Emerging Market Links + The Week Ahead (April 22, 2024)

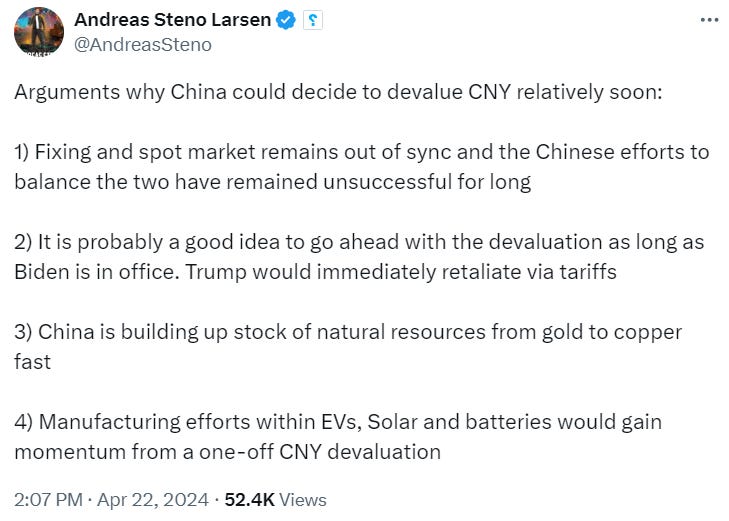

China has its share of perma-bulls and perma-bears (the coming collapse of China crowd…), but Steno Research has issued a report (mostly behind a paywall) noting:

China is preparing for something major. That seems increasingly obvious judging from the stockpiling of important resources. Could it be that they are preparing a major one-off devaluation of the CNY?

Of course, the conspiracy theorists and China bears have other ideas about what China might be preparing for…

Then there is this meme posted in a reply to the Steno Research tweet about their piece that sums up the current state of the currency wars:

Finally, and to build upon a podcast covered in yesterday’s paywalled post, it’s been noted that S&P ratings of South Africa-focused companies are holding up in spite of rising costs and all of the the problems the country faces (including the coming elections). However, the IMF has warned of El Niño drought’s impact on growth outlook in sub-Saharan Africa – something that will have implications for food commodity prices.

$ = behind a paywall

-

🇮🇳 moneycontrol India Stock of the Day (March 2024) Partial $

-

Bosch Ltd, Coal India, Ami Organics, Coforge, Shivalik Bimetal Controls Ltd, Aditya Birla Capital, Protean eGov Technologies Ltd, NTPC Ltd, Metro Brands, Vijaya Diagnostic Centre, Ramkrishna Forgings Ltd, Balaji Amines Ltd, Control Print, Sirca Paints, V Guard Industries Ltd, Cyient & Aavas Financiers

-

-

🌐 EM Fund Stock Picks & Country Commentaries (April 21, 2024) $

-

A number of new March or Q1 factsheets-commentaries discussing stock picks, when economies falter (Brazil), the label JSE does not reflect the SA market’s contents, Vietnam + India trip reports, etc.

-

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 Exclusive: CATL founder upbeat about Ford battery plant tie-up, EVs future in China (Caixin) $

Robin Zeng Yuqun, the 56-year-old founder and chairman of the world’s top electric vehicle (EV) battery-maker Contemporary Amperex Technology Co. Ltd. (CATL) (SHE: 300750) (宁德时代), struck an upbeat note in a recent exclusive interview with Caixin, saying that construction work on the company’s $3.5 billion U.S. plant with Ford is “progressing smoothly” and that the prospects for EVs in China are ever brighter.

However, he also acknowledged the challenges the Fujian province-based giant faces, including regulatory challenges in Europe and the difficulty of commercializing solid-state batteries, a technology that could bring an end to the “range anxiety” that wards off some potential EV buyers.

🇨🇳 Alibaba reorients business, rejigs overhaul after catalogue of mistakes (SCMP) 🗃️ & Alibaba diverts from new retail push in strategy reckoning (Caixin) $

As part of a sweeping business revamp to rebuild growth, Alibaba Group (NYSE: BABA) has been dialing back its “new retail” push, sparking speculation that its offline retail businesses such as Freshippo and RT-Mart might be put up for sale.

While emphasizing its focus on its core e-commerce and cloud computing businesses, Alibaba’s leadership has signaled an intent to shed marginal assets.

🇨🇳 Alibaba doubles down overseas for new growth drive (Caixin) $

China’s e-commerce giant Alibaba Group (NYSE: BABA) is looking for growth by going abroad.

Cross-border e-commerce is considered Alibaba’s most promising segment, despite stiff competition from fast-rising upstarts such as the fast fashion retailer Shein and Temu, the overseas marketplace operated by PDD Holdings Inc.

🇨🇳 JD.com (JD US / 9618 HK): Announced 2.8% Share Buyback In 1Q24 + My 1Q24 Preview (SmartKarma) $

JD.com (9618 HK) announced this week that it has repurchased 2.8% of the outstanding shares of the company in the first quarter of 2024.

Improved shareholder returns is a key thesis for the stock, given that there is little market expectation on such given limited track record.

A positive catalyst on full year performance could be the government’s announced stimulus policy for home appliance in April this year (trading old for new).

🇨🇳 Innovent Biologics (1801 HK)– More than Just a GLP-1 Play (SmartKarma) $

Innovent Biologics (HKG: 1801 / FRA: 6IB / OTCMKTS: IVBXF / IVBIY) is most well-known as the developer of mazdutide in China, however this is overshadowing a strong portfolio of oncology drugs in a very high growth market.

