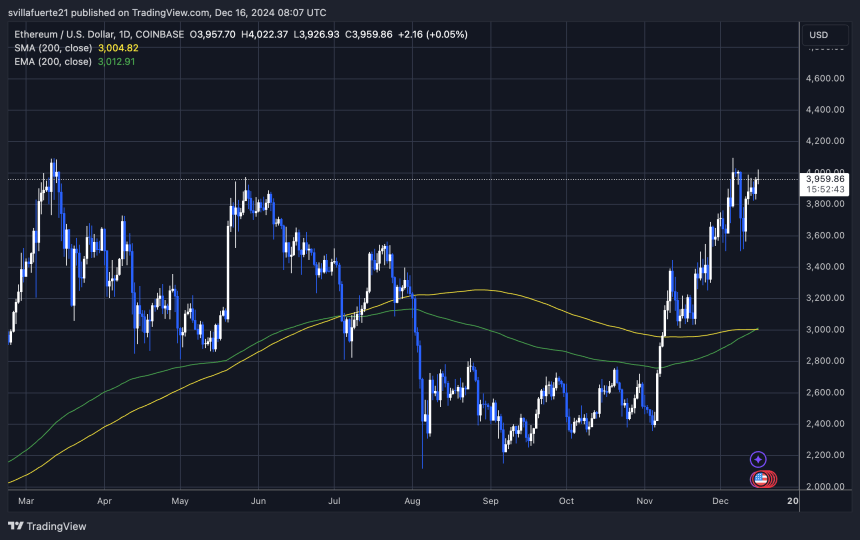

price test decisive resistance

Ethereum (ETH) is trading at $3,950 and has been struggling to break the important $4,000 resistance level for several days. Nonetheless, prices remain resilient, indicating strong market support. $4,000 represents a psychological barrier and key resistance area for the asset, so a break from this level is essential to confirm the continuation of the uptrend.

If Ethereum fails to break through $4,000, a return to the low demand area around $3,500 can be expected. This level has served as strong support in recent weeks, acting as a buffer during periods of increased selling pressure. A pullback into this area could allow for new buying momentum, setting the stage for another attempt to the upside.

Related Reading

However, recent market dynamics suggest that Ethereum has the potential for a significant upside. Bitcoin’s surge in price discovery and growing optimism about altcoins have created a bullish environment. As whales continue to accumulate ETH, as highlighted by on-chain data, market participants are becoming increasingly confident in Ethereum’s ability to retest and surpass its all-time highs.

Featured image by Dall-E, chart by TradingView