Despite the criticism, the Lightning Network continues to see major launches.

The following is an excerpt from the latest edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be the first to get these insights and other on-chain Bitcoin market analysis delivered to your inbox, Subscribe now.

Bitcoin’s revolutionary Lightning Network launched two major planned launches last month, including new access to Coinbase in Southeast Asia and globally. Nonetheless, there is growing criticism that the entire protocol is fundamentally flawed.

Lightning Network is a layer 2 protocol being developed on the Bitcoin blockchain with the ambitious goal of solving Bitcoin’s scalability problems. Since its initial development in 2016, the underlying theory of this protocol has received great attention from the entire industry for its revolutionary new potential future. Essentially, Lightning seeks to further embrace the decentralized nature of Bitcoin by relying on a mesh network of locally hosted nodes to perform key functions. Microtransactions in BTC are made by various users and processed through these nodes. Smart contracts enforce a system that mixes and bundles these small transactions. These large bundles are then actually processed directly on the original blockchain, minimizing congestion and allowing Bitcoin to be used for everyday transactions. Since development began, large and influential figures have supported the project. Most famously, the government of El Salvador used Lightning to make Bitcoin a payment option available to all citizens.

Despite initial expectations for the program, claims that business has stalled persist. A few years ago, multiple defenses of Lightning’s long-term viability as a concept acknowledged that frustration, arguing that the technology may not be enough as a “just-in-case bullet” to solve the scaling problem itself. Even as the network grew to new heights, a series of problems did not waver. For example, small nodes may not have the real capacity or startup capital to actually move users’ money. Bugs hinder the user experience. Merchant access is somewhat lacking. The same goes for other concerns.

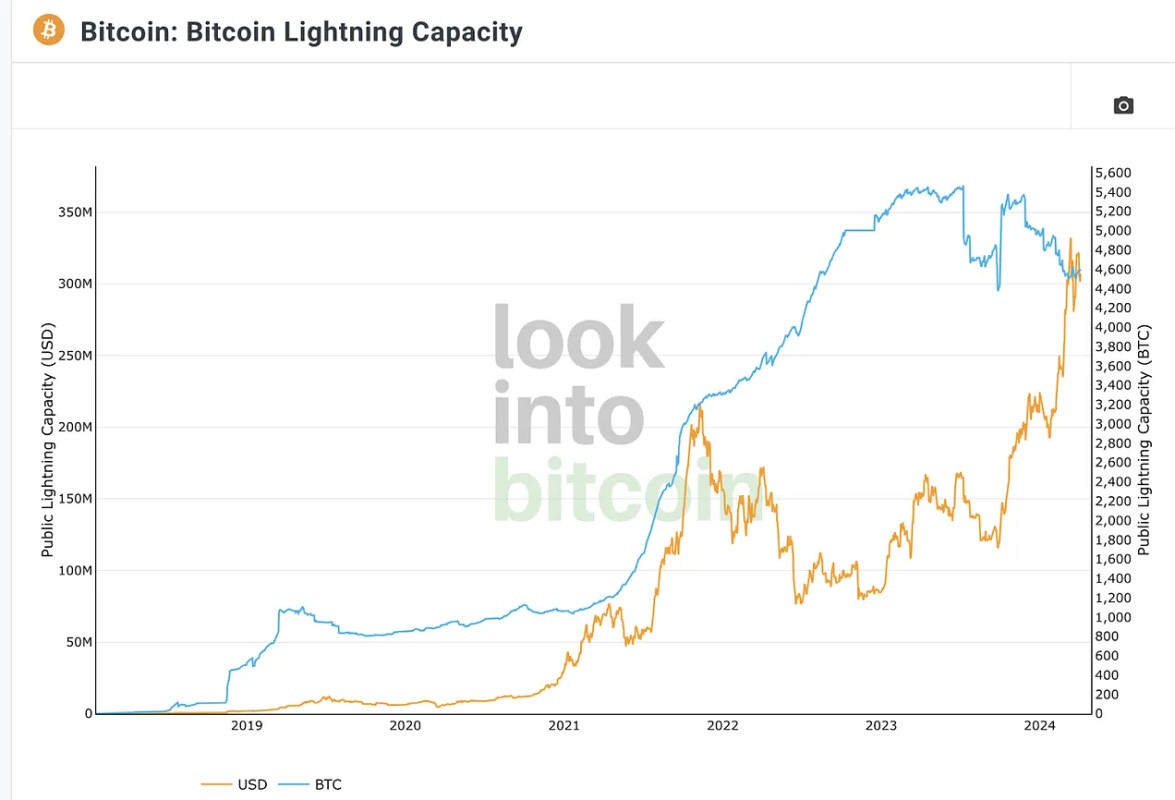

These issues are well known, but by April 2024, several signs are causing community members to question whether a breaking point has been reached. A series of long-term developers have publicly quit the project and blamed its flaws, and this list includes: both Original author of the protocol. A “trivial” amount of total Bitcoin is actually available on Lightning, as Paul Sztorc, Lightning developer and CEO of Layer Two Labs, said: “Everyone now recognizes that we can’t get 8 billion people to sign up for Lightning.” And, most damning of all, there has been a series of complaints that “almost everyone who uses real money hates it.” In fact, a particularly worrying statistic has emerged regarding Lightning’s future prospects: despite dollar capacity being at an all-time high, the network’s bit This is because coin capacity is steadily decreasing.