China’s approach to healthcare is being defined by having the biggest diabetic population, over 4 million new cancer cases per year, and over 100 million living with obesity.

We expect the valuation gap between the two first-to-market GLP-1 drugs, and competition to close. Oncology drug sales and valuations will continue its growth trajectory.

🇨🇳 In Depth: Chinese education firms learn tough lessons overseas (Caixin) $

Tutoring companies are increasingly looking to overseas markets — especially those with many Chinese nationals or local ethnic Chinese communities — to bolster their growth after a dramatic shift in government policy sent the sector into disarray.

However, as with many Chinese companies which have looked to the international market to offset a domestic downturn, tutors have found it hard to replicate their business model overseas.

🇨🇳 To meme or not to meme: Shengfeng stock on roller coaster ride in its first year (Bamboo Works)

The niche logistics company’s shares have swung widely since their public debut a little more than a year ago, but may have finally settled at a realistic level

Shengfeng Development (NASDAQ: SFWL) shares more than doubled just a few months after their IPO in March last year, then crashed and skyrocketed again, only to nosedive below the listing price

Unlike its stock performance, the niche logistics company’s revenue is growing steadily, while its profitability is also improving

🇨🇳 Feitian Moutai Price Drop Triggers Billion-Dollar Selloff in Liquor Stocks (Caixin) $

🇨🇳 Nongfu Spring (9633 HK): Criticism Not a Concern, Strong Performance, But Flat Price, Buy (SmartKarma) $

We believe the criticism against Nongfu Spring (HKG: 9633 / OTCMKTS: NNFSF) will eventually help the company.

Catching the trend of sugar free, tea revenue surged by 83% in 2023.

The company achieved higher growth and higher margin, but its stock price is still flat.

🇨🇳 How did KFC sell 190m cups of coffee in China? (Momentum Works)

Right pricing, right segment, right leverage

In the 2023 annual report of YUM China (NYSE: YUMC), the country’s largest restaurant operator which runs KFC, Pizza Hut and Taco Bell franchises, one line of the CEO’s letter caught people’s eyes:

“At KCOFFEE, with competitive coffee prices averaging below RMB9.9, we sold over 190 million cups in 2023, a 35% year-over-year increase.”

In the mass market, Luckin Coffee expanded to 16,000 stores by the end of 2023, was profitable, and focused on killing off rival Cotti Coffee, which had >7,000 stores, leaving Mixue’s Lucky Cup Coffee in the crossfire.

🇨🇳 Chinese tea chain ChaPanda seeking to raise $330m in IPO (World Coffee Portal)

🇨🇳 Nayuki tweaks franchising model as competitors serve up rival listings (Bamboo Works)

The premium tea seller had 205 franchised stores in its network at the end of March, following its decision last year to diversify beyond self-operated stores

Nayuki Holdings (HKG: 2150 / OTCMKTS: NYKHF)’s new store openings slowed in the first quarter due to seasonal factors, as it tweaked its franchising model aimed at boosting its presence in smaller cities

The premium tea seller will soon face new competition for investor dollars in Hong Kong, as at least five major rivals have filed for IPOs since last October

🇨🇳 China Tourism Group Duty Free (1880 HK): Headwinds Persist (SmartKarma) $

Since my previous insight on China Tourism Group Duty Free (HKG: 1880 / SHA: 601888) in October 2023, the stock has declined 33%, and year-to-date, the stock has declined 13%.

The company faces headwinds from continued overall weakness in Hainan duty free sales and potentially increased competition in Hainan.

The company already announced preliminary 1Q24 results, with sales down 9% yoy and net profit flat. The company is trading at 18x 2024 earnings.

🇨🇳 After big landlord concessions, CTG Duty-Free dogged by weak spending (Bamboo Works)

The duty-free store operator’s financial performance rebounded last year, but lackluster results in the first quarter of 2024 may reflect growing consumer caution

China Tourism Group Duty Free (HKG: 1880 / SHA: 601888)’s first-quarter profit was basically flat, while its revenue fell by nearly 10% year-on-year

The company made a senior management change before its first-quarter announcement, the latest in a series of similar adjustments

🇨🇳 FAST NEWS: JPMorgan ups stake in CTG Duty Free (Bamboo Works)

The Latest: U.S. banking giant JPMorgan purchased about 126,000 Hong Kong-listed shares of China Tourism Group Duty Free (HKG: 1880 / SHA: 601888) on April 10, raising its stake in the duty-free store operator from 7.89% to 8%, according to a new Hong Kong Stock Exchange filing.

🇨🇳 Travelsky (696 HK | HOLD | TP:HKD9.92): Domestic Travel Will Support Growth (SmartKarma) $

Travelsky Technology Ltd H (HKG: 0696 / FRA: TVL / OTCMKTS: TSYHY / TSYHF) Jan-Feb operational data strong, volume processed by domestic +45% YoY and international by +52% YoY; much higher than the consensus 2024 forecast of 15%

Traffic among the Big 3 Chinese airlines was up 46% YoY (-9% MoM) in March to +8% vs 2019. Domestic traffic rose 19% YoY (-11% MoM) to +24% vs 2019

TP of HKD9.92 (+8% UPSIDE) is based on 2024 PE 14.8x (1SD below mean). The upside is uncompelling, but we advocate a HOLD as traffic growth is stronger than consensus

🇨🇳 Deadbeat developer debt collection enters new phase with Shimao liquidation (Bamboo Works)

China Construction Bank (HKG: 0939 / VIE: CNCB / SHA: 601939 / OTCMKTS: CICHY / OTCMKTS: CICHF)’s request to liquidate Shimao Group Holdings Ltd (HKG: 0813 / FRA: QHI / OTCMKTS: SIOPF / SHMAY) shows that state-owned banks are starting to take legal action to recover their money from the debt-ridden industry

A unit of China Construction Bank has asked a court to liquidate Shimao Group, which had a net debt ratio of 473.2% at the end of last year

CCB Asia has taken legal action against three Hong Kong-listed Chinese real estate developers so far this year

🇨🇳 China’s sovereign fund bolsters big four banks with $722 million investment (Caixin) $

🇨🇳 Lao Feng Xiang B-share (900905 CH) (Asian Century Stocks) $

China’s largest jewelry company at 6.6x P/E

Lao Feng Xiang (SHA: 600612 / 900905) (US$2.1 billion) is the largest jewelry manufacturer and retailer in China, with an estimated market share of 7.5%.

Lao Feng Xiang’s niche is traditional gold jewelry. The designs tend to be simple and timeless, in contrast to, say, Chow Tai Fook Jewelry Group’s (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF)’s more trendy designs. Customers buy Lao Feng Xiang’s jewelry not only as accessories but also as investments - to protect their capital from inflation.

And the company has been immensely successful. Over the past 20 years, it’s compounded revenues at 20% and earnings at 32%. While the numbers for the past ten years have been more modest, the industry has suffered significant headwinds after the gold bubble burst in 2012. In light of these headwinds, Lao Feng Xiang has performed admirably.

🇨🇳 Chow Tai Fook glitters as hedge against lower interest rates (Bamboo Works)

China’s leading jewelry seller has benefited from spiking gold prices that reached an all-time high after Iran’s drone attack on Israel last week

Chow Tai Fook Jewelry Group’s (HKG: 1929 / FRA: 1CT / OTCMKTS: CJEWY / CJEWF)’s sales grew 12.4% in the first three months of this year, accelerating from the company’s 6% revenue growth in the six months through September 2023

As China’s largest listed jeweler, Chow Tai Fook could benefit from gold’s recent rise to record high prices

🇨🇳 FAST NEWS: Shandong Gold mines higher gold prices for big profits (Bamboo Works)

The Latest: Shandong Gold Mining Co. Ltd. (SHA: 600547 / HKG: 1787 / FRA: 188H) said on Thursday it expects to report a net profit of 650 million yuan ($89.8 million) to 750 million yuan for the first quarter of this year, up 48.1% to 70.9% from the same period of 2023.

🇨🇳 AIA Group: A Mix Of Positives And Negatives (Seeking Alpha) $

The favorable factors for AIA Group (HKG: 1299 / FRA: 7A2 / OTCMKTS: AAIGF) are the stock’s attractive valuations and the company’s growth opportunities in Southeast Asia.

AAGIY’s unfavorable factors relate to the risk of a slowdown in Mainland Chinese Visitors or MCV insurance sales and concerns about a potential decrease in capital allocated to buybacks.

A Neutral view for AIA Group is warranted, taking into account both the stock’s key positives and negatives.

🇭🇰 Belle Fashion IPO: The Investment Case (SmartKarma) $

Belle Fashion Group (2007708D HK), the largest fashion footwear company in China, is seeking to raise up to US$1 billion in a HKEx IPO.

Belle Fashion originated from Belle International Holdings (2129452D HK), which was privatised in 2017. In October 2019, Belle International spun off its sportswear business as Topsports International Holdings (HKG: 6110 / OTCMKTS: TPSRF)

The investment case rests on a market-leading position, return to growth, margin improvement, cash generation and modest leverage.

🇭🇰 Perfect Medical: Post Card From HK, Yield of 11.5% (SmartKarma) $

Perfect Medical Health Management (HKG: 1830 / OTCMKTS: PFSMF), post a correction of consumer discretionary stocks in HK, now trades at a yield of 11.5%, with cash & investments representing 24% of the market cap.

HK is experiencing a dip in consumer sentiment, and the company isn’t immune to it, but flat sales/profitability, a 24% net margin, and >40% ROE provide great margin of safety.

The stock trades at 9.3x FY24 PE and 11.5% yield (assuming a 110% payout average across company history) with a growth option once the HK economy kickstarts.

🇭🇰 Lonking (3339 HK): Policy Tailwind (SmartKarma) $

(Manufacturer of construction machinery) Lonking Holdings (HKG: 3339 / FRA: C9IB / OTCMKTS: LKHLY / LONKF)‘s demand should pick up in 2H24 supported by the government’s “Action plan to promote large-scale equipment renewals and consumer goods trade-ins”.

Industry volume sales have already witnessed a narrower YoY decline in Mar, with solid exports of wheel loaders and domestic sales of excavators.

After going ex- in late-May, its PER will drop to 7.0x and yield will rise to 6.6%. Net cash of HK$1.56/share is more than fully cover its share price.

🇭🇰 🇰🇷 Shin Hwa announces capital rejig, proposes share issue (GGRAsia)

Hong Kong-listed casino developer Shin Hwa World Ltd (HKG: 0582), promoter of Jeju Shinhwa World (pictured), a complex with a foreigner-only casino in Jeju, South Korea, has announced a proposal for a capital reorganisation and a follow-up rights issue, with the intention of raising about HKD309.3 million (US$39.5 million).

The company said in a Thursday filing that the capital reorganisation will include a share consolidation “whereby every 10 existing shares of HKD0.01 each … will be consolidated into one HKD0.10 share”.