Nonetheless, due to these issues, the community as a whole did not consider the project complete. First of all, some long-term developers have shown continued optimism and determination to continue development, and Bitcoin’s decisive spirit has not yet left Lightning. But more importantly, great progress is being made in reliable market access. In March 2024, Neutronpay, a Lightning company, secured $1.5 million in venture capital bridge funding to deepen its network infrastructure and viability in Southeast Asia. Ongoing projects like this are essential to ensure that users in less developed regions still have access to secure nodes.

But this victory pales in comparison to the events of April 3rd. But that’s because Coinbase has finalized a secure partnership to launch Lightning on its platform. Coinbase has expressed general support for Lightning access for months, but only specific agreements with partners like Lightspark can translate this support into access to the exchange’s global user base. Coinbase is one of the world’s largest exchanges, with over $150 billion in quarterly trading volume. Therefore, combining Coinbase’s vast resources with Lightspark’s specific technical know-how allows us to build a durable node infrastructure. One of the biggest concerns for the network as a whole is the countless problems that faulty nodes can cause, so Coinbase will certainly be a bastion in that regard.

The overall picture of the Lightning Network is strikingly similar to Ordinals, another popular Layer-2 protocol in Bitcoin. Rather than creating a platform that processes Bitcoin microtransactions as recurring payments, Ordinals seeks to transform BTC into a more durable microformat that is not used for recurring payments. Ordinals can “inscribe” unique data into individual denominations of Bitcoin, allowing the integration of popular new tokenized assets with leading blockchains. Of course, this project is not only dedicated to these tokenized assets. This is because inscriptions can be used to integrate a wide variety of information into an indelible blockchain. In one particularly memorable episode, some developers even used Ordinals to engrave discontinued video games.

This whole concept has caused considerable outrage in certain sectors of the community. For example, influential developer Luke Dashjr claimed that Ordinals’ entire rationale was a “vulnerability” in Bitcoin that was “being exploited to spam the blockchain.” The popularity of the Ordinals BRC-20 token has even been linked to Bitcoin’s major congestion problem, and Dashjr has proposed a way to “fix” this vulnerability and hinder the continued functioning of Ordinals. Despite the decline in network congestion, the entire concept is still seeing backlash. Binance cited “ongoing efforts toward rationalization.” “Product Offering” was the basis for completely removing Ordinals from the platform in April.

The criticism of the Lightning is certainly quite different from that of the Ordinals. Lightning’s detractors call it a failed attempt to help Bitcoin become more useful, while Ordinals’ critics see Lightning’s success as a threat to the same goal. Nonetheless, there are many similarities between the two positions. Both have developed vocal opposition, and both have suffered real difficulties in their overall capacity recently. The developers of the Bitcoin blockchain have always been an eclectic group with a variety of completely different perspectives on how to make Bitcoin better. It is not surprising that such a complex layer 2 protocol is experiencing some problems, especially considering that the world of Bitcoin is global and leaderless.

But neither of them was completely defeated. Dashjr’s proposal to disable Ordinals was resolutely rejected by the community and development continues. In an impressive twist, trillion-dollar financial giant Franklin Templeton also endorsed Ordinals with a report on the digital asset sector. The report claimed that Ordinals is leading a “renaissance” in Bitcoin adoption and that new Ordinals products have energized Bitcoin’s user base and clearly demonstrated the blockchain’s flexibility and superiority over its competitors. A compliment like this from such an important source could be truly groundbreaking.

Events like this help to prove once again that, above all, the spirit of Bitcoin is not simply to disrupt existing industries and build a more rational order out of the wreckage. Developers around the world also have an unwavering ability to keep their projects moving forward during difficult times, and this spirit has served us well on Bitcoin’s bumpy road to the top. Both Lightning and Ordinals developers have demonstrated a sustained ability to improve their projects despite great adversity, and that spirit has been rewarded with new institutional acceptance. At the moment, it is unclear where exactly either of these projects will go, or whether new Layer-2 solutions will surpass them both as the next revolution in Bitcoin. But no matter what happens, it is clear that Bitcoin as a whole will emerge stronger.