This will be followed by a capital reduction in which the issued share capital of each shareholder “will be rounded down to the nearest whole number by cancelling any fraction of a consolidated share,” with all the credits arising from the exercise to be transferred to the “surplus account” of the company.

🇭🇰 Mmg Limited 1208.HK – It’s Got It All – Copper, EV’s, and AI! (SmartKarma) $

MMG Ltd (HKG: 1208 / FRA: OMS1 / OTCMKTS: MMLTF)

Low-Cost producer of copper and zinc with two of the biggest ten mines in the world.

Recent mine acquisition and increased production at existing mines will grow earnings.

The supply and demand imbalance in copper will lead to higher prices.

🇭🇰 Pacific Basin (2343 HK): The Market Is Overly Conservative (SmartKarma) $

Pacific Basin Shipping (HKG: 2343 / FRA: OYD / OTCMKTS: PCFBY / PCFBF) just announced a US$40m buyback which equals 2.5% of market capitalisation, showcasing management’s confidence in the outlook.

At end-1Q24, it covered 68% of FY24 Handysize days at US$10,960/day and 78% of Supermax days at US$13,370/day, leaving significant room to capture the upside in 2H24.

Market consensus looks overly conservative with FY24 earnings of US$154m, given BDI of 1,808 YTD. The average half-year BDI and net profit since 1H20 is 1,822 and US$189m.

🇲🇴 Galaxy to gain market share, MGM China to slip: analyst (GGRAsia)

🇲🇴 Issue#4 : A wholesale business and Berlin property (Bargain Stocks Radar)

Another property investment company that’s also languishing on the LSE is a £19 million microcap called Macau Property Opportunities Fund (LON: MPO).

As the name suggest it’s a property fund dedicated to investing in Macau, the world’s largest gaming market and the sole city in China in which gaming has been legalised.

Its portfolio comprises prime residential property assets, such as The Waterside, The Fountainside and Penha Heights. The Fountainside is a residential development located in Macau’s prestigious Penha Hill district.

This has been an awful investment for any long term holders and is the definition of a value trap. However, it will be interesting to see how it plays out.

🇹🇼 TSMC plans to charge customers more for chips made outside Taiwan (FT) 🗃️

🇰🇷 Lock & Lock: Affinity Equity Partners Offers a Tender Offer of a 30% Stake (Douglas Research Insights)

On 17 April, Affinity Equity Partners offered a tender offer of a 30% stake in Lock & Lock at 8,750 won per share.

The tender offer period is from 18 April to 14 May. The number of shares that are included in this tender offer is 13.14 million shares (30.33% of outstanding shares).

(Household products company) Lock&Lock Co Ltd (KRX: 115390)‘s share price could trade higher close to the tender offer price of 8,750 won as the date as the end of the tender offer period approaches.

🇰🇷 Jeil M&S IPO Bookbuilding Results Analysis (Douglas Research Insights)

(Manufacturer of various types of tanks, sterilizers,

mixers, and fixtures for pharmaceutical and food) Jeil M&S reported excellent IPO bookbuilding results. Jeil M&S’s IPO price has been determined at 22,000 won per share (22% higher than the high end of the IPO price range).A total of 2,164 institutional investors participated in this IPO book building. The demand ratio was 646 to 1. Samhyun will start trading on 30 April 2024.

Our base case valuation of Jeil M&S is target price of 24,354 won per share, which is 11% higher than the IPO price.

🇰🇷 Megastudy Education: A Major Shareholder Return Policy in 2024-2026 (Douglas Research Insights)

On 16 April, MegaStudyEdu Co Ltd (KOSDAQ: 215200) announced a major shareholder return plan, driving up its share price by 14.2% to 60,400 won.

Driven by this attractive shareholder return plan combined with improving fundamentals, we believe that Megastudy Education’s shares could continue to outperform the market in the next several months.

The total shareholder returns including share buybacks/cancellation and dividends are 60% of the company’s non-consolidated net profit from 2024 to 2026.

🇯🇵 Japanese parent-child listings (East Asia Stock Insights)

Parent-child listings refers to when a parent company and its subsidiary (child) are both publicly listed.

The number of parent-child listings on the Tokyo Stock Exchange reached a peak of 417 in 2006. It has been on a decline ever since then – see below graph.

Note: The parent-child relationship is sometimes defined as when the parent owns more than 50% of the child. Other definitions set this threshold at 30%. The downward trend is consistent in both cases.

🇸🇬 OCBC’s Share Price is Touching a 52-Week High: Can the Bank Continue to Do Well? (The Smart Investor)

Singapore’s second-largest bank’s share price is touching its 52-week high. Can the bank business continue to grow?

The local banks have delivered a spectacular performance for 2023.

Surging interest rates have lifted net interest margins across the board, resulting in a sharp jump in net interest income.

Oversea-Chinese Banking Corp (SGX: O39 / FRA: OCBA / FRA: OCBB / OTCMKTS: OVCHY) is no exception.

A stellar set of earnings

Interest rates set to be “higher for longer”

A sanguine outlook

A refreshed logo and new tagline

Incremental revenue in the next three years

Get Smart: Encouraging long-term prospects

🇸🇬 CICT is Well-Positioned to Grow its DPU: Can its Share Price Soar This Year? (The Smart Investor)

The retail and commercial REIT has done well to grow its DPU in a difficult environment, but can its unit price soar to greater heights this year?

Despite these headwinds, there have been several REITs that reported a year-on-year increase in their distribution per unit (DPU).

One of these REITs is CapitaLand Integrated Commercial Trust (SGX: C38U / OTCMKTS: CPAMF), or CICT.

The retail and commercial REIT owns a portfolio of 26 assets in Singapore (21), Germany (2), and Australia (3) with a total value of around S$24.5 billion as of 31 December 2023.

🇸🇬 4 Singapore Semiconductor Stocks That Could Explode When the Industry Recovers (The Smart Investor)

The semiconductor industry is still in the doldrums but these four stocks could perform very well once the recovery takes place.

As demand normalised, global semiconductor sales decreased by 8.2% year on year to US$526.8 billion in 2023 after hitting a peak of US$574.1 billion in 2022, according to the Semiconductor Industry Association (SIA).

However, SIA reported that global semiconductor industry sales for February 2024 came in at US$46.2 billion, up 16% year on year which was the largest since May 2022.

UMS Holdings (SGX: 558 / KLSE: UMS / OTCMKTS: UMSSF) provides equipment manufacturing and engineering services to original equipment manufacturers of semiconductors and related products.

Venture Corporation (SGX: V03 / FRA: VEM / OTCMKTS: VEMLF) is a blue-chip electronic services provider serving customers in the life science, genomics, healthcare, networking, and test instrumentation sectors, among others.

Micro-Mechanics (Holdings) Ltd (SGX: 5DD / OTCMKTS: MCRNF), or MMH, designs, manufactures and markets high-precision parts and tools for the wafer fabrication and assembly processes of the semiconductor industry.

AEM Holdings (SGX: AWX) provides semiconductor and electronics test solutions to its customers and has manufacturing plants located in Singapore, Malaysia, Indonesia, Vietnam, China, South Korea, the US, and Finland.

🇻🇳 Vinfast (VFS US) – An EV Accident Waiting to Happen? (SmartKarma) $

VinFast Auto Ltd. (NASDAQ: VFS) is large on promise but low on delivery, with sales in FY2023 coming in well below expectations, and the vast majority being to related companies.

The company is building huge capacity in Vietnam, India, and Indonesia in the region, and in the US, where sales have been slow but where capex is required.

Vingroup has set up ride-hailing company GSM, using Vinfast vehicles for its fleet, making up 50% of its sales in 2023, leaving question marks over the sustainability of its model.

🇮🇩 Telekomunikasi Indonesia: Sell-Off Looks Overdone (Seeking Alpha) $

The recent pullback in Telkom Indonesia (Persero) Tbk PT (NYSE: TLK)‘s shares is overdone, as the company’s mobile ARPU outlook isn’t as bad as feared in my opinion.

Better-than-expected Q1 operating metrics and the successful monetization of the data center business via a partial sale might be potential catalysts for TLK.

I remain bullish on Telekomunikasi Indonesia stock, as I think that a buying opportunity for the company’s shares has emerged with the recent sell-off.

🇮🇩 Medikaloka Hermina (HEAL IJ) – Increasing Patient Velocity and Occupancy (SmartKarma) $

Medikaloka Hermina (IDX: HEAL) booked a strong recovery in revenues and profits in FY2023 driven by rapidly rising inpatient and outpatient volume growth with JKN patient share rising.

The company also saw significant improvements in working capital in 2023 and will step up its capex and hospital expansion in FY2024E helping to drive growth.

Medikaloka Hermina is differentiated by its women & children specialisation, higher JKN exposure, and its doctor partnership model. It trades at a discount to peers with higher growth expectations.

🇮🇳 GHCL Textile: The Undervalued & Turnaround Play (SmartKarma) $

Company recently demerged from GHCL Textiles Ltd (NSE: GHCLTEXTIL / BOM: 543918) and guiding for 30% revenue growth and double margins from here onwards with cotton prices being stable.

A Debt Free Textile company available at 0.56x Price to Book with growth plan in progress and adding Value added products in its portfolio.

Due to Forced selling from DII, FII company remained undervalued, now with changing margin profile, the Company will be available at a cheap valuation compared to peers.

🇿🇦 Sibanye Stillwater: The Tide May Be Turning (Seeking Alpha) $

Sibanye Stillwater Ltd (NYSE: SBSW)‘s stock has underperformed the market over the past 3 years, down 65% compared to the S&P 500’s return of 22%. But the tide may be turning soon.

Despite falling metal prices, the company’s cost-cutting efforts and focus on the green metals market make it undervalued with potential for growth.

The stock price may have hit a bottom, and a recovery is possible with the implementation of management’s strategic plan and the rise in commodity prices.

The SBSW stock is now “dirt cheap”, as some analysts put it. Looking at the most important competitors, SBSW’s EV/EBITDA of less than 5.1x is the lowest of all peers.

I reaffirm my “Buy” rating.

🇿🇦 Lesaka: An Undervalued Fintech Gem (Seeking Alpha) $

Lesaka Technologies (NASDAQ: LSAK) has made significant progress in its turnaround efforts and is ready to accelerate growth.

The company owns a 10% equity stake in Indian fintech company MobiKwik, valued at roughly $76 million (~30% of its current market cap).

The macroeconomic forecast in South Africa is favorable, with improving conditions and a growing fintech market.

Acquisition of Touchsides and favorable macroeconomic trends in South Africa boost Lesaka’s growth prospects.

Strong leadership and strategic acquisitions position Lesaka to capitalize on Africa’s burgeoning fintech market.

🇵🇱 Asseco Poland: Defense, Payments, And Cyber Exposures (Seeking Alpha) $

Asseco Poland SA (WSE: ACP / LON: 0LQG / OTCMKTS: ASOZF) is an under-the-radar pick in the Polish markets, strategically exposed to Israel’s defense budget and cybersecurity.

The company’s tech consulting and software businesses are experiencing growth in revenues, particularly in financials and fintech, across its Eastern European geographies.

The only issue is that their tech consulting model is facing pressure from general labor inflation. But the valuation angle is still attractive, especially considering the growth record.

🇵🇱 Dino Polska: Rural Poland Provides Room For Growth (Seeking Alpha) $

Dino Polska (WSE: DNP / FRA: 5Y2 / OTCMKTS: DNOPY) is a fast-growing Polish food retailer with over 2,400 grocery stores, focusing on rural small towns and the outskirts of larger cities.

The company’s growth strategy is based on expanding its store network, increasing revenue in existing stores, and improving profitability.

Dino has a proven track record of store network expansion and strong financials, with increasing revenue and stable profitability.

🌎 MercadoLibre Stock Is Cheaper Than You May Think (Seeking Alpha) $

MercadoLibre (NASDAQ: MELI) stock is currently trading 31% off its all-time high, presenting a buying opportunity, in my view – read on to learn why I think so.

The margin decline in Q4 should be seen as a one-off event rather than a new “secular trend”, in my opinion. The company’s investments position it for long-term growth.

The stock may be cheaper, than you might have thought: based on my DCF model, its fair value is >40% higher than today’s price.

Goldman analysts project strong growth potential for MELI, with a potential upside of 56% from the current price.

I think if you buy MELI today, you’re getting a great, fast-growing company operating in large underserved end markets with great prospects. That’s why I rate the stock a “Buy” today.

🇦🇷 Banco BBVA Argentina: The Trend Is Your Friend (Seeking Alpha) $

Argentinian bank stocks, including Banco Bbva Argentina (NYSE: BBAR) and Banco Macro Sa (NYSE: BMA), have seen gains of over 100% since the election of Milei in late 2023.

Banco BBVA Argentina has shown decent performance despite the challenging macroeconomic environment in Argentina.

The macro scene in Argentina is improving, which could lead to further gains for Banco BBVA Argentina.

Shares are a buy with a price target range between $11-$14.

🇦🇷 Supervielle: A ‘Higher Beta’ Play On The Argentine Bank Recovery (Seeking Alpha) $

Execution risk on Grupo Supervielle SA (NYSE: SUPV) has risen in light of its current CEO’s recent departure.

Fundamentally, however, the bank remains on the right track to capitalize on Argentina’s latest regime shift.

With the stock also priced at a wide relative discount to its peers, there’s arguably more reward per unit of risk here.

🇧🇷 Vale – worth the squeeze? (Calvin’s thoughts) $

Vale (NYSE: VALE) is a global iron miner with activities across the globe, though it has a concentrated presence in Brazil. Along with Rio Tinto plc (NYSE: RIO) and BHP Group (NYSE: BHP), it’s one of the world’s largest iron miners (some years, #1). Technically, it is a privately owned company, however, many of the larger shareholders (Brazilian banks and pension funds) are heavily influenced by the Brazilian government, which also has “golden shares” and special veto rights on some company activities. Though state influence is far less than Petrobras (NYSE: PBR / PBR-A) or Braskem (NYSE: BAK) for instance, it has played a role, and influenced decisions such as CEO appointments.

🇧🇷 Vale: How The Company Fits Into China’s New Economy (Seeking Alpha) $

The company has strong competitive advantages with high-quality iron ore amid China’s need to decarbonize.

Additionally, the company has the best margins and the best return on equity compared to its competitors.

Despite this, it is traded at an attractive valuation based on the EV/EBITDA multiple compared to its competitors.

🇧🇷 Vale’s Failures Don’t Make It Uninvestable (Seeking Alpha) $

Vale (NYSE: VALE) has made significant safety improvements, removing 90% of tailings and decreasing its injury rate by over 60%.

The company is expanding its iron ore capacity, with plans to add 50 million tonnes/year by 2026.

Vale’s financial performance has been strong, with increased EBITDA and cash flow, enabling substantial shareholder returns.

🇧🇷 Inter & Co: New Strategy Being Executed Impeccably (Seeking Alpha) $

Inter & Co Inc (BVMF: INBR32 / NASDAQ: INTR) delivered excellent results after its IPO in 2018, however the rise in interest rates harmed the company, which carried out a successful change in strategy.

Over the last 12 months, the company has focused on more profitable businesses and reducing its costs. This caused its shares to rise more than 200%.

Despite the improvement in results and a bold growth plan until 2027, the company’s valuation appears cheap compared to its peers and its own history.

🇨🇱 Andina’s Still Attractive Despite Argentina’s Challenges (Seeking Alpha) $

Embotelladora Andina Sa (NYSE: AKO.A / AKO.B) is the Coca-Cola licensee in Chile, Paraguay, Argentina, and Brazil, also bottling and distributing alcoholic beverages for third parties.

The company’s financial situation is improving as Chilean Peso inflation falls, and its stock price has remained flat since December.

Despite challenges in Argentina, Andina’s business is performing well in Brazil, Chile, and Paraguay, with expanding margins and improving net income.

🇵🇪 Cementos Pacasmayo : Potential Vehicle To Access Peru’s Economic Rebound (Seeking Alpha) $

Equities in Peru have outperformed emerging markets, with the market poised to benefit from increased copper demand.

Cementos Pacasmayo (NYSE: CPAC) may be a solid investment opportunity due to a short-term sell-off.

Peru’s economy is bouncing back, supported by a manufacturing rebound in China and the US, which could boost copper demand.

🇺🇾 🇻🇬 Satellogic Q4: The Business Struggles Amid Rapidly Contracting Satellite Networks (Seeking Alpha) $

Satellogic (NASDAQ: SATL)’s revenues soared by 67.6% to $10.1 million in 2023, but the improvement came from satellite sales.

Satellogic now has just 25 satellites in orbit, and I expect 2024 revenues excluding the Space Systems business to be flat or down slightly.

Free cash flow for 2023 was negative $64.5 million, and I think the company could run out of cash by the end of 2024.

The short borrow fee rate is over 50%, and it could be best for risk-averse investors to avoid Satellogic’s stock.

$ = behind a paywall / 🗃️ = Archived article

🇨🇳 STENO SIGNALS #96 – A MAJOR DEVALUATION OF THE CNY COULD BE IMMINENT (Steno Research) $

🇨🇳 Regulatory moves triggered latest slump in Chinese small caps, insiders say (Caixin) $

A two-day slump in Chinese small-cap stocks was triggered by new regulatory guidelines that tightened oversight of listed companies and dampened investor enthusiasm for the shares, industry insiders said.

The Wind Micro Market Cap Index, which tracks 400 of the smallest-cap Chinese mainland-listed companies with a market value typically between

1.3 billion yuan ($180 million) and 2.5 billion yuan, lost 8.9% on Monday and 10.6% on Tuesday, before recovering some of its losses on Wednesday, when it closed 9.7% higher, amid a broad market rally.

🇨🇳 🌐 Mainland China and Hong Kong Luxury Market: Unlock infinite growth possibilities and sustainable value of luxurious lifestyle (PwC) & Charts of the Day: China on track to become world’s largest luxury market (Caixin) $

China is expected to overtake the U.S. and Europe to become the world’s largest market for personal luxury goods by 2030, according to a new report from accounting firm PricewaterhouseCoopers (PwC).

After fluctuating significantly during the pandemic, China’s personal luxury market is believed to have rebounded to $69 billion last year, due largely to a recovery in international travel, PwC said in the report released Saturday.

🇨🇳 Tackling China overcapacity by investing abroad (The Asset) 🗃️

A global economic slowdown, together with rising geopolitical tensions, has led to overcapacity in crucial Chinese industries like alternative energy and electric vehicles. The only feasible solution is for Chinese companies to expand their overseas investments, particularly in the United States

🇨🇳 Businesses bank on Narendra Modi election win to ease India’s bottlenecks (FT) $ 🗃️

🇨🇳 How China Miscalculated Its Way to a Baby Bust (WSJ) 🗃️

(Note: From February)

🌏 The Silver Economy (Asian Century Stocks)

Developed Asia is aging, increasing the demand for healthcare, golf and several other sectors.

In developed Asia, a large part of the population is about to retire, causing massive shifts in consumption patterns. Specifically, they’ll shift their spending from transport and eating out to healthcare.

Healthcare, nursing homes, insurance companies, gyms, golf, special interest travel and deathcare are some of the beneficiaries of Asia’s aging populations.

I also discuss a few listed companies likely to be affected by this trend.

🇿🇦 S&P ratings of SA-focused companies holding up in spite of rising costs (IOL) & Sub-Saharan African Corporates: Rating evolution (S&P Global)

Credit ratings on domestically focused companies were proving resilient and most of S&P’s issuers were able to keep earnings relatively stable, but discretionary spending pressure and infrastructure failure was cutting back their efficiency and had increased costs.

This was according to S&P Global, which yesterday released a report on sub-Saharan corporates.

“Our ratings on sub-Saharan African companies were volatile throughout the pandemic and subsequent recovery. In 2020, sovereign rating actions were behind 50% of the corporate rating actions in sub-Saharan Africa, 95% of which were downgrades. Upgrades in 2021 and 2022 – mainly on the back of lower financial risks – gave way to a mixed picture in 2023, as some commodity markets flagged,” S&P Global said.

🇿🇦 IMF warns of El Niño drought’s impact on growth outlook in sub-Saharan Africa (IOL)

THE International Monetary Fund (IMF) has warned that risks to the sub-Saharan African economic outlook were tilted to the downside as a result of the impact of the El Niño-induced drought.

The ongoing strong El Niño event has been driving drier, hotter weather conditions and below-average rainfall across much of southern Africa since late 2023, resulting in below-average harvests and poor macroeconomic conditions.

Oxford Economics Africa senior economist Jee-A van der Linde said the intensification of El Niño puts under pressure Southern Africa’s entire supply chain of maize, the region’s main staple along with sorghum and wheat.

🇦🇷 Default — the fight over Argentina’s $100bn debt crisis (FT) $ 🗃️

🌐 Aluminium and nickel prices surge after sanctions on Russian supply (FT) $ 🗃️

🌐 Institutional investors pull $2bn from Ashmore (FT) $ 🗃️

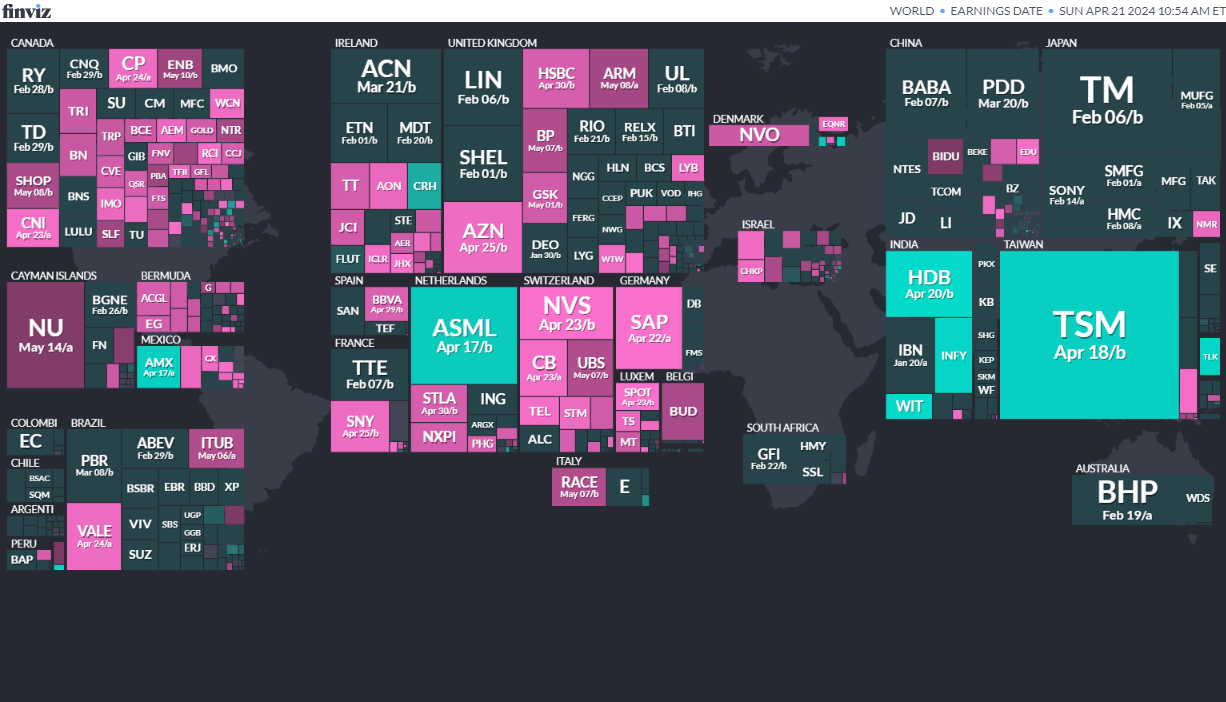

Note: Investing.com has a full calendar for most global stock exchanges BUT you may need an Investing.com account, then hit “Filter,” and select the countries you wish to see company earnings from. Otherwise, purple (below) are upcoming earnings for US listed international stocks (Finviz.com):

Click here for the full weekly calendar from Investing.com containing frontier and emerging market economic events or releases (my filter excludes USA, Canada, EU, Australia & NZ).

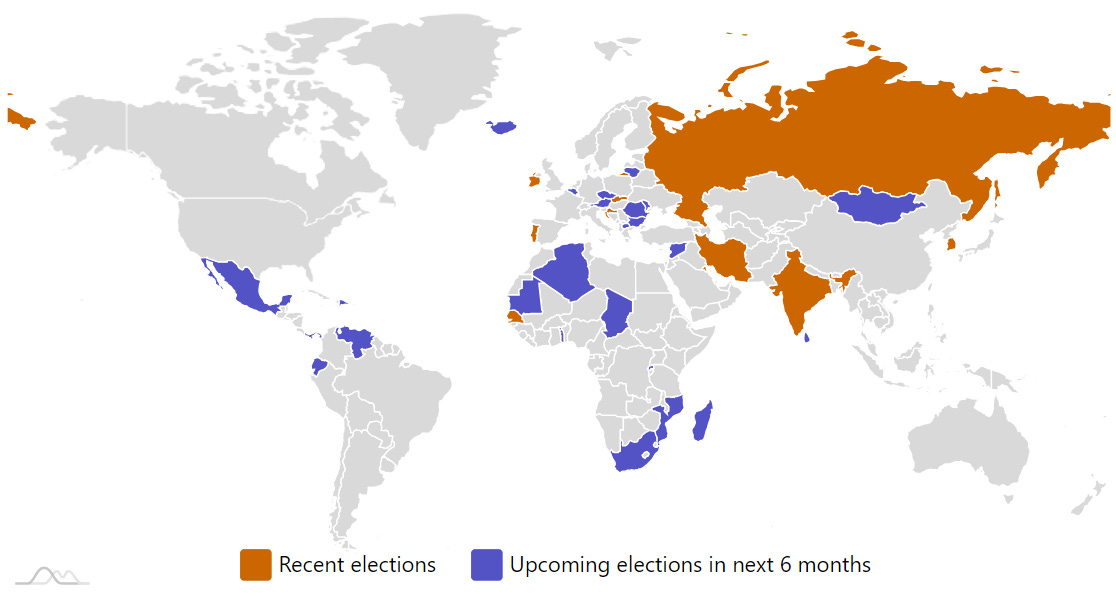

Frontier and emerging market highlights (from IFES’s Election Guide calendar):

-

CroatiaCroatian AssemblyApr 17, 2024 (d) Confirmed Jul 5, 2020 -

India Indian People’s Assembly Apr 19, 2024 (d) Date not confirmed Apr 11, 2019

-

Ecuador Referendum Apr 21, 2024 (d) Confirmed Aug 20, 2023

-

Panama Panamanian National Assembly May 5, 2024